Housing crisis before 1990s and after 2000

The oil crisis

The United States economy was hit hard by the oil crisis which occurred in 1973 as a result of Middle East countries curtailing their oil supply to the US. This led to oil shortages culminating into price hikes. The ultimate result was accelerated economic downturn. According to Fox (para. 10), the economic downturn affected the housing industry negatively.

For example, decline in consumer purchasing power led to a decline in demand for homes. In addition, a large number of home buyers cancelled their home purchasing agreements. This led to a massive slump in the price of homes and hence a decline in home sales.

Increase in consumer demand

According to Wright (38), post war America was characterized by a large number of poor citizens who were competing for affordable houses. The post war period was characterized by a significant number of Americans were living below poverty level. According to Wright (38), the rate was 13% during 1980s. On the other hand, the housing industry did not have sufficient number of units to cater for the rising demand.

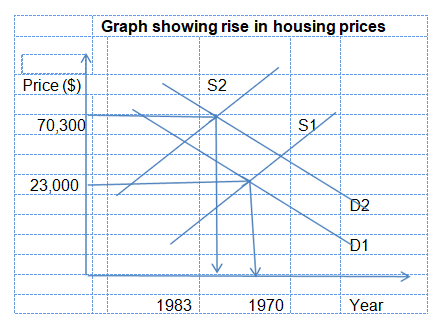

The rise in demand and the subsequent decline in housing unit led to a rise in the cost of housing as illustrated in the graph below. In 1970s the average price of a single unit was $23,000. As a result of rising demand, the price increased to $ 62,200 and $70, 300 in 1980 and 1983 respectively.

The median monthly rent for a unit increased from $108 in 1970 to $ 243 in 1980 and $ 343 in 1983. This represents a significant rise in housing price within one decade.

Subprime mortgages and increase in home supply

In the 21st century, United States experienced a rampant growth of the housing industry. Until 2006, price in the housing industry was on an upward trend. The lucrative nature of the industry led to a large number of investors venturing the industry.

In an effort to increase their profit, financial institutions issued undertook financial engineering by incorporating adjusted rate mortgages (ARMS) to individuals whose credit worthiness was relatively low (Reinhart 1). This means that they increased their lending capacity making it possible for individuals with low creditworthiness to own homes.

The ARMS had a relatively high rate of interest compared to conventional mortgages. This arises from the fact that the rate was fixed for certain duration. Upon adjusting the rate, the rate was increased making it costly for individuals to refinance their mortgages. As a measure to avert losses, financial institutions issued foreclosures to home owners who defaulted paying their mortgages.

According to BBC (para. 19), the repossessions led to a dramatic decline in house prices similar to that witnessed in 1930s. This arose from an increase in unsold homes. It is estimated that there were approximately 4 million unsold homes in US by November 2007 which depressed prices. As a result of rise in home supply, firms in the real estate industry were forced to lower their prices in an effort to dispose unsold properties.

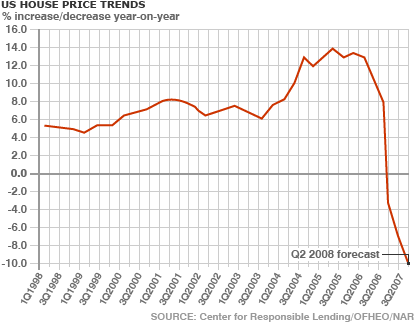

According to Maximus (1), an increase in supply of a commodity leads to a decline in its price. By the third quarter of 2007, it was estimated that house prices were declining with a margin of 4.5% annually which was expected to increase to 10% in 2008. The chart below illustrated the trend in housing prices from 1998 to 2007.

Work Cited

BBC. The downturn in facts and figures. BBC News. 2007. Web.

Fox, Richard. Understanding the housing crisis. Washington: The Jewish Policy Center. 2008. Web.

Maximus, Fabius. The housing crisis allows America to look in the mirror. What do we see? Word Press. 2009. Web.

Reinhart, Carmen. Reflections on the international dimensions and policy lesions of the US subprime crisis. VOX. 2008. Web.

Wright, James. Address unknown: the homeless in America. New York: Aldine Transaction, 2009. Print.