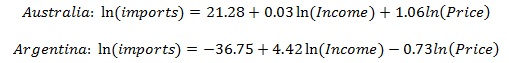

In order to estimate import demand function for Australia and Argentina, it was necessary to convert raw data into natural logarithms. The variables, in form of natural logarithms, are available in excel file. To establish a relationship between dependent and independent variables, the data was subjected to multiple regressions. This resulted in the following estimated demand equations for the two countries:

Based on the demand equations, both the price and income elasticity of demand can be deduced. By finding the absolute value of coefficient of ![]() , the result is price elasticity of demand. In the case of Australia, absolute value of +1.06 is 1.06. Price elasticity of demand is therefore elastic because 1.06 is more than 1.00. On the other hand, Argentina has inelastic price elasticity of demand since the absolute of -0.73 is less than 1.00. Different from price elasticity of demand, income elasticity of demand is not calculated by finding absolute values of coefficient of

, the result is price elasticity of demand. In the case of Australia, absolute value of +1.06 is 1.06. Price elasticity of demand is therefore elastic because 1.06 is more than 1.00. On the other hand, Argentina has inelastic price elasticity of demand since the absolute of -0.73 is less than 1.00. Different from price elasticity of demand, income elasticity of demand is not calculated by finding absolute values of coefficient of ![]() .

.

Instead, income elasticity of demand is obtained directly by looking at coefficients in the equation that represents income. Australia and Argentina then has income elasticity of demand of 0.03 and 4.42 respectively. In view of the fact that income elasticity of demand in Argentina is more than 1.00, the good meets condition of a luxury good. Conversely, the good imported by Australia is a necessity because it has an income elasticity of demand that falls between zero and positive one. This elasticity shows that demand for the good is rising along with income but in less than proportionate manner.

A business can use the knowledge of elasticity in various ways. First, price elasticity of demand would assist a businessperson to know the impact of a change in price on demand for a good. When the good is elastic, a business would register high returns by reducing the price of that good. In the same line, more profit would be recorded if a firm increases price of an inelastic good. Secondly, income elasticity of demand assists a firm to have a clear view of how change income of a consumer affects demand for goods produced. A firm that is producing inferior goods is aware that an increase in consumer income leads to a lower demand for the good.

In order to assess statistical adequacy of import demand equations, it is vital to conduct R square, F-test, and t-tests. The outputs from regression show that Australia and Argentina have R square of 0.94 and 0.73 respectively. It denotes that 94% and 73% of the variations in imports for the respective countries are explained by the equation. For that reason, both equations give the best fit.

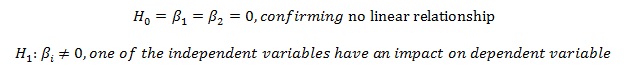

To establish existence of linear relationship between independent variables and dependent variables, F-test is applied. In this condition, hypothesis would be as shown below:

In the case of Argentina, the calculated F value is more than p-value. Null hypothesis is rejected and the conclusion is that at least one of the independent variable affects import demand. Australia as well has an F-statistic that is more than the p-value. This means that at least one of the independent variable affects import demand in the country. It confirms adequacy of the model.

Statistical adequacy of import demand model is further established by t-test. This test checks the importance of each coefficient in a model. The hypothesis for t-test is illustrated below:

Australia: p-Value (0.7156) for income is > α (0.05) thus null hypothesis is not rejected; income is not significant.

P-Value (1.5E-10) for price is < α (0.05) thus null hypothesis is rejected; income is significant.

Argentina: p-Value (4.48E-08) for income is < α (0.05) thus null hypothesis rejected; income is significant. P-Value (0.2665) for price is > α (0.05) thus null hypothesis is not rejected; income is not significant.