Introduction

There are many users of the financial statements of the Australian company, Petsec The users include the stockholders, the customers, the suppliers, the creditors, the banks and other lending institutions, the government regulating agencies, the government taxation agencies, the community, the employees, the labor union, the managers, the board of directors, and others. They will use the financial statements for their decision-making activities. These users rely heavily on the external auditors and internal auditors to give their professional opinion on the truthfulness and fairness of the financial statements in compliance with international accounting standards being implemented in Australia (Houston, and Reinstein 2001, 75). The following paragraphs clearly explain audit risk and the corresponding audit plans.

Body

PETSEC ENERGY is involved in the oil as well as gas discovery, development, and production business in the Gulf of Mexico and the Gulf Coast. It has also oil drilling operations in the United States and the Beibu Gulf in mainland China. The company’s Its head office is located at Level 13 1 Alfred Street, Sydney Australia. The company was able to invest in the Mobile Bay 953 lease. It has two oil fields.

Non Financial Inherent Risks

The Energy Current is the news for the business of energy. The news stated that Petsec oil of Australia had a decrease in revenue to the tune of twenty-two percent. The sales figure this second quarter of 2008 $30 million. This is lower by twenty-two percent when compared with the first quarter’s sales figures. In addition, petroleum production had slowed for the same time period. The company’s U.S. Gulf drilling operations had reached a complete stop stage. The company spent US$ 12.5 million (Ibid). There is an inherent risk that management may close down one or more of the oil wells in order to decrease production and thereby result in the current decrease in sales. The audit plan here is to personally visit the wells and have an ocular inspection.

The above data shows the comparative market cap, and the closing stock market price.

The same stock market figures above show that Petsec Oil has a very high market cap. Its market up is 62.43 M US$ figure. Another Australian oil company is Mosaic Oil. Its market cap is higher than the Petsec The Oil Research Ltd has the highest market cap. The market cap of Oil Research amounted to only $5.79 billion. In addition, the stock market price of Petsec had decreased from its prior stock market price. This shows that the people have lost interest in the company. The audit plan here determines the laxity or completeness of the internal control as a basis for the audit program(Power,1977,3).

Further, the non -financial inherent risk here shows that the owners or accountants could have manipulated the financial statements to cover up a higher decrease in the company’s net income amount. The audit plan here is to vouch if all sales accounts are backed up by delivery receipts. The customer signs here indicating that he or she had received the goods shipped to them. And, the auditor should look at the supporting documents like the second copy of the official receipts to determine if nonexistent sales amounts were recorded(Arens & Loebbecke, 1997,177)

The above table shows that the 2005 quarterly report shows that the company did better in terms of generating net profits. Likewise, the company’s return on assets has a better picture because the quarterly data shows that the return on average assets for the quarter amounting to 20.19% is definitely higher than the annual figure. This holds true also for the return on average equity. The company’s quarter average equity amounting to 27.36% is higher than the annual figure of 15.19%.

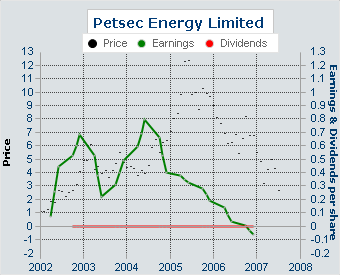

The above graph shows that the company’s stock market share has been on a downward trend. This is not good for the company. A very good reason for such a decline in stock market price is that people are no longer interested to invest in Petsec Australia Oil stocks. One major factor that contributes to this decline is the financial statement of the company. The decline in the profits of the company as emphasized by Australian Financial Review articles like the Energy Current stated that Petsec oil of Australia had a decrease in revenue by as much as twenty-two percent.

The quantitative inherent risks focus on the financial statement accounts (Whittington & Pany, 1995, 130). The audit plan starts with ranking the 2007 Petsec financial statement balances as to inherent risk. Certain accounts in the financial statements are classified as high inherent risks. The 2007 Petsec cash & equivalents balance is the most inherent because it is easy for the cashier to pocket the cash. Another very inherent risk is that is clearly explained here is the Petsec trade receivable. The cashier can collect the money from the customer and write –off his account balance. Then, the cashier can now embezzle the money. The cashier of Petsec Oil may embezzle money if internal control is not strong.

The above table shows that the 2007 receivables turnover of 3.7 times had increased from the prior year’s receivables turnover amounting to 3.6 times. This shows that there is could be an inherent risk where receivables have been collected per accounting records but the cash could have been stolen. The audit plan here is to check the official receipts, the delivery receiving report signed by the customers, and determine if all receivables written off are authorized by management.

The Inventory turnover shows that the 2006 figure of 10.7 times is better than the 2007 figure of only 10.4 times. This shows that there is an inherent risk that inventory could there are some of the corresponding inventory sold is still recorded as part of the ending inventory. The audit plan here is to physically inspect if the inventory end tallies with the inventory end per accounting records. The above ratio also shows that the Gross Property Plant and equipment turnover figure did not change when compared with the figures of the prior year, 2006. This shows that there is a regular buying and selling of these assets a few years for the year.

The inherent risk here is that the accounting books will show that the company owns these properties, plants, and equipment when in fact they could be nonexistent. The audit plan here is to physically inspect if the assets are in place. Also, legal documents like official receipts, deeds of sale, and statements of accounts will have to be vouched to determine the authenticity of the recorded property, plant, and equipment amount.

The depreciation figure above shows that the 2007 data is 7.90% of the related property, plant, and equipment. This is definitely lower than the 2006 figure of only 7.60%. The inherent risk here is that the company had decreased the 2006 figure in order to decrease the depreciation expense account. The sales figure is deducted amounts that include the costs of sales, the marketing expenses, and the administrative expenses.

A decrease in expenses would definitely give the show an increase in net profits. The audit plan here is to physically observe if the property depreciation analysis figure is realistic. To be realistic, the auditor must determine if the property, plant, and equipment net of the book depreciation amounts are fair. A fully depreciated property, plant, and equipment are still being used to its maximum strength by the company show that the depreciation computation was in error.

Conclusion

There is an audit risk where Petsec’s accountant and /or its management may present a fraudulent financial statement characterized by overstating its inventory end of resulting in a fraudulent increase in net profits. Another inherent risk is the overstatement of Petsec’s revenue accounts an amount higher than the actual figure. The accountant or management can also connive to understate the actual Petsec liabilities. This would result in a fraudulent increase in stockholders’ equity. The accountant and management can also connive to decrease its actual total operating expense amounting to in order to show a fraudulently higher net income. An adverse opinion is needed if the fraudulent accounts are material (Behn, Kaplan, and Krumwiede 2001, 13).

Further, the financial statement accounts of Petsec that are classified as high inherent risk accounts involve the following characteristics:

- There is difficulty in auditing transactions and balances.

- There are complex computations. A good example is the interest expense computation for long-term loans.

- There is a difficulty in implementing accounting issues for some business transactions.

- There is a problem with how to value certain business transactions

Fraud is an intentional error while an error is an unintentional mistake. One possible reason for the auditor’s difficulty in detecting fraud or error is because the management of the company connives with the accounting, the marketing, the production, and other persons in the organization to come up with a fraudulent financial statement (Sharma 2004,1).

For example, the management gives its approval to the cashier not to issue official receipts to its customers in order to reduce the income taxes that the company has to pay. Consequently, a physical count would result in the audit findings such as an overstatement of the inventory end resulting from the cashier’s fraudulently unrecorded sales transactions or not (Fargher, Mayorga, and Trotman 2005,1).

Works Cited

Arens, A., Loebbecke, J., 1997. Auditing an Integrated Approach, Prentice Hall, Sydney Australia.

Behn, Bruce K., Steven E. Kaplan, and Kip R. Krumwiede. 2001. Further Evidence on the Auditor’s Going-Concern Report: The Influence of Management Plans. Auditing: A Journal of Practice & Theory 20, no. 1: 13.

Fargher, Neil L., Diane Mayorga, and Ken T. Trotman. 2005. A Field-Based Analysis of Audit Workpaper Review. Auditing: A Journal of Practice & Theory 24, no. 2: 85+.

Johnson, Eric N., Jane Baird, Paul Caster, William N. Dilla, Christine E. Earley, and Timothy J. Louwers. 2003. Challenges to Audit Education for the 21st Century: A Survey of Curricula, Course Content, and Delivery Methods The 2000-2001 Auditing Section Education Committee American Accounting Association. Issues in Accounting Education 18, no. 3: 241+.

Power, Michael. 1997. The Audit Society: Rituals of Verification. Oxford: Oxford University Press.

Sharma, Vineeta D. 2004. Board of Director Characteristics, Institutional Ownership, and Fraud: Evidence from Australia. Auditing: A Journal of Practice & Theory 23, no. 2: 105+.

Whittington, R, Pany, K. 1995. Principles of Auditing, London, Irwin Press, Energycurrent. Web.

Finance. google. Web.

Corporate information. 2008. Web.