The Ricardian model of international trade

The Ricardian model usually illustrates the universe where commodities are produced competitively from just one production factor called labour. During the production, the level of technology applied by different nations differs significantly to generate the competitive advantage amid countries.

From the supply side economics, the Ricardian model tries to clarify the comparative advantage disparities arising from the nations technological differences. According to this model, different nations have identical production factors except the level of technological adoption and capability.

The labour value theory is perceived to be the basis of the model though differences in technological endowment are key grounds under which trade activities are conducted.

The Ricardian model assumptions

- The manufactured commodities are perceived to be homogeneous athwart nations

- At home borders, labour is supposedly homogenous although the productivities of laborers fluctuate athwart states

- The Ricardian model was created based on the structure of the universal equilibrium.

- During the production process, labour is assumed to be the only critical production factor

- There are two nations that take part in the commerce activities

Comparative and absolute advantage

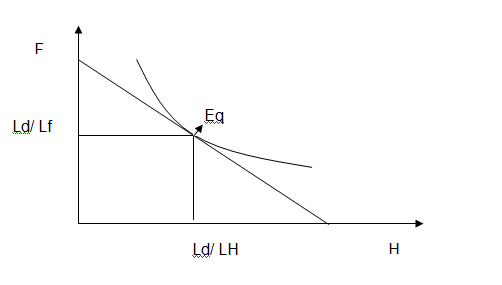

Assuming that there are two nations namely foreign (F) and home (H) countries. However, only a single production factor named labor is available, but in every nation, labor (Lc) supply is constant. Besides, both countries can produce two commodities such as C and W.

The returns to scale in the adopted technology are constant and the level of output will hardly vary since labour supply is fixed (Ld). The available labour in every nation is used to produce both the commodities C and W irrespective of the total quantity produced.

When the countries draw on the Ricardian trade model, they are likely to gain from free trade. Given that, the budget is constrained while the nations want to produce both goods, it is important to determine the opportunity costs of producing these commodities.

When country F can produce product W at a relatively lower cost than product C while country H can produce C at extremely lower cost than it can produce product W, then each country can benefit from free trade by specializing in the production of a commodity that the country has a comparative advantage. Producing both commodities will leave the countries at the same equilibrium point.

Through specialization, the available labour will be geared towards the production of a single commodity which the country has a comparative advantage. Each country specializing in the production of one commodity will experience an increase in commodity demand and the indifference curve will be higher implying that the countries are better off.

The relative extent of the derived gains depends on the global demands for the commodities and the nation’s labor or resource endowment put to meet the export demands.

Heckscher-Ohlin (H-O) model of trade

This theory expounds on the reasons why different nations trade services and goods amongst themselves. The dissimilarity in the capacity to obtain factors of production gives one condition for trade between two republics. The difference emerges when a nation possesses vast capital inform of machineries but with insufficient employees while the other country shows the inverse.

Therefore, a commodity that might be generated by a realm permits the kingdom to direct the production processes towards the H-O presumption. A nation specializes in specific goods that necessitate enough capital if it has abundant capital with limited workforces. The theory thus supposes that higher living standards in these countries are generated via the trade and product specialization.

Postulations on the Heckscher-Ohlin global business theory

- There is no cost related to the shipping of goods amid two states

- The general public coming from different (two) states share or have equal market demands

- There is no movement of capital and labour amid nations

- Relatively more labour and extra capital is required for the two commodities produced

- Capital and labour, which are the major factors of production, are not proportionally available in both countries

The determinants of trade patterns

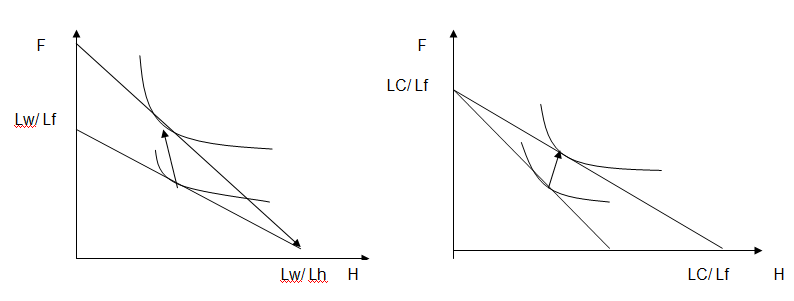

The patterns of trade in different nations are determined by the availability of the factors of production. Every single state will export goods that intensively use the factors of production the country owns in large quantity. Despite the two factors and two commodities accruing from the production using abundant resources, a country will import the other commodities.

The comparative cost of commodities in the manufacturing nation emerges from the no-trade value. This grants the incentive access for the country to export the difference in exports while producing more goods. A fall in the relative costs of production to no-trade worth is experienced by the external country.

The equalization of profit and wage rates in H-O model

When there is free trade, every market will be perfectively competitive implying that the producers of these two commodities will take the given market wages and prices. This will mean that the profits generated from trade will be zero making the wage bills and accruing revenues to be equivalent as in shown by the autarky equilibrium.

The conditions that falsifies both or either of the conclusions

In the event of specialization or monopoly, a country will be able to set distinctive or own prices as the sole producer of a commodity. Wages and profits will hardly be equal since specialization will ensure that monopolistic nations maximize the ensuing returns.

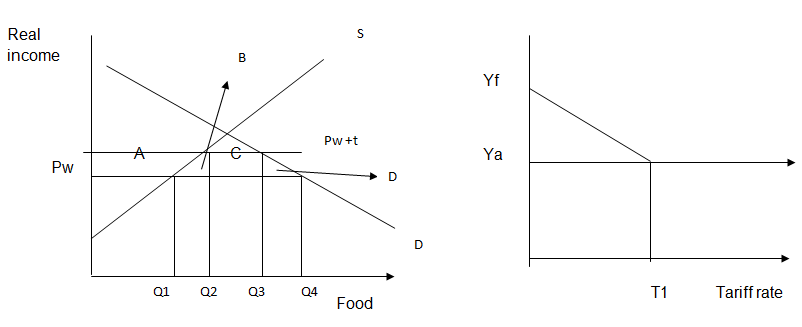

The effects of tariff imposed by a small country

Less efficient resource allocation

The imposition of trade tariffs causes production inefficiency represented by triangle B. For every increase in the price of imported commodities, the dead weight loss appears thus causing a shift in resource allocation to the other productions.

Therefore, any further deviations from free trades cause the real income to reduce from the production distortion loss. If the tariff barriers persist, the real income will continue to decline until the country is driven to the real autarky income by the prohibitive tariffs.

Lower utility or well being on the clients’ part

From the above diagram, the domestic consumers’ demand more commodities than what can be supplied (Q1 Q4). The imposition of tariffs on the imported commodities makes the demand arc for the imports to shift leftwards causing the demand to reduce to Q2 Q3.

That is, the imposition of tariffs on imports increases the prices charged on the imported commodities by the amount of tariff imposed, Pw +t. Triangle D denotes the dead weight loss or consumption inefficiency or consumption distortion loss accruing from the rise in prices caused by the imposed tariffs.

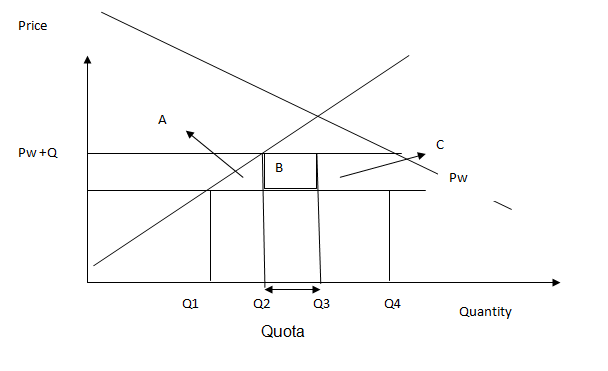

Price 1. A quota

Without quota, the imported volume will be Q1Q2. The state administration can decide to reduce the imported commodities to Q2Q3 by imposing a quantitative restriction called quota. The quota will increase the charged prices to Pw +Q. The difference amid the global price and domestic is the rent quota equivalent to tariffs.

Thus, the triangle sum (A + B+ C) denotes the net consumer welfare loss accruing from the rise in prices caused by the imposed quantitative quota. Conversely, the imposition of quota causes production inefficiency represented by triangle A.

For every increase in the price of imported commodities due to the quantitative restrictions, the dead weight loss arises thus causing a shift in resource allocation to the other production.

A subsidy

Unlike tariffs and quota, the provision of subsidy by the government significantly increases the level of product consumption as subsidies reduce the prices of the imported commodities. However, there will be underutilization of the production resources in the country where the state offers subsidy. Subsidies have positive effects on the consumers’ welfare but negative effects on the producers’ resources.

Arguments opposing free business

The employment case

The household or national manufacturers are forced out of the trade dealings whenever businesses incorporate the economical worldwide market rivals. Often, this argumentative case materializes to be restricted given that the case is precisely faulty.

Two important considerations arise when discussing free trade. One consideration asserts that reducing the costs of goods bought by shoppers’ couple the forfeiture of domestic jobs. When considering the tradeoffs engaged in protecting free trade versus domestic production, there is essence to disregard the ensuing benefits.

The second consideration provides that free trade generate jobs in some industries besides reducing job in certain industries. Hence, both these happen as improved income held by foreign personnel benefiting from free trade increase while utilizing domestic goods. However, some national manufacturers in other industries end up becoming exporters.

Case on state-run protection

Studies show that it is uncertain to hinge on antagonistic homelands for the central commodities as suggested in this case. In fact, some industries ought to get defense from the national security interest. In order to salt away the distinctive and the firms’ significance without regard for clientele, this case is functional than initially thought given that the argument seems precisely acceptable.

The infant industry argument

Substantial learning curves in certain industries permit the companies to develop and stay longer in the business thus quickly augmenting their production. Hence, to be competitive, the corporations catch up by lobbying for the global provision of competition security.

If long-term achievements are considerable then the companies require no assistance from the government. Such companies will yearn to experience short-term losses.

However, some companies cannot survive the short time losses due to the liquidity constraints. As an alternative to providing global business cover, the state administration ought to recommend liquidity via issuing out mortgages.

Argument on strategic protection

The all-inclusive negotiations can employ threats of quotas and tariffs in haggling chip as claimed by the trade restriction advocates. Threatening to be decisive must not be the attention of the state since the strategy is regarded as a non-credible hazard thus, unproductive and risky strategy.

The unfair competition argument

Other nations have similar costs of production and hardly keep the trade rules. Therefore, individual nations emphasize that there should be no international competition. The nations must understand that lack of justice assist nations even though the countries may be correct.

Indeed, local consumers benefit from low-prized imports when other nations retain or incur low costs. The domestic producers can be kept out of business by this competition. Besides, the regulars benefit more than the manufacturers lose when other nations are capable of producing at low costs due to fair play.