Funding adjustments

This is a process whereby money suppliers and users react to make ADF and ASF magnitudes to approach one another. The purchasers of current domestic output are categorized in 3 groups

- Group 1 has sufficient money balances

- Group 2have insufficient money balances

- Group 3 have more sufficient money balances

Financial institutions and banks advise group 2 to borrow and group 3 to lend to ensure adjustments.

Case scenarios

Funding adjustments if ADF=ASF

In this scenario the total supply funding is equal to the demand in the economy. The members of group 2 will be having little funding, thus prompting them to borrow more. Contrary, group 3 members will be having excess funding making them lend the excess funds. When ADF and ASF are equal, the amount of group 3 funds has for lending would be equal to the total amount group 2iwould be willing to borrow. Since no manipulation on interest rates would be necessary, the banks’ lending and borrowing rates would remain unchanged as funds easily flow from group 3 to group 2 through the banks and other financial institution.

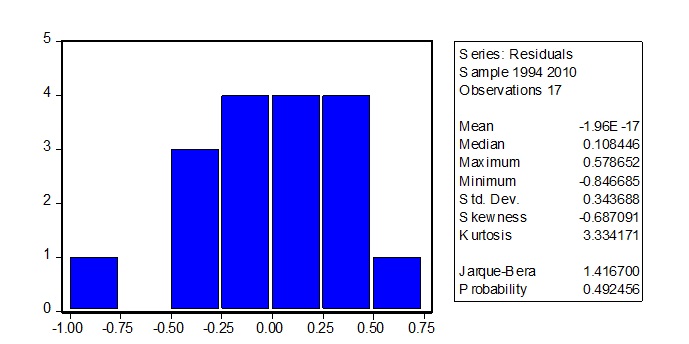

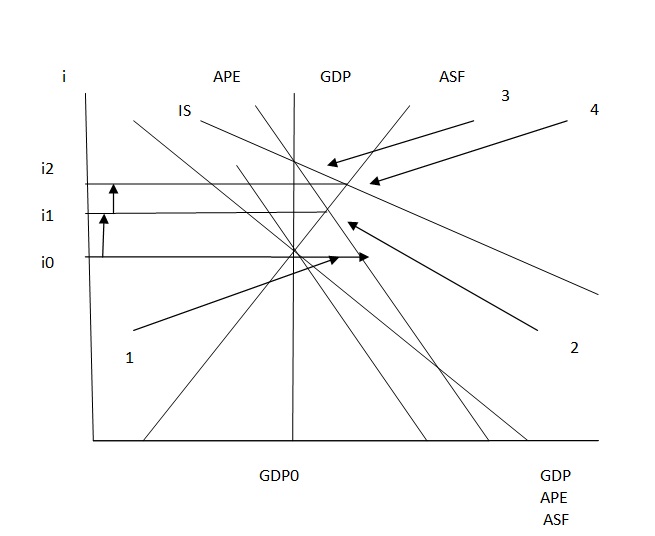

In this situation the total supply funding is insufficient to meet the current demand. Members of group 2 will be having little funding, this will prompt them to borrow more. However, group 3members will having more funding and would be willing to lend the excess funds. At this point, the total sum of funds group 3 members will be willing to lend will be less compared to the borrowing demand by group 2. The banks would be faced with a deficit in terms of funds flowing in from depositors to satisfy the demand of the borrowers. So as to overcome the deficit, the banks would be forced to raise the level of interest rates paid to depositors and charged to borrowers. This would discourage borrowers but attract depositors. At this level ASF would increase, APE fall with ADF expected to fall. Raise in interest rates will continue until ADF is equal to ASF. As shown in the graphical representation at point i1 ADF is above ASF and as I increases ADF falls and ASF rises. This makes interest rates level rise to i2 when ADF is equal to ASF.

Funding adjustments if ADF<ASF

Members of group 2 will experience little funding and be forced to borrow more. However, members of group 3 members would have more than enough funding and would have the desire to lend excess funds. As a result, funds that group 3 will be willing to lend will be more than the amount group 2 will be willing to borrow. However the number of borrowers willing to borrow would be low. This would force the banks to lower interest rates charged to borrowers and that paid to depositors. This would encourage more borrowing from members of group 2 and discourage deposits. At this level, ADF rises as ASF falls. Financial institutions will continue to lower the interest rates until inflows match the outflow [ADF=ASF]. As shown in the graph illustration, ASF is greater than ADF at i3 and as i declines ASF decreases too. When ADF is equal to ASF, the interest rate level falls to i2.

Output-price adjustments

This involves 3 groups of the domestic output producers

- Group A – firms have average demand

- Group B – firms have excess demand

- Group C – firms have insufficient

Assumptions made is that Group A operates at economic zero economic profits and group B and C have

Output-price adjustment when GDP=APE=ASF

When APE=GDP producers is group B would face excess demand and they would respond through the raise product prices as well increasing its output. However, group C members would be faced with insufficient demand and be prompted to cut their prices and as well as reducing their output. At this level the excess demand faced by group B is equal to the total demand shortage faced by group C. Price and output changes made by Group B will have sufficient effects and offset group C price and output effects. This will have no effect on total output and price levels. These adjustments will have no impact on output, prices, interest rates and the level of employment.

Output-price adjustments if GDP<APE=ASF

This occurs when there is net excess demand. Group B producers are faced with excess demand and their immediate response would be the raising of output and price. However, producers in group C would be faced with inadequate demand and would respond by lowering price and output. The excess demand group B experiences exceeds the shortages faced by producers in group C by same amount APE exceeds GDP. This means that Prices and outputs in group B would increase more that the output and price cuts faced by group C producers. This raise prices and GDP shifting ASF to the left. GDP expansion generates a matching GDY rise, which induces increase in demand. Increase in price and output invites more firms to enter the industry. However, industry B firms making negative profits would exit the industry. With time this scenario would be reserved and group B would be operating as C and B like C. When the 3 variables shift to their normal positions the output-price adjustments would reach its end.

Output-price adjustments if APE < GDP = ASF

When APE.

Macroeconomic Shocks

The coordination of Macroeconomic process is triggered by external shocks that include the fall or the rise of GDP, ASF, or, APE. The shocks that result from the decrease in GDP, increase in APE and increase in ASF are as follows.

Case #1 – Demand-Caused Expansion (APE increases)

The increase in aggregate demand (APE) may result from economic improvement, economic stimulation by the federal fiscal policy, or an increase in demand products by foreign economies. This would cause shift in APE to the right leading to a funding problem. The new demand would remain unfunded because of the excess of APE over ASF existence. The need for more funding would cause a rise in APE as well as interest rate (i) rise. Rise in ASF would alleviate instance of demand being crowded out because it would be funded in the process. This demand would be able to meet the excess supply funding in the market.

- APE has increased (shifting the APE and IS lines); so, now at i = i0 GDP = ASF < APE

- Funding adjustment: APE > ASF causes i to rise, ASF to rise, and APE to fall until APE = ASF; now at i = i1 GDP < APE = ASF

- Output-Price adjustment: GDP = APE = ASF along this portion of the IS line, with some inflation and some GDP growth

- Long-run sustainable equilibrium with no inflation, substantial GDP growth, and a significant rise in interest rates

At point i1 GDP<APE=ASF and the net excess demand funding is more than the overall output. When producers raise prices line ASF will be shifted to the left. Movement of GDP and the APE lines to the right would be prompted by output and employment increase. The changes are shown in the graph. Sustainable long run equilibrium would be reached when industries mutual crossing of APE, GDP and ASF occur and slide downwards along the IS line.

As the output-price adjustment is applied, the interest rates, employment, prices, output, and profits would rise until GDP, ASF, and ASF reach equilibrium. The output expansion and that employment level will continue until the profits and prices are back to original position. Finally interest rates, output and employment will remain high as prices and profits being at the same level. These would remain unchanged up to when the economy is hit by another economic shock.

Case #2m – Money-and-Credit-Caused Expansion (ASF increase)

This involves the increase in money supplied (M) and money velocity (V). When the banks increase the lending rate the ASF is increased leading to in the increase the loanable amount. On the hand, Non-bankers will be having the desire to increase their lending level, which leads to ASF increase. However, the velocity of money (V) would also be increased. Given that GDP=APE=ASF attempts to rise ASF would shift the ASF line to the right side making GDP equal to APE and unequal to ASF. An excess supply funding would be created when APE rises more than ASF. This would cause excess in supply funding that would not be needed for the support of APE and GDP. As a result lenders will be prompted to lower their interest rates thus a raise the level of APE as ASF falls so as to create equality between ASF and APE. When output-price adjustment is initiated interest rates rises, this triggers a rise in employment, prices, output, and profits until equilibrium is reached. Expansion of the employment level and output level continues until the profits and prices are pushed back to original place. This state remains until the economy is hit by another shock.

Case #2c ─ Cost-Induced Expansion/Deflation

Fallen cost structures leads to fall in the prices fall as the level of employment and output increases. This lowers the industries average prices thus shifting ASF to the right. Increase in level of employment and output level the GDP which is the total output would increase shifting the APE and GDP lines to the right side. This would be temporal but move along the IS line as interest rates drifts downwards. With costs being low and expanded, prices would be pushed down with relative amount as that of fallen average costs. High profits would attract more firms in the industry causing a continued rise in employment and output as the interest rates continue to fall. Because of the fallen average cost, the industry expansion would stop affecting employment and output. The prices will remain down causing deflationary expansion. This state is expected to remain until economy is hit by another shock.

Case #3 – Supply-Caused Inflation

Inflation is known to suppress the level of GDP in the economy of a country. Falling GDP causes a subsequent fall in the level of income (GDY) and employment level. This causes a fall in APE by fifty percent and would lead to this: GDP<APE

Demand caused recession caused collapse in aggregate demand. Decrease in APE funding is offset by relative increase by nation’s producers who have the desire to finance excess inventory accumulation resulting from excess GDP compared to APE. APE<GDP=ASF at the time. Firms wait with expectations of increase in demand. Application of the output-price adjustment reduces employment, profits, output, and interest rates until APE=GDP=ASF. This generates negative profits in the economy making companies shrink and others exit the industry. The negative economic profits lead to further decrease in GDP. As companies shrink, the economy moves to a sustainable equilibrium in the long run. Falling of employment and output continues until the prices and profits rise to get rid of the negative profits. The final stage of the output-price adjustment ensures that interest rate, output, and employment remain low while the prices and profits remain static. This remains unchanged until the economy is hit by another shock.

Money-and-Credit-Caused Recession involves a fall in funding supply (ASF) that results from M*V reduction by the banks and other lending institutions. Fall in ASF creates GDP=APE

Case #5c ─ Cost-Push Inflation

Inflation increase in operating costs affect employment, interest rates, output and prices. When firms output rises, they reduce the output but increase the product prices as level of employment falls. Industry decrease in employment and output leads to decrease in GDP thus shifting the ADPE and GDP lines to left. With interest rates rising, and high costs firms will exit and the remaining will push the prices by same value of average cost increase. Increase in profits from negative profits would stop firms shrinking and make employment and output cease from reductions. The prices would stop from rising; employment and output remain low as interest rates remain high. These levels would remain unchanged until the economy is hit by another shock.

The Growth Problem

Investment which is part of APE increases GDP as well as GDY increase that induce demand. Aggregate demand (APE) would be less than GDP creating insufficient demand. Increase in GDP generates the need for more funding as ASF remains static. This would generate ASF<APEAPE=ASF. Need to fund the accumulated inventories will pull the interest rates and ASF upwards until ASF and GDP are at the same level pushing the APE lower. Reactions because of low demand would prices and employment would fall down so is the output until it reaches the original position. Prices would remain the same, as the economy suffers demand caused recession that would push the output, employment, and interest rates level below the original positions. The prices would be left unchanged at this point.