Introduction

Shale gas is natural gas that is fascinated in shale configurations. Shale elements are small granule sedimentary rocks that are loaded foundation of petroleum and natural gas. In the ancient times, it was not cost-effectively as possible to generate shale gas.

Nevertheless, with advancement in technology and the critical thinking perceptions, the progression has become more cost-effective due to flat drilling and rupturing. The overall production of natural gas in 2009 had 87% of other gases with the shale gas taking the remaining percentage. The supply of the shale gas is anticipated to increase to roughly 62% of the United States total natural gas supply by 2030.

In addition, natural gas production is enhanced energy security in United States as she does not need large exports to meet her domestic expectations. Environmental goals are also met in the United States as natural gas which is more environmental friendly have replaced coal and increased use of renewable energy in electric generation (Schwede 6). The present and future state of energy in the United States therefore relies on the production of shale gas.

The big question to consider is whether shale gas is a feasible energy option for the United States to reduce her dependency on the Petroleum Exporting Countries while increasing financial accountability and fiscal viability in the short and long run scrutiny?

The input of shale gas has been apprehended into three phases, the stimulated financial input, tortuous, and the express inputs. First, the direct input involves the industrial output and the income. For instance, the direct contribution of the shale gas industry comprises of transportation and delivery services which has direct influence on the industrial output.

Second, the indirect contributions are initiated alteration in the direct purchase of shale gas. For instance, change in demand results into direct change in industrial output. Last, the induced economic contribution comes about when the industrial employees spend their income on different expenditures. In each stage, the economic contribution is determined in terms of the Gross Domestic Product and the labor income.

Economic Analysis

The trade in shale gas has contributed to economic development in terms of employment, addition of economic value and income for the government (Ashford 1). The extraction of the shale gas has transformed the United States energy position and the economy at large. In 2010, the total production of natural gas in the United States was composed of 27% of shale gas.

There is a great expectation in the growth of total shale gas extraction in the coming five years and immense increase in 2030. The research shows that shale gas is capable of sustaining millions of employment opportunities. It can add billions to the Gross Domestic Product by 2035. Shale gas is estimated to provide more revenue to the government, tariff income as well as national sovereign payments in the next 26 years (Kaiser 75).

The extraction of shale gas also has a wider effect on both the households and businesses. The research shows that inadequate production of shale leads to tripling of the current cost of natural gas. The economic output and the employment are steadily boosted by the low price of natural gas which at long run enhances domestic manufacturing. This is experienced in firms and industries that enjoy the low cost of electricity such as the chemical industry.

Economic input of shale gas can be calculated through the addition of the express input and the circuitous input of the provider industries of shale gas and encouraged economic contribution which result from extra spending in the United States.

The shale gas industry sustained over 600,000 employment opportunities. This represented 148,000 direct employments in the United States and roughly one hundred and ninety-four thousand circuitous employments within the distributing diligences and nearly two hundred and fifty thousand stimulated employments.

The future expectation of the shale gas industry is to sustain more than 1.6 million jobs athwart the United States. The approximated figure is inclusive of approximately three hundred and sixty express employments, roughly 545,000 tortuous employments and nearly seven hundred and fifty thousand stimulated employments.

Shale Gas Employment Contribution in Estimate

F workers

The shale gas industry is anticipated to give over $76 billion in 2010. In 2015 the anticipation is $118 billion and about three times by 2030s.

Table Showing Approximate Contribution of Shale Gas

Source: (Ashford 4)

The elasticity of the supply curve for the natural gas is as a result of the large quantity of shale gas and its low extraction cost. The base for natural gas in the United States can contain major increases in demand without increasing costs. Shale gas has been anticipated to have more economic significance than the gas extracted from the conventional wells.

As a result, the large quantity of shale gas elevates the likelihood that domestic supply can meet significant growth in the United States natural gas usage over the next few years without significant gains in natural gas costs and with less dependence on importation of liquefied natural gas (Bros 97).

Conclusion

The United States order for ordinary gas has developed in current days; the extensive viewpoint of demand for ordinary gas demonstrates extensive rise through 2035; technological advancement have added to recent development in the extraction of shale gas and the increased extraction will lead into the development in capital investment, productivity and job opportunities.

The shale gas industry enhances valuable contribution in the United States economy through the direct employment. With the expansion of the shale gas extraction over the years, a significant expansion of the economy will be realized. By the year 2030 more jobs will be granted by the gas firm and a substantial increase in the government revenue.

The subsidized natural gas costs as a result of shale gas production will lead to an average decrease in electricity costs. Shale gas therefore provides the United States with a solution to the energy problem and to become independent in the energy sector.

According to the researchers, shale gas will significantly enlarge worldwide energy supply. The improved shale gas extraction in the United States and Canada could assist prevent Organization of Petroleum Exporting Countries from ordering higher costs for exported gas.

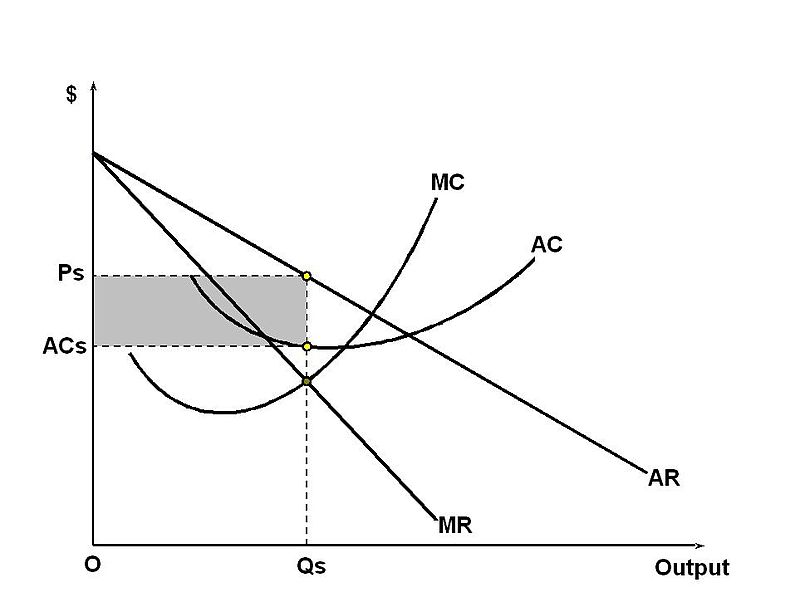

Firm under Monopolistic Competition in the Short Run

The firm gets more profit when its marginal revenue is equivalent to its marginal cost and generates magnitude. Firm is capable of collecting a cost based on the AR’s curve. Total profit is given by the quantity sold (Qs) multiplied by the distinction amid the firms’ AR and AC.

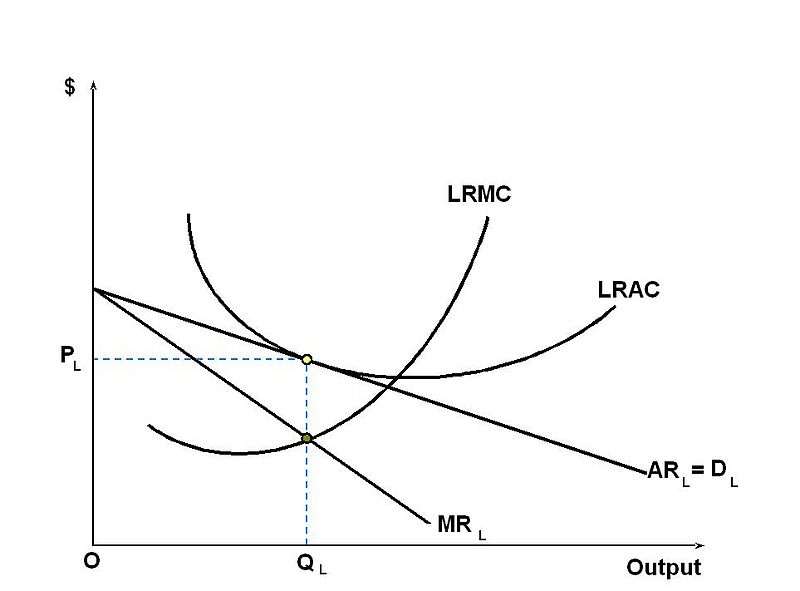

Firm under Monopolistic Competition in The Long Run

When MC and MR are equal, firm still produces nevertheless; the curve for demand shifts as other firms penetrates sales ground and increase contest. The industry at this point does not claim economic profit as it sells its goods above average cost.

Works Cited

Ashford, Lillian. “The Economic and Employment Contributions of Share Gas in the United States.” Global Insight 2011:2-81. Web.

Bros, Thierry. After the US Shale Gas Revolution. Paris: Editions Technip, 2012. Print.

Kaiser, Mark. “Haynesville shale play economic analysis.” Journal of Petroleum Science and Engineering 82.1 (2012): 75 – 89. Print.

Schwede, Katrin. Shale Gas Interest Representation in the EU: Public Affairs / Lobbying in the European Union. Munich: Grin Verlag, 2012. Print.