Introduction

Despite the fact that the provisional estimates for the total number of UK-related domestic and foreign mergers and acquisitions (M&A) for the first quarter of 2017 were lower than that for the last quarter of the previous year, the level of M&A activity has remained relatively stable overall since the economic downturn of 2008–2009 (Office for National Statistics, ‘2017’ 2). M&A plays an important role in corporate growth strategies; however, the complexities surrounding the process of consolidation of organizations may prevent some acquirers from creating value for their shareholders. The aim of this paper is to analyze the acquisition of Landmark Aviation by BBA Aviation.

Analysis

M&A Involving UK Companies

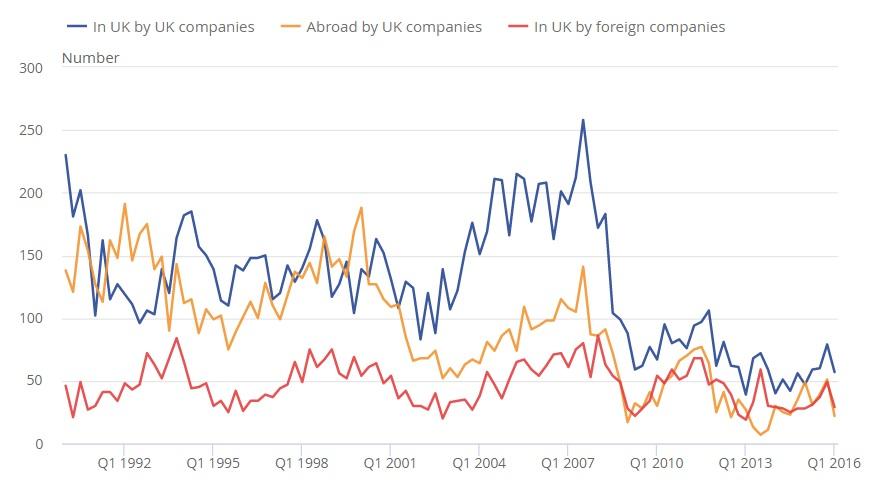

In the first quarter of 2017, there were 127 acquisitions involving UK companies, 48 of which were domestic (Office for National Statistics, ‘2017’ 2). These domestic acquisitions are worth £3.6, representing a substantial decrease from the first quarter of 2016 – £11.9 billion (Office for National Statistics, ‘2017’ 2). Although the level of M&A activity reflected in the total value of acquisitions was lower than that for the previous year, ‘the value of inward M&A activity recorded in 2016 was unusually high and dominated by a small handful of very-high-value transactions’ (Office for National Statistics, ‘2017’ 3). Figure 1 represents the number of M&A involving UK companies since 1992.

The Acquisition

In its latest annual report, BBA Aviation highlights the importance of the $2.076 billion acquisition of Landmark Aviation, which has allowed the company to expand its operational abilities in terms of 62 fixed-based operators (FBOs) and almost 3000 new employees (BBA Aviation, ‘Annual’ 1). BBA Aviation is a global provider of aviation services that operate in the business and general aviation (B&GA) market. The company is headquartered in London, United Kingdom, and employs around 6500 people at more than 220 locations around the world (BBA Aviation, ‘Annual’ 8). The most recent financial statement of BBA Aviation shows that in 2016, the company also completed the acquisition of manufacturing rights from the following entities: Pratt & Whitney Canada, GE Aviation, and Ultra Electronics (BBA Aviation, ‘Our Markets’ 12). These acquisitions come on the heels of the disposal of the plane refueller company ASIG, which has allowed BBA Aviation to substantially reduce its debts (Ough).

Acquisitions always have longer-term ramifications for the dominant entity participating in subsuming activities than for the company that is being acquired. This has to do with the fact that the subsumed entity allows its shareholders to sell their stock at a substantial premium and is especially true when it comes to all-cash deals. According to BBA Aviation’s most recent strategic financial report, ‘the acquisition was partly funded by the proceeds of the rights issue completed in 2015 and by the drawdown of debt under the AFA’ (BBA Aviation, ‘Our Markets’ 34). It can be argued that BBA Aviation’s decision to opt for an all-cash deal with Landmark Aviation was a mistake. This relates to the fact that if an acquirer pays partially in cash and partially in shares, shareholders of a subsumed entity would have a stake in the long-term success of the dominant company.

It is clear from the size of the acquisition that the deal’s impact on BBA Aviation was substantial. The all-cash acquisition significantly depleted the company’s cash holdings. Therefore, the deal was partially financed through debt, which increased BBA Aviation’s indebtedness. The most recent independent auditor’s report shows that in 2016, the company’s net debt was $1335.3 million, which represents a substantial increase from the previous year’s $456.5 million (BBA Aviation, ‘Auditor’s Report’ 92).

The company’s decision to choose an all-cash acquisition transaction was supported by its total net cash flow from operating activities that reached $374.9 million in 2016 (BBA Aviation, ‘Annual’ 35). The figure represents a 50 percent increase since 2015 – $456.5 million (BBA Aviation, ‘Annual’ 35). It must be borne in mind that all-cash deals that increase an acquirer’s debt load are acceptable if a subsumed entity’s contribution of additional cash flows is beneficial to the dominant company. The substantial increase in net cash flow resulted from an influx of cash from Landmark Aviation. However, the company’s annual statement reveals that the growth of net cash flow was offset by ‘increased capital expenditure and interest payments’ (BBA Aviation, ‘Annual’ 35) associated with the deal. The acquisition of Landmark Aviation’s subsidiaries also put a strain on the company’s cash reserves.

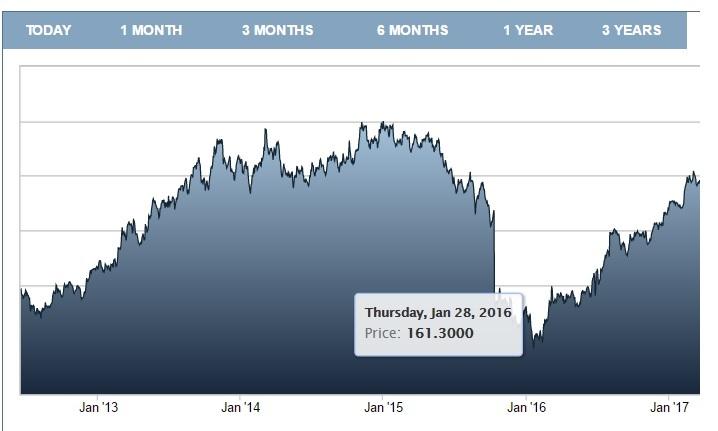

It can be argued that BBA Aviation would have been better off if it had opted for financing the acquisition through its stock. However, at the time of the deal, the company’s share prices had dropped to a five-year low of £167 (see fig. 2). Not surprisingly, the management of Landmark Aviation was not persuaded to accept the company’s stock. Landmark Aviation’s decision to opt for the all-cash deal was justified by the fact that the acquirer’s shares were not premium-priced at the time of the acquisition.

At the time of the announcement of the acquisition, the company’s board pronounced the deal as strategically compelling (BBA Aviation, ‘Clearance’). Also, the acquirer’s motivation was to expand its network of FBO, the largest in the world. The company’s board named ‘substantial cost synergies and taxed benefits’ (BBA Aviation, ‘Clearance’) as other motivations for the deal. BBA Aviation also anticipated that return on invested capital would exceed the cost of capital in 2018 (BBA Aviation, ‘Clearance’). The acquisition was highly successful because the increased revenues from the company’s FBO network grew by 56 percent, which signifies a significant market outperformance (BBA Aviation, ‘Trading Statement’). Also, the company has almost completed after-acquisition reforms aimed at achieving more than $30 million in annual cost savings (BBA Aviation, ‘Trading Statement’).

Conclusion

The paper has shown that the acquisition was in line with BBA Aviation’s trading and cash flow expectations and helped the company to substantially increase its revenues.

Works Cited

BBA Aviation. “Annual Report 2016.” bbaaviation. Web.

BBA Aviation. “BBA Aviation Obtains Regulatory Clearance for the Acquisition of Landmark Aviation.” bbaaviation. Web.

BBA Aviation. “BBA Aviation Trading Statement and Acquisition.” bbaaviation. Web.

BBA Aviation. “Independent Auditor’s Report.” bbaaviation. Web.

BBA Aviation. “Our Markets in 2016.” bbaaviation. Web.

London Stock Exchange. “BBA Aviation PLC ORD 29 16/21P.” londonstockexchange. Web.

Office for National Statistics. “Mergers and Acquisitions Involving UK Companies: Jan to Mar 2017.” ons. Web.

Office for National Statistics. “Mergers and Acquisitions Involving UK Companies: Jan to Mar 2016.” ons, Web.

Ough, Tom. “BBA Offloads Plane Refueller ASIG to John Menzier in $202m Deal.” The Telegraph. 2016. Web.