The phenomenon of financialization is typically defined as the “process by which innovations are used to expand credit relations allowing finances to capture or capitalize a great share of the surplus at the expense of workers and non-financial capitalists” (Schmidt, 2015, p. 43). Financialization can be viewed as the current tendency in the economy on a global level and, therefore, has to be taken into consideration when developing an approach for a firm to adopt in the context of the global market. The changes in the relationships between the representatives of different social strata may affect the efficacy of businesses unless a sustainable approach is designed to address the subject matter.

Labor Productivity and Wages v. Executive Compensation – U.S. and EU

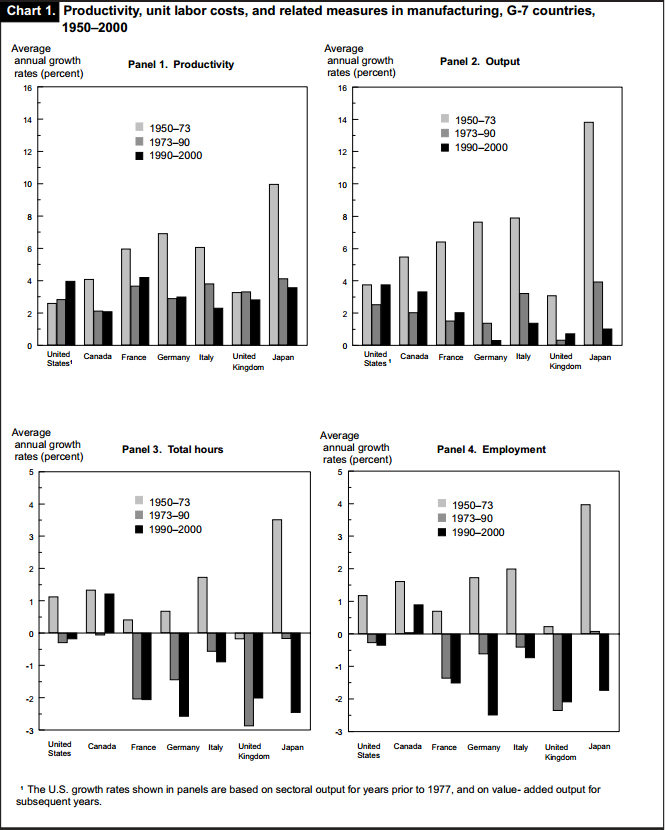

To evaluate the changes that have occurred to the U.S. economy and the economic stability of the EU countries, one will have to consider the labor productivity rates in the countries above. In the given scenario, the concept of labor productivity should be viewed as the value of actual manufacturing output as the latter is comparatively easy to quantify and, thus, carry out the necessary comparison.

The current U.S. labor productivity rates, in their turn, can be deemed as consistently rising since 2000. The state owes the above characteristics to the technological breakthrough that it has been witnessing since the 90s. The spur in the hardware and software development, which has altered the landscape of most economic activities, making the key processes comparatively easier and faster, has also contributed to the emergence of a variety of economic theories along with strategies promoting further growth (Kurre & Andrews, 2013).

In light of the globalization process, the EU countries have also been experiencing a similar change in labor productivity rates. As the table able shows, the labor productivity rates in the EU area can be deemed as rather inconsistent, whereas the United States, on the contrary, has been displaying a rather sharp increase therein. The changes in the output also follow the above pattern, whereas the tendency in the alteration of the total hours and the employment rates are strangely reverse as Figure 1 above shows.

Similarly, the development of executive compensation has been occurring in the U.S. and the EU in different ways. In general, the rates thereof have risen over the past few decades in both areas. For instance, the changes that can be witnessed in the United States show that the average compensation of a CEO reached the mark of $15,200,000 in 2013 (Gonzalez & Sala, 2013). The above number is much higher than the compensation provided to an average worker, which contributes to the overall progress of the financialization process and the creation of an economic gap between different tiers of the American society.

As recent reports say, the difference between the executive compensation rates of the 50s and the 2010s can be deemed as very high: “From 1978 to 2013, CEO compensation, inflation-adjusted, increased 937 percent, a rise more than double stock market growth and substantially greater than the painfully slow 10.2 percent growth in a typical worker’s compensation over the same period” (Davis & Michel, 2014, par. 3). The employee compensation rates, in their turn, seem to have dropped, which is affecting the financialization process negatively, making the difference between different tiers of the American society increasingly more evident. Compared to the index thereof that could be observed 50 years ago, the specified ratio indicates that the American economic environment is under a tangible threat.

Maximization of Shareholder Value and Agency Theory

As the evidence provided above shows, the contemporary global society has been experiencing a rapid financialization process, which inevitably leads to the creation of a gap between different economic classes in modern society. While being admittedly natural, the above process is still affected by a range of internal and external factors to a considerable extent. At this point, the significance of a change in the agent affecting the target area needs to be mentioned.

Similarly, the Agency Theory has had a huge impact on the evolution of economic relationships between the states operating in the global economy. By definition, the Agency theory implies that the very existence of the economic environment demands cooperation among its agents so that the emergent problems could be resolved successfully and that efficient strategies could be identified. The conflicts, in their turn, are traditionally attributed to the complexities in the relationships between the principal, i.e., the person or the institution at the helm of the identified process, and the shareholders, or agents, involved.

The ongoing increase in the percentage of shareholders and, therefore, their value, owes much to the changes in the structure of shareholding. Particularly, the shift from the direct to the indirect, and, then, to the institutional shareholding has created prerequisites for a rapid increase in the effects that shareholders have on the choice of the routes that organizations take in the environment of the global economy. The fact that the number of shareholders tends to increase means that the opportunities for the design of more sensible company policies that could appeal to all target denizens of the population could be created. The above changes can be attributed to the fact that the increase in the number of shareholders contributes to the promotion of the corporate governance principle as the foundational concept of leadership in the environment of the target organization: “Based on the above-mentioned arguments, it can be concluded that corporate ownership structure is one of the key determinants in influencing the internal corporate governance in the company” (Hamzah & Zulkafli, 2014, p. 128). In other words, the rise in the shareholders’ number serves as the boost for the introduction of companies to the principle of diversity and the subsequent rise in the firm’s revenues.

Other Implications (Current Shareholder Structure/Relationship): Individuals, Executive Compensation, Business and Society

As recent studies show, the current stakeholder structure in the environment of the global economy presupposes that the concept of sustainable resource use should be introduced in the framework of the contemporary companies’ operations (Liikanen, 2012). Although most stakeholders are primarily interested in the financial opportunities that the entrepreneurship promises in the nearest future, it is essential that sustainable use of resources should be adopted to meet the needs of the customers, retain the assets of the organization by applying the concept of lean management, and making sure that the staff members are comfortable with the opportunities that they have.

Also, sustainability defines the relationships between business and society nowadays. With a strong emphasis on the adequate use of resources, the society may hamper the progress of organizations unless the latter focuses on promoting sustainable consumption of the existing reserves, particularly, the natural ones. To put it differently, the focus on environmentalism should also be taken into account when designing the sustainable approach applicable in the context of a particular organization.

Examples of Income/Wealth Disparities

The distribution of wealth has never been a fair process that allowed for meeting the needs and satisfying the demands of all denizens of the population. Therefore, the phenomenon of income and wealth disparities can be deemed as fairly common in the environment of the world economy. One might argue that the issue in question cannot possibly be eliminated due to the specifics of economic relations and the unique characteristics of certain countries. However, economic inequalities can be reduced once an appropriate set of tools is used.

India: Where Economic Extremes Meet

When it comes to discussing the contemporary financial disparities in the global society, India is typically viewed as a graphic example thereof. Partially because of the economic specifics of the state, and partially for social reasons, the state has been witnessing a significant gap between the people belonging to different social strata.

One must admit, though, that the economic challenges that India has been experiencing for significant time are barely a threat to the economic environment of the United States, mainly due to the social environment thereof. As it has been stressed above, the specifics of social interactions in India are the prime reason for the economic inequalities to exist. The specified structure of social relationships represents a striking contrast to the social environment of the United States, which implies that equal freedoms and opportunities should be granted to all members of society. Therefore, it is highly unlikely that the USA is ever going to face the issues that India is currently having.

Poland: The Great Divide

Another country that has seen the problems related to economic inequality, Poland needs to be mentioned as a prime example of the state that has gone through impressive economic trials and tribulations. The existing historical record shows that the state witnessed a rapid economic demise in the first half of the 20th century as the country was split into two parts (Poland A and Poland B respectively). Being under the aegis of Germany, the Western part of Poland (Poland A) was much more prosperous and developed, whereas the Eastern area was economically devastated.

The above phenomenon, in its turn, is also a rather unlikely scenario of the U.S. development due to the economic independence thereof. One could argue, however, that the lack of connection between the western and the eastern parts of the country could be paralleled with the differences created historically between the American South and the North correspondingly. Nevertheless, the current tendency for multiculturalism and the emphasis on addressing the cross-cultural issues emerging in the environment of the global economy is likely to help the United States avoid the above issue regarding a cultural divide between the members of the American population.

Conclusion: Implications for U.S. Future Developments

Preventing an economic crisis form development by facilitating the environment favoring the progress of the existing businesses is not only challenging but barely possible; instead, the focus should be on the identification of the strategies for guiding entrepreneurship through the difficulties of operating in the environment of the global economy. As the existing evidence shows, it is crucial that a flexible approach towards the design of the leadership strategy should be adopted and that the corporate governance principle should be incorporated into the company’s operational design. At the same time, it is crucial for entrepreneurship to remain appealing to the target denizens of the population and satisfy the needs of all stakeholders involved, which is only possible once the concept of sustainable use of resources is adopted.

Reference List

Cobert, A. E., & Wilson, G. A. (2002). Comparing 50 years of labor productivity in U.S. and foreign manufacturing. Monthly Labor Review, 126(1), 51-56.

Davis, A., & Michel, L. (2014). CEO pay continues to rise as typical workers are paid less.Economic Policy. Web.

Gonzalez, I., & Sala, H. (2013) Investment crowding-out and labor market effects of financialization in the U.S. Berlin: Institute for the Study of Labor.

Hamzah, A. H., & Zulkafli, A. H. (2014). Multiple shareholders structure (MSS) and corporate financial policy. Journal of Finance and Bank Management, 2(1), 107-134.

Kurre, J. A., & Andrews, P. S. (2013). What determines labor productivity differences for manufacturing industries across U.S. metro areas? Web.

Liikanen, E. (2012). High-level Expert Group on reforming the structure of the EU banking sector. Web.

Schmidt, T. P. (2015). The political economy of food and finance. New York, NY: Routledge.