Introduction

Background information

Beyond Bank is a firm that operates in the Australian banking industry. The bank ranks as one of the largest customer-owned banks in Australia. The bank’s headquartered are located at the Australian Capital Territory in South Australia.

The bank has undergone significant changes with regard to its operations and structure. Initially, the bank operated as a credit union under the name Community CPS Australia. However, the firm transformed its structure into a mutual bank in 2013 through a merger between CPS Credit Union Cooperative Limited and Commonwealth Public Servants Credit Union.

In an effort to provide its banking services to a large number of customers in Australia, Beyond Bank has established a number of branches in different territories in Australia such as New South Wales. Currently, Beyond Bank has established 49 branches and it has a total human resource base of 600 employees.

Beyond Bank is committed to increasing its customer base in order to achieve a high level of financial stability. It is estimated that the bank had a total customer base of 195,000 by the end of 2013. Subsequently, the bank has managed to improve its financial stability with its total assets estimated to amount to $4 billion. Furthermore, the bank has increased its shareholding to 202,000.

In an effort to meet the customers’ needs, Beyond Bank has diversified its product and service portfolio. The bank offers diverse services such as business banking and personal banking. Other financial services that the firm offers to its customers include term deposits, accounting and tax services, insurance, and loans. Furthermore, Beyond Bank provides customers with financial planning services.

In the course of its operations, Beyond Bank is committed towards achieving a high level of prosperity. Subsequently, the bank has developed an effective distribution network by developing a comprehensive network of over 3,000 automated teller machines.

Moreover, the bank has developed a strong working relationship with various community groups in an effort to achieve social sustainability through corporate social responsibility (Beyond Bank Australia 2014).

The firm seeks to achieve its growth and profit maximisation targets. In a bid to achieve this goal, the firm’s management team appreciates the importance of integrating the concept of internationalisation in its strategic management practices. Pride and Ferrell (2006) argue that internationalisation enables a firm to achieve its profit maximisation and growth objective.

This assertion emanates from the view that venturing into the international market presents an organisation with a wide range of opportunities. Sandhusen (2008) asserts that the intensity of competition in the foreign market might be lower as compared to the local market. Therefore, there is a high probability of a firm maximising its profits by exploiting the prevailing market opportunities is relatively high.

This goal can be achieved by adopting diverse growth strategies in the international market such as new product development. Moreover, an organisation may decide to market its existing products in the new market. Currently, the Beyond Bank’s operations are mainly based in Australia.

The firm has identified Qatar as one of the most viable investment destinations in its market expansion efforts. Currently, Beyond Bank has not established its presence in Asia. Qatar is ranked amongst the fastest growing economies in the Gulf region. The growth has arisen from the adoption of effective economic policies such as liberalisation of various economic sectors.

Additionally, Qatar has adopted effective economic policies such as formation of free zones. This move has played a remarkable role in enhancing trade with other countries. Moreover, Qatar has entered various free trading agreements with other GCC countries. Qatar is experiencing a high rate of economic growth in most of its economic sectors.

The financial services sector is ranked amongst the fastest growing economic sectors in the country. A report released by the Qatar National Bank (2013) ranked the Qatar banking industry as the fastest growing amongst the GCC banking sector and the growth rate was estimated to be 18.4% by June 2013.

Furthermore, the report asserts that the industry will experience a high rate of growth arising from the government’s efforts to stimulate economic growth in an effort to restore the country’s economic status, which was affected adversely by the 2008 global economic recession (Qatar National Bank 2013).

Objective

This report provides a comprehensive analysis of the internationalisation strategies that Beyond Bank should adopt in its effort to improve its market presence in Asia. The report specifically focuses on Qatar as the potential foreign expansion destination.

During its initial market entry phase, Beyond Bank intends to establish its physical presence in Doha before expanding to other regions of Qatar. The report is intended to illustrate how Beyond Bank’s management team can successfully penetrate the Qatar banking industry.

The report is organised into a number of sections, which include an illustration of company situation, an analysis of the target market, and evaluation of the market entry strategies that the firm should adopt. Finally, a number of recommendations that the firm should consider in its operations in the host country are outlined.

Analysis of the target market [Qatar]

The decision to target Qatar arises from the high potential for growth as illustrated by the industry structure. Currently, Qatar has 18 banks, which are located in different parts of the country. The chart below illustrates the constitution of Qatar banking industry.

Table 1 – number of banks in Australia. Source: (Austrade 2011).

The Qatar banking industry has experienced significant increment in the volume of deposits over the past few years. For example in 2012, total deposits increased by a 26% margin and this trend further continued in 2013 whereby deposits increased by a further 17% total (Qatar National Bank 2013).

This growth was largely associated with growth in the public sector. Moreover, the private sector has also contributed significantly to the industry’s growth. For example, the volume of deposits from the private sector increased by 16% in 2012 (Qatar National Bank 2013).

Qatar banks have experienced a significant improvement in their ratings over the past few years. This aspect illustrates the effectiveness with which the banks have implemented corporate governance concepts. Furthermore, the high rating is an illustration of the Qatar government’s commitment in creating an environment conducive for investment in the banking industry.

The rating by major rating agencies such as Standard’s & Poors, Capital Intel, Fitch and Moody’s has improved their ability to access the international bond markets. The chart below illustrates the rating of the top 5 banks in Qatar (Qatar National Bank 2013).

Table 2 – rating of major banks in Qatar. Source; (Qatar National Bank 2013).

The Qatar banking industry has also been characterised by significant increment in the level of profitability. For example, during the first half of 2013, the industry experienced an 8.9% increment in the level of profits.

The industry is expected to sustain its profitability in 2014 due to the high infrastructure spending by the national government. Subsequently, there is a high probability of banks in the industry experiencing significant opportunity with regard to credit growth.

The table below illustrates the trend in the industry’s profitability during the period ranging between 2008 and June 2013 (Qatar National Bank 2013).

Table 3: profit growth amongst banks in Qatar.

Graph 1. Source- (Qatar National Bank 2013).

SWOT analysis

Kazmi (2008) argues that businesses are subject to the environment in which they operate. Subsequently, it is imperative for organisational managers to develop a broad understanding of the prevailing environments.

Since its inception, Beyond Bank has been committed to managing its internal and external environments. The chart below illustrates the degree to which Beyond Bank has managed its internal and external environments by illustrating the firm’s strengths, weaknesses, opportunities, and threats.

Table 4- Beyond Bank Australia SWOT analysis.

Company situation analysis

Company strategies

Strategy formulation is vital in organisations’ efforts to achieve long-term success (Carroll & Buchholtz 2014). Subsequently, failure to implement effective strategies can affect an organisation’s ability to achieve its goals. Carroll and Buchholtz (2014, p.129) further assert, ‘Firms have several levels at which strategic decisions are made, or the strategy process occurs’.

These strategies range from formulation of goals, vision, and mission to high risk strategies involving high degree of uncertainty. Organisational managers should consider different levels of strategy in their strategic management practices and they include corporate, business, and functional level strategies. The functional-level strategies aim at improving an organisation’s operations at different levels of operation.

On the other hand, corporate level strategies are concerned with developing a comprehensive definition of how a firm intends to achieve long-term business sustainability, and thus they enhance an organisation’s ability to achieve business growth and long-term profitability (Saee 2007).

Some of the main corporate level strategies adopted by businesses include formation of mergers, divestitures, and acquisitions (Ireland, Hoskisson & Hitt 2008).

Business level strategies aim at ensuring that an organisation achieves the desired market position and competitive advantage. Additionally, business-level strategies focus at ensuring that an organisation is effective in responding to market changes. Subsequently, business level strategies enable organisations to achieve a high degree of operational efficiency in coordinating and uniting the functional level strategies.

Beyond Bank Australia has integrated the aforementioned levels in its strategy formulation process. In its functional level, Beyond Bank Australia has integrated three main departments, which include personal banking, corporate banking, and business banking departments. By integrating these functional levels, Beyond Bank has achieved a high degree of operational efficiency and effectiveness.

Business level strategies

In its pursuit for competitive advantage, Beyond Bank has adopted two main business level strategies, which include differentiation and focus strategies.

Customer focus

The firm’s focus strategy is illustrated by its commitment to serve a large number of customer groups. Subsequently, it must develop a broad product portfolio in order to meet the customers’ needs. Moreover, the broad range of products provides the firm with a high degree of flexibility to serve the target customer groups efficiently.

Beyond Bank Australia intends to increase and sustain its customer base by offering a broad range of financial products per customer group. The firm mainly focuses on three main products, which include insurance, wealth, and deposits.

In an effort to develop a strong customer base, Beyond Bank Australia has adopted a comprehensive sustainability strategy, which entails assisting its customers to attain sustainable financial future in an environment that is characterised by a high rate of economic changes.

For example, the bank assists its customers in managing their wealth by offering different asset management services (Beyond Bank Australia 2014).

In an effort to achieve a high level of efficiency in its operation, Beyond Bank Australia has established a number of subsidiaries, which include:

- Beyond Bank Australia Wealth Management.

- Beyond Taxation Services.

- Beyond Business and Accounting Services.

Each of the above subsidiaries specialises in a specific area of operation. For example, Eastwoods Wealth Management Pty Limited specialises in provision of financial planning services. On the other hand, Eastwood Accounting and Taxation Pty Limited specialises in provision of accounting and taxation services.

The bank has established three main divisions, which offer financial services to specific customer groups in its New Zealand, Australian, and near pacific markets. The first group includes the Australian Financial Services, which is responsible for offering business and retail financial services.

Differentiation strategy

Schermerhorn (2010) asserts that differentiation is achieved by offering customers’ unique products and services. In an effort to attract and retain a large number of customers, Beyond Bank Australia has also integrated the concept of differentiation, as evidenced by its digital innovation projects.

The projects aim at ensuring that the customers’ personal information is adequately protected. This has been achieved by implementing an ePayment Code, whose purpose is to regular electronic payment. The ePayment Code ensures that the customers’ transactions through mobile, ATMs, internet and eftpos platforms are protected (Beyond Bank Australia 2014)

Corporate level strategies

In an effort to achieve its desired level of growth and competitiveness, Beyond Bank has integrated the concept of mergers and acquisition in its strategic management practices. In 2013, CPS Credit Union Cooperative Limited merged with Commonwealth Public Servants Credit Union leading to formation of Beyond Bank Australia.

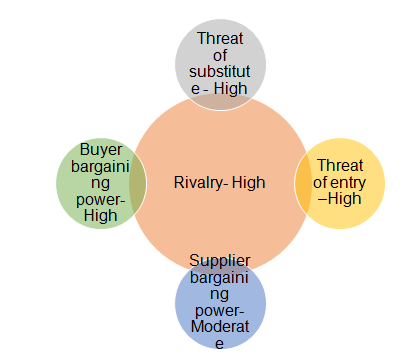

The Australian banking industry is characterised by a relatively high degree of rivalry arising from the large number of competitors. Currently, there are 56 banks [both local and foreign] established in Australia. The chart below illustrates the intensity of competition in the Australian banking industry.

Internationalisation and global expansion

Internationalisation strategy into Qatar

The above analysis shows that there is a high potential for growth in the Qatar banking industry. In a bid to exploit this market opportunity, Beyond Bank should consider adopting the most effective market entry strategy. Levi (2006) argues that selection of the mode of entry is subject to a number of factors, which include

- The level of competition in the foreign market.

- The company size with regard to its financial and asset base.

- Nature of the product or service being offered by the firm.

- Goal of the company in the international market.

- The prevailing trade barriers.

The above analysis identifies Qatar as a potential investment destination as illustrated by the intensity of competition and lack of trade barriers. Furthermore, an analysis of Beyond Bank Australia shows that the bank has developed a substantial asset and financial base.

Furthermore, the firm intends to increase its profitability by venturing into new markets. Below is an analysis of the internationalisation strategies that the firm should consider.

Direct investment

Beyond Bank Australia should consider adopting the concept of foreign direct investment in its market entry. This strategy will entail establishing new branches in Doha, Qatar. One of the major benefits of adopting this strategy is that the firm will have total control of the operations of the new branch.

Through direct acquisition, the bank will be in a position to develop quick access in Qatar due to the already established market network. Furthermore, direct acquisition will present the firm with a high probability of success due to the low degree of risk involved compared to Greenfield investment.

Klug (2006) argues that Greenfield investment in a foreign country is risky because of the high costs involved despite the view that the firm has full control of the firm. Furthermore, gaining free enterprise in the host country through Greenfield market entry method will take a substantial amount of time.

This assertion arises from the view that the firm will be required to establish its own distribution networks and setup operations from the scratch. Therefore, the firm might experience competitive challenges during its initial market entry phase from the already established firms.

Joint ventures and strategic alliances

Beyond Bank Australia should also consider investing in joint ventures in order to improve the effectiveness with which it penetrates the Qatar banking industry. The firm should identify a potential local bank in Qatar whereby it can purchase major shares, which will lead to the establishment of a new entity. Through the joint venture, Beyond Bank Australia will have substantial control power.

Subsequently, the bank will make operation and investment decisions. In addition to control, joint ventures will provide the bank with an opportunity to access sufficient knowledge of the local market. Moreover, Beyond Bank Australia will improve its competitive advantage by enhancing the prevailing network of relationships (KPMG 2013).

Furthermore, the firm should consider integrating the concept of a strategic alliance by identifying a potential local firm with whom the alliance should be made. For example, the firm should identify a potential firm offering Islamic banking products in Qatar to increase its product portfolio by developing a new Islamic financial product (Hossain 2009).

Conclusion and recommendations

The report shows that Beyond Bank has managed to develop a strong market presence in Australia and New Zealand. Moreover, the firm has entered some Asian markets such as China and Asia. However, the firm has not fully penetrated the Asian market. Subsequently, it is imperative for the firm to conduct a comprehensive market research in order to identify potential markets to enter.

One of the markets that the firm should consider entering is Qatar, which is one of the emerging economies in the GCC region. The Qatar banking industry has experienced significant growth over the past few years. The growth has arisen from increment in the rate of government spending on infrastructural projects.

The appropriateness of the Qatar banking industry is further enhanced by the view that the intensity of competition is relatively low. Subsequently, the firm should consider investing in Qatar in an effort to achieve its growth and profit maximisation goals.

However, the firm’s success in Qatar will be determined by the effectiveness with which it undertakes the internationalisation process. The firm’s management team should consider the following aspects.

Merger and acquisition

To improve the likelihood of succeeding, the firm should identify a local bank in the host country that it can acquire. However, the firm should conduct a comprehensive analysis of the targeted firm for acquisition in order to determine its efficacy. For example, the bank should conduct a cultural analysis of the identified firm in order to determine the degree of cultural fit between the two firms.

Previous studies show that most mergers and acquisitions fail due to lack of effective cultural analysis in order to determine the degree of cultural fit. Beyond Bank Australia should compare its organisational culture with that of the targeted firm to aid in determining the degree of congruence between the two firm’s cultures.

A high degree of cultural fit will minimise the likelihood of the firm experiencing conflict amongst employees after the merger. Consequently, the likelihood of Beyond Bank succeeding in its integration phase will improve significantly.

Strategic partnerships

It is imperative for the firm’s management team to consider entering strategic alliance with already established an already established bank in Qatar. This move will provide the bank with an opportunity to penetrate the host market effectively and efficiently by leveraging on the strategic partners’ distribution network.

Subsequently, it is imperative for the Beyond Bank’s management team to identify the most effective strategic partners. Some of the aspects that the firm should identify relates to the target firm’s distribution network, corporate governance, and quality of products.

New product development

To succeed in Qatar, Beyond Bank should identify the prevailing market opportunity that it can easily exploit in order to maximise its profitability. The analysis shows that Beyond Bank has managed to develop a substantial competitive advantage due to its strong financial base. However, it is important for the firm’s management team to consider leveraging on its financial capability in the international market.

Subsequently, the firm should invest in a comprehensive consumer and competitor market research. Consumer market research will aid in understanding the customers’ needs and expectations.

On the other hand, competitor market research will aid in identifying market gaps that the firm can exploit. One of the areas the areas that the firm should consider relates to the types of Islamic products offered by local banks. Subsequently, the firm will attract new customer groups hence increasing its profitability.

Organisational culture

The success of Beyond Bank in its target market will be subject to the organisational culture developed. Therefore, it is imperative for the firm’s management team to nurture an efficient and effective organisational culture.

Some of the aspects that the management team should take into account include adopting a flatter organisational structure. This move will improve the effectiveness with which decisions are made and hence the likelihood of the firm exploiting the prevailing market opportunities.

Distribution network

The report shows that the bank has established over 1,400 outlets globally. Upon entering the Qatar banking industry, Beyond Bank Australia should consider increasing its market presence by establishing additional retail outlets. This move will improve the effectiveness with which the firm offers financial services to a large number of customer groups.

Customer service

The bank’s ability to attract and retain customers in the host country and hence its long-term survival will be determined by the quality of services’ profits. Subsequently, it is imperative for Beyond Bank Australia to invest in a comprehensive customer service program by developing an employee training and development program in order to improve the level of their skills and knowledge on how to serve customers.

One of the aspects that the firm should focus on relates to the host country’s culture. Furthermore, the firm should focus on developing a strong customer relationship in order to improve the level of loyalty. Previous studies conducted show that the quality of banking services provided has a significant influence on the level of customer loyalty developed.

Reference List

Austrade: Australia banking industry 2011. Web.

Beyond Bank Australia: At Beyond Bank Australia, we’re the other way to bank 2014. Web.

Carroll, A. & Buchholtz, A. 2014, Business and society; ethics, sustainability and stakeholder management, Cengage Learning, New York.

Hossain, M. 2009, ‘Customer perception on service quality in retail banking in Middle East; the case of Qatar’, International Journal of Islamic and Middle Eastern Finance and Management, vol. 2 no. 4, pp. 338-350.

Ireland, D., Hoskisson, R. & Hitt, M. 2008, Understanding business strategy; concepts and cases, South-Western Cengage Learning, Mason.

Kazmi, E. 2008, Strategic management and business policy, McGraw-Hill, New York.

Klug, M. 2006, Marketing entry strategies in Eastern Europe in the context of the European Union; an empirical research into German firms entering the polish market, Deutscher Universitats-Verlag, Wiesbaden.

KPMG: Conquering global markets 2013. Web.

Levi, K. 2006, Market entry strategies of foreign telecom companies in India, Deutscher Universitats-Verlag, Wiesbaden.

Mitchell, P. & Satter, R. 2013, Westpac caught up in world’s biggest money laundering sting. Web.

Pride, W. & Ferrell, O. 2006, Marketing: concepts and strategies, Houghton, Boston.

Saee, J. 2007, Contemporary corporate strategy: global perspective, Routledge, New Jersey.

Sandhusen, R. 2008, Marketing, Barron’s Educational Series, Hauppauge.

Qatar National Bank: Qatar economic insight 2013. Web.

Schermerhorn, J. 2010, Management, John Wiley, Hoboken, New Jersey.