Abstract

The essay is about the Saudi British Bank and the JP Morgan Chase Bank and their performance in the year 2006. SABB or the Saudi British Bank being the largest financial banking institution in Saudi Arabia provides a range of banking services including interest-free loans while JP Morgan Chase Bank is a leading global financial services firm that operates in almost 60 countries providing its consumer’s asset management and private equity services apart from banking, financial services, small business, and commercial banking. Furthermore, the essay deals with the financial performance of both the banks and make a comparative analysis of their performance. After getting into the basic information related to each of the banks, the differences between the two alternative banking models, their structure are analyzed in more detail in the later stages. The analysis also indicates that the among the two banks’ loan quality in the case of SABB is relatively less general and their loan market appears to have been saturated with less growth in consumer loans and at the same time sharp fall in overall overdrafts.. We recommend on the basis of the analysis that SABB adopt a more active marketing strategy to expand and create their own market and adopt the loan policy in a way that they can make a loan decision with a more reliable cash flow analysis. In the case of JP Morgan Chase bank, the bank is on a very fast track to become a truly international bank and our analysis suggests the need to emerge as a strong player in the developing world especially India and China.

Comparative Analysis: SABB & J P Morgan Chase Bank

The banking sector in this world is as diverse as the world itself. The two banks taken over here are following a very different business model as well as the target market. Beginning with SABB; the bank is one of the leading banks in the Kingdom of Saudi Arabia and is an associated company of the HSBC Group, one of the world’s largest banking and financial services organizations, with over 9,800 offices in 77 countries and territories in Europe, the Asia-Pacific region, the Americas, the Middle East, and Africa. Being a Saudi Joint Stock Company, it operates as a commercial bank through a network of 73 branches including 13 exclusive ladies’ sections/ branches. The bank has over 2000 employees and is a leader in offering its customers a full range of banking services. The Bank also follows the Shariah-based system in which provides non-interest-bearing products are provided with whole structure being approved and supervised by an independent Shariah Board established by the Bank.

JP Morgan Chase Bank traces its history back more than 200 years to its first predecessor in 1799. Merger and acquisition activity over the years has combined the operations of J.P. Morgan, Chase Manhattan, Chemical, Manufacturers Hanover, Bank One, First Chicago, and National Bank of Detroit into a global financial services leader. JP Morgan Chase & Co goes to market under three brands, which are: “JP Morgan Chase – the overall corporate brand”, “JP Morgan – the umbrella brand for investment banking, worldwide securities services, private banking, asset management, private equity, and private client services” and “Chase – the brand for JP Morgan Chase’s consumer and commercial banking businesses, under which home financing falls”. Chase is one of the industry’s leading providers of home mortgages and home equity loans originating almost $200 billion in home loans. Chase also services another $6 billion worth of third-party loans (loans that Chase does not originate) through its Systems & Services Technologies, Inc. (SST) subsidiary.

Comparative Analysis of the two banks

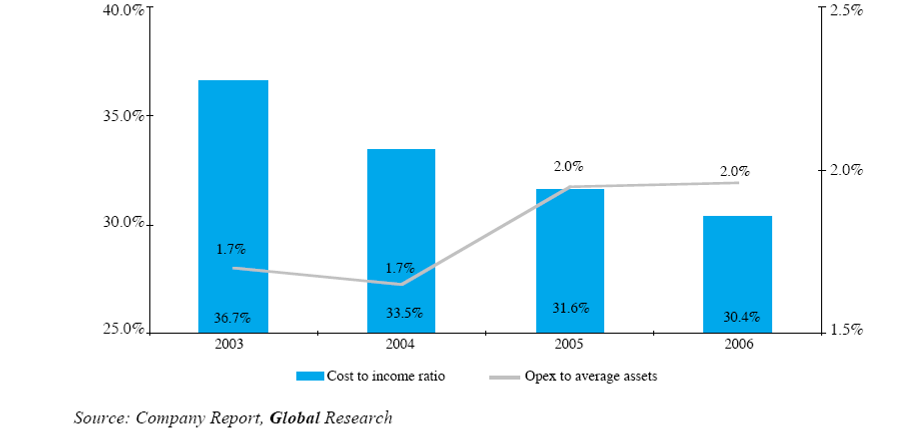

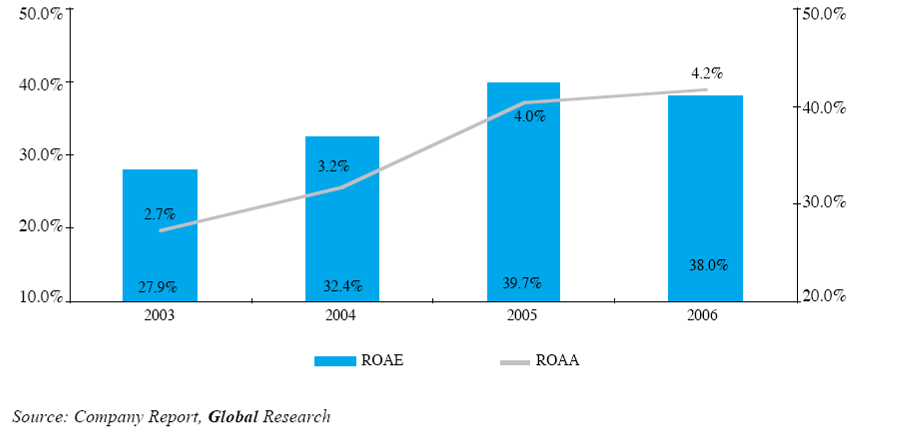

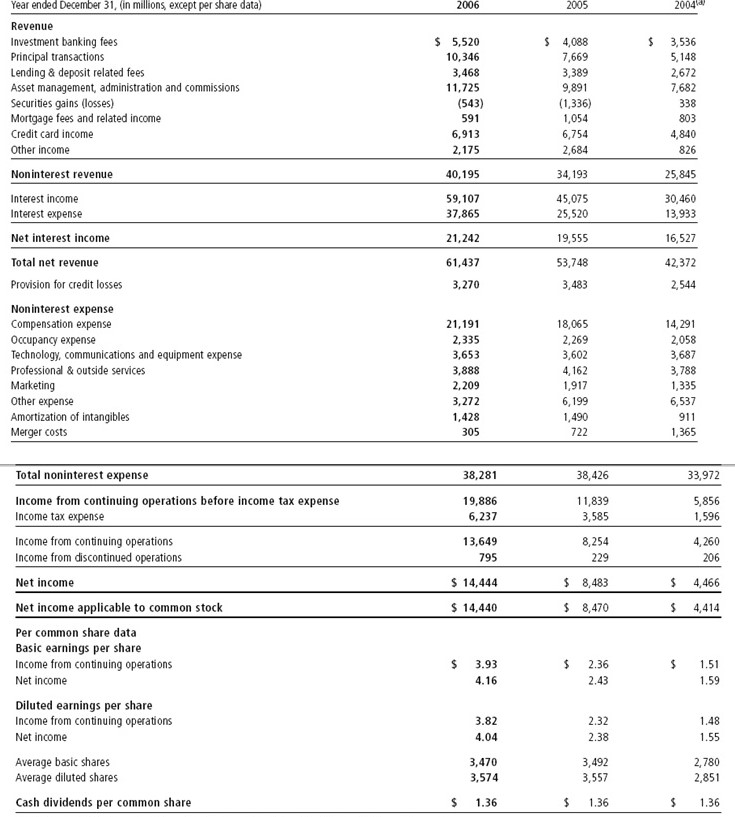

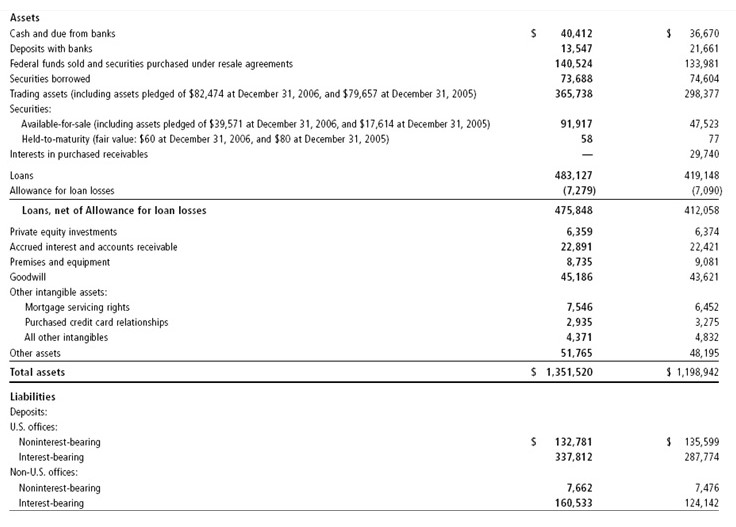

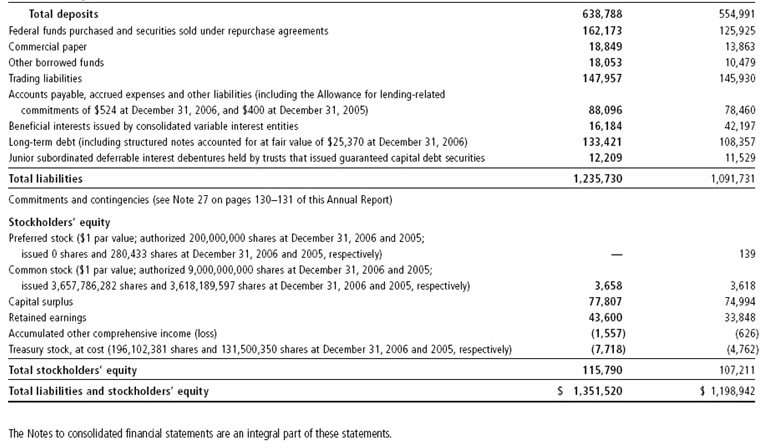

For the purpose of comparative analysis of SABB and JP Morgan Chase Bank’s performance, the annual report of the two banks for the year 2006 has been taken into consideration. For those selected banks, we collected the performance ratios over the year, and for the purpose of analysis, each bank group’s performance ratio is summarized for the year in the form of the simple average ratio. These summarized data are presented with the attached tables. Several financial ratios which indicate the results of banks’ performance have been selected. The ratios for this study include those of core capital to total assets, interest spreads, noninterest income to average assets, overhead expenses to average assets, domestic loan growth, domestic loans to deposits, net charge-offs to average loans, nonperforming loans to gross loans, and return on assets. The following analyses those ratios with emphasis on the two banks’ performance in the year 2006.

Tables and Charts

References

Global Investment House. “Saudi British Bank: Update 2006”.

JP Morgan Chase Co. “Annual Report: 2006”.

JP Morgan Chase Co. “Consolidated Final Statements and notes: 2006”.

Saudi British Bank. “Annual Report: 2006”.