Summary

Samba Financial Group is one of the leading financial institutions in the Kingdom of Saudi Arabia. The firm traces its history back to 1950 when Citibank opened its first branch in the country. Saudi American Bank was established in 1980 when Citibank was forced to sell 60% stakes in the company to locals because of the new laws that the government had enacted (Samet, 2018). The firm assumed the name Samba Financial Group in 2003 in what some financial analysts believe was a result of the growing anti-American sentiments in the region. The firm has seen grown immensely as it seeks to spread its operations globally.

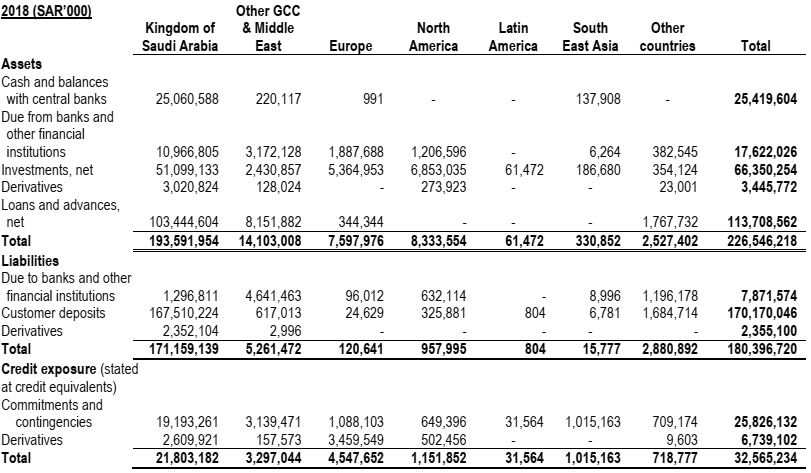

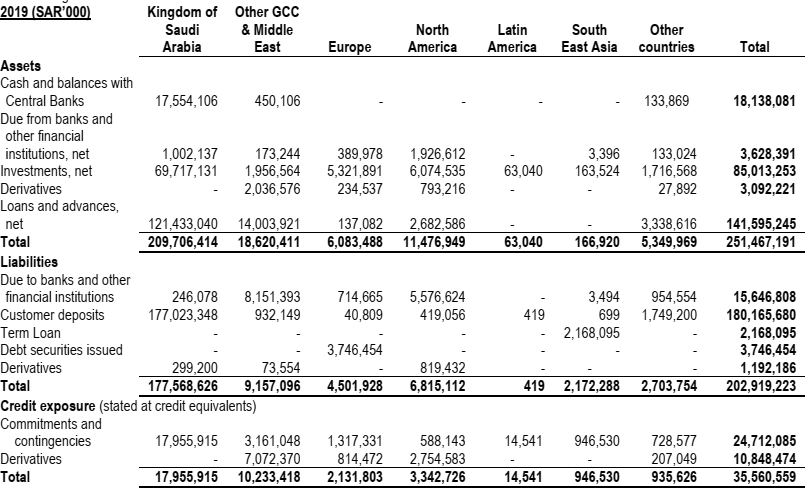

Currently, the firm has branches in several countries within the Middle East and North Africa (MENA) region, Europe, North America, Latin America, and Southeast Asia among other regions, as shown in its financial statements in the appendix of this report. In this study, the analysis of financial data and performance of this company will be limited to the Kingdom of Saudi Arabia.

Vision, Mission, and Planning Strategies of the Company

It is important to understand the vision, mission, and planning strategies of the company as it seeks to achieve growth in the market. The vision of this company is “to be the foremost financial institution in Saudi Arabia by providing world-class solutions to our customers to not only meet customer needs, but also exceed expectations, and to investing in people, benefiting local communities, and delivering superior returns to our investors” (Samba Financial Group, 2020, p. 5).

As shown in the definition, the firm seeks to become the leading financial institution in the country offering its clients quality products. The mission of the bank is “to be the most admired bank by providing world-class service and innovative solutions through its people and technology, yielding superior returns and demonstrating responsible corporate citizenship” (Samba Financial Group, 2019, p. 4). The mission statement explains how the firm seeks to achieve its vision and stakeholders that will directly benefit from the firm if the vision is realized.

The company’s strategies are clearly defined on its website, making it possible to understand its approach to realizing the vision. “Samba prides itself on having its unique way of life called the SambaWay when it comes to our work environment.

The SambaWay encourages trust and mutual support amongst its customers, employees and shareholders” (Samba Financial Group, 2020, p. 6). The firm introduced the concept of SambaWay in its operations to promote trust and mutual support for all the stakeholders as a means of strengthening its organizational community and ensuring that its clients get the best services that they deserve. “Geographical and product diversification is part of our strategy which aims to expand the business and enhance shareholder returns. We continue to expand into other markets in the world, thereby increasing our reach, fine-tuning service delivery and achieving synergies across client segments” (Samba Financial Group, 2020, p 11). The statement should that geographical expansion of its operations is another strategy that the firm is using to achieve growth in the market despite the intensified competition.

Financial Principles and Bottom Line Impact

Samba Financial Group operates in a highly competitive and very sensitive industry. The ability of the firm to achieve success in such a market depends on how effectively it understands and uses financial principles to not only achieve growth in its profit margins but also ensure that it meets both local and international accounting regulations. These financial principles directly impact its bottom line because they define the approach that the firm takes to achieve profitability. Virgo (2020) explains that for a financial institution that embraces Islamic financial principles, it becomes essential to understand policies that are used to define operations. Unlike conventional banks that make most of their profits through riba (interests), Islamic banks have to find alternative ways such as sharing profits with their customers.

Accounting Policies and Standards’ Implications on the Financial and Macro-Environment

Accounting standards or policies refer to a common set of principles and procedures that forms the basis of accounting practices and policies. They define a standard format that individual firms, especially publicly listed companies, must follow when making their financial records (Fox et al., 2020). A country may have its unique accounting standards that define how companies in that country make their financial reports. However, globalization has created an environment where it is necessary to have a common accounting standard that can facilitate cross-border analysis. Currently, the International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP) are the universally accepted and the most common accounting standards. In the Kingdom of Saudi Arabia, the IFRS was adopted for all publicly listed companies.

These international accounting standards have a major impact on the financial and macro-environment of companies. The introduction of these international policies has attracted foreign investors into the local market. Scott (2018) explains that when a country has embraced IFRS or GAAP, it becomes easy for international investors to analyze and interpret the financial statements of local firms. It becomes easy to identify profitable firms that are worth buying their stock. The increased inflow of capital from these foreign direct investors has improved the macro-environment for firms such as Samba Financial Group.

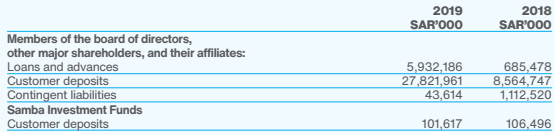

Use and Misuse of Financial Data in Management Accounting and Financial Accounting

Financial data plays a critical role in the practice of management accounting and financial accounting. According to Spiteri (2020), the data is used in assessing the financial progress of a company. The information is critical for both internal and external stakeholders. Internally within the company, the management of Samba Financial Group uses the data to assess its financial growth, areas that have resulted in major losses, areas that pose greater growth opportunities, and issues that would require the attention of the top management. These records can also enable the management to identify possible cases of theft or mismanagement of funds.

External stakeholders also use these financial data for various purposes. The government relies on the report to define the amount that a firm should pay in tax. Investors rely on the report to determine the financial health of the firm before they can make their investments.

The problem arises when individuals or firms misuse financial data for personal selfish gains. Cases have been witnessed where those trusted with the accounts of a firm provide misleading information for organizational or personal gains. For instance, the 2008 global recession, which many financial analysts believe was caused by the collapse of the subprime mortgage market, as a result of the misuse of financial data. Firms such as Lehman Brothers manipulated their financial records to hide the level of toxicity of the loans they were repackaging and selling as securities all over the world (Bowers, 2019).

Such practices may have a devastating impact on an entire industry or the economy, as was witnessed in 2008. The management of this company will need to develop strict principles that will discourage the misuse of financial data by internal auditors. Events of this recession show that such malpractices may not only affect customers but also cripple a firm and even force it to bankruptcy, just as was the case with Lehman Brothers.

How Plan and Execution Can Lead to Effective Financial Management at Samba

Having a plan and executing it effectively can lead to effective financial management of a firm. Samba Financial Group has been using IFRS for a long time as it has been keen on attracting foreign investors and expanding its operations beyond the MENA region. The management developed an accounting plan and policy where all financial records are audited and reports are made by two different entities. The first audit takes place monthly, after every three months, six months, and one-year intervals are conducted by internal auditors. They help the firm to assess its financial progress in the market. The second audit is often conducted after six months and most importantly by the end of the financial year by external auditors. These external auditors help the firm to identify any misinformation that could have existed in the internal audits.

Their reports are used by both the government and investors to make various decisions. An effective plan that is properly executed defines how financial data should be presented and steps that the management should take in case such audits reveal anomalies at various levels or departments within the company.

Ratio Analysis & Financial Interpretations

Using financial ratios helps in defining the financial health of a firm. Samba Financial Group has managed to achieve rapid growth in the market despite the stiff competition that it faces both in the local and international markets. According to Virgo (2020), the firm is currently one of the leading financial institutions in the MENA region and has developed a wide range of products to meet its customers’ needs. Ratio analysis and financial interpretation will help in assessing its progress in the market and the challenges that it faces as it seeks to maintain growth. To assist in this analysis, it was necessary to compare the financial performance of this firm with that of its major rivals in the local market. Riyad Bank was selected as the most appropriate competitor because of the ease with which its accounting records are available and its size in the local market. Although Samba Financial Group operates in the global market, this analysis focused only on the local operations within Saudi Arabia.

Liquidity Ratios

Liquidity ratios are an important class of financial ratios that helps in determining the ability of a firm to pay its current debts without the need of raising external capital. A financially sound firm should have the capacity to pay all the due debts without having to struggle to source additional funds. External capital is often appropriate for supporting expansion projects instead of meeting the normal obligations of a firm. In this analysis, the focus will be on the current ratio and cash ratio for the two selected financial institutions.

- Current Ratio= (Current Assets/Current Liabilities)

Current ratio is used to determine the ability of a firm to pay its current liabilities using current assets. In this case, current assets refer to cash and other stock that can easily be transformed into cash whenever it is necessary. The analysis was conducted for the two firms in two different financial years (2018 and 2019). The outcome of the analysis below shows how the two firms compare.

Samba Financial Group

2018: Current ratio = (193,591,954/ 171,159,139) = 1.13

2019: Current ratio = (209,706,414/ 177,568,626) = 1.18

Riyad Bank

2018: Current ratio = (27,638,973/ 178,676,940) = 0.15

2019: Current ratio = (34,533,222/ 208,291,605) = 0.17

The outcome of the analysis above makes it possible to compare the financial performance of the two firms within the stated period. Virgo (2020) explains that a good current ratio should be 1.2 to 2.0, which means that the can pay its short-term debt with ease (Shkulipa, 2020). A current ratio of 2.0 means that the firm has 2 times more current assets than current liabilities. The data shows that in 2018, Samba Financial Group could pay its current liabilities using current assets 1.13 times. Within the same period, the current ratio of Riyad Bank was 0.15. It means that only Samba Financial Group was in a position to repay its loans with ease. The analysis shows that Riyad Bank was in a worse position to pay its current debts than Samba Financial Group. This bank would need external funding to meet settle the current debt.

In 2019, the current ratio for Samba Financial Group was 1.18. It was a slight improvement from the value it had in 2018. Riyad Group also registered a similar improvement within the same period, recording 0.17. Just like the previous year, Samba Financial Group registered an impressive performance, being able to settle its current liabilities without outside sourcing. Despite the improvement that Riyad Bank recorded, it still had to rely on external sources to meet its financial obligations based on the statistics above. The improved performance of the two organizations from 2018 to 2019 was impacted by macro developments in the country. The entire industry experienced major growth within the period (Virgo, 2020). It explains why both firms achieved growth in terms of their capacity to pay their current debts.

- Cash Ratio = (Cash + Marketable Securities) / Current Liabilities

Cash ratio helps in determining the capacity of a firm to pay off its short-term liabilities using its highly liquid assets. Sometimes it may not be desirable for a firm to have to convert all its current assets into cash to enable it to meet its obligation of paying debts that are already due. As such, the cash ratio helps in determining the ability of a firm to meet such obligations using highly liquid assets, most preferably cash and marketable securities. The comparative analysis below shows the outcome of that analysis.

Samba Financial Group

2018: Cash ratio = (25,060,588/171,159,139) = 0.15

2019: Cash ratio = (17,554,106/177,568,626) = 0.10

Riyad Bank

2018: Cash ratio = (27,352,348/ 178,676,940) = 0.15

2019: Cash ratio = (33,924,375/ 208,291,605) = 0.16

The assessment above shows the cash ratio of the two firms. Bowers (2019) argues that although there is always no ideal figure for the cash ratio, the higher the figure, preferably above 0.5, the better. Higher figures show that such a firm would not need to convert all its current assets to cash to meet these obligations. In 2018, Samba Financial Group’s cash ratio was 0.15 and that of Riyad Bank was 0.15 as well. It means that both firms could repay 15% of their current debts using highly liquid assets. The value dropped for Samba Financial Group in 2019 to 10% while Riyad Bank dropped to 16% within the same period.

The reduced ability of Samba Financial Group to pay its current debts using current assets does not mean that its financial performance worsened during the same period. The macro-environmental analysis showed that firms in the banking industry registered growth within that period. The reduced ratio was a result of the increased investment or purchase of other assets (both current and non-current) that might have reduced the amount of cash available at the firm.

Profitability Ratios

Some of the most important ratios to both internal and external stakeholders of a firm are the profitability ratios. They help investors to determine the ability of a company to generate profits relative to the revenue. The government also uses the same information to define the amount of tax that it needs to collect from a given company. In this section, gross margin and profit margin was used to conduct a comparative analysis of the two firms within the financial years 2018 and 2019.

- Gross Margin = (Gross Profits/ Net Sales)

Samba Financial Group

2018: Gross margin = (5,549,588/8,156,520) = 0.68

2019: Gross margin = (4,619,487/6,376,648) = 0.72

Riyad Bank

2018: Gross margin = (4,716,085,000/ 8,967,401,000) = 0.53

2019: Gross margin = (6,232,066,000/ 10,717,063,000) = 0.59

The analysis of the financial data of the two firms shows that they are relatively profitable organizations. Samba Financial Groups’ gross margin for the year 2018 was 68%, which is an impressive performance. Within the same period, Riyad Bank recorded a gross margin of 53%. Although both institutions had a good performance, Samba Financial Group once again emerged as the better firm. In 2019, Samba Financial Group’s gross margin improved to 72% while that of Riyad Bank went up to 59%. Once again Samba emerged as the better performing institution.

The improved gross margin reaffirmed the improved macro-market factors that favored all financial institutions in this industry. They both recorded a near similar performance improvement within the same period even though one firm performed better than the other as explained above. As Spiteri (2020) explains, when the external operating environment is conducive, it is easy for firms to achieve the desired level of growth.

- Profit Margin = (Net Profit/ Net Sales)

The profit margin is another profitability ratio that helps investors and other stakeholders to determine how a firm makes net profit relative to the revenue. An analysis of the profit margin for the two firms was conducted within the financial period of 2018 and 2019. The outcome of the analysis is shown below.

Samba Financial Group

2018: Profit margin = (3,059,720/8,156,520) = 0.38

2019: Profit margin = (3,990,680/6,376,648) = 0.63

Riyad Bank

2018: Profit margin = (3,092,000,000 / 8,967,401,000) = 0.34

2019: Profit margin = (5,602,000,000/ 10,717,063,000) = 0.52

The statistics show that in 2018, the profit margin for Samba Financial Group was 38%. Riyad Bank’s profit margin within the same period was 34%. The value shows impressive performance of the two firms, though Riyad Bank was outperformed in this index. The two companies registered a significant improvement in their profit margin in 2019. Samba Financial Group’s profit margin was 63% while that of Riyad Bank was 52%. Samba Financial Group’s performance using this index is better than that of Riyad bank although both registered a satisfactory performance.

The improved performance can be attributed to the enabling external macro-environment in the country. There was government support for these institutions and the economy, in general, was also growing. The financial sector is always very sensitive and it is easily and directly impacted by the performance of other industries in the country (Scott, 2018). Their growth within the period of analysis helps in determining the growth of the country’s economy.

Activity Ratios

Activity ratios, also known as operating efficiency ratios or turnover ratios, are used to assess the efficiency of a company’s operations. It helps in determining how effective a firm is in employing its assets and capital to generate revenue in the market. In this assessment, receivable turnover and total assets turnover ratios were conducted for both Samba Financial Group and Riyad Bank for the financial years 2018 and 2019. The outcome of the analysis is shown below.

- Receivables Turnover = Revenue / Average Receivables

Samba Financial Group

2018: Receivables turnover = (8,156,520/207,379) = 39.3

2019: Receivables turnover = (8,600,351/373,490) = 23.0

Riyad Bank

2018: Receivables turnover = (8,967,401/ 348,506) = 25.7

2019: Receivables turnover = (10,717,063/ 430,429) = 24.9

- Total Assets Turnover = Revenue / Average Total Assets

Samba Financial Group

2018: Total assets turnover = (8,156,520/242,771,050.5) = 0.034

2019: Total assets turnover = (8,600,351/242,771,050.5) = 0.035

Riyad Bank

2018: Total assets turnover = (8,967,401/247,844,227) = 0.036

2019: Total assets turnover = (10,717,063/247,844,227) = 0.043

The receivable turnover for Samba Financial Group in 2018 was 39.3 while that of Riyad Bank was 25.7. In 2019, the value for Samba Financial Group dropped slightly to 23.0 while that of Riyad Bank dropped to 24.9. The ratios above show that both firms are efficient in employing their assets to generate revenues despite the fluctuations witnessed. They are both effective in collecting debt and extending credit. The total asset turnover ratio for Samba Financial Group in 2018 was 0.034 while that of Riyad Bank is 0.035. In 2019, there was an improvement at both institutions, with Samba recording 0.035 while Riyad recorded 0.043. It is evident that in the two financial years, Riyad performed better in using its assets to produce sales.

Capital Structure Ratios

Capital structure ratios help in determining the long-term financial position of a firm. It helps in assessing the mix of capital in terms of how it combines equity and debt. Investors need this information to determine the security of their investment, especially in a worst-case scenario where the firm has to go through liquidation (Scott, 2018). The debt ratio and capitalization ratio for the two firms in the two financial years were calculated.

- Debt Ration = Total Debts/ Total Assets

Samba Financial Group

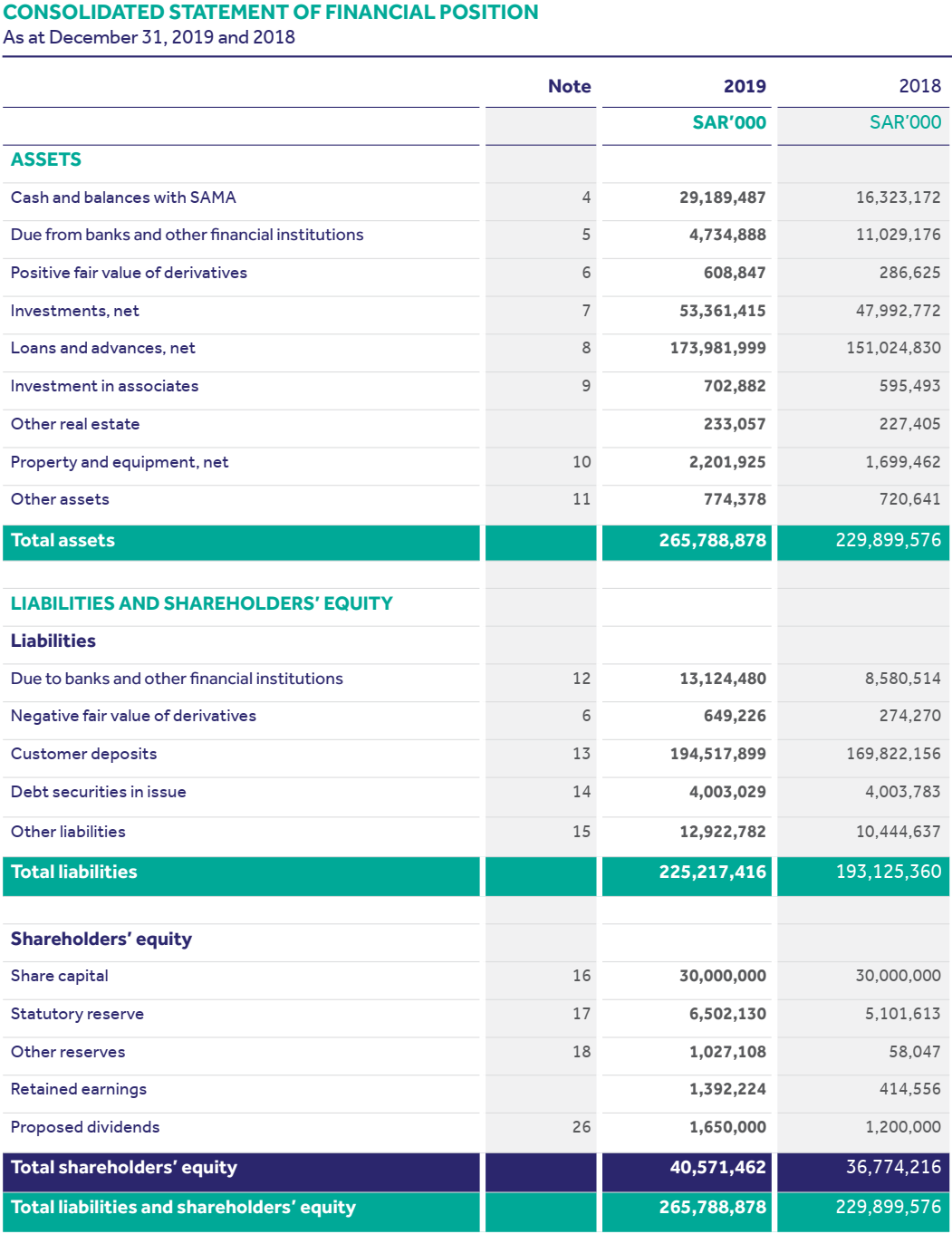

2018: Debt ratio = (187,632,365/ 229,938,300) = 0.816

2019: Debt ratio = (210,154,969/ 255,603,801) = 0.822

Riyad Bank

2018: Debt ratio = (193,125,360/ 229,899,576) = 0.840

2019: Debt ratio = (225,217,416/ 265,788,878) = 0.847

- Capitalization Ratio = Long-Term Debt/ (Long-Term Debt + Shareholders’ Equity)

Samba Financial Group

2018: Capitalization ratio = 9,590,745/ (9,590,745 + 42,305,935) = (9,590,745/ 51,896,680) = 0.185

2019: Capitalization ratio = 14,342,481/ (14,342,481 + 45,358,820) = (14,342,481/ 59,701,301) = 0.240

Riyad Bank

2018: Capitalization ratio = 14,722,690/ (14,722,690 + 36,774,216) = (14,722,690/ 51,496,906) = 0.286

2019: Capitalization ratio = 17,575,037/ (17,575,037 + 40,571,462) = (17,575,037/ 58,146,499) = 0.302

In 2018, Samba Financial Group’s debt ratio was 0.816 while that of Riyad Bank was 0.840. It means that for both banks, their capital exceeded their debts, which is a healthy financial position for a firm. The debt ratio for Samba Financial Group increased slightly in 2019 to 0.822 while that for Riyad Bank increased to 0.847. Comparatively, Samba Financial Group has emerged as a better performing bank because it relies less on debt to finance its capital than the competitor. The capitalization ratio for Samba Financial Group in 2018 was 0.185 while that for Riyad Bank was 0.286. In 2019, the ratio for Samba increased to 0.240 while that for Riyad increased to 0.302. The macro-economic environment forced the two firms to borrow more, but Samba still emerged as the better performing firm.

Growth Ratios

Growth ratios also enable investors to assess the level of attractiveness of a firm in the market. Below is the outcome of the analysis conducted of the two companies within the stated financial years.

- Return on Assets = Net Income/ Total Assets

Samba Financial Group

2018: Return on assets = (3,059,720/ 229,938,300) = 0.013

2019: Return on assets = (3,990,680/ 255,603,801) = 0.016

Riyad Bank

2018: Return on assets = (3,092,000/ 229,899,576) = 0.013

2019: Return on assets = (5,602,000/ 265,788,878) = 0.021

- Return on Equity = Net Income/ Shareholders’ Equity

Samba Financial Group

2018: Return on equity = (3,059,720/ 42,305,935) = 0.072

2019: Return on equity = (3,990,680/ 45,358,820) = 0.088

Riyad Bank

2018: Return on equity = (3,092,000/ 36,774,216) = 0.084

2019: Return on equity = (5,602,000/ 40,571,462) = 0.138

The return on asset ratio for Samba in 2018 was 0.013 while that for Riyad Bank was also 0.013. In 2019, both firms registered improved performance to 0.016 and 0.021 respectively. In this index, Riyad Bank performed better than Samba. In 2018, the return on equity for Samba was 0.072 while that for Riyad was 0.084. There was an improvement in 2019 when they recorded 0.088 and 0.138 respectively. Once again, Riyad Performed better in this index, showing that it is more rewarding to investors than Samba.

Literature Review on Budgeting Practices

Budgeting

Budgeting is a critical planning activity for any organization. According to Scott (2018), the management must come up with a comprehensive plan on how to fund various activities that have to be completed within a given financial period. The process helps in determining how the available resources will be utilized to fund the activities, and when necessary, propose borrowing if there is a budget deficit. Samba Financial Group has been keen on expanding its operations beyond the national borders. These expansion projects require financial planning to ensure that as the firm establishes new branches in different cities around the world, its current operations are not financially strained. In this section, the researcher will assess traditional and modern budgeting strategies and how emerging technologies have become critical in enhancing the budgeting process.

Traditional Budgeting Versus Modern-Age Budgeting

Traditional budgeting has been used for a long time in the financial planning of institutions of varying sizes. According to Bowers (2019), the traditional budgeting approach of financial planning heavily relies on historical data. In this approach, every department within an organization is expected to submit their previous year’s financial record to facilitate the financial planning process. The finance department and other senior managers responsible for budgeting will then assess how much each department is expected to receive based on their expenses in the previous year. The allocations to each department primarily depend on their expenses in the preceding year.

Virgo (2020) argues that the variation in the amount set for these departments may be caused by factors such as inflation, expanded responsibilities, and the number of employees within the current year and other related factors. The assumption made in this approach to budgeting is that each department within an organization is expected to use the same amount of resources as was the case in the previous year unless something drastic emerges.

Samba Financial Group has been using the traditional budgeting approach for a long time to plan for its finances. Traditional budgeting has been essential in enabling this firm to budget for its finances. Fox et al. (2020) believe that this approach enables a firm to predict the future by assessing past trends. This firm of budgeting remained popular for a long time because it was easy to explain to all the stakeholders where a firm was planning to spend its resources in a given way. Historical data acted as a point of reference. Despite these benefits, Bowers (2019) explains that this approach to budgeting has a major flow when it comes to predicting the future.

As shown in the two exhibits in appendix 1 and 1 (financial statement of Samba Financial Group) expenses and income of a firm vary significantly from one financial year to the next. As was explained above, some of these variations are caused by macro-economic factors which are beyond the control of a firm. It means that expenditure can significantly increase or drop from one year to the next depending on the circumstances that a firm faces. Sometimes when a firm may have a balanced budget or even a budget surplus when developing the plan at the beginning of a new financial year. However, it may be forced into a budget deficit because of unforeseen expenses that force it to borrow to finance its operational activities. These challenges associated with traditional budgeting led to the emergence of modern-age budgeting.

The modern-age budgeting seeks to address major flows associated with traditional budgeting. Zero-based budgeting is one of the most common modern-age budgeting that companies around the world are using.

It involves developing a financial plan from scratch without considering historical records, just as the name suggests (Shkulipa, 2020). Instead of relying on historical records to allocate resources, the budgeting team has to provide a clear justification of every expense in the current year. It takes place in three distinct stages. The team has to determine expenses for the financial year based on the prevailing factors in the market. The next step is to project revenues based on the operational activities that will be conducted in that period. The last step is to project the profit that will be accrued from the activities.

This modern budgeting approach has received popularity because it is more efficient and accurate in allocating resources. Instead of basing the budget on assumptions, this method emphasizes the need to have facts (Fox et al., 2020). Every department has to explain why they need to spend a given amount of money within a given financial year. It eliminates wastage that is associated with traditional budgeting. Some departments often spend money on unnecessary and less profitable activities just to ensure that they get increased allocations in the next financial year. Such practices are eliminated in modern-age budgeting.

Elimination of inflated budgets promotes lean operation and effective coordination of departments. Bowers (2019) notes that the main challenge of this approach to budgeting is that it is more labor-intensive than the traditional approach. The firm has to find experts that understand it and sometimes it may lead to high manpower turnover as redundancies are often eliminated.

How Budgeting Can Lead to Enhanced Operational Performance

Budgeting is critical in enhancing the operational performance of a company. Virgo (2020) states that the financial planning of a firm defines its ability to undertake all important activities that will facilitate growth. For instance, Samba Financial Group has been keen on expanding its operations all over the world. However, such a move would require a substantial amount of money. As such, it has to develop an effective plan on how to support its expansion projects while at the same time protecting its current operation. Financial planning starts by identifying all the activities that have to be completed within the financial year to ensure that the firm is operating normally. When the budgeting team realizes that it has additional funds that can support additional activities, all the new activities have to be ranked based on their viability and ability to generate attractive income for the firm (Bowers, 2019). Only those that prove to be most attractive would be allocated resources.

Budgeting has become a standard practice for organizations irrespective of their size or profit goals. Operational success in a firm can only be realized through a proper allocation of resources. Modern-age budgeting has a better capacity to enhance a firm’s operational performance because funds are directed towards specific functions (Spiteri, 2020). Each department must define the activity, the funds needed, and the period within which it has to be completed. It creates a sense of urgency and responsibility for all the responsible stakeholders because by the end of a specific period, they have to provide a report based on the assigned project and allocated resources. They have to prove that they used their funds responsibly to achieve specific goals.

Impact of Smart Technologies in the Budgeting Process

Smart budgeting technologies has emerged to help organizations to develop an effective financial plan. In the past, historical data were used to make predictions about future expenses. However, smart technologies have replaced such inaccurate and inefficient approaches to financial planning. These technological tools provide a more accurate prediction of future expenses. A firm can accurately determine how much each activity will cost.

The budgeting team only needs to have an accurate computation of activities that are to be conducted, the amount needed currently for them to be completed, and possible inflation that may affect the overall cost (Samet, 2018). The management will be able to plan for its resources more accurately and fairly. Human judgment is sometimes skewed because of personal prejudice. As such, it is common to find one department being allocated more resources without a proper justification. The use of a scientific method of allocating resources eliminates such problems.

It is also important to note that smart technologies in budgeting are critical in identifying and eliminating redundancies. In the current competitive banking industries, firms such as Samba Financial Group are under immense pressure to cut down on their operating cost as a means of improving their profit margins. One of the ways of achieving such goals is to eliminate redundancies. It means that during the process of budgeting, an assessment must be conducted to ensure that all the activities are financially viable and relevant to the growth of the firm. The scientific approach to budgeting makes it possible to identify possible redundancies that inflate the cost without a proper justification (Fox et al., 2020).

When such redundancies are identified, the budgeting team will advise the relevant departmental heads to halt such activities. Employees that were assigned to undertake such activities will have to be redeployed or eliminated to help lower the cost of operation. Such initiatives help in promoting lean operation within a firm. It also promotes a sense of responsibility among employees because they will be aware that their job security depends on the relevance of the activity they are assigned in terms of enhancing the profitability and sustainability of the company.

Investment Appraisal Techniques

Samba Financial Group is committed to making significantly high-value capital expenditures meant to facilitate its rapid expansion both regionally and globally. The chief executive officer (CEO) of the company will need to approve specific expansion projects, postpone others, and reject some based on their viability to the firm. As such, it is necessary to conduct investment appraisals to select the most viable projects.

Investment Appraisal Techniques Important When Seeking an Approval from the CEO

A firm may use various investment appraisal techniques when assessing the viability of high-value capital expenditure. To ensure that the CEO of the company gives their approval, it is necessary to carefully select appropriate appraisal techniques. The investment appraisal technique should be simple enough to be understood with ease while at the same time being effective enough in explaining all the important factors that should be understood by the officer providing the approval. The payback period and profitability index are important when seeking the approval of the top management unit.

The payback period is an investment appraisal technique that seeks to determine when a firm will recover the cost of a given project. The management of Samba Financial Group will need to know how long it would take for the firm to recover all its investments made in the project. The shorter the period the more attractive the project (Virgo, 2020). The profitability index is an investment appraisal technique that assesses how much a firm will earn per dollar of the investment made (Fox et al., 2020). Simply put, it determines how profitable the project will be to the firm. The CEO of Samba Financial Group is more likely to approve more profitable projects. The period of recovering the investment and the profitability of the projects are the most important assessment tools needed for the management to make an approval.

Discounted and Non-Discounted Cash Flow Analysis

Discounted cash flow analysis is based on the concept that money that is received today is more valuable than when the same amount is received at a later date. The longer it takes, the more the money loses its actual value. As such, discounted cash flow analysis takes into consideration the lost value of money over a given period after an investment is made. The formula below shows how discounted cash flow is calculated. Non-discounted cash flow does not take into consideration the depreciated value of money. Tables 1 and 2 shows the discounted and non-discounted cash flow analysis of Samba Financial Group for the year 2018 and 2019.

Discounted cash flows= CF 1/ (1+r) 1 + CF 2/ (1+r) 2 +… CF n (1+r) n

CF= Cash flow

r = Discount rate

Table 1: Discounted Cash Flow.

Table 2: Non-Discounted Cash Flow.

Reference List

Bowers, S. L. (2019) Accounting and corporate finance for lawyers. New York, NY: Wolters Kluwer.

Fox, D. et al. (2020) Sealy and Hooley’s commercial law: text, cases, and materials. New York, NY: Oxford University Press.

Samba Financial Group. (2019) Samba Financial Group annual report 2018. Riyadh: Samba Financial Group.

Samba Financial Group. (2020) Samba Financial Group annual report 2019: focused on a new era. Riyadh: Samba Financial Group.

Samet, I. (2018) Equity: conscience goes to market. Oxford: Oxford University Press.

Scott, P. (2018) Introduction to financial accounting. New York, NY: Oxford University Press.

Shkulipa, L. (2020) Accounting journals: Scopus, web of science, scimago. Berlin: Science.

Spiteri, S. (2020) Financial accounting: from its basics to financial reporting and analysis. Newcastle upon Tyne: Cambridge Scholars Publishing

Virgo, G. (2020) Principles of equity & trusts. Oxford: Oxford University Press.

Appendices