Executive Summary

Downer EDI Limited is an international company which operates in Australia, Asia Pacific and New Zealand. It is included in top 100 of the Australian Stock Exchange. Downer EDI Limited provides public and other private sectors with engineering and infrastructure management services.

Having considered the Annual Reports of the company from 2006 up to 2010, it can be stated that the company increased its revenue and financial power each subsequent year. Implementing different strategies as the result of the changes in the legislative and AASB Standards, Downer EDI Limited managed to remain a successful and frequently growing company.

The Australian Accounting Standards Board either implemented changes to the existing laws or created new standards which affected the operation of Downer EDI Limited.

The main purpose of this report is to consider the transformations which took place in the accounting regulations, understand the changes of the national and international economic environment and summarise the information having stated how each of the changes influenced the company during different years.

An Analysis of Downer Group’s Announcements across the 5-Year Reporting Period 2006-2010

Most of the actions provided by Downer EDI Limited were announced with the purpose to inform stakeholders about the nearest changes in the company organization, operation, financial structures, etc. Some of the announcements were price sensitive, others were not.

The price sensitive announcements in 2005-2006 reporting year were dedicated to the announcement of overall contracts in excess of $360 million which caused the company’s successful completion, acquisition of group Duffill Watts King and Coomes Consulting, and a number of other contracts (Downer Group 2006).

2006-2007 was as successful as the previous one according to the announcements. Downer Group declared about successful secures in Pilbara, acquisitions in New Zealand, new funding agreements, new water industry contract and extension of the relationships with Foxtel, the increased rail capacity in Maryborough and other new rail projects, to PPP Financial Close, contracts with Xstrata and ARTC, Alliance with Roche Mining, etc. (Downer Group 2007).

Still, the company success was slowed down in 2007-2008 reporting year, according to the announcements. At the beginning of this reporting year, Downer Group announced about trading halt and sale of century resources. The appointment of a new Chief Executive Officer caused the changes in the contract between Downer EDI Mining and FMG.

Still, starting with the beginning of 2008 and up to the end of the reporting year on July 30, 2008, the company signed up a number of acquisitions and contracts which increased its net income.

Considering the media release headings of price sensitive announcements, the complete financial situation of the company can be followed, “Downer EDI signs contracts worth over $1 billion”, “Downer EDI announces Alliance with Western Power”, “Downer EDI wins supply order for 19 locomotives”, “Downer EDI Engineering to purchase Astute Limited”, “Downer EDI completes refinancing of A$ Facility”, etc (ASX 2008).

2008-2009 reporting year was full of contracts and acquisitions which increased Downer Group’s net income in many million dollars. Thus, the new $200 m rail contract for QR, alliance deal with Xstrata, and completion of funding are the announcements which declared about the company stability and flourishing.

Additionally, much attention should be paid to NZ $1 billion Telco contract and to investment statement aimed at raising up to $100 million (ASX 2009).

During 2009-2010 reporting year, Downer Group expanded its business, secured $170 million on mining and over $400 million by means of new contracts. More and more money is earned by means of signing up new contracts and expanding its business. More and more new projects are announced.

Having considered Downer Group’s announcements, it may be concluded that since 2005 up to 20101, Downer Group had been doing all possible to increase their investing power, sign up contracts with as many as possible suppliers and consumers of the services to increase their own income ().

Looking in the future, the company signed up contracts which price was abnormal, but they were worthy. It should be noted that working in many directions, Downer Group mostly wins, however, being scattered, it fails to run the whole business successfully.

The Impact of Changed Regulations on the Downer Group’s Primary Financial Reports

Downer EDI Limited is impacted by Statement of Accounting Concepts (SAC 1) and (SAC 2) aimed at regulating the reasons and norms for providing annual financial reporting. These documents are considered to be the initial ones and have been added and changed from the day of their implementation (Public Sector Accounting Standards Board 1990).

The Income Statement, the Statement of Financial Position and the Statement of Cash Flow are considered to be the primary financial report sections and the changes in the accounting statements of these regulations (since 2006 up to 2010, the periods under discussion) affect the company performance greatly.

The main purpose of this section is to dwell upon the changes in the accounting standards and other regulations to consider their impact on Downer Group.

Accounting standards

The Statement of the Chase Flow was changed in 2007 (the regulation affected all the reports beginning with 1 January 2007).

Ten paragraphs were amended, one of which, devoted to cash flow statement format, was deleted, while another one, devoted to “the aggregate amounts of the cash flows from each of operating, investing and financing activities related to interests in joint ventures reported using proportionate consolidation” (Australian Accounting Standards Board 2007, p. 21), was added.

Paying attention to the fact that the Statement of Financial Position and the Income Statement are the primary financial reports of the Downer Group, accounting standards dedicated to them were developed only in 2009 with the remark that this standard should not involve the reports prior to 1 July 2009.

Thus, this document affects only the last Downer Group’s report under discussion. This document has changed the performance of the company as it allows presenting the income statement as a separate displaying apart from the statement of comprehensive income (Australian Accounting Standards Board 2010, p. 34).

The Statement of Financial Position was presented in the RDR Early Application Only (Australian Accounting Standards Board 2010, p. 27) and it stated the information to be provided under this section. The main impact of this regulation is that it allowed the company to put financial position under a separate section and discuss in detail the information of the primary importance for the company (Downer EDI Limited 2010).

Concise Annual Report 2006-2007 (Downer EDI Limited 2007), Annual Report 2007-2008 (Downer EDI Limited 2008), and Annual Report 2008-2009 (Downer EDI Limited 2009) do not contain such information.

Other regulatory changes

Apart from the primary financial reports, Downer Group was influenced by other regulations. In 2006, the company prepared the report affected by accounting policy of construction contracts for the first time. This action materially affected Downer Group that year (Downer EDI Limited 2006).

The Share Based Payments Statement was changed (Australian Accounting Standards Board 2009), therefore, the further calculations were provided on the basis of the stated document. In spite of the fact that only several AASB new accounting standards are mentioned, they have been the most influential for Downer Group since 2005 up to 2010 reporting periods.

The Impact of the Economic Environment on the Downer Group’s Past and Future Prospects

This part of the report is aimed at discussing the economic environment of Downer Group. In particular, it is necessary to show how various economic issues affected the performance of this company in the past and explain how them may influence it in the future.

Overall, Downer Group operates in different fields and markets; therefore, its performance can be dependent on many factors, especially the overall development of Australian economy and growth of different industries such as extractive industry. This argument will be further illustrated in the following parts of this report.

Significant economic issues affecting the group

One of the areas, which have always been of great importance to Downer Group, is the development of transport infrastructure, namely airports, railroads, harbors, and so forth. Such projects are usually funded by the government. Thus, the performance of this company can be affected by the willingness of the state to spend on rail or road infrastructure (Downer EDI Limited 2006, p. 24).

Such construction sources have been a continuous source of income for Downer Group, and its income can be affected by the availability of resources. It should be noted that in the last decade, the Australian government continuously increased in expenditures on road or rail infrastructure.

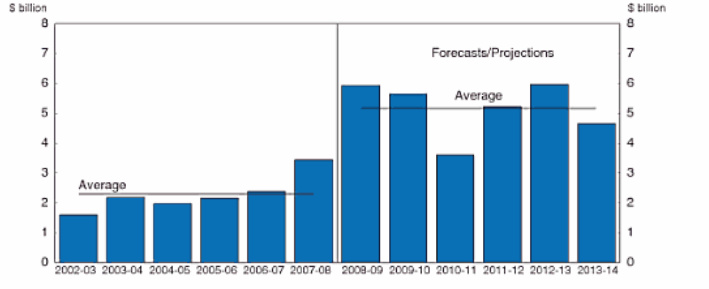

Currently, this figure numbers 6 billion dollars (OECD, 2010, p. 97). However, according to the Organisation for Economic Co-Operation and Development, the expenditures may decline in the next decade (OECD, 2010, p 97). This chart illustrates how the government spending will change in the next ten years.

(OECD, 2010, p 97).

This data indicates that to a large extent, the performance of Downer Group will be affected by the overall development of Australian economy and availability of financial resources. Again, one cannot accurately predict the amount of government’s future investment in infrastructure, but this chart suggests that this organization should be ready for the possible decrease of their revenues.

Most likely, the Australian government will not change its attitude toward the infrastructure, but due to financial crisis, they may be forced to reduce these expenses. This is the main risk that the management of Downer Group should be aware of.

This is only one of the factors many influence this company. Another area which is of great interest to this organization is mining or extractive industry. In 2010 exploration management and drilling brought them 973.5 million dollars and this is a significant part of their income (Downer EDI Limited 2010, p. 7).

Hence, financial performance of this company is directly dependent on the efficiency of agricultural industry in Australia and willingness of domestic and international companies to work in this field. At the moment, mining industry contributes approximately 8 per cent of the country’s GDP; more importantly, at least 26 percent of total investment is directed in this particular area (Richards 2009, p. 214).

Under such circumstances, Downer Group can occupy a very strong position in construction market. The thing is that increased extracting capabilities of the country intensified the necessity for sea port and road construction. Hence, we can argue that this situation creates extra opportunities for Downer Group.

Nonetheless, one should bear in mind the supplies of minerals are going to be exhausted sooner or later, and this will produce very adverse affects on this organization. Certainly, it is not going to happen in the near future, but this possibility should not be neglected; otherwise this company will be very vulnerable to the changes in economic environment.

The third economic factor, which may influence this company, is the price of oil and gas. For at least fifty years, Downer Group has been closely cooperating with gas and oil sector (Downer EDI Limited 2011). Downer Group provides them with engineering and construction services. Cooperation with gas and oil sector is of great importance with these companies.

Yet, one should take into account that such cooperation can be fruitful only on condition that oil prices remain high. Provided that they decline, Downer Group will no longer be able to derive profit from working in this area. Furthermore, this organization will be strongly affected by the changes in demand for oil and gas (Taylor 2006, p. 9-28).

It is hardly possible to predict other the fluctuation in oil prices, and one can say how they will change in the next decade. Of course, Downer Group only assists oil-extracting companies; its technical capabilities can be required by other organizations. However, the decline of their profitability will have very adverse effects on this company.

This is one of the reasons why Downer Group invests more in the development of renewable energy technologies which can play a key role in Australian economy. We can say that Downer Groups attempts to diversify the sphere of its interests in order to minimize possible economic risks.

Among other economic factors, which are of great significance to the company, is the competition that they have to face. This organization holds its operations in very saturated markets in different countries, and they have to contest with both domestic and international companies that specialize in construction, technology development, consulting, and so forth.

Only in-depth expertise in these areas enables Downer Group to occupy strong positions in these markets. Other economic forces that shape the performance of this organization are the cost of labor, taxation rates, the degree of governmental intervention into economy. Downer Group operates in New Zealand, India, and China (Downer EDI Limited, 2011).

On the whole, the governments of these countries do pursue the policy of protectionism, and this company is able to benefit from such a situation. Currently, economic forces are mostly favorable to this organization, but they cannot be controlled in any possible way. The most important issue is that their economic health is strongly connected with the financial performance of various industries and companies.

Downer Group provides them with technical solutions, and if these companies do not succeed, the services and expertise of Downer Group may no longer be necessary. This is the main danger that the company should avoid.

The company’s past performance in reaction to the economic issues

In the previous years, Downer Group was able to benefit from various economic changes. For instance, the government’s decision to invest in road infrastructure helped them increase their revenues.

In 2006, the company made several important acquisitions which enabled them to become a leading road constructor in Australia, in this case, we need to speak primarily about the acquisition of Emoleum the company that specializes in bitumen and asphalt paving (Downer EDI Limited 2006, p. 44).

During the last five years, increasing governmental attention to infrastructure produced very beneficial effects on their financial performance. The same thing can be said about the growing importance of Australian mining industry and active participation of domestic and international companies (Richards, 2009, p 214).

Overall, we can say that the management of Downer Group has always tried to adjust this company to the changing economic environment. As it has been said before, they try to expend their sphere of interests and invest capital in different areas such renewable energy or telecommunication.

There are several rationales for this diversification of their services. The management of Downer Group understands that various economic factors have brought many benefits to their company, but they also realize that such a situation can change sooner or later.

The future economic health of the group

While assessing future economic health of Downer Group, one should take into account two very important circumstances. On the one hand, its financial performance is directly dependent on various economic factors which can hardly be controlled by this company. For instance, we can single out the amount of governmental expenses, the performance of extractive industry, prices for oil or gas and so forth.

This company is strongly related with various industries, and its profitability is affected by their successes or failures. Thus, on the one hand, we can argue that its positions are very vulnerable. Nonetheless, Downer Group has a very diverse sphere of interests; they invest in many different areas, like renewable energy, communications, environmental management, international network development and many others.

This diversity of interests can greatly benefit Downer Group because the areas in which they invest will play a very important part in Australian and international economy. In this case, the ability of the management to allocate resources will be the key to their economic health.

During the last decade, macroeconomic environment of Downer Group greatly contributed to their growth, but this organization should be ready for the possible changes. Judging from its current strategies and reaction to the changing environment, one can say that Downer Group will retain competitive position.

Conclusion

Having considered the situation in Downer Group during 2006-2010 reporting period, it is possible to conclude that the company development may be considered by means of its annual reports, announcements, and changes in economic environment and accounting standards.

First of all, it should be mentioned that operating in different spheres of business, transportation, energy, oil, etc. the company success depends on many factors. External factors are important as well as internal ones.

The changes in the economic environment worldwide and in the country along with the amendment of accounting statements and other legal regulations may cause positive and negative effect on the operating of the company.

Second, widespread of the company interests can result in the following, if one sector the organization fails, then it succeeds in another one. Therefore, the company always remains in winning position and even if one sector stops bring profit, Downer Group can always shift to another manufacturing and get the most of it.

The changes in regulations and accounting standards influenced the financial reporting on the company. Still, those changes can be considered as positive ones. The Statement of Financial Position and the Income Statement were not the part of accounting standard up to 2010, however, they were Downer Group’s Primary Financial Reports.

The changes in the accounting standards allowed the company organize their documentation and annual reports better, informing the stakeholders about the most significant changes in the company operating.

The conclusion may be drawn about the future of Downer EDI Limited on the basis of the considered information. The company stands firmly and it is proposed to increase its income in general, even though such spheres as oil and road construction may become unprofitable.

Reference List

ASX 2008, Announcements released as DOW. Web.

ASX 2009, Announcements released as DOW. Web.

ASX 2010, Announcements released as DOW. Web.

Australian Accounting Standards Board 2007, Compiled Accounting Standard AASB 107: Cash Flow Statements. Web.

Australian Accounting Standards Board 2009, Compiled AASB Standard AASB 2: Share-based Payment. Web.

Australian Accounting Standards Board 2010, Compiled AASB Standard – RDR Early Application Only AASB 101 Presentation of Financial Statements. Web.

Downer EDI Limited 2006, Concise Annual Report 2005-2006: Engineering and maintaining essential infrastructure. Web.

Downer EDI Limited 2007, Concise Annual Report 2006-2007. Web.

Downer EDI Limited 2008, Annual Report 2007-2008. Web.

Downer EDI Limited 2009, Annual Report 2008-2009. Web.

Downer EDI Limited 2010, Annual Report 2009-2010. Web.

Downer EDI Limited 2011, The Official Website. Web.

Downer Group 2006, Archived ASX Announcements 2006. Web.

Downer Group 2007, Archived ASX Announcements 2007. Web.

Organization for Economic Co-Operation and Development 2010, OECD Economic Surveys: Australia 2010, OECD Publishing, Melbourne.

Public Sector Accounting Standards Board 1990, Statement of Accounting Concepts (SAC 1): Definition of the Reporting Entity. Web.

Public Sector Accounting Standards Board 1990, Statement of Accounting Concepts (SAC 2): Objective of General Purpose Financial Reporting. Web.

Richards, J. 2009, Mining, Society, and a Sustainable World, Springer, Melbourne.

Taylor, M. 2006, Managing enterprise risk: What the electric industry experience implies for contemporary business, Elsevier, New York.

United Nations Organizations 2009, Economic and social survey of Asia and the Pacific; 2009: Addressing triple threats to development, United Nations Publications, New York.