Introduction

Time and again, short-run economic growth shifts from its long-run growth pattern. This phenomenon causes distortions in the markets for commodities and capital, which could result in fluctuations in economic performance. Economists have for ages studied causes and consequences of economic fluctuations, also called business cycles. Some studies have established that most business cycles are caused by the imbalance between capital investment by firms and the amount of savings by the public. Thus a growth in investments could be caused by the increase in savings, which is called a savings induced boom, or by the increase in money supply by the central bank, which is referred to as a credit induced growth. Consequently, economic scholars from different schools of economic thought have developed theories that explain business cycles. One theory is the Austrian Business Cycle Theory (ABCT), which explains why some economic booms (the upward trends of business cycle) are sustainable while others are not.

ABCT’s Background

ABCT finds its roots in the capital theory outlined by Carl Manger in his late 19th-century book, Principles of Economics (Manger 96). The theory was late improved by Eugen Von Bohm-Bawerk in his book Capital and Interest (Bohm-Bawerk 126). Economist Knut Wicksell was to later improve the theory by combining Manger’s capital theory with Bohm-Bawerk’s interest rate dynamics. Indeed according to Roger Garrison, Wicksell’s work gave the theory a complete Austrian school of thought outlook. Garrison adds that it was the well-known Austrian economists, Ludwig Von Mises and Friedrich A. Hayek, who improved Wicksell’s theory and titled it the “Austrian Business Cycle Theory” (Ebeling 23). The ABCT explains the difference between an economic boom caused by an increase in savings, and one caused by an increase in credit. For reasons that are going to be explained later on in this paper, ABCT concludes that the savings-induced growth is sustainable, whereas the credit-induced growth is not. Non-sustainability of the credit-induced growth makes it unpopular among Austrian economists.

How ABCT Works

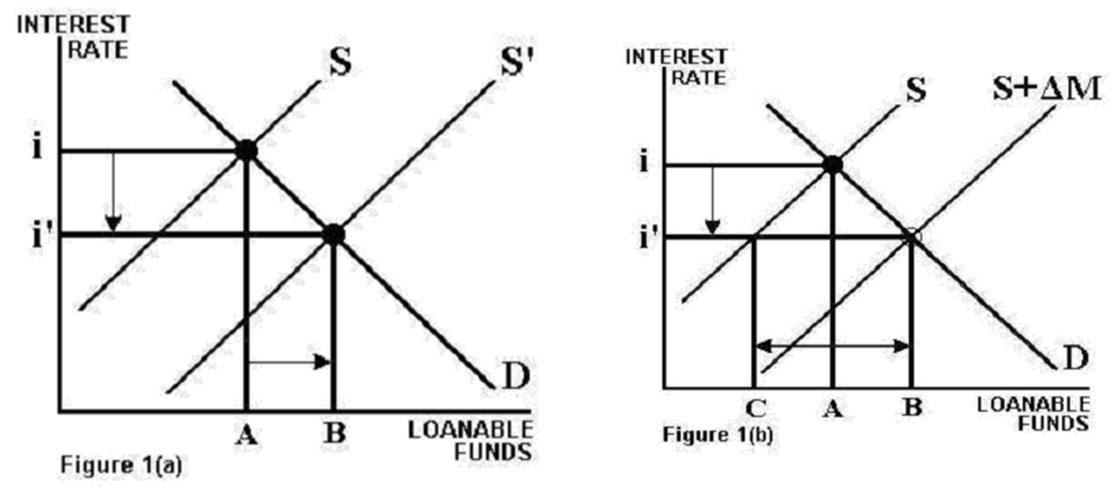

The Austrian theory arrives at its conclusions by aggregating the interactions between money, credit, and investment in the credit market (Cochran 16). The theory uses several economic models developed by earlier Austrian economists to explain the sustainable nature of savings-induced growth and the non-sustainability of credit-induced growth. The models used to explain ABCT include: the loanable funds model, production possibilities frontier, and the Hayekian Triangles. ‘i’ will, however, explain the theory using the loanable funds model illustrated below:

Figure 1(a) shows an economic boon caused by increase in savings. Here, the loanable funds model illustrates people’s willingness to have chosen to replace current consumption with future consumption. At interest rate ‘i’, the public’s total savings amount to $ A. As people save more, the supply curve of saved money shifts from S to S, which serves as the supply for loanable funds (saved money that is available to be loaned out). With time, people become more future-oriented and increase their savings from $ A to $ B. To use Carl Manger’s words, individuals have at that point become concerned with their short-term and longer-term consumption (Manger 78).

Due to the increase in savings from $ A to $ B, the interest rate decreases from ‘i’ to i because the supply is higher than demand. According to Roger Garrison the decrease in the rate of interest entices entrepreneurs to undertake investment projects previously considered unprofitable, which ends up improving the economy’s productivity (Ebeling 13). The rate also benefits savers because there is a market for their savings, which guarantees interest. The ABCT refers to the above increase in the economy’s productive capacity (through the reduced consumption and increased savings) as a sustainable, genuine growth. This is because firms actually borrow the amount that is already there. Under this system, the maximum that firms can borrow does not exceed $B.

Figure 1(b) shows the market for loanable funds when economic short-term growth is caused by increase or decrease in money supply by the central bank. The central bank intervenes in the loanable funds market by reducing or increasing interest rates. In this figure, the initial savings are at interest ‘i’, but when the central bank, by policy, reduces interest rate to ‘i, loanable funds supply shifts to the right. The low-interest rate makes entrepreneurs think there has been an increase in the savings, and therefore, rush for more investment funds.

However, there has not been an increase in the savings. Instead, the central bank happens to have supposedly increased the supply of loanable funds on the credit market. Notice that there is a gap between the amount saved by the public and the amount borrowed by firms. This wedge actually reflects reduced savings from the initial $A to $C, what Austrian economists refer to as “forced savings.” This is because individuals are no longer willing to save as much as before. With the reduction in public savings from A to C, one would think firms would also borrow at C, but that never happens. Instead, firms borrow at B.

It is evident that funds being borrowed do not entirely come from savings, which is contrary to the theory that investments equal savings (I=S) exemplified in figure 1(a). Entrepreneurs instead borrow the extra funds from credit markets. This situation, where investment is higher than savings, is referred to as “malinvestment,” which means directing resources to projects that are unprofitable. As Garrison notes, the low bank rate of interest stimulates unsustainable economic short-term economic growth and is followed by a bust (Garrison Slide 10).

Implications of Credit-Induced Growth

The ABCT introduces the concept of an intertemporal structure—the distance between different stages of production and final products to consumers—to illustrate how credit-induced growth causes malinvestments and finally busting of the economic boom. The Austrian Business Cycle Theory argues that the supposed increase in savings causing interest rates to decrease, which makes investors venture into projects that are further away from the production of consumers goods. Projects that are far away from the final (consumer) goods tend to be expensive. Therefore, entrepreneurs rush to get loans at the low-interest rates to finance those projects. Garrison demonstrates that malinvestments, “makes the rate of interest and credit availability play a significant role in allocation of resources among stages of production (Garrison Slide 24).” As entrepreneurs’ demand for investment funds increases, consumers, as indicated by graph 1(a), are forced to save less money and increase their consumption.

Credit-induced growth has two immediate effects on the economy. First, the rising entrepreneurs’ demand for credit leads to declining reserves and rising interest rates. The second is that the rising commodities demand by consumers leads to an increase in inflation. In the end, the rising interest rates force entrepreneurs to abandon their investment plans (projects started when interest rates were tampered with by the central banks) due to the increasing cost of capital to maintain those projects. Sadly, abandoning these projects leads to layoffs, as well as reduction in the economy’s output. This is contrary to the expectations of policymakers in the central banks who were, according to Garrison’s words, “trying to grow the economy instead of letting the economy grow.” (Garrison Slide 19) At the same time, rising inflation forces consumers to spend their income on consumption goods, instead of savings. However, this does not happen in the savings-induced growth, which is the perfect way of letting the economy grow.

So, can the woes of credit-induced growth be prevented? Austrian Business Cycle Theory shows that it is possible, if only central bankers could avoid creating credit. Since the recession is the corrective phase of the cycle, market forces have begun to reassert themselves. Once a crisis has begun, policymakers should let the market forces take their course. Instead, policymakers respond by using more regulations, which sometimes worsens the situation.

However, despite the Austrian Business Cycle Theory being so straightforward in explaining the disadvantages of credit induced growth and pushing for the monetary policymakers to opt for the savings-induced growth, it is not a popular theory among policymakers because they have been so entangled in the mentality of using interest rates to control the market for loanable funds. If market processes are not interfered with by price rigidities, the recession that follows the crisis should be a procedure that eliminates and corrects the past errors and malinvestments (Garrison Slide 22).

Works Cited

Cochran, John, & Steven, Call. Austrian Business Cycles, Plucking Models, and Real Business Cycles. 2001. Mises Institute. Web.

Ebeling, Richard. The Austrian Theory of the Trade Cycle and Other Essays. Auburn: Mises Institute, 1996.

Garrison, Roger. An Analysis of Sustainable and Unsustainable Growth. A PowerPoint Presentation: Auburn: Mises Institute August, 2004.

Menger Carl. Principles of Economics. Grove City: Grove City College, 1913.