Introduction

The demand for energy is increasing at a very fast pace throughout the world. This will entail establishing more infrastructure in the production and distribution of petroleum and other energy related products. In the case of petroleum, oil pipelines will have to be laid connecting onshore and offshore drilling rigs to the refining units. Corrosion of the pipelines is a critical factor that oil companies have to be careful about. This is especially true in the case of offshore pipes laid in the seabed.

Salt water is highly corrosive and would need high quality, long life anti-corrosive coating both on the outside and inside of the pipes. It is proposed to introduce the Yellow Jacket anti corrosive products manufactured by the one of the most respected and oldest companies in the industry, namely Bredero Shaw.

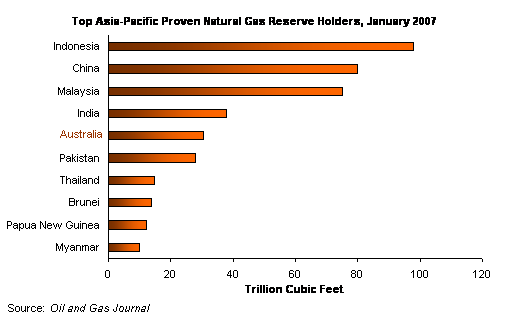

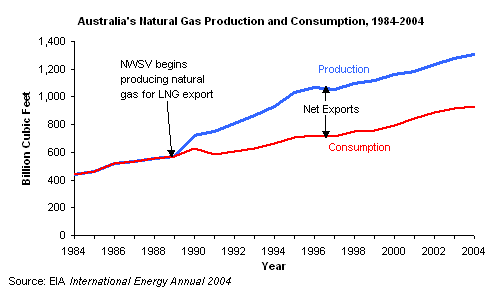

As with most countries of the world, it is only expected that the demand for oil and natural gas will increase significantly over the years. The present demand for oil in the country is approximately 750,000 barrels a day. This is expected to rise to “over 800,000 barrels per day by 2009-10, and over 1,200,000 barrels per day by 2029-30.” (Future Oil And Demand Supply: Oil Production And Consumption in Australia. 2006). The current oil production in the country is around 500,000 barrels per day and is not expected to grow significantly unless new oil reserves are explored and exploited. In any case, infrastructure of meeting the demand (through increased production and imports) will need infrastructure in new pipelines.

This indicates that the demand for pipelines and hence coating materials will also significantly increase. The situation with regard to natural gas is much more encouraging. It is estimated that another 5 billion AUD (in the coming ten years) for new pipelines alone will need to be invested to meet the demand for domestic consumption and export purposes. (Natural Gas: Pipelines. 2007). The country has also huge gas reserves that can be exploited in the future.

(Natural Gas. 2007). The country is also a major exported of liquefied petroleum gas with current production exceeding demand for the product in the country.

Coating solutions background

Metal pipelines a prone to corrosion especially if they come in contact with sea water. There have been many methods developed over the years as a solution for this problem. Coating can be done with paint, epoxy solutions, polyethylene, polypropylene, asphalt enamel, concrete etc. Since petroleum based coatings are more resistant to corrosion and have a long natural life, Yellow Jacket coating technology uses polyethylene for coating the pipelines.

Company background

Bredero Shaw is the industry leader in the business of developing and manufacture of pipe coating solutions. Its main clients are the oil and natural gas and the water supply industry. The company was started during the 1930’s and its corporate office is situated in Toronto, Canada. The company employees more than 4000 employees and twenty seven plants located in strategically around the world. The company can offer ready made and custom coating solutions and its products bear the ISO 9000: 2000 certification. The company has done coating for nearly 250,000 kilometres of pipelines and its major clients include Chevron, BUD (Trinidad and Tobago), PDEG – Petrobras (Brazil), The Kuwait Oil Company etc. (Partial List Of Key Offshore Projects Around The World. 2008).

Product Description

Bredero Shaw has coating solutions using many of the methods mentioned in coating solutions background given above. The product for which the market planning is framed is Yellow Jacket of Bredero Shaw Company which is concentrated and specialised in production of anticorrosion coatings for the oil field pipes. They have 75 years of experience in pipe coating solutions. Yellow Jacket is applicable in oil, gas and water work industries for maintaining moderate temperature with better handling techniques.

Our product is featured with strong resistance to corrosion and moisture in various soil conditions.. It is specially designed to protect the oil pipes from handling problems. Through these peculiarities the product offer reduced manpower requirements in installation stage as well as low level maintenance and repairing costs. The technology used for the product is regarded as a leading one which helps to existing in the industry over 50 years with customer satisfaction. (Yellow Jacket: High Density Two Layer Polyethylene Coating. 2008).

Competitors Analysis

In order to formulate appropriate marketing it has to identify the strength and weakness of competitors existing in the industry. By analysing the strategies followed by the competitors we can derive the opportunities and threats existing in the competitive environment of the industry. The major competitive forces existing in the Australian pipeline coating industry are described below.

- PPSC industries SDN. BHD is a Malaysian based oil coating Products Company. They started working in 1984 and get ISO 9002 certification in 1994. They are capable of supplying wide range of coating systems for pipes used in various fields. Their strategic sea port location helps them to carry out their exporting easy. (Ppsc Industries. 2008).

- Vasco Energy: Their motto is servicing the global oil and gas industry. They are the supplier of a wide variety of products and service in the oil and gas industry. They are specialised in developing pipe coating and corrosion protection products. Internationally accepted quality, health, safety and environment standards are employed by the company in its operations. QHSE is accepted by it as a part of its business culture. For assuring constant growth it concentrate on installing global excellence in its products and services. They are located in Melbourne. (Servicing The Global Oil and Gas Industry. 2008)

Petro Coating Systems Pty limited

It is a major supplier of field joint coatings to the Australian pipeline projects since 1992. They occupy experienced human resource personnel. Their products are capable of ensuring long life anticorrosion protection to all types of pipes used in oil and gas line industry as well as petrochemicals and other industry sectors. Strict quality control measures as per ISO9000 standards are ensured by them in their products. (About Petro Coating Systems: Background. 1992).

Ameron Performance coatings and finishes

It is a major competitor in pipeline coating industry with applicability in oil and gas industries, refineries, petrochemicals, and water pipes. Their product is specially designed to protect steel and concrete pipes from corrosion due to the industrial and marine exposures. Safety to environment is also assured by them through developing proprietary coatings and processes which reduce the use of environmentally harmful chemicals. They ensure safety of the workers as well as society through environmentally designed products. Their technology is also very advancing in nature. (History. 2007).

Ideas Group: They engaged in the production and supply of pipes and coatings for all types of industries

These are the major competitors in Australian pipeline coating industry.

Pest Analysis

PEST analysis is ideal for finding out the opportunities and threats relating to political and socio economic factors existing in the country.

Political factors

Pipeline industry is considered as vital for ensuring remote resources of the country to its vast population. The fuels and water pipelines are considered as crucial factor in Australia’s economic prosperity. The Australian Government does not have a high stake in the oil and gas sector in the country the majority of the players are privately owned corporations or consortiums formed by them. This indicates a favourable atmosphere for private player who will be concerned about the quality of the anti-corrosion systems they use. The Australian political system is very advanced and stable with no unreasonable polices being formulated. Hence the business is safe regarding this aspect. (About The Pipeline Industry. 2008).

Economic factors

There is always high demand for pipeline construction works all over the world. It is resulted from the increasing need of oil products as a part of development. With regard to this increasing opportunity for pipeline construction works there arise need for advanced technology to ensure better service in even harsher conditions. Pipe coating industry is also required to react positively with the changing needs in the industry.

Socio Cultural factors

Environmental concerns may be a negative factor for the oil and gas industry since it depletes a non-renewable natural resource. Oil rigs and refining facilities are also pollutants to a certain extent. The advantage is that more care will be taken with regard to offshore oil pipelines due to the threat of oil spills. This will ensure that companies will use the best anti-corrosion products available.

Technological factors

The Yellow Jackets produced by Bredero Shaw is technologically advanced and the company has very capable R&D facilities. There is no real concern for the company with regard to technical competition. What could be a possible area of concern is that considerable research is being done for the development of alternate and renewable sources of energy. This is a long term threat since a viable alternative to petroleum and gas is not expected in the near future. But once this happens the need for extensive pipelines may come down drastically.

Porter’s Five Force analysis

This market analysis was introduced by Michael E Porter and first appeared in his book titled “Competitive Strategy: Techniques for Analyzing Industries and Competitors“. According to this method, analysis can be done using five criteria namely supplier power, customer power, threat of new entrants, threat of substitutes and competitive rivalry. (Recklies 2007).

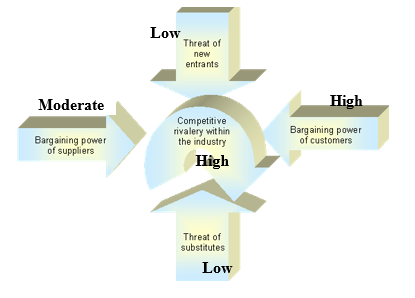

Supplier power: The technology for Yellow Jacket coating has been available with the company and they have the capability to produce high quality products. One major raw material for the product is polyethylene which is a petroleum by-product. The price and production for this is controlled be very few countries and hence could be a favour in supplier power. For all other raw materials supplier power is limited and hence not of much concern for the company.

Customer power: Anti-corrosion in the oil and gas industry is not an area where customers can lower prices thereby compromise on quality. Moreover, regulations also exist as to the type of quality of corrosive material to be used. Here the reputation enjoyed by the company is an advantage. The background of the company had been given earlier. Hence there would be no significant concern regarding high power of suppliers. The company need to focus on its service and after sales service. One disadvantage is that even though there are not many competitors, the number of customers is also limited. The scenario is that this huge market is dominated by few larger companies or consortiums.

Threat of new entrants

The anti corrosion industry is a technology based industry and it would be difficult for new entrants to enter the field. They would have to compete with well respected and established companies like Bredero Shaw. Hence the threat of new entrants is not high for the company and its products. Hence there are a lot of barriers to entry for new players.

Threat of substitutes

There are a few other methods other than using polyethylene for anti-corrosive purposes. This has already been mentioned in earlier section. The threat for substitutes in this case is high unless regulations force customers to use polyethylene alone. An alternative would be to deal in the company’s other anti-corrosion products which uses some of these methods alongside Yellow Jackets.

Competitive rivalry: An analysis of competitors has been done in the earlier section titled ‘competitor analyses’. It can be seen that there is a fair amount of competition in this market. This is compounded by the fact that the number of customers is small. But gaining acceptance from one or two of them through long term supply contracts will bring down this problem to a large extent.

With regard to Porter’s Five Forces analysis, the company and its products do not face much challenge in the market place if proper service is done to the customers. The name and reputation of the Yellow Jackets made by Bredero Shaw is an advantage.

Market positioning

Positioning the product in the market is very important when launching a product in any market. “Positioning refers to ‘how organisations want their consumers to see their product’.” (Positioning). Since this is a specialised product which will be used in a specialised field, positioning is quite straightforward. Moreover, the customers are few and are knowledgeable about the product (whether using polyethylene, epoxy coating or any other method of anti-corrosion) Hence the need to educate customers need not arise.

Target customers: Understanding the target customer especially when a new product is being launched is very important for any company. Defining the target customers is very simple and straightforward in the case of Yellow Jackets. They are the oil exploration, drilling, refining and distributing companies in Australia. An additional segment would be water authorities since water is also very corrosive. But it is intended that the initial focus will be on oil companies and additional segments will be targeted only after establishing a market in this segment.

Strategy

The strategy to be followed in introducing the product is given below. As mentioned earlier, this is a specialised product that has uses in one specialised field. Hence a general advertising campaign is not required here. What is proposed is a direct approach to the prospective customers to inform and educate them about the Yellow Jackets. It is presumed that most of the companies will be aware of the product and the name of its manufacturer.

Advertisements in trade and industry journals related to this market are an option worth pursuing. The one serious option would be to arrange meetings with prospective customers and educate them about the benefits of using polyethylene over other methods of anti-corrosion. They should also be informed about the long term cost benefits of using Yellow Jackets. Statistics of the company records and performance of the product with regard to previous installations can be provided. The list of clients as well as the total length of pipeline that have been coated (250,000 kilometres, mentioned earlier) can also be provided.

Provision for contacting past clients by prospective ones can also be arranged. The company is confident that if a prospective client does this for getting a good feedback, it will be properly reciprocated by previous happy and satisfied customers. This would also be the best advertisement that the product can receive. Moreover, this is a limited market (in terms of number of customers) and the prospect of getting word of mouth endorsing is also high.

Consumer behaviour

In this instance it would be easy to predict the behaviour of the prospective customers. Consumer behaviour is dependent on five steps, based on which they will make the ultimate decision to purchase. The steps are need recognition, information search, evaluation of alternatives, purchase decision and evaluation of purchase. (Introduction To Marketing. 2006). It is a fact that every oil and natural gas company will need anti-corrosive protection for their pipelines. Hence, need recognition is not a factor to be considered here. Information search is also productive for customers because of the relatively small number of suppliers and the specialised nature of the product.

Each of the customers will already have used similar products already. The next step is evaluation of alternatives and the product has to be featured prominently for their evaluation. The availability of alternatives (product as well as supplier) has been mentioned in five forces model it can be said that alternatives do exits in this case. It is up to this dealer to see that a good offer be given at this stage. In such a case, there is a high probability that the customer will offer to buy the product from us.

The oil and gas industry is characterized by long term agreements in many areas especially in supply of crude oil to buyers. This strategy can be adopted here also. Long term agreements can be made with provision for possible price increases.

Quality competitiveness

In this area the dealer is confident that Yellow Jackets made by Bredero Shaw will be accepted by concerned companies in the industry as one of the best in the market. The products have ISO 9000: 2000 certification as mentioned earlier in the company background section. Since oil drilling, refining and transportation is a high risk industry the need for quality need not be stressed. The risk can be in terms of fire and oil spills. An explosion from a leaking pipe can cause both human and economic losses. An oil spill in the ocean can cause huge environmental damage especially to marine life. All these factors are well known to customers. Hence the need to educate prospective customers about the quality of the products will not entail much effort.

Cost competitiveness

Quality will necessarily come with a higher cost. But this is only true in the short run. The anti-corrosion coating has to be effective at least for a period of ten to twenty years. This is because of the practical difficulties in accessing the pipelines (for re-coating) especially where they are laid on the sea bed. If the frequency of re-coating increases, add on or hidden costs will increase the total cost of the whole process. Since Yellow Jackets have a long life this frequency will come down to a great extent. Taking this into consideration, the price and the terms offered by the dealer would turn out to be beneficial for the customer.

Unfortunately, a price comparison is not practical here. Prices can vary a lot depending on the type of coating, the thickness, the location of the pipelines (on land, water, sea bed). Price will very much be ‘need and location’ sensitive. For example the price quoted for an offshore pipeline will be much more when compared to an onshore line. This is because the specifications will be different. A higher thickness and strength in coating will be necessary for pipes laid on the sea. Moreover if the location is in a far off and remote place, the price quoted will be higher. This is mainly because of the transportation of equipment needed for coating to the site.

This will be the case with all the companies in this area of business. Hence a price comparison of Yellow Jackets with the products of competitors in impractical at this stage. The price quoted will vary in each case and hence, the only step to be taken is to see that the customer is given a competitive price which will be beneficial to them in the long run. This price coupled with proper servicing and maintenance will be sufficient to obtain orders in these types of businesses.

Conclusion

A proposal for introducing the Yellow Jackets manufactured by Bredero Shaw has been given here. The company is a well known and highly respected organization in the field of anti-corrosion. Even though this is a highly competitive field with few (large) customers and suppliers, it is expected that the product can be launched successfully in this market. The demand for oil in the country will only rise in the future.

Even though the government does not predict a huge increase in domestic production in the near future, the need for infrastructure to cope up with the increased demand will be there. This will entail in the laying of new pipelines which will need anti-corrosion protection. If new oil fields are identified and exploited,

it will be all the more better for the dealer. The case of natural gas is highly optimistic for anti-corrosion materials. The country has surplus production and huge reserves. This will definitely be good for the anti-corrosion industry. The estimated investment in pipelines by 2010 is expected to be 5 billion AUD (mentioned earlier). The whole length of this newly laid pipeline will need anti-corrosion protection. Taking all this into consideration, the launch of Yellow Jackets in Australia will be highly successful especially in the long run.

Bibliography

About Petro Coating Systems: Background. (1992). Petro Coating Systems. Web.

About The Pipeline Industry. (2008). Welcome To The Australian Pipeliner. Web.

Future Oil And Demand Supply: Oil Production And Consumption in Australia. (2006). Parliament of Australia Senate. Web.

History. (2007). Ppg Industries: Australian General Industrial Timber Protective and Marine Coating. Web.

Lamb, Charles W., Hair, Joseph F., and McDaniel, Card D. (2006). Introduction To Marketing. P.125. Web.

Natural Gas: Pipelines. (2007). Energy Information Administration: Official Energy Statistics. Web.

Natural Gas. (2007). Energy Information Administration: Official Energy Statistics. Web.

Natural Gas: Exploration And Production. (2007). Energy Information Administration: Official Energy Statistics. Web.

Partial List Of Key Offshore Projects Around The World. (2008). Bredero Shaw: A ShawCor Company. P.16. Web.

Ppsc Industries. (2008). Ppsc. Web.

Positioning. Learn Marketing. Web.

Recklies, Dagmar. (2007). Porters 5 Forces: The Five Competitive Forces. Web.

Servicing the Global Oil and Gas Industry. (2008). Wasco Energy. Web.

Yellow Jacket: High Density Two Layer Polyethylene Coating. (2008). Bredero Shaw. : A ShawCor Company. Web.