Abstract

The U.K. financing sector is well known for establishing proactive policies that help to provide sufficient capital for many of its small to medium scale enterprises. On the other hand, due to the 2008 financial crisis, the current European debt crisis as well as the general slowdown in the global economy this has led to small to medium scale enterprise growth rates being capped at 3.5% for the past 2 – 3 years. This paper will provide recommendations and information on the financial opportunities and problems that entrepreneurs/ business owners face when it comes to starting and expanding a business in the U.K. It will explore the prevalence of the use of alternative methods of finance due to the “hesitance” felt within the banking sector to give out loans due to generally lacklustre performance of the global economy which has adversely affected the economy of the U..K. As a result, this paper will examine whether such policies by banks and the new focus on alternative sources of funds has created a negative impact on the growth potential of SMEs within the U.K. This examination will involve the identification of the main sources of finance and developing strategies on how to overcome the various problems associated with them. It is anticipated that through this paper, a better and more effective system of SME financing can be established within the U.K.

Review of Related Literature

Introduction to Literature

This section reviews and evaluates literature and theories on access to various sources of finance for small to medium scale enterprises. The literature in this review is drawn from the following EBSCO databases: Academic Search Premier, MasterFILE Premier, Global Events, ERIC, and Professional Development Collection. Other sources of information utilized in this section are drawn from various online resources such as the Etisalat.com, The Economist.com, as well as various news media websites.

Entrepreneurs, regardless of their inherent location, share similar problems in terms of access to sufficient capital to start their business, being able to attract customers, developing a sufficient cash flow to sustain their venture and a variety of other nuances that are connected to the process of developing a business (Kirby 1990, 7pp. 78 – 87). Within the study Kirby (1990, pp. 78-79), it was explained that in most market economies small to medium scale enterprises (SMEs) make up the bulk of a country’s enterprises constituting 80 to 90 per cent of local businesses and as such shows the relative importance of SMEs to the U.K. economy (Kirby 1990, 7pp. 78 – 87). In this paper, what will be analyzed are the various methods of capital access available to small to medium scale enterprises within the U.K. and the inherent difficulties associated with the process of obtaining sufficient funds to start a profitable business venture. It is expected that this section will act as the basis behind an assessment that would create effective suggestions as to how entrepreneurs within the country can best respond to various financial opportunities and challenges.

The growing stages of the small-medium enterprises

According to Commission Recommendation of 3 April 1996, the provision of small medium-enterprises that if the employee is limited to 250, and either the annual turnover not exceeding€40 million or balance sheet totalling not exceeding €27 million. This provision was changed to the enterprise must have fewer than 250 employees, which have the annual turnover not exceeding €50 million or balance sheet totalling not exceeding €43 million before 1 August 2008. However, after 1 August 2008, the programme of small medium-enterprises is being enlarged to firms with employees is limited 500 and either the annual turnover not beyond €100 million or under €86 million of the annual balance sheet total (Department for Business Innovation & Skills).

According to U.K. Company Law Section 248, to satisfy the two conditions among followings can be regarded as small businesses:one of them is the annual turnover is under £2.8 million, another one is the annual balance sheet total not exceeding £1.4 million, the third one is that company has fewer than 50 employees. At the same time, it rules that if one can meet two conditions, it can be regarded as a medium enterprise, namely that the annual turnover is less than £11.2 million. Not only that, the annual balance sheet total should be under £5.6 million and the employees not beyond 250 people within the organization itself for the provisions to be considered applicable (Kasseeah, 2008).

Traditionally (Bank of England, 2001), there is an innovative development idea about the proportional financial products which are sale for different scale mainly include four stages that different phases need diversity financial services. The first stage, the concept of innovation is designed, and the possible results relative to a great deal which is only composed of the cost of an investment plan which needs a technical and economic assessment. Because of capital intensity, the amount of sales is almost nil. In the second stage or the start-up stage, as the increasing capital intensity results in the absence of revenues, companies require large amounts of finance. In the next early growth stage, there is a declining of operating risk, due to the growing capital intensity with a quick increase in the operational budget, the financing needs keep to be high. The number of sales growing rapidly, which satisfy companies to make self-financing but not enough to cover all financial requirements. Because the businesses make progress on to continuing growth stage, as the rapid growth of the sales with a capital intensity tends to decrease, companies have more capability to call into being internal resources (Venturelli and Gualandri, 2009).

For a company’s growth, the increase of the financial requirement will be covered partly by self-financing and current debts, and partly from external sources, consisting of equity and loan capital (Venturelli and Gualandri, 2009).

The theoretical framework of small-medium firms finance sources

Before trying to categorize companies into financing groups, to understand what are the impetuses behind capital (financial) structure decisions are important. There exist many research on capital structures today,the first is from Modigliani and Miller’s (1958) studied the optimal capital structures. The process of their examination supposed in a perfectly competitive market with perfect information availability, no taxes, and no transaction costs. Below these conditions, a company’s capital structure cannot influence the firm’s value; however, it can only distribute a company’s earnings direct to different stakeholders. However, in reality, as the financial markets are not perfectly like researchers assumed, there are many situations within a firm’s financing procedure.

There are some considerable obstacles that enterprisers facing is safeguarding the inevitable resources when they convert a blueprint to business reality. In fact, Scholtens (1999) point out those enterprisers must think about completely the financial implications of company plans as financial resources are necessary for making the blueprint can be a reality in the use of assets and also for raising the business needs continuing capital.

Pecking order theory

Myers and Majluf (1984) propose that companies would string along a pecking order financing sequence for their investment activities’ funding, which for the sake of against contrary to inefficient pricing of information-sensitive financial claims. When a business opened and enterprises being processed, SMEs owners prefer to use internal finances by owners’ savings, borrowing money from family, friends and the company’s retained earnings or other forms of financial slack (Curran, 1986; Jarvis, 2000). If internal financing cannot completely satisfy the company’s working capital, external finance is required (Scholtens, 1999). Besides, the companies will prefer debt to equity, as the equity is more informationally efficient than debt. Accordingly, SMEs may issue riskless debt, risky debt, mezzanine financing, and equity running in this order on the next. Romano, Tanewski, and Smyrnios (2001) describe there is a series of complex factors that influence the owners and managers to use this type of financing system decision.

Gregory, Rutberford, Oswald and Gardiner (2005) find that the pecking order theory is specifically for small and medium enterprises. First of all, New enterprise in the growing process that is difficult to maintain in financial items especially hard in using debt capital of self-finance for innovative companies (Hall, 2002), that is because the high risks in the initial operating phase with the absence of track record, companies do not have an ability to provide guarantees, and the moral hazard is remarkable. Scholtens (1999) researched that companies’ size and age decide their reliable reputation. Therefore, some young SMEs do not have their reputation yet that will be restricted to use signalling devices in the public market, for instance, credit ratings, accountant statements, profitability track records, dividend policy, working and composition of the supervisory board, previous trustworthy behaviour, etc. (Jensen and Meckling, 1976). Because of SMEs experience harder to access suitable external finances (Holmes and Kent, 1991), information on small-medium firms is less valid than it on larger firms so that SMEs rely on the private capital markets which are characterized by complex contracts managed by professional financial intermediaries (Berger and Udell, 1998). Therefore, this pattern restricts the SMEs’ receivable financing types.

Secondly, although the contracts are frequently between SMEs and financial institutions, these financial institutions still charge a higher capital cost for SMEs than the charge for larger firms, since Gregory, Rutherford, Oswald and Gardiner, 2005 said that the shortage of small and medium firms’ effective information could be provided to the professional financial institutions that lead to institutions increase their charge of the cost of capital to protect a high return on their investment. However, from small and medium companies side, Chittenden, Hall and Hutchinson (1996) demonstrate that in order to decrease the higher cost of working capital, business is trying to use more short-term debts which have lower costs while increasing the business’s risk.

The third one, as previously discussed, the problem of information availability weights heavily on the SME (Petty and Bygrave, 1993). SMEs are representative not publicly held and thus not enslaved to the Securities and Exchange Commission’s (SEC) public disclosure regulations. Moreover, small firms often do not have audited financial statements as contrary to the large firms which must expose much quantity information about their financial situation as systematic. Berger and Udll (1998) called this kind of unconformable information provided within small and medium businesses “acutely informationally opaque”. Without available information, investors do not differentiate high-quality and low-quality small firms. Apart from this, as investors require a higher rate of return, but they can hardly obtain proper information from investing firms, this result in the cost of capital funds are increased. Practically, as Weinberg (1994) shows that due to many SMEs cannot pay for the high cost of capital, the phenomenon what discussed above restrains these firms using external finances.

In consequence, these restrictions make SMEs preferential first using internal sources of capital (Holmes and Kent, 1991). And pecking order theory proposes that firms prefer to use internal sources of capital first and will use external sources only if internal sources are inadequate (Myers, 1984). As the financial growth cycle (Berger and Udell, 1998), at the same time, firms use informal sources of capital (such as owners savings or there is equity offered by business angels) for their normal operation. Under this stage, the equity becomes necessary. In the following stages with growing more stable of firms, they would like to diversify their financial sources, in the other side, due to firms mitigate the problem of asymmetric information and the track records to build reputations give them an ability to issue external finance from financial markets (Venturelli and Gualandri, 2009). However, too small and medium enterprises, according to the features of venture capital, which is unsuited to financing the scale of projects are too small or business activities in the seed phase, their company, can only overcome this small ticket problem (Berger and Udell, 1998) by the institutions want to make an investment in smaller amounts projects such as business angels.

Pettit and Singer (1985) collect the data from The State of Small Business (1984) suggest that “smaller firms use more debt financing, particularly current debt, rely more on internal funds and loans from stockholders to finance operations and do not use much external equity relative to larger firms.” Scholtens (1999), Ou and Haynes, (2003) argues that internal financing is the main financial source for SMEs’ net investment. With respect to external finance, there are informal finance, venture capital, market finance, bank finance and government support. Moreover, he found the data displayed of net sources of finance by Corbett and Jenkinson (1994) noted from 1970-1989, which the most significant financing source among external finance sources of all enterprises is bank finance, expect the U.S., where the bank and bond finance in other developing countries like the U.K., Japan and Germany are equally important.

Asymmetric information

As has been discussed above, the problem of information availability weighs heavily on the SME (Petty and Bygrave 1993). Carpenter and Petersen (2002) argue that the problem of information asymmetries in particular for SMEs. Smaller firms are typically not publicly held and therefore not subject to the Securities and Exchange Commission’s (SEC) public disclosure regulations. Additionally, small firms often do not have audited financial statements. Therefore, asymmetric information is an important issue in SMEs financing.

SMEs’ growth is an assumed object with companies’ development through a life cycle. There is a difference with public businesses; unlisted businesses cannot provide private information to creditors, investors and customers (Ang, 1992). SMEs have some limitations to access to external financing due to transparent disclosure’ shortage, SMEs are less able to provide reliable signals to trade creditors, investors, banks or venture capitalists. Therefore, the limitation of access to external funds hinders small and medium enterprises accumulate their retained assets and impede companies’ potential growth.

According to Udell and Berger (1998) demonstrate there exists different optimal capital structure at different points within a financial-growth cycle exemplification of SMEs’ capital structure. Most of SMEs depend on internal finance in the early operating years. With companies’ size and age are growing, SMEs should have better access to external finances. After they experienced a critical start-up stage, companies are inclined to diversify their financial sources. Gregory et al. (2005) state since the fact that bigger and older SMEs have better collateralizable assets and technical sophistication to reduce the situation of asymmetric information and firms have built reputations as well, which let small and medium enterprises are able to operate on the financial markets (Venturelli and Gualandri, 2009). Under this situation, the equity becomes required necessary in companies’ capital structure. However, this situation may upgrade, for venture capital investors it is too small of the SMEs financial requirement, while to business angles, the financial requirement is too large to cover. This is the situation known as the equity gap. This could be seen as a broader concept as a finance gap for private businesses (Storey, 1994; Deakin, 1996; Berger and Udell, 1998).

Asymmetric information is a direct violation of the Modigliani and Miller theory of capital structure. The theory of asymmetric information argues that it is difficult to distinguish good from bad borrowers (Auronen, 2003) which normally results in adverse selection and moral hazards problems. The traditional wisdom states that information is lack of transparency impedes SMEs’ access to external finance (Ang, 1992; Berger and Udell, 1998; Gregory et al., 2005). As Stiglitz and Weiss, 1981; Storey, 1994 ever indicated before because of market failure or credit rationing, which resulting a “finance gap” appeared between SMEs and external funds’ lenders (Ang, 1992; Avery, Bostic, and Samolyk, 1998). In this world, SMEs seems growing as prescriptive prospects. However, as a result of informational asymmetry that leads to finance gap, then small and medium enterprises are incapacity to grow.

The term equity gap, like the broader concept of financing gap, describes a situation in which, due to market failures, deserving companies do not receive the volume of financing to which they would be entitled in an efficient market (European Commission, 2005). It must be made clear that this concept does not merely refer to situations in which the demand and supply of capital fail to come together, as generally understood, without making a distinction between the actual gap and the perceived gap. Basically, the mere fact that some SMEs do not obtain capital does not in itself mean that there is a financial gap: if we assume that the firms concerned are operating on a competitive, efficient market, some firms will, in any case, fail to obtain finance, because their risk profiles exceed those accepted by financial intermediaries for the expected return involved (OECD, 2004, 2006a).

Pettit and Singer (1985) state that both the asymmetric information and flexibility problems can be controlled. Firms can submit to monitoring of their assets and operations by outsiders and can accept explicit contractual restrictions on their activities. For example, customers may demand contract completion bonds, employees may require complete vesting of pensions, and creditors may require increased security, sinking funds, and other safety covenants in the indenture agreement.

Agency theory

Jensen and Meckling’s (1976) agency theory provides further insight into the financial management of capital structures. According to the theory, a firm must manage a series of relationships between different stakeholders, namely the firm’s owners (principals) and the firm’s managers (agents). Further, the agency theory explains that the interest of the lenders and the borrowers diverge because both parties have different utility functions. This situation normally makes the principal and the agent prefer different actions because of the different risk preferences (Eisenhardt, 1989).

The fact that these two parties have different incentives in terms of the firm’s operations imposes agency costs on the firm. The introduction of agency costs creates trade-offs in capital budgeting decisions, as the use of debt contains agency costs associated with the potential conflict of interest between lenders and the firm’s ownership. These agency costs must be weighed against the benefits of financial leverage.

The U.K. Financial sources

Internal finance sources

Internal finance is a very useful long term finance source since it provided by the business’s creating profit. It takes a vast majority of finance sources of firms, especially for SMEs. There are several sources of internal finance. One is from depreciation, the strategy of use depreciation is capital can be kept from the tax liability decreases since assets are depreciated. The second one is retained earnings, also can be called as surplus or undistributed profits (Myers, 2001). The third one is the sale of stock and fixed asset. In the 1990s, Brealey and Meyers (2000, table 14.1) research that internal finance has big proportions almost 90% of total investment which is including network capital investment in U.S. Carpenter and Petersen (2002) hypothesize that they extracted more than 1,600 small manufacturing firms and found that firms use all of retaining income but little external finance. Fraser (2004) report figures of 1% for the percentage of companies, who with no formal external finance, the finance sources they could instead of from friends and family. Apart from this little part and in the same situation, with no formal external finance, 99% of firms use other sources of finance but not family and friends. He estimates that the amount of SMEs depends solely on internal sources of finance take about 20% percentage.

According to Scholtens (1998) provide some figures from Corbett and Jenkinson (1994) about net sources of finance between four developed countries, 1970-1989, which show that among small and medium enterprise, the U.K. has the highest percentage about 97.3% internal finance of all net sources of finance. Scholtens (1998) also claims in the early stages of SMEs, seem like seed or start-up companies, as businesses are not stable in this stage yet, so their investment must be financed from internal resources firstly. Also, according to Myers (1984) indicate hierarchy theory of company finance, and proposed that retained earnings are the most preferred source. There is a study that reports that the number of SMEs did not need external finance sources takes 85% of which companies did not seek new finance (Cosh and Hughes, 2003). Companies use internal money as preferred source as transaction costs can be saved, and the tax on dividend also can be decreased. However, there produce a financing problem, which is as internal finances are mostly from existing capital like retained earnings and reserves, but earnings or reserves very small in the seed or start stage of the business. Therefore, when the firms’ principals have sufficient capital can be used at companies’ investments, this method of SMEs’ financing is allowed (Gartenstein, 1999).

External finance

Debt (Bank finance)

Fraser provides evidence that 80% for the percentage of SMEs have one or more external financial sources in the last three years before 2004. Also from Fraser’s study that they report several amounts of external products in past three years before 2004, that are, “overdrafts, term loans (including mortgages), asset finance (leasing or hire-purchase), asset-based finance (factoring, invoice discounting or stock finance), credit cards, grants, or equity finance.”

Cressy and Olofsson (1996) argue as to Hughes’ analysis about small and medium-size enterprise accounts in the U.K. Within pecking order theory they find that smaller business achieved much external finance sources from banks after internal finance sources utilized first. And the four mainly clearing groups are Barclays, Lloyds TSB, Royal Bank of Scotland Group and HSBC (Competition Commission, 2002).

Moreover, there is evidence that SMEs whose growth ambitions are above average have better access to external finance (Storey, 1994). For those getting loans, Mester (1997) says banks discovered that business owner characteristics rather than business characteristics are better predictors of commercial business loan performance. We also find owner’s characteristics to be determinates of financing activity. Fraser (2004) quoted in Obamuyi (2007) as well as Beck, et al., (2006), among other things, observed that size and age influence financing relationship of lenders to borrowers. Among companies aged less than two years, most of them choose personal savings as capital to operate the business, besides this internal finance, for external finance about 1 in 10 of businesses depended on the bank loan and just less than 1 in 20 of companies owners will choose equity issued from their home.

There are several banking institutions within the U.K. that do in fact provide small business loans to SMEs such as Lloyd’s bank, Standard and Poor, HSBC etc. It must be noted though that due to the high degree of loan default experienced by these banks from 2001 to 2009 the loan process often involves considerable amounts of paperwork and at times recommendations from well-established business people in order to gain approval for particular loans (Moore, Slack & Gibbon 2009, pp. 173-188). This in effect shuts out various entrepreneurs and business people who do not have the same amount of clout or the connections necessary in order to show that they can be trusted in being able to pay back a loan they made (Moore, Slack & Gibbon 2009, pp. 173-188). In this particular case it is often necessary for entrepreneurs to go through the hurdle of government sponsored programs which act as intermediaries between the bank and the entrepreneur and acts as a safety net should a loan default occur.

While this section has shown that there exists quite literally a plethora of funding and training opportunities for local SMEs to start their own business ventures, what it does not show is that most of the funding and training opportunities are oriented towards the development of localized business opportunities and neglect to encompass a wider range of potential ventures through international markets. The study of Nandy (2010, pp. 577-603) which examined the funding and training opportunities that are currently in practice within the U.K. reveals that most of the revenue derived from entrepreneurial activity within the country is primarily the result of derived income from local markets (Nandy 2010, pp. 577-603).

There are relatively few cases of entrepreneurs which focus on international trade with one of the reasons being that despite the presence of funding programs with associated training schemes, these programs actually encourage and focus on developing entrepreneurs to focus on developing local businesses (Kheni, Gibb, & Dainty 2010, pp. 1104-1115). They present the idea that international business ventures are somewhat risky resulting in the creation of a business culture that is more internally focused rather than externally adaptive (Kheni, Gibb, & Dainty 2010, pp. 1104-1115). In cases where an SME is actively seeking funds in order to expand their business venture in order to encapsulate a greater degree of international trade, their loan requests are often turned down. Banks in this particular situation tend to agree to loans of this nature when requested by large firms or conglomerations. This, in effect, shuts out small entrepreneurs from international trade which is an important aspect of developing a local business.

Venture capital

Another of the problems faced by entrepreneurs and business owners within the U.K. is the distinct lack of venture capitalists within the SME sector. An examination of data obtained from 2010 reveals that the U.K. has one of the lowest rankings of any G7 country in terms of venture capital funding with less than $25 million being invested by venture capitalists in small/ medium scale businesses at the time (Nias 2010, pp. 19-83). Studies such as those by Nias (2010, pp. 19-83) reveal that venture capital funding is an important facilitator of entrepreneurial and business activity since it acts as a method of funding “outside” of the regular methods facilitated through bank loans (Nias 2010, pp. 19-83). With entrepreneurs and the venture capitalists sharing the risks that come with developing a particular business venture this actually results in the sharing of ideas, better internal management of operations and funds and the creation of new lines of business which helps to considerably expand the venture beyond what the entrepreneur would have been capable of doing alone (OneSource Expands Coverage of U.K. Small, Mid-Sized Businesses 2006, pp. 3-6).

As seen in the case of the U.S. venture capital investments have helped to create a solid foundation for the development of numerous businesses which has actually encouraged entrepreneurial activity due to the potential that venture capitalists may choose to invest with a particular venture thus enabling it to expand based on the plans of the entrepreneur. The lack of venture capital funding in the case of the U.K. helps to explain the relatively anaemic growth seen in the development of new entrepreneurial ventures since an external source of capital without the accompanying financial indebtedness associated with bank loans would have definitely encouraged the development of a sufficiently strong entrepreneurial sector within the country. One way of explaining the lack of venture capital funding can be seen in the study of Spence, Schmidpeter & Habisch (2003, pp. 17-29) which explored various aspects of financing within the U.K. Schmidpeter & Habisch (2003, pp. 17-29) explains that the concept of venture capital funding is relatively new within the U.K. since it is a development that has only occurred within the past few decades within various other countries (Spence, Schmidpeter & Habisch 2003, pp. 17-29).

Since the U.K. has developed in an entirely different way as compared to other countries such as the U.S. its banking and finance sector, this would, of course, result in the creation of distinctly different financial instruments for funding business ventures within the country. This is especially true when taking into consideration the fact that “family funds” are still one of the most used methods of funding a business within the country and external methods of funding not associated with either the state or a bank are still viewed with a certain degree of distrust by the local business culture. Aside from that, most entrepreneurs within the U.K. have no idea what a venture capital fund is or how it even operates. Thus, its level of acceptability and implementation within the context of the local economy is also rather low. Furthermore, since the venture capital sector of the U.K. economy is still within its relative infancy, this means that the roadshows, presentations, exhibits and forums normally associated with venture capital firms as seen in the context of the U.S. are relatively absent. This means that venture capitalists can neither show what methods of financing they can offer to entrepreneurs, and neither can prospective entrepreneurs show their business ventures to venture capitalists. In the end, this creates a situation that is not at all conducive towards the development of any form of venture capital financing operation within the U.K. and explains why the amount of venture capital funding is so low within the country despite the size of its economy.

Government support

Some good businesses may discover they did not have sufficient funds as they without a track record or with off-gauge features. In this situation, SMEs need to provide a mortgage to achieve funds from larger loans. Moreover, the U.K. government play a vital role through the SFLG (Graham, 2004) to support SMEs lending, especially for start-up companies and high-growing companies.

The sufficient capital available for start up companies and firms’ growth is essential for businesses to step to the glory (HMT/SBS, 2002). Whereas, because of the capital markets are not perfect, in order to fulfil smaller companies’ development needs, firms raising funds from external finance and there are some consistent concerns about the SMEs’ ability (Bolton, 1971; Wilson, 1979; Graham, 2004). Moreover, the central government began to interpose some raising methods from these persistent concerns, in both debt and equity markets, such as the Small Firms Loan Guarantee Scheme (SFLG) and the Regional Venture Capital Funds (RVCF).

Over the past several years, to provide services for SMEs, there has an obvious lack of competition in the banking market (Cruickshank, 2000; Competition Commission 2002). Thus, public concern has changed. Concerning this issue, there are some measures suggested from the Competition Commission to solve this lack of competitiveness. The first one is making a price comparative of banking services. The second one is buying services from various banks. The last one is if companies do not satisfy the bank’s price or service, smaller companies can moderating this issue through switching banks. Beck (2007) argue more than 70 developing countries and concluded that governments have roles of building appropriate institutions, providing the regulatory framework and undertake market-friendly activist policies in order to reduce financing obstacles for SME.

Insufficient Penetration within the local Stock Market

Aside from venture capital investments, another alternative to financing the expansion of a business venture has been through the use of the stock market. In regions such as the U.S. and several parts of Asia (Hong Kong, Japan, Singapore etc.), posting their company on the local stock market has been an effective method by which entrepreneurs of mid-sized corporations have been able to garner sufficient funds in a rather efficient manner. Unfortunately, in the case of the U.K., it has been noted that despite the fact that the local stock market has actually improved by 50% as a source of funding for businesses, most of this has been primarily isolated to large scale enterprises and has barely penetrated into the SME sector. One of the reasons behind this is the apparent lack of a specific SME market which as a result prevents various U.K.-based entrepreneurs from accessing their needed funds for expansion as compared to their counterparts within the G7 countries.

From a certain perspective, it can be assumed that due to the current predilection of U.K. entrepreneurs to view the stock market as a novelty exclusively for the rich rather than alternative method of funding, this, as a result, constrains their ability to utilize the local stock market to its fullest potential. Studies such as those by Vasek (2011, pp. 115-120) have indicated that despite the 90% rise in the usage of the U.K. stock market by investors and ordinary citizens alike, SMEs continue to have a relatively low profile in it due to an insufficient amount of information regarding the process of registration, compliance and how the stock market works in general (Vasek 2011, pp. 115-120). It is based on this that Vasek (2011, pp. 115-120) recommends a greater degree of government assistance in the form of information campaigns so as to educate local entrepreneurs regarding the various advantages of posting their company on the stock market.

Lack of Sufficient Foreign Direct Investments/ Foreign Based Businesses

Another of the funding problems experienced by SMEs within the U.K. is a distinct lack of foreign direct investments or even the establishment for foreign-based businesses from which local entrepreneurs could derive a variety of manufacturing contracts. What must be understood is that foreign direct investments, as well as the establishment of foreign-based businesses within a country, are necessary factors towards the continued growth and stability of any globalized economy. The more international investors and foreign business contracts a country has the better its economic position especially when it comes to the creation of various business opportunities for local entrepreneurs (Schlegelmilch, Boyle & Therivel 1986, pp. 177-182).

Alternative Funding Source for SME’s within the U.K.

One of the oddest discrepancies that have come up during the research for this study is that despite the fact that the U.K. is widely recognized as a leader in promoting and supporting entrepreneurial activities, it actually has a financial sector at the present that is not as conducive towards small to medium business loans as one might expect. It is usually the case that if a country is known for supporting an entrepreneurial activity, this would, in turn, result in a commensurate effect on its local banking sector wherein loans for small to medium scale enterprises and ventures would be more readily given but this is not the case, and in fact, it is actually more difficult to obtain these types of loans within the U.K. as compared to other countries within the same region (i.e. France, Germany etc.,) as well as in countries such as China, and the U.S.

An examination of the U.K. business market reveals that as a direct outcome of the 2008 financial crisis, the reduction in consumer demand from the U.S. and the current debt crisis within Europe banks within the U.K. financial sector have actually drastically reduced their loan activities which has made it that much harder for entrepreneurs and various businessmen/ businesswomen to finance their ventures or already established businesses. In order to address this rather odd disparity, an examination was conducted as to how small to medium scale enterprises were normally funded and how did this type of funding differ from what can be seen in other countries. It was seen that in the case of the U.K., family played a crucial role in the funding and development of small to medium scale business ventures in times of economic scarcity (i.e., at present) wherein more than 75% of local businesses started by entrepreneurs were a result of family members contributing towards the initial starting capital of the entrepreneur and actively gave advice regarding the proper management of the business.

In fact, it was noted by researchers such as Alonso-Mendo, Fitzgerald, & Frias-Martinez (2009, pp. 264-279) that it is the strong interfamily ties within the country’s culture at present due to limited access to finances as well as a general degree of “fear” within economic markets that limits the export market of the U.K. due to the development of a new type of business culture wherein it has become preferable to deal with family members or friends of the family when it comes to joint business ventures and business opportunities which in effect severely curtails the ability of a business to expand beyond its current market due to the inherent hesitance in dealing with the “red tape” so to speak of a financial market that is currently reeling from an overall lack of sufficient market activity (Alonso-Mendo, Fitzgerald, & Frias-Martinez 2009, pp. 264-279). Going back to the issue of family and its connection to the financing of small to medium scale enterprises, what must be understood is that due to the proliferation of family as one of the alternative methods of financing entrepreneurial business ventures during times of economic scarcity (though there is also a certain degree of such actions during times of economic prosperity as well albeit in a far smaller degree as compared to the present) this has actually resulted in the local banking sector within the past few years developing in such a way that they have been catering more towards large scale enterprises or higher tier medium scale businesses as compared to small or lower-tier medium scale companies.

This, in effect, isolates a large percentage of the local population who do not have access to considerable family funds to start their business. Such a situation is in stark contrast to the way in which the banking sector in other countries such as China, the U.S and even in certain sectors in the Middle East work since it is often seen that investing in entrepreneurs creates numerous beneficial actions (i.e. better local economy, the greater amount of deposits, helping out what could potentially develop into a larger enterprise etc.) which banks generally think of as “safe bets” when it comes to loans especially when it comes to the attitude of entrepreneurs to pay back what they owe on even if a particular business did not turn out as successful as expected (Gurău & Merdji 2008, pp. 55-81). It is often the case that such individuals within the U.K. have to rely on their own personal savings as their primary method of creating start-up capital which is an incredibly laborious and time-consuming process which would, of course, slow down the process of entrepreneurial activity within any country that utilizes such a system. Evidence of this can be seen in the U.K. 3.3 to 3.5 per cent anaemic entrepreneurial growth at present, which shows the negative impact that the current loan system has on creating better entrepreneurial activities within the country.

The inherent weakness of the “family fund system” currently utilized by a large percentage of entrepreneurs and various business owners is that when it comes to expanding the business beyond its current form and structure, this is when family members at times baulk and refuse to or are unable to provide the necessary funds for the development of the business beyond its current form (Chaston, Badger & Sadler-Smith 2001, pp. 139-151). The reason behind this constitutes a plethora of reasons ranging from the belief that after a business has been established an individual should be responsible for its own expansion or that expansion itself is potentially risky without sufficient added benefits (Katsikea, Theodosiou, Morgan & Papavassiliou, N 2005, pp. 57-92). As a result, this curtails the potential for various entrepreneurial ventures to expand to foreign locations and is evidenced by the fact that more than 50% of all local entrepreneurial revenue is derived from within the U.K. economy alone instead of through outside ventures (Aslan & Kumar, P 2011, pp. 489-526). It must also be noted that another problem with the “family-based” method of funding is that it actively promotes insufficient market examinations and a more lax behaviour when it comes to developing processes that are more efficient and less costly.

Based on the study of Blackburn & Smallbone (2008, pp. 267-288) it was noted that family-based methods of funding were considered a relatively “safe” and “easy” method of funding for a business which did not have the same stringent procedures and viability checks that are necessary when it comes to a bank loan (Blackburn & Smallbone 2008, pp. 267-288). As such, entrepreneurs under this particular system are less likely to favour processes that maximized the usage of capital and utilized more efficient methods of operations due to the rather “easy” way in which funds could be obtained to run a business. This, Carter (2011, p. 19) remarks, is one of the main reasons why plenty of businesses fail within the first year of operation in the U.K. since it is usually the stringent process of loan evaluation seen in most banks that encourages entrepreneurs to think outside of the box resulting in financial success and ingenuity.

Though not particularly as relevant, it must be noted that there is also another socially based reason as to why certain entrepreneurs are experiencing a higher degree of difficulty when it comes to finding sufficient capital: declining rates of marriage. With the development of various policies regarding education and workplace equality comes an era where women have started to become more empowered. This is evidenced by the fact that nearly 54% of all university graduates within the U.K. are women and that a growing percentage of them have started to focus on their own careers and the development of the family business rather than enter into a prospective marriage. As a result, with declining marriage rates comes a distinct decline in access to sufficient capital by bachelors since it is the intermarriage between families that oftentimes results in the ability of an entrepreneur to access sufficient capital to establish his own business. This is not to imply women themselves cannot be entrepreneurs within the country. Far from it, women are actually actively encouraged to take part in business, and several have become successful entrepreneurs, however, due to various types of cultural restrictions (supposedly they “do not exist” when in fact they really do) which are part of the social tradition in the U.K., this results in a low rate of entrepreneurship for women with only 15 to 25 per cent of entrepreneurial businesses being started by a woman.

Key Factors in a Successful Business

Focus on Quality

One of the most important factors in creating and maintaining a successful business is a focus on quality and ensuring that any product bought by a customer is not the result of inferior production or craft (Worthington, Ram, & Jones 2006, pp. 201-217). What must be understood is that customers tend to patronize businesses that show that they care about their customer by ensuring that the strictest measures are followed in product quality. In instances where a company has failed to live up to the expectations of consumers regarding the overall quality of a product, it is often seen that such companies tend to lose customers in droves (Worthington, Ram, & Jones 2006, pp. 201-217). This was seen in various technology companies such as Dell that neglected to implement proper quality control measures on its motherboards resulting in several computers being sold whose motherboards leaked chemicals when overheated. Such a fiasco was a nightmare for Dell and ruined its reputation with several of its customers in effect sending them to other companies as a result (Worthington, Ram, & Jones 2006, pp. 201-217). It is based on this that it can be seen that a focus on quality is an important aspect for any company to follow in order to grow and maintain its consumer base.

Adapting to Changes in Business Environments

Another factor that businesses should take into consideration is adapting to changes within local business environments. What must be understood is that businesses do not operate within a vacuum, and as such, it becomes necessary to observe that it occurs within local business environments and responds accordingly. This can come in the form of expanding during times of economic prosperity or cutting back and outsourcing specific aspects of the company’s operations during lean economic times (Crick 1997, p. 135). Not only that, companies should be prepared to respond to changing consumer trends in order to stay relevant lest they fall into obscurity and stagnation. Such a situation occurred in the U.S. between Netflix and Blockbuster, wherein Blockbuster continued to stick to its original business model despite changing consumer habits regarding using the internet. The result was that Blockbuster in effect lost its dominant market position to Netflix and has been plummeting in value ever since. It is based on this and other similar instances that the necessity of observing and responding to change shows its importance for any company that wishes to stay relevant in its chosen market. This is particularly important to consider given the various changes that are currently occurring within the U.K.

Strategies for Stability

Stability within a country often coincides with strong economic and domestic policies that create an ideal environment wherein businesses and various industries can operate without fear of sudden destabilizing economic events (Bhatty 1981, pp. 60-72). As such, in order to attract foreign direct investments, it would be necessary to develop strong fiscal policies that focus on limiting currency fluctuation, ensuring that inflation is kept under control while at the same time focusing on a development strategy that emphasizes on the creation of private-public partnerships for various infrastructure development projects throughout the cities of the country (Bhatty 1981, pp. 60-72).

It is expected that by keeping a tight rein on local banking policies through the central bank, it would be possible to create a banking environment that focuses more on internal lending to various local corporations and entrepreneurs rather than investing into international markets. By doing so, this creates a platform by which local industries may sufficiently develop to the point that they become competitive in the international market through the sale of a variety of goods and services. Not only that, by developing special economic zones within the country that have no government tax rates this should encourage various corporations to outsource aspects of their operations and manufacturing processes to our country in order to take advantage of the encouraging business. This, as a result, would create higher local employment rates resulting in increased government tax revenue as well as create a society that has higher levels of localized demand for consumer products. The end result would be a stable local economy with high industrial outputs that would seem ideal for foreign direct investments.

Strategies for Growth Potential

Before proceeding any further, it must be noted that the growth potential of any country is inherently connected to the skill sets possessed by the local population. As evidenced by the case of the Philippines which is known for the quality of its local and overseas workers, having a well educated and skilled population can do wonders for any company that chooses to invest within the country. It is based on this that the development of government-funded technical skill centres will be implemented so as to create a better skilled and more educated workforce that would be able to address a wide variety of potential industries that may establish themselves within the country as a result of foreign direct investments.

Aside from this, in order to assure investors of accurate growth projections of the country’s industrial infrastructure, it will be necessary to implement not only a greater degree of transparency within the government in order to reduce instances of corruption, but it would also be necessary to focus on the development of a strong utility sector that could serve the energy needs of a developing industrial base. What must be understood is that an overly corrupt government casts a considerable degree of doubt on the country’s growth potential due to the creation of a competitive environment that focuses on who can give the bigger bribe rather than who could create the largest amount of benefit for the country

(Tamari 1980, pp. 20-34). By implementing various methods of transparency in government proceedings, this, as a result, would show investors the commitment of the local government towards improving the local business environment in such a way that their investment within the country can be considered relatively safe and would result in considerable gains over the long term.

Methodology

Introduction to Methodology

This section aims to provide information on how the study will be conducted and the rationale behind employing the discussed methodologies and techniques towards augmenting the study’s validity. In addition to describing the research design, the theoretical framework, and the population and sample size that will be used in this study, this section will also elaborate on instrumentation and data collection techniques, validity and reliability, data analysis, and pertinent ethical issues that may emerge in the course of undertaking this study.

Statement of the Problem

To what extent have alternative methods of financing for SMEs been gaining momentum as a direct result of financial scarcity?

The reason behind the creation of this research question revolves around the issue of the increasingly difficult methods by which SMEs within the U.K. are relying on to finance their ventures due to the current financial recession brought about by a variety of factors within the global economy (i.e. low consumer demand from the U.S. and the European debt crisis). With this added, difficult comes the predilection for utilizing.

Hypothesis

The hypothesis of the study is that due to the recent economic problems faced by the U.K. due to the general slowdown in the global economy, SMEs are increasingly turning towards alternative methods of finance as compared to more traditional sources with primarily well established large enterprises taking up the bulk of the loans from the local financing sector which as a result limits the business growth of small to medium enterprises within the U.K.

Model Design and Analysis

- Presentation of research data is an important process that ensures the results obtained are easily understood. Besides, the analysis provides a platform where research findings can be used for the development of an in-depth understanding of the issues being studied. The main purpose of the study was based on the objectives and the relevance of financing for SMEs. This study is qualitative in nature as it sought to infer clear comprehension of the roles played by financial institutions in policy and practice and which determined the ability of an organization to get the current fast growth through enhanced performance. It was due to this effect that all the measures were developed in a format that took into the considerations of the research goals as well as the method to be used in the analysis. It is worth noting that thorough understanding of the different variables that link to the main objectives and manifestations in the running of an organization was very crucial in maintaining the necessary course for answering the main questions of the study.

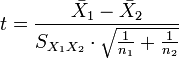

- Taking into consideration that this study assimilated a highly qualitative nature, the acquired data were analyzed using the following equation that compares the outcomes of the different study variables. The equation for T-test tested the correlation of various dependent and independent variables data from the study.

T-test

The researcher also designed the approach in a manner that all the collected data at the time of study maintained the holistic orientation of the research as provided by the objectives to easily establish the viability of the hypothesis. The first formula indicated with the model is to be utilized in order to gauge the responses of various SMEs within the U.K. regarding their predilection towards the use of various methods of funding their business while the second formula is to be utilized in order to gauge the prevalence of usage of alternative methods of finance over the traditional sources based on market data as well as compare economic data from 8 years ago to the present in order to gauge the impact that different levels of access to financial sources has on the rate of entrepreneurial activity/business growth. As such, this study will attempt to confirm its hypothesis by examining both collected market data from SME owners as well as that found in information garnered from financial institutions regarding the rate by which consumers are increasingly turning towards the use of alternative methods of finance.

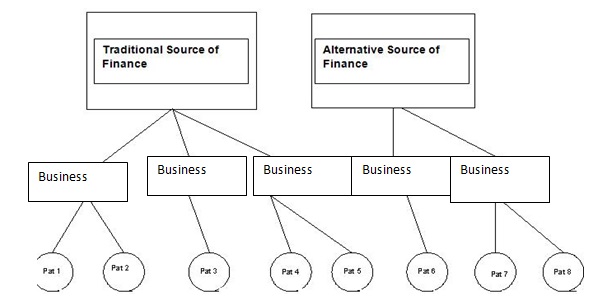

Study Model

The following model shows how the examination will be conducted with two sections examining traditional and alternative methods of finance, the businesses that utilize them and opinions of the owners regarding their usage.

Research Design

The present study will utilize a mixed quantitative/qualitative research design to explore the access to financing sources for small to medium enterprises between the U.K. and its impact on business growth and entrepreneurial activity. This methodological approach will objectively answer the key research questions. Hopkins (2000) noted most quantitative research designs are concerned with determining the relationship between independent variables and dependent variables in a study framework. This study will thus rely on regression analysis in order to measure the relations between such independent variables as the rate of entrepreneurial activity, particularly the number of loans given to small and medium scale enterprises, and dependent variables such as the general opinion of entrepreneurs and employees of financial institutions regarding access to loans. Not only that the econometric data of the last eight years of the U.K. will also be examined in order to create a more in-depth analysis on the economic effects of differences in access to financial loans for small to medium scale enterprises. Furthermore, the researcher will also rely on such qualitative methods as interviews in order to see how access to loans affects the ability of entrepreneurs to either start a business or expand one that is currently in place.

Sekaran (2006) observed most quantitative studies are either descriptive or experimental. The study will utilize a descriptive correlational approach because participants will be measured once. Furthermore, it is imperative to note that the study will employ a survey technique for the purpose of collecting participant data from the aforementioned areas indicated in the previous paragraph. According to Sekaran, a survey technique is used when the researcher is principally interested in descriptive, explanatory or exploratory appraisal, as is the case in this study. The justification for choosing a survey approach for this particular study is grounded on the fact that participants will have the ability to respond to the data collection tool by way of self-report. Thus, this project will utilize a self-administered questionnaire schedule for purposes of data collection. An analysis of related literature will be used to compare the study findings with other research on the comparative analysis of access to financing sources for small to medium enterprises in the U.K. and its impact on business growth and entrepreneurial activity. Such analysis, according to Sekaran (2006), is important in identifying the actual constructs that determine efficient analysis because “it goes beyond a mere description of variables in a situation to an understanding of the relationships among factors of interest” (p. 119).

Data Analysis –SPSS

The data analysis program known as SPSS for Windows will be used for purposes of analyzing the quantitative data. The basic initial steps will include data coding, entry, cleaning, analyses, and interpretation. Univariate analyses aimed at generating frequency distributions and descriptive analyses will be used to compare the growth of local business within the U.K., the rate by which small to medium scale loans are given out as well as increases or decreases in the amount of trade occurring inside the countries being examined. The data resulting from the frequency distributions will be further harnessed and presented using pie-charts, tables, and bar-graphs in order to present the needed data for this study more succinctly. The data from the study will also be analyzed using t-test and MANOVA in order to determine any correlations between entrepreneurial activity and access to methods finances over the past ten years. Hierarchical multiple regression analysis will also be conducted with economic conditions acting as the moderator.

Role of the Researcher

The role of the researcher in this particular study is primarily that of a recruiter and aggregator of data. This takes the form of the researcher being the primary point of contact when it comes to negotiating with the appropriate financial institutions, companies, government agencies etc. in order to obtain the necessary amount of subject data from the various individuals within the areas where recruitment and direct face to face interviews will occur (or in the case of entrepreneurs/ members of various financial institutions email or Skype conversations will be utilized). During each individual interview/ questionnaire distribution, the researcher will communicate with the research subjects in order to give an overview of what is expected of the respondent. Though it can be expected that there will be some problems involving the language barriers and subsequent translation of what the research subject meant when describing particular events and situations, it is expected that through communication and collaboration with the subjects involved that some relevant means of effective data recording can be accomplished.

This, unfortunately, brings up the issue of “interpretation bias” wherein what was stated by the research subject is interpreted in such a way that it conforms to what the researcher is attempting to prove via the study. In order to prevent accusations of unethical manipulation of all data, interpretations will primarily be handled by a third party interpreter (i.e. a colleague of the researcher) with the data only being corrected for grammatical consistency in order to be effectively understood. This ensures that the research data is consistent with proper academic ethics. It must also be noted that prior to the start of the data collection process via interviews the researcher will also need to play the role of a “teacher” so to speak in order to properly coach the research subjects regarding the purpose of the study and the various terminologies that will be utilized. This particular aspect of the data collection process is absolutely necessary due to the potential that the translated data may not properly conform to the appropriate levels expected of an academic thesis. As such, by ensuring that the research subjects are properly informed this reduces the instances where problems may arise related to collected data that has very little relevant information that can be utilized within the study.

Instrumentation

As mentioned earlier, aside from econometric data, this study will utilize a set of questionnaires in order to examine the perspective of entrepreneurs from the U.K. regarding the impact of access to loans towards the development of their businesses and the use of alternative methods of finance. This can consist on how it affects their ability to develop a business in particular locations, how it has enabled the distribution of goods and services, how it has impacted local entrepreneurship as well as other such factors related to the positive/ negative aspects related to the inherent differences in access to monetary resources. It is based on this that the research questionnaire will be geared towards members of urban populations and will focus on issues that primarily impact entrepreneurs who live within the various cities found in the U.K. (i.e. London) that will be examined.

While the researcher acknowledges the fact that rural populations are also similarly impacted by poor access to loans, the fact remains that considering the sheer size of the areas being examined and the inherent difficulty and danger in contacting people found in far-flung locations, it was decided that for the sake of safety and expediency that the researcher should focus primarily on urban population sets. Another factor that should be taken into consideration is the necessity to choose people who are more aware of entrepreneurship and who take a more active part in this process. This can consist of scholars, traders, or those individuals who have businesses of their own or are in the process of creating one. Cluster sampling will be particularly helpful for the purpose of this study. This approach will enable the researcher to find the respondents quickly and above all, safely.

Context

The data gathering procedure for the interview will be held over a three week period spanning various areas from London as well as online interviews of various entrepreneurs and business owners. For each individual location, the researcher will spend approximately 3 to 4 days in order to gather the necessary research data. For the first day, the researcher will orient the necessary research subjects within the locations (i.e. through email) while the next two to three days will be spent arriving at the various organizations that were contacted beforehand in order to begin the data gather process. The process will focus on gaining an economic perspective, referring to how business owners and traders have been affected by access to financial sources.

Research Subjects

The research subjects for this particular study will consist of individuals recruited from various academic institutions, financial business districts, as well as a variety of recruitment companies within the U.K.

The individuals who will be utilized in the study must fulfil the following requirements in order to be considered viable enough to be included:

- Must have a high degree of literacy in order to understand the concepts that the questionnaire and interview entail.

- Must have a general awareness regarding the concept and impact of access to financial sources and its effect on business development.

- Should be an urban resident of the capital city of the U.K.

- Should fulfil either one of the following requirements: an academic, a tradesman, an entrepreneur or an individual that travels in the U.K.

- The research subjects should also fall under the age demographic of 23 to 55 years of age in order to ensure that they have developed sufficient awareness and experience regarding the impact of access to financial sources on their daily business activities.

- Lastly, the research subjects that are included in this examination should not be migrant workers. This ensures that all responses are based entirely off of local residents which ensures that the responses given are only applicable to the locations that are being examined.

While it may be true that the level of research subject discrimination implemented by the researcher is indicative of a certain degree of undue manipulation of the study results, what must be understood is that since it is the intention of the researcher to analyze the access to financing sources for small to medium enterprises in the U.K. and its impact on business growth and entrepreneurial activity, it would, of course, be necessary for the research subjects involved to actually have a certain degree of knowledge regarding this so as to produce a relevant contribution to the research material. Thus, the level of research subject discrimination is justified in this particular case.

Population

The sample to be interviewed will consist of entrepreneurs of 30 local SMEs and ten well established “large” enterprises within the U.K. This study intends to find out from these participants their means of acquiring capital, their relationship with the success or failure of their ventures and their views regarding the state of financing within the U.K.

Aside from these considerations, there will be a methodical criterion for selecting the participants in order to ensure that the desired individuals participate. There will be an evaluation of individual profiles from the business records presented by the participants. The evaluation will involve an examination of the level of individual participation in business-related activities with respect to the new venture/ established company. This is to determine whether the participants correspond to the needs of the project. Finally, the participants will be asked to present their credentials/ business license in order to ensure that each participant is or was the real owner of a business venture.

Justification for Utilizing Questionnaires

It was determined by the researcher that utilizing a combination of questionnaires and interviews was the most appropriate method to obtain firsthand accounts of the impact of access to financial sources, at present, and should prove to be invaluable since the data collected is from the direct perspective of entrepreneurs, academics and employees of the various sectors from the U.K. and would complement the data already presented within the literature review section.

Study Concerns

This methodology exposes the participants to an assortment of risks that need to be taken into consideration during the research process. The main risk the participants will encounter is if any of their answers that criticize or indicate dissatisfaction with access to methods of financing leaks. This may have consequences on the attitude and opinion of government institutions and officials towards them and can result in victimization. To eliminate this risk, the responses will be kept in an anonymous location. This way, the only way to access the information will be through a procedure that involves the researcher. The project thus observes research ethics in sampling as well as during the data collection process.

By conducting the interviews in person or via video teleconference should the need arise, the researcher can observe the reactions of the individual to the questions, conduct the interview process, and verbally record the responses. Transcription of the recorded interviews by an independent person will provide objectivity to what was said by the interviewee. A combined data review that includes the researcher and other professionals will show that the data were reviewed in an unbiased manner. The researcher has a responsibility to present the data in such a way that the reader can make an informed judgment about the issue (Schram, 2006). Patton (2002) describes the concept of extrapolation in which the researcher speculates on how likely the findings would occur under other similar conditions. As such, the researcher will emphasize how the results presented can be easily obtained by other researchers who utilize the same process as the one described within this paper.

Deciding on the Questions to be used in the Interviews

The questions for the interviews were based on an evaluation of the research questions and the data and arguments presented in the literature review section. The aim of the researcher was to develop the questions in such a way that they build upon the material utilized in the literature review. Thus, the questions place a heavy emphasis on confirming the data in the literature review, reveal the current state of the SME sector from the perspective of entrepreneurs and members of the local financial sector and determining what factors influence the financing of business start-ups.

Interview Questions

As explained earlier, the methodology that will be utilized within this particular study will be comprised of an evaluation of questionnaire results given to a variety of entrepreneurs, local merchants, job seekers, police officials etc. within the U.K. in order to determine the various nuances they experience on a daily basis when it comes to access to methods of financing.

The following questions were created based on an assessment of the research question, the data that the researcher would need and how pertinent they would be in terms of the participants actually being able to answer them. Also, the research questions will be divided into different sets based on the type of respondent that the researcher was able to get in contact with. This results in the creation of a questionnaire for entrepreneurs and business people while the other set of questionnaires will encompass questions for people who work within the financial institutions themselves.

Note*

The questionnaire shown below may differ from the one utilized during the research process due to the necessity of having an interpreter translate the questionnaire in such a way that it can be understood by the local populace. The subject and context of the research questions utilized will remain the same with a few alterations based on the discretion of the translator.

The first set of questions that will be sent to entrepreneurs will be comprised of the following:

- How were you able to initially fund your business? Was it through family funds? Bank loans or through government-sponsored programs?

- Aside from the method of funding that you utilized for the initial financing of your business, what method of funding would you want to utilize for any future expansion? Are you going to utilize the same initial source of funding, or are you going to go for alternatives?

- Would you say that financing a business is relatively easy or simple within the U.K.?

- Have you ever utilized a bank loan as a means of financing some method of your business operation? If so, what were the complications that you experienced if any?

- What are some of the complications you had experienced as an entrepreneur in the U.K.? Please elaborate on some of your experiences when it came to finding funds for your business.

- Would you say that local government programs have been an effective resource for local funding?

- In terms of developing an entrepreneur, would you say that the local government programs aimed at educating young entrepreneurs have been effective?

- Various types of research have shown that despite the programs promoting entrepreneurship established by the government, entrepreneurial growth within the country has remained anaemic at 3.3 to 3.5 per cent, what is your perspective as to why this is occurring?

- When it comes to the sale and development of your current product line/service, are you looking towards expanding only within local markets or do you have any plans in expanding internationally, please explain your reasons for doing so on whatever choice suits you the most?

- Do you know of any entrepreneurs that have been successful in developing their business to encompass foreign markets? If so, what was the source of their finances?

- As an entrepreneur within the U.K., please elaborate on the current status of entrepreneurial funding within the country and how this has affected the success/ failure rates of entrepreneurs.

- With all the recent programs aimed at creating better conditions for entrepreneurs, would you say that such programs have been effective or have things remained the same despite their implementation?

- Do you know what a venture capital fund is?

- Do you know what foreign direct investments are?

- Have you ever used a government information system? For what purpose? How effective was it?

- What is the most popular type of funding for entrepreneurial activities?

- Have you ever considered exporting your products/ service to locations outside of the U.K.? If so, what were the various obstacles you experienced when it came to finding sufficient funding?

- Have you ever taken part in a government entrepreneurship program? If so, how effective was it?

- What are the marketing strategies you usually implement when it comes to your business?

- From your own personal perspective, what methods of entrepreneurial funding would you like to see implemented so as to create a better business environment that is more conducive towards an entrepreneurial activity.

Data Collection Process

Anderson (2004) notes that research that is performed in a rigorous manner can lead to more effective practices than decisions based mainly on intuition, personal preferences, or common sense. It is based on this that the researcher will utilize the views garnered through the interviews that will be conducted along with econometric data in order to develop a sufficient platform from which effective and above all accurate conclusions can be developed. The data collection process will actually be quite straightforward; several weeks prior to leaving for various locations within London the researcher will utilize the internet in order to find businesses, government institutions and a variety of other appropriate establishments that appear to be effective locations where the appropriate type of data can be located.

Enlisting the services of a language school (or Google Translate if a language school does not have the appropriate type of services) the researcher will compose an introduction letter in both English in order to inform the organization of the intent of the researcher and whether it would be possible to conduct a series of interviews based on the attached questionnaire in order to examine the access to financing sources for small to medium enterprises in the U.K. and its impact on business growth and entrepreneurial activity. By asking permission prior to the data collection procedure, this ensures that the researcher will not waste time in having to contact the necessary organizations upon arriving and can immediately proceed in collecting the needed data.

The interviews will be conducted individually to ensure their alignment with the aforementioned anonymity of the study results. It will also be necessary to assure the participants of the safe storage of information before the interview begins to encourage them to give genuine answers. It was determined by the researcher that responses will be more favourable if the interview is conducted privately. This approach will mitigate accommodation costs, thus making the project more cost-effective. After collecting and analyzing data, the final report, together with recommendations will be presented to the study participants via email in order to show the impact of their opinions and ensure that responses were utilized in such a way that it complies with views that the participants intended to give out and are completely anonymous thus preventing any possible victimization from occurring.

Evaluating the Questionnaire Responses

Two methods may be used to score the test, raw score and relative. Both will be used for comparison in the study. The raw score method is a simple sum of the responses within each scale. This involves merely examining which responses seem similar to each other or which are widely divergent. The relative scoring method compares scales for relative contribution to the overall score (the formula presented early on will be utilized in this case). The relative proportion for each scale is found by dividing the individual mean score for the scale by the combined means for all scales. What must be understood is that unlike other types of questionnaires administered through similar studies, this questionnaire does not utilize a score or point system wherein responses are limited to a set amount (i.e. picking from a set of 4,5,6 etc.). The reason behind this is quite simple; the researcher is attempting to gauge the individual accounts of the research subjects in the form of data which involves their own personal accounts and experiences regarding access to methods of financing.

For example:

“Have there been any significant improvements that you have observed which have resulted in better business conditions for you.”

This particular question is an example of an important examination of business conditions within the U.K. as a direct result of access to methods of financing. As such, the resulting answer cannot be quantified in the same way as other forms of information. Do note though that the researcher did take into consideration the use of a generalized research questionnaire form, however, based on the necessity of personal responses it was deemed a method that would divulge the type of data needed given the necessity of examining individual experiences at the local level.