Critical Review of the Paper

The article under consideration is a work by Geroski et al. (2003) “Are Differences in Firm Size Transitory or Permanent?” The research question is “What are the differences in grow rates of firm and what is their character?” The goals of the study are to present the typical empirical model of corporate growth and develop a description of the data set a well as report the empirical results. Investigation of peculiarities of firm size and its change can be important for further research.

For example, Revilla and Fernandez (2012) investigate the correlation between firm size and research and development productivity in the context of different technological regimes. A similar issue is discovered by Pagano and Schivardi (2003). The researchers focus on the relationship between productivity growth at the industry level and size structure. Thus, they reveal a positive relation between average firm size and growth.

Moreover, they conclude that innovation in the context of research and development is a meaningful factor for firm growth. Probably, the current study would have benefited if the researchers considered the determinants of firm size. For example, Kumar et al. (2000) suggest that firms performing in bigger markets are larger. Also, there is a connection between the industry sector and firm size. Still, there is no consensus about the issue of firm size in the current literature. The paper under analysis is different from the rest of literature because of the long period of time it includes.

The authors ground their work on earlier empirical studies dedicated to corporate growth rates. These studies apply cross-section or short-panel econometric techniques and lead to a conclusion that growth rates are random but that some degree of mean reversion exists. This idea can be interpreted in a way that size differences among firms are transitory. Moreover, there is another more natural way to investigate the long-run dispersion of firm sizes, which is to explore data about the growth of certain firms over long periods of time. This research involves a sample of 147 UK firms that were continually monitored for more than 30 years.

The researchers come to the following conclusions. First of all, growth rates vary significantly over time and discrepancies in growth rates between firms do not remain unchanged for a long time. Secondly, firms do not reveal any systematic similarities in size or have a pattern of stable size differences over time. The researchers compare and contrast the results with standard approaches that lead to a conclusion that firms achieve and preserve sustainable positions in a skewed size distribution. Nevertheless, in the original article the authors mention this finding as interesting and it looks natural that firm size rankings change over time.

The source of data for the study is the DTI-Meeks–Whittington database. The initial sample is retrieved from this source. In the paper by Geroski at al. (2003, p. 50), the authors observe time period from 1948 to 1985 inclusive. The given data from the initial sample comprise 44,041 annual observations on an unbalanced panel of 3,266 UK-registered firms with at least 5 continuous observations from 1955-1985 inclusive.

This sample is different from the one where observations were carried out for 30 ears and the results of analysis will be also different. All the companies included in the sample are referred to as “population” (Geroski et all. 2003, p. 51). The selected data is appropriate for the research question because it enables observation of changes in firm size during a long period of time, which allows investigating the character of these changes. Data cleaning was applied and provided an opportunity to select data about companies that were functioning during the definite period of time.

Summary statistics is as follows. For further analysis, it was necessary to define the number of years during which ever company was observed. The calculation was performed using Excel tools and SPSS Statistics. The results of calculations for the number of years for each company are marked with a help of its unique code (“ts”) in the initial sample. The calculations lead to the following conclusions:

- There are 3266 companies in the whole initial sample;

- All 3266 companies present in the initial sample were observed for at least 5 years;

- The number of companies which existed every year within the period from 1955 to 1985 (for 31 years) is 155 and they form a “continued sample” (Geroski et all. 2003, p. 51);

- Overall, the number of firms in the ‘all sample’ varies from over 2470 in 1955 to 2652 in 1959, then reduces to 1915 in 1963, 1720 in 1968 (increasing slightly in 1964 and 1969), 1215 in 1970 (increasing slightly in 1969), 894 in 1975 (increasing slightly in 1974), 487 in 1978 to the lowest indicator of 231 in 1985, which can be better traced in Figure 1.

- For the 155 firms from “continued sample” mean real total net assets are £306 546,3 with the overall standard deviation of 619 549. The natural log of real total net assets has a mean of 11.57068, and its first difference has a mean of 0.0271.

There are 147 large firms in the first sample. Their observation time is the period from 1948 to 1985 inclusive. The conditions that are supposed to be fulfilled for including a company to the first sample are as follows:

- a company must have been admitted to the Official List of the Stock Exchange,

- a company must be an independent one or included to company groups,

- a company must operate mainly in the UK.

The following conditions are applied to the companies that are selected from the initial sample:

- their principal activity must be manufacturing, distribution, construction or transport (“industry” in the initial sample is between 5 (min value of “industry”) and 88 (max value of “industry”, so according to the UK 1980 Standard Industrial Classification all companies in the initial sample satisfied that condition),

- company must exceed the following sizes:

- 1948–1959, no size qualification,

- 1960–1963 net assets ≥ £0.5 million or 1960 gross income ≥ £50 000,

- 1964–1968 net assets ≥ £0.5 million or 1964 gross income ≥ £50 000,

- 1969–1974 net assets ≥ £2 million or 1968 gross income ≥ £200 000,

- 1975–1977 net assets ≥ £5 million or 1973 gross income ≥ £500 000

There are only “net assets” in the initial sample. It is need extend the conditions to 1985. For example, there are only 5 cases where the value of the assets exceeds 5 mln, only 27 cases where the value of the assets exceeds 2 mln, 117 cases where the value of the assets exceeds 1 mln, and 335 cases where the value of the assets exceeds 0.5 mln. To set the respective conditions, it is necessary to analyze the Gross Domestic Fixed Capital Deflator, which is available from year 1955 onwards.

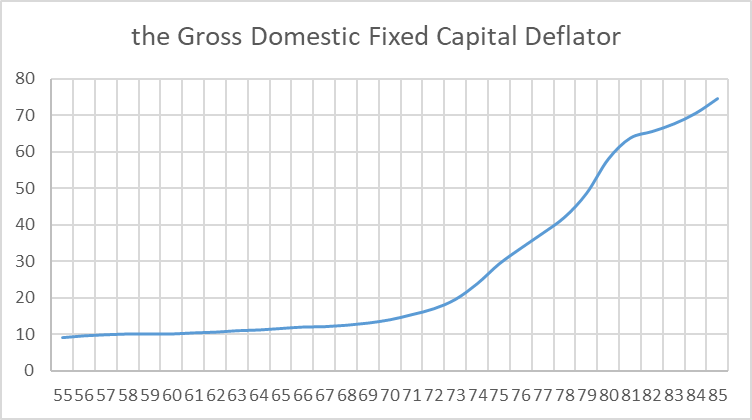

The Gross Domestic Fixed Capital Deflator dynamics is presented in Fig.2. As of year 1973, a doubling of the value was observed in comparison to year 1955, and as of year 1977, the value is 4 times bigger.

Then, for example, such conditions can be suggested:

- 1965–1973 net assets ≥ 0.5 million,

- 1974–1977 net assets ≥ 1 million,

- 1978–1985 net assets ≥ 2 million.

There are 37 cases that satisfy (a) conditions, 13 cases that satisfy (b), and 22 cases that satisfy (c) conditions. These groups can comprise different as well as the same companies at different times of observation. Nevertheless, the sample received in such way is rather small. Consequently, selection of conditions in such a way is not rational. Moreover, the authors use the value “firm size” (Geroski et all. 2003, p. 51). Firm size is measured by total net assets, normalized on an implied, seasonally adjusted, aggregate deflator 1990 D 100 taken from annual editions of the CSO Blue Book.

The firm size can be computed by the formula:

firmsize=100*assets/gdfcfpi

The large company can be defined by its “firm size”. In the paper by Geroski et all. (2003, p. 52) the “continued sample” contains 402 companies. Among them, 147 companies were considered to be large companies. It is 147/402 or 36.6%.

36.6%*155 = 56,73.

Therefore, there is an opportunity to select instantly about 57 companies with the largest “firm size”. To do this, there is a need to sort the companies in a descending order Si,t ( Si,t is the size of the firm i at time t ), and choose among them the first 57 firms (by a unique code, “ts”).

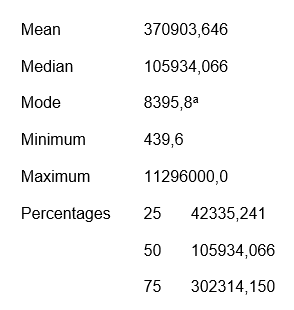

From the statistical analysis of 155 firms in the given data “continued sample,” the following characteristics of “firm size” were calculated:

Multiple modes exist related to these data and the smallest value is shown.

On the whole, the paper by Geroski et al. (2003) has the following results. The researchers conclude that the growth rates of firms that survive long enough to record 30 years of history are random. Moreover, a firm size displays almost no tendency to converge to either a common, steady-state optimum firm size or to a set of stable size differences between firms. Therefore, the complex methodology applied by the researchers was not effective enough to reveal any trends relevant to firms’ size. The authors themselves admit that their conclusions may not be completely correct despite the extensive sample involved in the study.

The study has both strengths and limitations. Thus, one of the evident strengths is a big sample that, in other conditions, could contribute to research validity. Also, a strong point of this study is that the research data that undergo analysis are taken for 30 years, which is a long period of time for a business research. Moreover, the researchers utilize complex tests to analyse the research data, which means that the research findings are likely to be reliable. Nevertheless, there are also weaknesses and limitations that should be considered for the interpretation of research findings. First of all, the major weakness is that the researchers do not come to any definite conclusions about transitory or permanent character of differences in firm size.

Probably, this fact can be explained by a large time period included in the analysis because the observed companies underwent significant alterations due to changes in economic policies of the country as well as market situation as a whole. In addition, the study comprised only firms located in the United Kingdom, which means that the research findings cannot be generalized and applied to companies in other countries. Consequently, it is a limitation of the study.

Replication of the Main Estimation Results of the Paper

The econometric model considered in the paper will be estimated, and is as follows:

where Si,t is the size of the firm i at time t , and εi,t is an i.i.d. white noise process. The observation that β<0 indicates the existence of mean reversion, and is an integral requirement for convergence in the sense of a shortage in the variance of the log of firm size over time. Nevertheless, in case β>0 , the firm sizes will diverge. Finally, if β=0 , firm size evolves according to a random walk, Gibrat’s Law can be applied (Geroski et al. 2003, p. 48). However, this model is criticized by the authors of the article under consideration, which indicates the cases in the results obtained from this model can have different interpretations. The model was not simplified because it is already not complicated. It applies linear regression with further definition of mean β.

First of all, it seems at least that any econometric model like that presumes that α and β are common for different firms, is unlikely to provide a very accurate description of the data. Secondly, 90.5% of the total variation in logarithms of firm size in research data is between firm variations. On the contrary, only 4.63% of the total variation in growth rates is observed between firm variations. Finally, while the sample variance of firm sizes in each year included in research rose over time prior to 1968, it decreased after 1968 and then again increased after 1980 or so (which is evidence consistent with convergence).

A simple panel estimate of model produces an estimate of β=0.028 with a standard error of 0.002 for all firms included in the study “population”. In case of applying model (1) to the 31 annual cross-sections in given data, an average estimated value of β=0.00068 is produced.

Table 1. Firm-specific estimates of convergence β (standard error)

For each of the 155 tests, the t-statistics for testing the null are computed from standard errors that have been bootstrapped. None of the 294 unit root tests leads to rejection. The null hypothesis of non-stationarity for Log(Si) at the 5% significance level. Mean difference is 9.24 with confidence interval of the difference 9.186 (lower) and 9.297 (upper). For a deeper analysis, DF, IPS, and other tests could be used, but they are time-consuming ant complicated for this type of a task.

Modelling Differences Between Firms

None of the ADF (1) tests on the differences between firms revealed any signs of stationarity [2]. Autocorrelation results are presented in the table 2.

It should be mentioned that the research question was not directly answered in the initial article. The authors conclude that there is no definite tendency in firm size changes even during a long-term observation. The calculations executed within this study have a similar result and do not give an answer to the research question. It is evident from the linear regression that there is no general tendency to increase or reduction of firm size. Therefore, there is no opportunity to make conclusions about transitory or permanent character of firm size. However, these results can be explained by the choice of mean in data analysis, which is not always informative. Probably, the study could have benefited in case mode or median had been applied.

On the whole, the study by Geroski et al. (2003) touches an important issue because firm size is one of the determinants that have influence on its financial performance. The other significant factors include diversification, leverage, liquidity, age of a firm, premium growth and claim (Kaguri 2013, p. 24). Still, a sector in which a form provides its activity also matters. Another concept where the firm size matters is job quality.

For example, Bryson et al. (2017) compare the effects of firm size on job quality in France and Britain and come to a conclusion that firm size is negatively correlated with non-pecuniary job quality in Britain and France, but the later observes such a correlation only in the context of the largest firms.

Summarizing, it should be said that the model described by the researchers is controversial. On the one hand, the model is grounded on the analysis of a sufficient sample of firms for a long period of time. On the other hand, the study findings lack consistency and do not lead to a single and definite conclusion. Probably, the researchers should have worked more on the sample and develop characteristics that would have allowed to select firms that can undergo the analysis that will be more informative than the one in this study. Thus, further research can be provided with such extensions as the choice of other statistical indicators and sample stratification.

For example, the firms selected to the sample can be divided into subgroups according to their size. Nevertheless, a negative result or the absence of a single conclusion about the character of firm size change in the research under consideration witnesses that companies are diverse and do not follow a definite pattern of size change because they are under the impact of various factors.

Reference List

Bryson. A, Erhel, C, & Salibekyan, Z 2017, The effects of firm size on job quality: a comparative study for Britain and France, Discussion Paper Series. Web.

Geroski, P, Lazarova, S, Urga, G & Walters, C 2003, ‘Are differences in firm size transitory or permanent?’, Journal of Applied Econometrics, vol. 18, no. 1, pp. 47-59.

Kaguri, AW 2013, Relationship between firm characteristics and financial performance of life insurance companies in Kenya. Web.

Kumar, KB, Rajan, RG, & Zingales, L 2000, What determines firm size? Web.

Pagano, P & Schivardi, F 2003, ‘Firm size distribution and growth’, Scandinavian Journal of Economics, vol. 105, no. 2, pp. 255-174.

Revilla, A & Fernandez, Z 2012, ‘The relation between firm size and R&D productivity in different technological regimes’, Technovation, vol. 32, no. 11, pp. 609-623.