The current global knowledge economies dictate innovation, upholding and use of information to establish the rate of success within firms. Organisation enrichment is inevitably enhanced through performance measurements as firms strive to improve their production systems which necessitate application of quantifiable scientific methodology (Irala, 2007).

Consequently, the Balanced Scorecard (BSC) has been established as one of the best methods in appraising performance within organisations (NetMBA.com, 2010). The key factors considered in the benchmark encompass issues like the needs and expectations of clients and shareholders; tactical approach based on client’s needs; and available resources of the organisation (Kaydos, n.d.).

The BSC standard developed by Kaplan & Norton (1996) provides a more balanced approach to traditional performance appraisals schemes through the incorporation of financial metrics that can empirically generate a reasonable scorecard of an organisation and staff achievements against set targets.

The approach offers organisations the chance to integrate the strategic management goals with the balanced scorecard; thus formulating truly calculable objectives (Balancedscorecard.org, 2011).

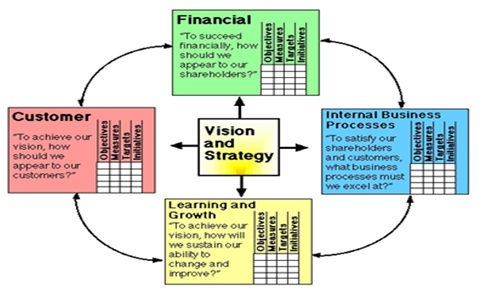

The scorecard is designed to conform to modern management systems that variably combine customer needs, systems, staff, technology and creativity in their strategies from four major standpoints (Figure: 1).

Applying a strategy map, management can deduce the interlinked critical performance strategic objectives, integrating both financial and non-financial factors thus generating a Balanced Scorecard for the proposed performance yardsticks from the above four perspectives.

According to Banker et al. (2004: 435), focusing only on financial metrics like return on assets (ROA) is too constrained, since it just leads to quick-fix reactions that ignore strategic objectives which may be obscured and not immediately visible. Nonetheless the visionary objectives should be balanced by financial aspects to have a better perspective.

Ittner et al. (2003:725) have though applied psychology-based rationalizations that ‘balance’ the scorecard by putting more weight on financial aspects against non-financial measures whilst discounting quadrant based evaluations thus integrating other measures lacking in the scorecard. This is more ideal in bonus payment formulation as it is less subjective to non-quantifiable factors.

Nevertheless, performance measurement heavily based on financial aspects is criticised for ignoring individual characteristic like customer and employee satisfaction, input of contractors with cumulative market share, current stock price return on sales, economic value added (EVA), return on equity and market capitalisation; as being of extra import to the executive and directors.

The BSC aptly incorporates all these evaluation measurements in addition to non-financial aspects (Johnson, 2007).

The significance of organisations suitably applying BSC encompasses: transforming tactics into discernable functioning metrics and objectives; uniting organisations on distinct, rational schemes; ensuring schemes availability to all employees; ensuring tactical enhancement; and mustering alterations via powerful, efficient management.

Using the balanced scorecard enables organisations achieve value-based management systems, thus leading to higher return on equity (ROE), return on assets (ROA), stock price and other enhanced performance.

The balanced scorecard amply assesses five performance fundamentals including client satisfaction, pace, precision, expenses, and staff growth. However, the use of BSC must be well balanced to avoid ignoring significance of financial measurements and future prospects while emphasising on non-financial aspects like customer and staff requirements.

Each firm should weigh own goals and objectives subjectively to guide the BSC as opposed to importing ‘templates’ from other ventures. Thus the balance scorecard is still viable in assessing organisations’ performance particularly if indicators are properly applied.

List of References

Balancedscorecard. (2011). Balanced Scorecard Basics. Web.

Banker, R. D. (2004). A balanced scorecard analysis of performance metrics. European Journal of Operational Research, 154, 423–436.

Irala, L. R. (2007). Performance Measurement Using Balanced Score Card. Web.

Ittner, C. D. (2003). Subjectivity and the Weighting of Performance Measures: Evidence from a Balanced Scorecard. The Accounting Review , Vol. 78, No. 3 pp. 725–758.

Johnson, C. C. (2007). Introduction to the Balanced Scorecard and Performance Measurement Systems. Harvard Business Review.

Kaydos, W. (n.d.). What Should Your Company Measure Besides Financial Results?. Web.

NetMBA.com. (2010). The Balanced Scorecard. Web.