Problem Statement

Insolvency proceedings influence economic growth and stability throughout the world. The cost, time, and outcome of these measures determine the rate at which an organization recovers from the debt burden by using liquidation, reorganization or liability enforcement to repay secured creditors. Although countries are interdependent economically, they use different approaches to resolve insolvency.

Introduction

SMEs Adopted by the Dubai SME

The economy of Dubai is highly dependent on small and medium enterprises (SMEs). Indeed, SMEs represent 95 per cent of all establishments in the Emirates. Moreover, 40 per cent of the total value-add generated in Dubai comes from SMEs (Yanes-Estévez, et al., 2018). They also provide 42 per cent of jobs, which is why the government is keen to ensure they do not fail. Any issues arising due to insolvency are sorted quickly by relevant authorities to ensure economic stability in Dubai and the UAE at large.

Aims and Objectives of the Analysis

The main aim of this analysis is to look at how Germany, USA, and Norway resolve insolvency and compare them to the UAE. Insolvency or bankruptcy often evokes negative associations with failure and shame, and potential entrepreneurs can be deterred from starting a new venture by it (Yanes-Estévez, et al., 2018). Indeed, the possibility of going bankrupt is the greatest fear associated with starting a business, ranking higher than irregular income and job insecurity. If a government creates a proper framework for the resolution of insolvency, many people will be interested in starting businesses, and this will stimulate economic growth. Thus, the objective of this study is to look at how the US, Germany, and Norway handle insolvency concerns with a view to influencing current measures undertaken by the UAE government.

Countries to be Included to the Analysis

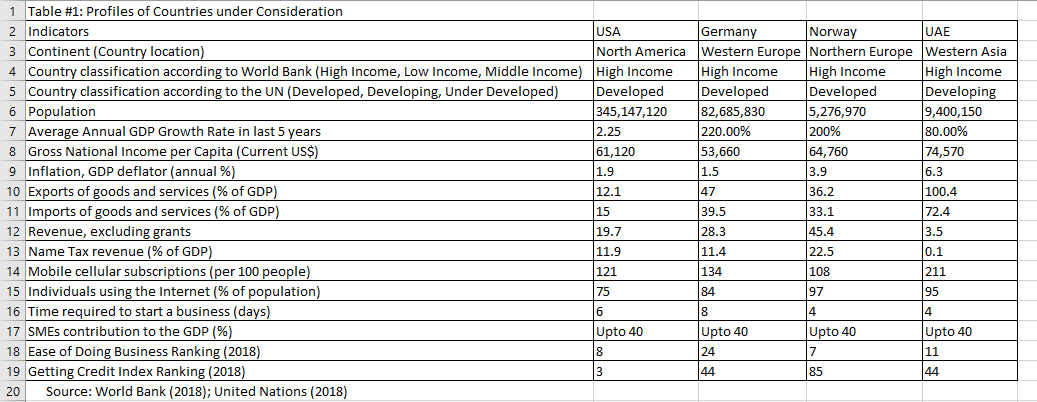

As already mentioned, the countries to be included in the Analysis are the United States, Germany, and Norway. These three “high-income countries” are in different parts of the world, including North America, Western Europe, and Northern Europe. Therefore, their inclusion in this analysis provides global insight. Notably, it is relatively easy doing business in these countries judging by their respective ease of doing business and getting credit indices. Table 1 (separate Excel file) summarizes the profile of each country; it includes the ease of doing business and getting credit indices at the bottom. The ease of doing business for USA, Germany, Norway and UAE are 8, 24, 7 and 11 respectively. The getting credit index for all the four countries is 3, 44, 85 and 44 respectively. These data are provided in country profiles available on the World Bank website (World Bank, 2018). A screenshot of Table 1 is included below, and the data also reflect the information from the country profiles prepared by the United Nations (2018).

Getting Credit in USA, Germany, Norway, and the UAE: Policies Involved

Summary of the Section

In this section, a brief discussion on policies about getting credit in Germany, USA, Norway and the UAE is provided. For these countries, the policies that would be under consideration are government loan guarantee, special guarantees and loans for start-ups, government export guarantee (trade credit) and subsidised interest rates. The analysis starts with Norway, since it has the highest ranking (position 7), followed by United States (position 8) and Germany (position 24); UAE is position 11 but is considered the last because recommendations for improvement following this analysis are meant to benefit it.

Norway

Government Loan Guarantee

In Norway, the government offers some form of loan guarantee through its Innovation Norway initiative (Innovation Norway, n.d.). The framework is meant to benefit creative and innovative individuals throughout the country. In addition to loan guarantees, Innovation Norway offers a wide range of grants and loans to creative and potential entrepreneurs. The government’s efforts through this initiative alleviate fears and encourage people in Norway to venture into business and to diversify their offering to the local and the international market.

Special Guarantees and Loans for Start-ups

As mentioned, the Norwegian government also offers special loans and guarantees for start-ups in the country. This move is intended to benefit good entrepreneurs and companies, helping them create additional jobs throughout the country. In the provision of special guarantees and loans, the government focuses on cultural and creative industries as a way of releasing private capital through the mitigation of perceived risks in starting and conducting new business ventures (Solsvik, 2019). Innovation Norway is the most important innovation instrument the Norwegian government relies on for enterprise and industry development.

Government Export Guarantee

The Norwegian government offers export guarantees through the Norwegian Export Credit Guarantee Agency (GIEK). Operating under the Ministry of Trade, Industry and Fisheries, GIEK issues guarantees on behalf of the state to promote Norwegian exports (GIEK, n.d.). Since establishment, this public sector enterprise has facilitated a significant increase in export activity in the country. The enterprise removes the risks involved in exportation, which encourages many people to look for global markets for their Norwegian goods and services.

Subsidized Interest Rates

Norway has plans to raise interest rates gradually but cautiously in the future. The government believes that export guarantees, special loans and grants for different business enterprises reduce the risks involved in doing business through borrowed money. Therefore, a need to reduce interest rates does not exist. Still, the interest rates in Norway are low compared to many OECD countries. From 1991 to 2019, the interest rate in Norway averaged 4.07 per cent (Trading economics, n.d.). The highest level ever recorded in this period was 11 per cent (in September, 1992), and the lowest was 0.50 per cent (in March, 2016).

USA

Government Loan Guarantee

Like those of other developed countries, the government of the United States offers loan guarantees to small and medium enterprises throughout the country. The guarantee increases the lender’s willingness to offer the loan, especially when the lender sees the borrower as a high-risk individual or organization (USA.gov, n.d.). It also increases the likelihood that a business person will look for a loan and advance their business. Agency tools and services that make government loan guarantees in the US easy include Small Business Administration, US Department of Agriculture (USDA), and GovLoans.

Special Guarantees and Loans for Start-Ups

The government of the United States also contributes financial support to small and medium enterprises that may have problems or difficulties qualifying for a loan in the traditional sense. The government offers these special loans in collaboration with specific banks and lending institutions that have registered for the program (USDA, n.d.). The loans and special guarantees are available for individuals and institutions who want to start or expand businesses.

Government Export Guarantee

The government of the United States also has an export guarantee. The program exists under the USDA, and it is called the Export Credit Guarantee Program (GSM-102) (USDA, n.d.). The main function of the export guarantee is to encourage lenders to finance the commercial export of agricultural goods produced in the country. The program encourages importers in developing countries as it reduces financial risks to their lenders.

Subsidized Interest Rates

The interest rate in the United States varies, depending on the performance of the economy. Often, a slow economic growth, as is the case for 2019, means no rate rise for that year (BBC, 2019). At present, the interest rate in the country ranges from 2.25 per cent to 2.5 per cent and it will remain so for the whole of 2019 due to the slowing down of the country’s economic activity from its fixed rate in the fourth quarter.

Germany

Government Loan Guarantee

Government loan guarantees in Germany are available only under special circumstances. Through the United Loan Guarantees, which is an element of the Federal Government’s Raw Materials’ Strategy, the Federal Republic of Germany covers raw material lenders abroad against their political and commercial credit default risk (AGAPortal, n.d.). The establishment of this initiative was necessitated by the fact that Germany is one of the largest consumers of raw materials in the world, and a constant access to such material is critical to its continued growth and development.

Special Guarantees and Loans for Start-ups

Support programs, special guarantees, and loans for start-ups in Germany are provided by the government through the Ministry of Finance, the ERP Special Fund, the German Länder and the EU (Federal Ministry of Finance, n.d.). Most of the support that these institutions offer is in the form of loans for public development, low interest rates, and long maturities. However, access to these services is complicated depending on the specific area.

Government Export Guarantee

Hermes Cover is the name given to Germany’s export guarantee. The government uses this policy as a key instrument for the promotion of foreign trade by protecting exporters against bad debt and losses that happen due to commercial or political reasons (AGAPortal, n.d.). In most cases, Hermes Cover is necessary before a bank or any financial institution can fund any export operations. It gives individuals the confidence to participate in the exportation of German goods and services.

Subsidized Interest Rates

At present, the interest rate in Germany is 0 per cent. Notably, the benchmark interest rate in the Euro Area was last recorded at 0 per cent. From 1998 to 2019, the interest rate in this area averaged 1.94 per cent, with 4.75 per cent in October, 2000 being the all-time high and 0 per cent in March, 2016 being the all-time low (Trading economics, n.d.). The rate at present remains at 0 per cent.

UAE

Government Loan Guarantee

Loan guarantees schemes are available for Emirati SMEs, and can be extended to all small and medium enterprise whether it is owned by locals or foreigners. It is important to note that in this regard, the focus is debt financing. Credit guarantee schemes in the UAE include the Mohammed Bin Rashid Fund for SME, the Khalifa Fund, and SME financing by Emirates Development Bank.

Special Guarantees and Loans for Start-ups

Special considerations in the UAE are made for start-ups. Government guarantees through the EDB ensure that start-ups are not constrained in their economic endeavors. The special program by the EDB will increase the number of SMEs, improve existing ones, and help them to establish a positive credit history.

Government Export Guarantee

Trade and export credit in the UAE is offered following Sharia law through the Islamic Corporation for the Insurance of Investment and Export Credit (Emirates Development Bank, n.d.). The export credit focuses on goods and services other than those related to the oil industry. Islamic risk mitigation tools may be unique, but they offer the needed protection just like traditional or regular risk abatement tools do.

Subsidized Interest Rates

Interest rates in the UAE are subsidized in special circumstances. The biggest beneficiaries of the program include SMEs and start-ups. The government uses this program to encourage trade and ensure that individuals and organizations with UAE citizenship grow and expand. Subsidized interest rates are also under Sharia law.

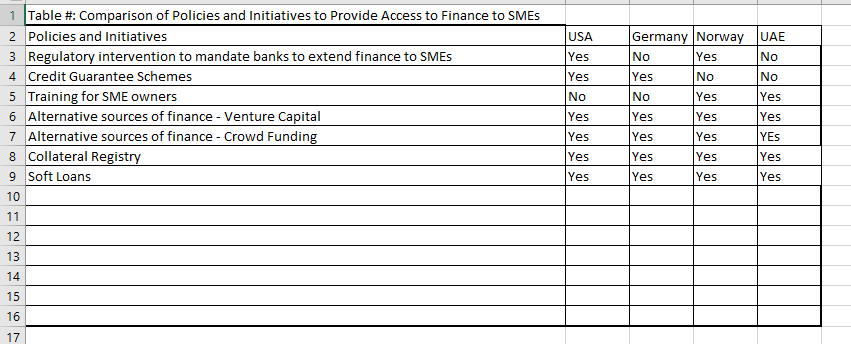

Gap Analysis

Table 2 summarizes the policies in the countries under consideration. The screenshot is provided below. The data are taken from the country profiles available at the United Nations (2018) and World Bank (2018) websites. Looking at policies in Norway, Germany, and the United States, it is evident that a great opportunity for process improvement exists in the UAE. Although the policies that these three countries implement have the same name, they focus on different issues. A country’s focus depends on its economic status and economic activity. For example, most of the trade encouragement tools in Germany focus on the importation of raw materials because Germany is one of the biggest consumers of raw materials in the world. In the US, the focus is on agriculture because many people there do large-scale farming and produce quality products fit for exportation. In the UAE, the focus is on supporting locals in contrast to expatriates, with a special emphasis on the compliance of all business activities with the principles of the Sharia law. Therefore, there is a need to liberate the UAE market and business environment.

Recommendations for the UAE

While the UAE is not doing poorly, there is always room for improvement. One of the things that the country should do to ensure continued growth and development is the liberation of the market. Strict cultural and religious laws may keep society intact, but they hinder development. For example, focusing on creating business ties with Westerners, the UAE government can revise strict regulations and norms according to which partnerships are realized. Another thing that the UAE could change is diversifying its offering. The government should consider providing protections to SMEs in all sectors without discrimination (oil-sector SMEs seem to be discriminated against at present). For instance, more governmental and financial support for SMEs in various sectors should be proposed.

Timeline and Resources Required for the Implementation

The implementation of policies with the above recommendations will take a significant amount of time and resources. The government will need to do extensive research to determine the best way of developing these policies. It will also have to ensure that it has constituted a team of local and international experts to help in the development of appropriate systems given the recommendation. The team will take time researching and experimenting with different ideas until it establishes the best one. Therefore, five years is the minimum amount of time required to create and implement appropriate policies that take into consideration the recommendations given above. The entire work will consume about 3 million dollars for the first five years. Therefore, proper planning and budgeting are needed.

Conclusion

Small and medium enterprises play an essential role in most economies across the globe. They ensure the availability of a wide variety of goods and services for local and global consumption while simultaneously creating numerous job opportunities. Therefore, governments across the globe should ensure that they provide enough support for these institutions. Start-ups should also get access to the support they need to grow, expand, and become profitable. Most entrepreneurs fear to venture into business because they lack the assurance that the money they invest in different ventures will yield reasonable returns. Some fear that they may become insolvent. The government, especially in the UAE, should look at how countries that perform well in terms of business carry out their activities. The UAE should find a way to implement similar policies at home to boost SMEs and start-ups within the country.

Reference List

AGAPortal, n.d. Fundamentals of the Untied Loan Guarantees.Web.

AGAPortal, n.d. Hermes Cover: fundamentals of the export credit guarantees. Web.

BBC, 2019. Slower US growth means no rate rise for 2019, says Fed. Web.

Emirates Development Bank, n.d. Credit guarantee scheme – Emirates Development Bank. Web.

Federal Ministry of Finance, n.d. Support for start-ups. Web.

GIEK, n.d. Overview. Web.

Innovation Norway, n.d. Start page. Web.

Solsvik, T., 2019. Norway to raise interest rates gradually, cautiously – central bank chief.Web.

Trading economics, n.d. Germany interest rate.Web.

Trading economics, n.d. Norway interest rate. Web.

United Nations, 2018. Coun try profiles. Web.

USA.gov, n.d. Finance your business. Web.

USDA, n.d. About the Export Credit Guarantee Program (GSM-102).Web.

World Bank, 2018. Country profiles. Web.

Yanes-Estévez, V., García-Pérez, A. & Oreja-Rodríguez, J., 2018. The strategic behaviour of SMEs. Administrative Sciences, 8(4), pp. 61-67.