This paper seeks to respond to questions relating to an owner of the growing business who needs more information regarding sales revenues generated from corporate customers and non-corporate customers.

How would the recordingaccounting system need to be modified to maintain records that will provide this information to aid management and the owner? The accounting system may be modified in having one separate ledger for corporate customer and another ledger account for non-corporate customer. The same change will necessarily result to changes in the account codes for each ledger account and separate columns in the sales journal and the cash receipts journal. The related expense accounts which have direct relationship with the each type of customer could also be broken in the journal and in the ledger for purpose of controlling their level in the relation to the type of revenues. The result could also be found in the presenting there sales revenues of two types of customer in the income statement, although both will form part of the total revenues.

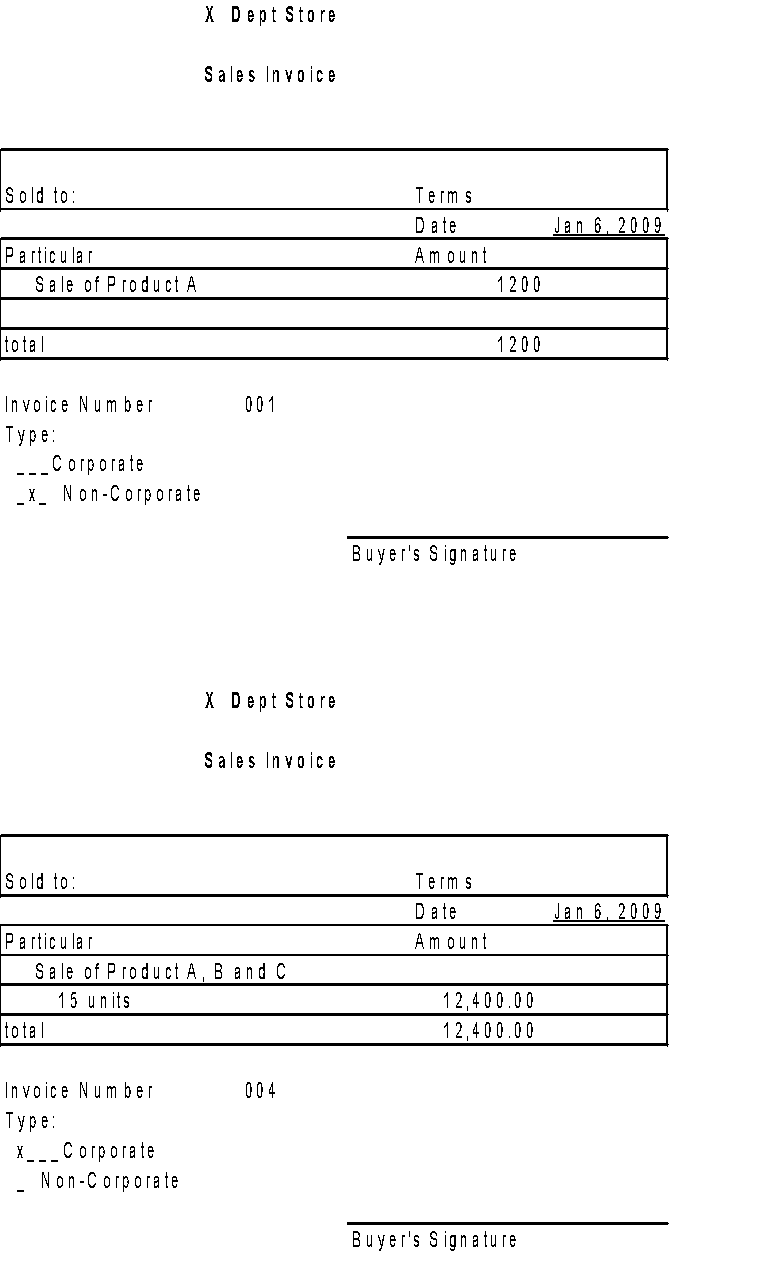

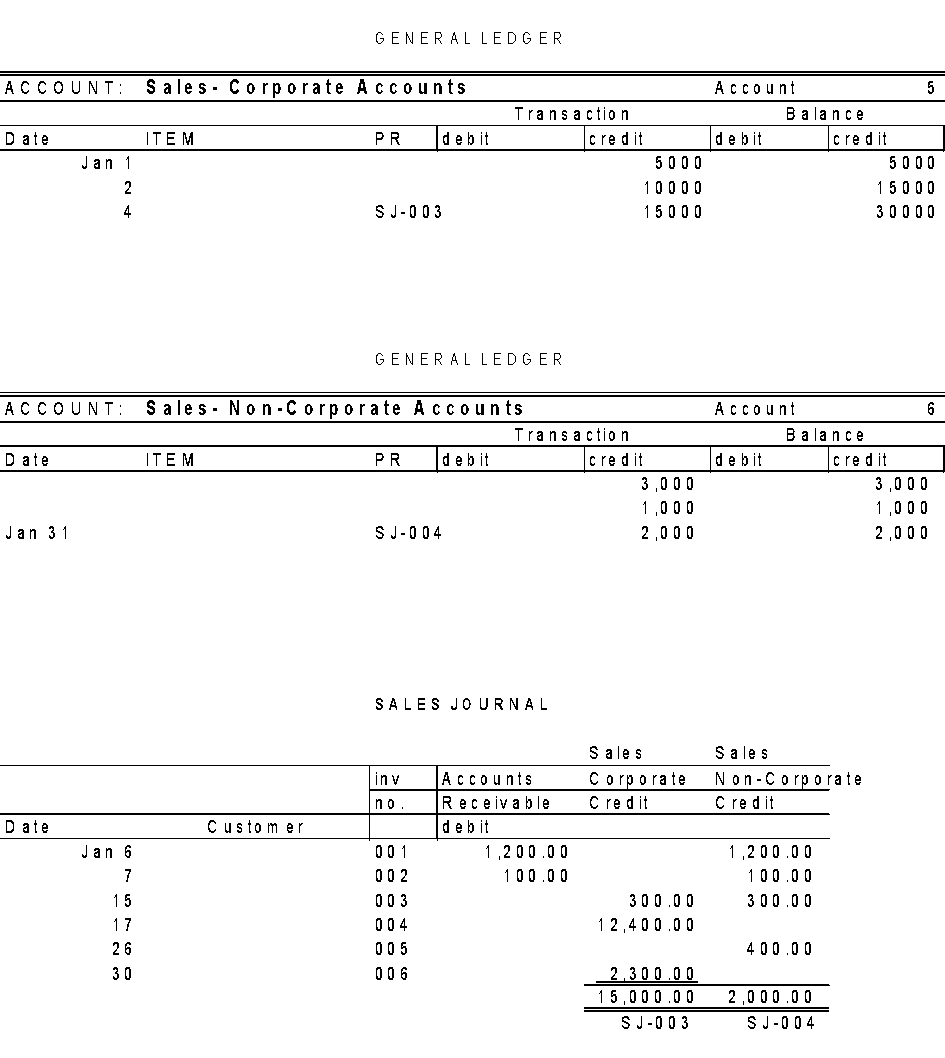

How would a sample of the two documents and two records reflect these changes? Under the ledger accounts, one account would be called “Sales- Corporate Accounts” and other account would be called “Sales- Non-Customer Accounts”. In the sales journal as a separate document from the ledger, one column would be labelled “Sales-Corporate Accounts” and another column would be labelled “Sales- Non-Customer Accounts”. See Appendix A. The two documents would be the separate notations in the invoices for corporate and non-corporate accounts. See Appendix B.

What could be seen as the benefits of these changes for business in the future? The benefits could be helping management to know where it should focus its marketing and operation efforts. Knowing which of the two types of revenues produces the greater revenue, would help management where to focus its efforts in order to maximize profitability. Since it is assumed that each type of customer would require a different approach of advertising and marketing efforts that may vary also in amounts, the production of separate reports could indeed provide management on how it could balance the level of advertising expenses in relation to the level of sales revenues. More specific information for two types of customers would also help management to determine the marginal revenue of each which could help the company to maximize revenue. The same argument could be used in determining the marginal cost for determining the minimum cost per each level of activity for each type of customer. Combining two would help management to maximize the profit that would help the company in its wealth maximization objectives.

It can be concluded that the business gets complicated in terms of more sources of revenues, management would become more interested in the relation of each business variable that could help it to attain its wealth maximization objective. More specific information is considered more reliable and more accurate for decision-making. Better decision-making should assure better accountability from managers and the same could lead to a more stable relationship among the people in the organization as it would be easier to attain goal congruence between what is expected from managers and what the business wants to attain in terms of its defined objectives. Necessarily, better information should lead to better planning.

Works Cited

- Atkinson, A. et al. Management Accounting. New Jersey: Person Custom Publishing, 2005

- Massie, J..Essentials of Management. London: Prentice-Hall International, 1987

- Samuelson, P. and Nordhaus, W. Economics. London: McGraw-Hill, Inc.,1992

Appendices

Appendix A – Two Records: Ledgers and Journals

Appendix B- Two documents: Separate notations in the invoices