Executive Summary

The oil industry plays an important role in the economy of Iran since it is the main source of export earnings. However, the full potential of the industry cannot be realized due to inadequate investments and lack of expertise. Research shows that biofuels can be used as an alternative to oil since it reduces environmental pollution. It is also a reliable source of export earnings.

Problem

OPEC is increasingly losing its ability to control global oil prices by regulating the supply of crude oil. Uncontrolled supply will lead to a significant reduction in oil prices, thereby reducing Iran’s oil export earnings. Iran can hardly increase its oil exports in the short term due to the sanctions imposed on it by the US and the European Union. Rapid depletion of the country’s oil reserves will also reduce its oil exports. Although biofuels are green energy sources, their use is still limited due to high production costs.

Possible Solutions

The government of Iran should focus on diversifying its economy by developing the non-oil sector. This will help in reducing the negative impact of declining oil export earnings on its economy. The use of biofuels should be supported through increased investments in cheap feedstock, which in turn will reduce production costs.

Recommendations

First, economic diversification in Iran should focus on the manufacturing and service sectors. These sectors are likely to improve the country’s economic growth through job creation and exports. Second, investment in research and development should be increased to develop new techniques for producing biofuels at a low cost. Third, OPEC should adopt a new price stabilization policy/ mechanism since regulating oil supply is no longer effective.

In sum, OPEC is likely to continue losing its influence on the global oil prices as production increases in non-member countries. The future of economic growth in Iran depends on the country’s ability to develop the oil industry and other sectors of the economy. Moreover, the use of biofuels is likely to increase in future due to high prices and limited supply of oil.

OPEC Organization

History

The Organization of the Petroleum Exporting Countries (OPEC) was created to coordinate and unify the petroleum policies of its member countries. OPEC “was established in Bagdad, Iraq in 1960” (OPEC). In 1960s, OPEC focused on building the capacity of its members to utilize their oil resources for national development (OPEC). In 1970s, OPEC gained international attention by directly controlling the global supply and prices of crude oil. OPEC focused on implementing new policies to stabilize the supply and prices of oil in the international market in 1980s and 1990s (OPEC). In 2000s, the main objectives of OPEC included the development of stable energy markets and reducing the environmental impact of using oil.

Member Countries

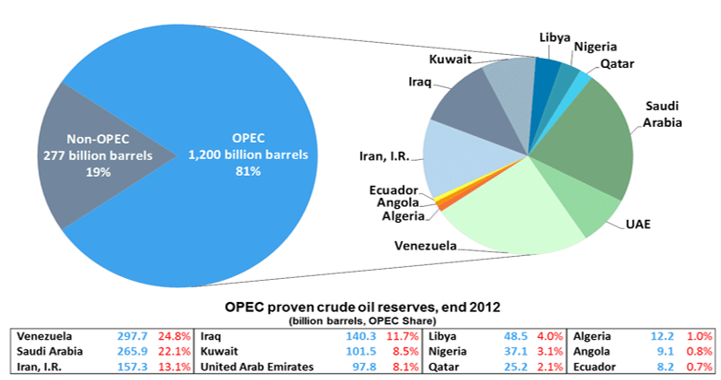

The founding members include Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela. Currently, OPEC is composed of 12 countries namely, Iraq, Iran, Kuwait, Nigeria, Angola, Saudi Arabia, Libya, the United Arab Emirates, Qatar, Venezuela, Algeria, and Ecuador (OPEC).

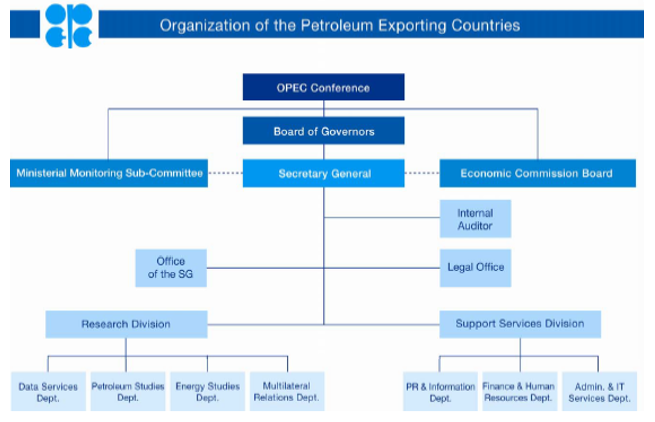

Organizational Structure

OPEC is made up of four major organs namely, the conference, the board of governors, the economic commission board, and the secretariat. The conference is the highest policy making division of the organization (OPEC). The board of governors overseas the activities of OPEC and implements the decisions made by the conference (OPEC). The role of the economic commission board is to study oil markets and the economic factors that are likely to affect the prices and production of oil globally. The secretariat is in charge of the day-to-day activities of the organization. It consists of several departments that undertake the activities of the organization. Figure 1, summarizes the organizational structure of OPEC.

Recent Decisions and Prediction of the Future

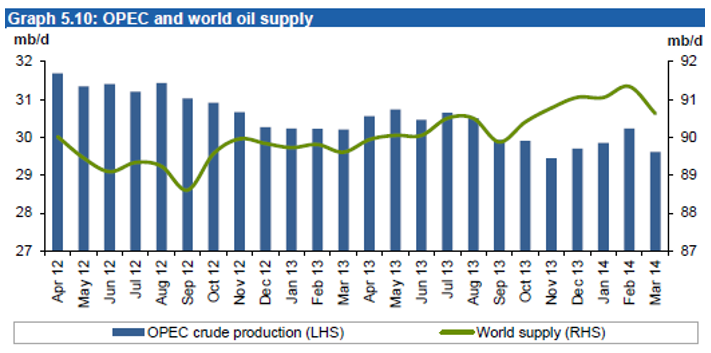

During the 2008 global financial crisis, oil prices reduced to $32.4 per barrel, thereby reducing the income of OPEC countries (Rainey, Siems and Ashton 355-369). As a result, OPEC decided to reduce the output level of its member countries by approximately 4.2 million barrels per day. The resulting reduction in supply led to an increase in oil prices from $32.4 in 2008 to $72 per barrel in 2009 (OPEC). In 2012, OPEC ordered its members to reduce oil supply by 1.6 million barrels per day to avoid a significant decline in prices. Consequently, crude oil prices remained above $100 per barrel (OPEC).

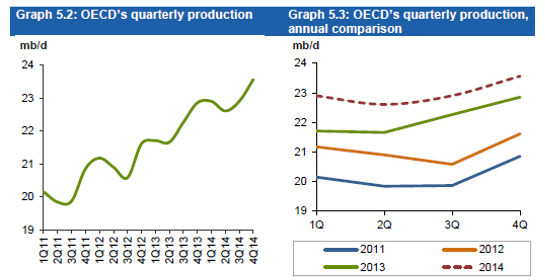

In the long-term, the influence of OPEC on the global oil market will decline significantly. Currently, its major producers such as Saudi Arabia, Iran, Iraq, and Nigeria are exceeding their production quotas to bridge their national budget deficits (WTO). Moreover, increased production of oil in OECD and other countries as shown in figure 2 and 3 will significantly limit OPEC’s ability to control prices by regulating supply.

Events that Shaped the History of OPEC

The 1973 oil shortage transformed OPEC into a strong political entity. The Arab countries in the organization drastically reduced their oil supply to the US and Western Europe (Desta 523-551). This decision was meant to exert pressure on western countries to withdraw their support for Israel during the Arab-Israeli conflict. The war between Iraq and Iran in 1980s and the war between Iraq and Kuwait in early 1990s negatively affected cohesion within OPEC. This led to establishment of conflict resolution mechanisms in late 1990s that improved the effectiveness of the organization.

Iran

Membership in OPEC

Iran joined OPEC in “1960 as one of the founding member countries” (OPEC). The country was granted full membership due to the substantial amount of its crude oil exports. Currently, Iran is an influential member of the organization because of its huge oil reserves. Oil production accounts for nearly 23% of Iran’s GDP and 75% of its export earnings (CIA).

Oil Reserves and their Lifetime

Iran has the “fourth largest proven oil reserves in the world” (Yazdan 678-686). Among the OPEC countries, Iran had the third largest proven oil reserves in 2013 as shown in figure 4. Specifically, the country has 157.3 billion barrels of oil reserves (OPEC). This represents 13.1% of the total oil reserves under the control of OPEC. In the last decade, the country discovered new oil fields, which include Yadavaran, Azadegan, and Marun. However, lack of adequate expertise and sufficient investments hinder exploitation of the new oil fields. The existing oil reserves have a lifetime of approximately 70 years (Yazdan 678-686).

Current Production Rate

Iran is the “second largest OPEC producer of oil and the fifth largest globally” (Yazdan 678-686). Currently, the country produces between 3.8 million and 4 million barrels of oil per day. Iran operates nine refineries that have a combined capacity of approximately 1.78 million barrels per day (Yazdan 678-686). However, the refineries mainly produce low-value petroleum products. In the short term, Iran’s ability to produce crude oil is limited by the sanctions imposed on its oil exports by the US and the European Union.

Moreover, OPEC has put a ceiling on production, which limits Iran’s ability to increase production. In the long-run, production will decline due to depletion of oil reserves. The country has already exhausted nearly 75% of its oil reserves (CRS 1-42). Thus, it has to depend on new oil fields that cannot boost production substantially because of their underdevelopment.

Oil Exports

Under the current sanctions, Iran is required to limit its oil exports to one million barrels per day (Hume 2). This limit was set after Iran agreed to abandon its uranium enrichment program. Although the ceiling is expected to expire in July 2014, the chances of increasing oil exports are limited. One of the factors that are likely to reduce oil exports is that Iran has consistently exceeded the ceiling. For instance, it has been exporting an average of 1.4 million barrels of oil per day since January 2014 (Hume 2). Thus, the US and the EU are likely to reduce the ceiling before the end of the year. Iran’s oil is mainly exported to China, India, South Korea, and Japan.

Distribution of Oil Income

The income generated from oil production in Iran mainly goes to the government and a few influential businessmen. The oil is produced by the National Iranian Oil Company and distributed by the National Iranian Oil Refining and Distribution Company (Yazdan 678-686). Both companies are owned and directly controlled by the government through the ministry of petroleum. The revenues generated by the companies are managed by the government. Businessmen who have political influence determine the appointment of officials in the two companies and the ministry of petroleum. This gives the businessmen the opportunity to share the oil revenue with the government through corruption in the oil industry.

Green Energy: Biofuels

History

Biofuel refers to “a renewable source of energy, which is produced from biological materials or biomass such as cane, corn, cellulose, and vegetable oil” (Babcock 407-426). The most common types of biofuels are ethanol and biodiesel. The use of biofuels began in the 19th century when the first diesel engine that used vegetable oil was discovered. At the beginning of the 20th century, ethanol was widely used to propel cars. In the mid 20th century, the use of biofuels reduced as motorists and manufacturers shifted to the use of cheap petroleum-based fuels (UNCTAD 10-118). However, the use of biofuels became popular again in 1970s due to oil shortages. Similarly, the introduction of tough carbon emission standards improved the use of biofuels in the 21st century.

Cost and Current State of Development

Biofuels have not been widely adopted in the manufacturing and automobile industries in Iran and other countries. Apart from Western Europe, Brazil, and the US, no country has prioritized the production of biofuels on a large-scale (Jupesta, Harayama and Parayil 231-247). Africa and the Middle East are the major regions that lag behind in the use of biofuels. In these regions, nearly 90% of manufacturers and motorists use fossil fuels such as diesel.

The cost of biofuels varies from country to country. For instance, in German biodiesel is cheaper than petroleum-based diesel. However, in the US biodiesel and ethanol are more expensive than petroleum-based fuels (Jupesta, Harayama and Parayil 231-247). The high price is explained by the high cost of producing biofuels.

Problems with Widespread Use

The main challenge that prevents large-scale production of biofuels is high food prices. Food prices have been rising over the last decade due to limited supply. As a result, most governments have focused on producing food crops rather than the crops that are used to manufacture biofuels (UNCTAD 10-118). High cost of farm inputs also increases the cost of producing the vegetable oils that are used to manufacture biofuels. The resulting increase in retail prices limits the use of biofuels. In the developing world, lack of expertise and financial resources is the main factor that prevents large-scale production and use of biofuels.

Long Range Opportunities

Rising concerns over increased carbon emissions will lead to a shift from petroleum-based fuels to biofuels in future. Rapid depletion of global oil reserves in the next decade will be a huge opportunity for large-scale production of ethanol and biodiesel (UNCTAD 10-118). In developing economies, the need for diversification and improved export earnings present long-term opportunities for biofuel production. Specifically, research shows that developing countries with adequate farmland can improve their economic growth by producing biofuels for the export market.

SWOT Analysis

The main strength of biofuels is that they reduce emission of greenhouse gases. They are also reliable since their supply can be stabilized through effective planning of production capacity. The main weakness of biofuels such as biodiesel is that their performance in terms of combustion and viscosity is very poor under low temperatures.

Rising concerns over global warming is the main opportunity that will promote the use of biofuels. The adoption of biofuels is expected to rise to reduce emission of greenhouse gases, which cause global warming. The main threats to the use of biofuels are high production costs and lack of expertise.

Works Cited

Babcock, Bruce. “The Impact of US Biofuel Policies on Agricultural Price Levels and Volatility.” China Agricultural Economic Review 4.4 (2012): 407-426. Print.

CIA. Economic Overview: Iran 2013. Web.

CRS. Iran’s Economy, Washington, DC: Congressional Research Service, 2008. Print.

Desta, Melaku. “The Organization of Petroleum Exporting Countries, the World Trade Organization, and Regional Trade Agreements.” Journal of World Trade 37.3 (2003): 523-551. Print.

Hume Neil. “Iran likely Exporting Higher Crude Oil Volumes than Allowed, Says IEA.” Financial Times. 2008: 2. FT. Web.

Jupesta, Joni, Yuko Harayama and Govindan Parayil. “Sustainable Business Model for Biofuel Industries in Indonesia.” Sustainability Accounting, Management, and Policy Journal 2.2 (2011): 231-247. Print.

OPEC. About Us 2014. Web.

Rainey, Ivan, Mathias Siems and John Ashton. “The Financial Regulation of Energy and Environmental Markets.” Journal of Financial Regulation and Compliance 19.4 (2011): 355-369. Print.

UNCTAD. The Biofuels Market: Current Situation and Alternative Scenarios, Geneva: United Nations, 2009. Print.

WTO. Oil Price Volatility: Origins and Effects 2012. Web.

Yazdan, Gudarzi. “Causality between Oil Consumption and Economic Growth in Iran: An ARDL Testing Approach.” Asian Economic and Financial Review 2.6 (2012): 678-686. Print.