Abstract

An attempt has been made in this paper to comprehend the budgeting process of the organization named Wolfenden Concrete Ltd. in relation to make link between interactive and diagnostic aspect of the budgeting control process. The role of budgeting control process has been discussed with a view to generalise the planning, control and responsibility accounting. The effectiveness of budgeting of the Organization has been elucidated linking with the role of budget. The recommendations have been drawn bearing in mind that of modern accounting system.

Introduction

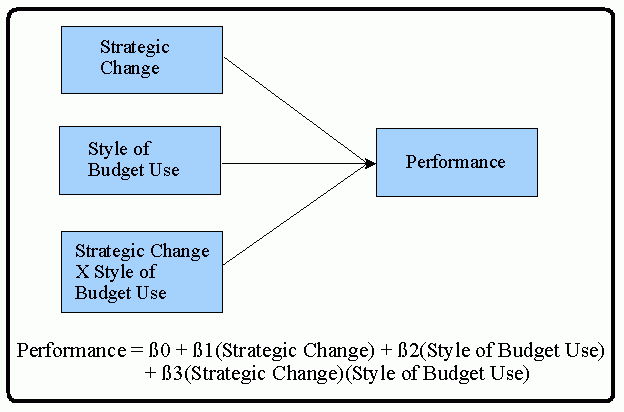

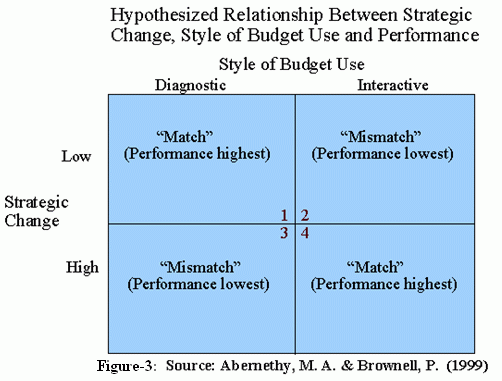

Burchell et al, (1980) has pointed out the multiple roles Budgets and argued that budgets can play an interactive role where they are treated for learning as an exchange of ideas and idea creation machine. Budgets also have a diagnostic role, which refers to the conventional purposes of responsibility accounting and performance management. They also added” The relation between strategic change and performance will be moderated by the extent to which budgets are used interactively”

Being business world sophisticated and intricate, the budget one of the pivotal accounting tools, helps control over company’s future activities and obstructs any unfavorable incident in the market caused by any uncertainty. In that case the companies use budgetary control system to forecast their future activities. A budget is a financial or quantitative statement, prepared prior to a specified accounting period, containing the plans and policies to be pursued during that period. It is used as the basis for budgetary control. It is used for both planning and control.

Overview of the company: Wolfenden Concrete Ltd

The business concern Wolfenden Concrete Ltd is a UK based Company mostly engaged in producing prime quality concrete goods for the agricultural and building trade all over the United Kingdom. Mr. Michael was founder of the company and run it as a family owned business. Wolfenden has started operation since 1977. The company produces very high quality products and the company carefully maintains highly economical pricing. The designs of their concrete products are ensure all British Standards (BS). For this reason the products that they manufacture are perfect for agricultural and construction purpose use. The company also ensures easy transportation for their products to the customer’s site at a very competitive price.

At the commencement of the company it fashioned pre-cast products exclusively for the agricultural market. But at present time the company manufactures: piling systems, retaining walls, slurry channels, cattle cubicles, cattle slats, feeding troughs, slurry panels, storage tanks. It also gained a market share for bespoke concrete castings and concrete ready mixes such as channels in building sectors for factory construction, hospitals, water treatment works, schools and housing and agricultural sectors.

Budgeting System of Wolfenden Concrete Ltd

The company has a master budget for planning the budgeting process. The master budget includes following list of documents that would be a part of master budget:

- Sales budget; including a schedule of expected cash collections

- A production budget

- A direct material budget

- A direct labor budget

- A manufacturing overhead budget

- An ending finished goods inventory budget

- A selling and administrative budget

- Cash budget

- Budgeted income statement and

- Budgeted balance sheet.

Wolfenden Concrete Ltd. prepares the above budgeted statements in the following way:

Sales budget

McLaney, E. & Atrill, P. (2005) sated that the sales budget is the starting point in preparing the master budget. The sales budget is constructed by multiplying the budgeted sales in units by the selling price. The preparation of this budget is generally the starting point in the operations of budgetary control because sales become more often then not the principal budget factor.

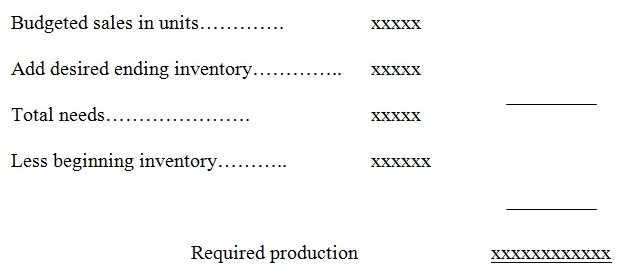

The production Budget

Dyson, J. R., (2004) mentioned that the production budget is prepared after the sales budget. The production budget lists the number of units that must be produced during each budget period to meet sales needs and to provide desired ending inventory. Production needs can be determined as follows:

At Wolfenden Concrete Ltd Management believes that an ending inventory equal to 20% of the next quarter’s sales strike the appropriate balance. (In table 2).

A direct materials budget

Returning to Wolfenden Concrete Ltd after the production requirements have been computed, a direct material budget can be prepared. Dyson, J. R., (2004) added that the direct materials budget details the raw materials that must be purchased to fulfill the production budget and to provide for adequate inventories.

A direct labor budget

Atkinson, A. A., and Banker, R. D., (2001) mentioned that the labor budget is developed from the production budget. Direct labor requirements must be so that the company will know whether the sufficient labor time is available to meet production needs.

The manufacturing overhead budget

The manufacturing overhead budget provides a schedule of all costs of production other than direct materials. At Wolfenden Concrete Ltd the manufacturing overhead is prepared into variable and fixed components.

An ending finished goods inventory budget

The Wolfenden Concrete Ltd. computes the unit production cost after preparing above all budgeted statements. The main reason behind preparing the statement is the computation of the carrying cost of unsold units.

The selling and administrative expense budget

The selling and administrative budget lists the budgeted expenses for areas other than manufacturing. The selling and administrative budget is divided into variable and fixed cost components. In the case of Wolfenden Concrete Ltd the variable selling and administrative expense is very low near to 2 pound per case.

Cash budget

The cash budget is composed of four major sections:

- the receipts section

- the disbursements section

- the cash excess of deficiency section

- the financing section

The receipts section consists of listing of all of the cash inflows, except for financing, expected for during the budget period. Generally the major source of receipts will be from sales. The disbursements section consists of all cash payments that are planned for the budget period. These payments include raw material purchases, direct labor payments, manufacturing overhead costs.

If there is deficiency during any budget period, the company will need to borrow funds. If there is cash excess during any budget period, funds borrowed in previous period can be repaid or the excess funds can be invested. The financing section details the borrowings and repayments projected to take place during the budget period. It also includes interest payments that will be due on money borrowed.

The budgeted income statement

It shows the company’s planned profit for the upcoming budget period, and it stands as a benchmark against which subsequent company performance can be measured.

The budgeted balance sheet

The Wolfenden Concrete Ltd prepares the budgeted balance sheet by beginning with the current balance sheet and adjusting it for the data contained in the other budget.

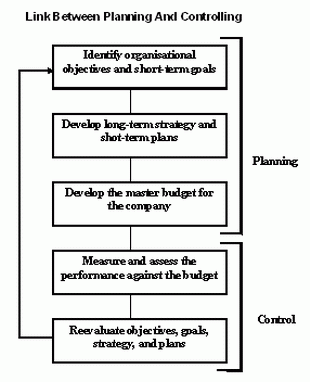

The role of budget

Burchell et al, (1980) has pointed out the multiple roles Budgets and argued that budgets can play an interactive role where they are treated for learning as an exchange of ideas and idea creation machine. Budgets also have a diagnostic role, which refers to the conventional purposes of responsibility accounting and performance management. Most members of households of households have at some time developed a financial plan to guide in allocating their resources over a specific period. Usually the plan reflects the spending priorities and demands, including specific categories on which money will be spent such as the mortgage, utilities, property taxes, and essential item such as food and clothing.

Horngren, C. T, Foster, G. and Datar, S. M., (2005) argued that as in a household, budgets in Organizations reflect in quantitative terms how to allocate financial resources to each Organizational sub unit, based on its planned activities and short run objectives. The budget plays the interactive role to create a link between the planning and controlling the Organizational goal both short-term and long-term.

Well-managed company such as Wolfenden Concrete Ltd. usually cycles through the following budgeting steps during the course of the fiscal year:

- Working together, managers and management accountant plan the performance of the company as a whole and performance of its subunits (such as departments and division). Taking into account past performance and anticipated changes in the future, managers at all levels agree on what is expected.

- Senior managers give subordinate managers a frame of reference, a set of specific financial and non-financial expectations against which actual result will be compared.

- Management accountants help managers investigate variations from plans, such as an unexpected decline in sales. If necessary, corrective action follows, such as a reduction in price to boost sales or cutting of costs to maintain profitability.

- Managers and management accountant take into account market feedback, changed conditions, and their own experiences as they begin to make plans for the next period. For example, a decline in sales may cause managers to think about introducing new flavor of product next period.

Drury, C. (2001) agued that the master budget expresses managements operating and financial plans for a specified period (usually a fiscal year) and it includes a budgeted financial statements. The master budget is the initial plan of what he company intends to accomplish in the budget period. The master budget evolves from the both operating and financing decisions made by managers.

- Operating budget forecasts revenues and expenses during the next operating period including monthly forecasts of sales production and operating expenses.

- Financial budget identify the expected financial consequences of the activities summarized in the operating budget.

Garrison, R. A, and Noreen, E. W, (2007) pointed out another role that the budget could play is the responsibility to the Organization. The basic idea behind the responsibility is that a manager should held for responsible for those item –and only for those item that the manager can actually control to a significant extent. Each line item including revenue and cost in the budget is made the responsibility of a manager and that manager is held responsible for subsequent deviations budgeted goals and actual result. In effect responsibility accounting personalizes accounting information by looking at cost from a personal control; stand point. This concept is central to any effective profit planning and control system. Some must be responsible for each cost or else no one will be responsible and the cost will inevitably grow out of control.

Horngren, C. T., and Sundem, G. L., (2004) stated, being held responsible for cost does not mean that the manager is penalized if the actual result does not measure up to the budgeted goals. However the manager should take the initiative to correct any unfavorable discrepancies should understand the source of significant favorable and unfavorable discrepancies and should be prepared to explain reasons for discrepancies to higher management. The point of an effective responsibility system is to make sure that nothing “falls through the cracks” that the Organizations react quickly and appropriately to deviations from its plans and that the Organization learns to penalize individuals for missing targets.

The effectiveness of budgeting process

The effectiveness of budgeting process in Wolfenden Concrete Ltd has a great impact on its performance. The company realizes many benefits from a budgeting program. Among these benefits are the following:

- Budget provides a means of communicating management’s plan throughout the Organization.

- Budgets force managers to think about and plan for the future. In the absence of the necessity to prepare a budget, manager would spend all of their time dealing with daily emergencies.

- The budgeting process provides a means of allocating resources to those parts of the Organization where they can be used more effectively4.

- The budgeting process can uncover potential bottlenecks before they occur.

- Budgets coordinate the activities of the entire Organization by integrating the plans of the various parts. Budgeting helps to ensure that everyone in the Organization is pulling in the same direction.

- Budgets define goals and objectives that can serve as benchmarks for evaluating subsequent performance.

- The effectiveness of budget could ameliorate the motivation of employees of the Organization as it has been observed in Wolfenden Concrete Ltd. Most employees are motivated to work more intensely to avoid failure to achieve success. As employees get closer to a goal, they work harder to achieve it.

Recommendations

The process of budget that Wolfenden Concrete Ltd follows is a time consuming process that involves all levels of management. Wolfenden Concrete Ltd could follow the zero-based budgeting process. Under a zero-based budget managers are required to justify all budgeted expenditures not just changes in the budgets from previous year. The base line is zero rather last years’ budgets.

McLaney, E. & Atrill, P. (2005) argued that a zero-based budget requires considerable documentation. In addition to all of the schedules in the usual master budget the manager must prepare a series of decision packages in which all of the activities of the department are ranked according to their relative importance and cost of each activity is identified. Higher-level manager can then review the decision packages and cut back in those areas that appear to be less critical or whose costs do not appear to be justified.

Another recommendation has offered to Wolfenden Concrete Ltd hat it could prepare monthly budgeted statement rather than quarterly to forecast the future expenditure effectively.

Conclusion

In recent days budgeting is the most important accounting tool to the small and large companies in the world. To control the expense, budgeting process of an Organization play the vital function. Moreover it can ameliorate the motivation of the employees within the Organization. The new technique of budgeting process has been emerged to make easy to reach the goals of the Organization. Thus, Budgets have multiple roles. Budgets can play an interactive role where they are used as a dialogue, learning and idea creation machine. Simultaneously Budgets also have a diagnostic role, which refers to the traditional purposes of performance management and responsibility accounting.

Bibliography

Atkinson, A. A., and Banker, R. D., (2001), Management Accounting, 3rd ed., Pearson Education Asia, Singapore.

Burchell et al, (1980), The Roles of Accounting in Organizations and Society, Working Paper, Accounting, Organizations and Society, Volume 24, Number 3, 1999.

Dyson, J. R., (2004), Accounting for Non Accounting Students, 6th ed., FT Prentice Hall, London.

Drury, C. (1998), Costing: An Introduction, 3rd ed.,, Chapman & Hall, London.

Drury, C. (2001), Management Accounting for Business Decisions, 2nd ed., Thomson Learning Business Press, London.

Horngren, C. T, Foster, G. and Datar, S. M., (2005), Cost Accounting: A Managerial Emphasis, 12th ed., Prentice Hall, New Jersey.

Horngren, C. T., and Sundem, G. L., (2004), Introduction to Management Accounting, 12th ed., Prentice Hall, New Jersey.

Garrison, R. A, and Noreen, E. W, (2007), Managerial Accounting, 13th ed, McGraw Hill: Irwin.

McLaney, E. & Atrill, P. (2005), Accounting: An Introduction, 3rd edition, Prentice Hall Europe.