Capital Budgeting

- The investment decisions of a firm are generally known as the capital budgeting, or capital expenditure decisions.

- Thus capital budgeting has following characteristics:

- The exchange of current funds for future benefits.

- The funds are invested in long-term assets.

- The future benefits will occur to the firm over a series of years.

The management of any organization has to make the investment decisions on its capital expenditure proposals based on the Cash outflows and expected revenues from the project.

Criteria Selection of Capital Budgeting

- Should maximize the shareholders’ wealth.

- Should consider all cash flows to determine the true profitability of the project.

- Should provide for an objective and unambiguous way of separating good from bad projects.

- Should help ranking of projects according to profitability.

- Should recognize that bigger cash flows are preferable to smaller ones and early cash flows are preferable to later ones.

- Should help to choose among mutually exclusive projects which maximizes the shareholders’ wealth.

- Should be a criterion, which is applicable to any conceivable investment project independent of others.

In the case Claire’s warehousing issue, the management of Claire is confronted with the location of its warehouse. There were two.

Options available to the company for locating the warehouse. Since the construction of the warehouse involves heavy initial capital outlay the management considered different investment scenarios taking into account the different cost elements including depreciation and the tax factor involved.

Net Present Value Method

- Cash flows of the investment project should be forecasted based on realistic assumptions.

- Appropriate discount rate should be identified. The appropriate discount rate is the project’s opportunity cost of capital.

- Present value of cash flows should be calculated using the opportunity cost of capital as the discount rate.

- The project should be accepted if NPV is positive (i.e., NPV > 0).

The best method to decide on the capital investment decisions is to discount the future cash flows at certain assumed cost of capital. The discounted cash flows should provide the management a net positive cash inflow. Then only the project can be said to be viable.

Recommendation

North Warehouse Proposal

- Under present assumptions:

- scenario-I:

- COST OF CAPITAL 10%.

- CON TRIBUTION MARGIN 55%.

- REJECT AS NEGATIVE NPV.

- scenario-I:

- Recommend: North Warehouse proposal.

- Under new assumptions:

- Scenario -II:

- COST OF CAPITAL 12%.

- CONTRIBUTION MARGIN 55%.

- REJECT AS NEGATIVE NPV.

- Scenario-III:

- COST OF CAPITAL 8%.

- CON TRIBUTION MARGIN 55%.

- REJECT AS NEGATIVE NPV.

- Scenario-IV

- COST OF CAPITAL 8%.

- CON TRIBUTION MARGIN 65%.

- REJECT AS NEGATIVE NPV.

- Scenario -II:

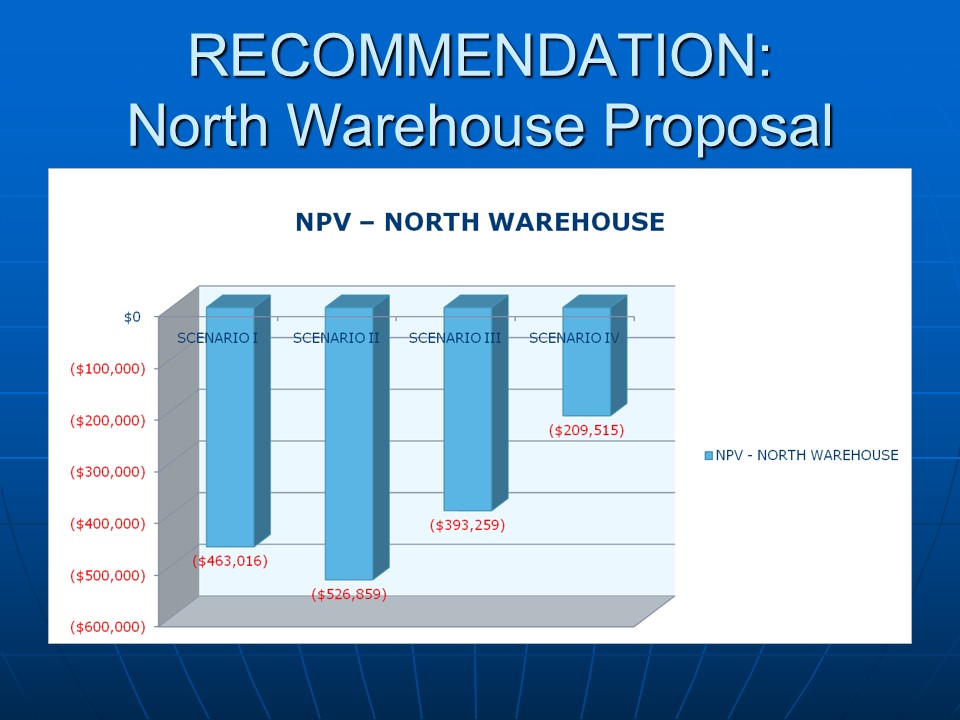

In the present instance there are four scenarios considered for the north warehouse with different cost of capital and contribution margin percentages.

Since all the four scenarios present a negative discounted cash inflow in terms of their present values, the north warehouse proposal is

Rejected by the management of Claire.

Proposal West Warehouse

- UNDER PRESENT ASSUMPTIONS:

- SCENARIO-I:

- COST OF CAPITAL 10%.

- CON TRIBUTION MARGIN 45%.

- REJECT AS NEGATIVE NPV.

- SCENARIO-I:

- UNDER NEW ASSUMPTIONS:

- SCENARIO-II:

- COST OF CAPITAL 12%.

- CON TRIBUTION MARGIN 45%.

- REJECT AS NEGATIVE NPV.

- ASSUMPTION -III:

- COST OF CAPITAL 8%.

- CON TRIBUTION MARGIN 45%.

- REJECT AS NEGATIVE NPV.

- SCENARIO -IV:

- COST OF CAPITAL 8%.

- CON TRIBUTION MARGIN 65%.

- ACCEPT AS POSITIVE NPV (SEE ATTACHED EXCEL FILE).

- SCENARIO-II:

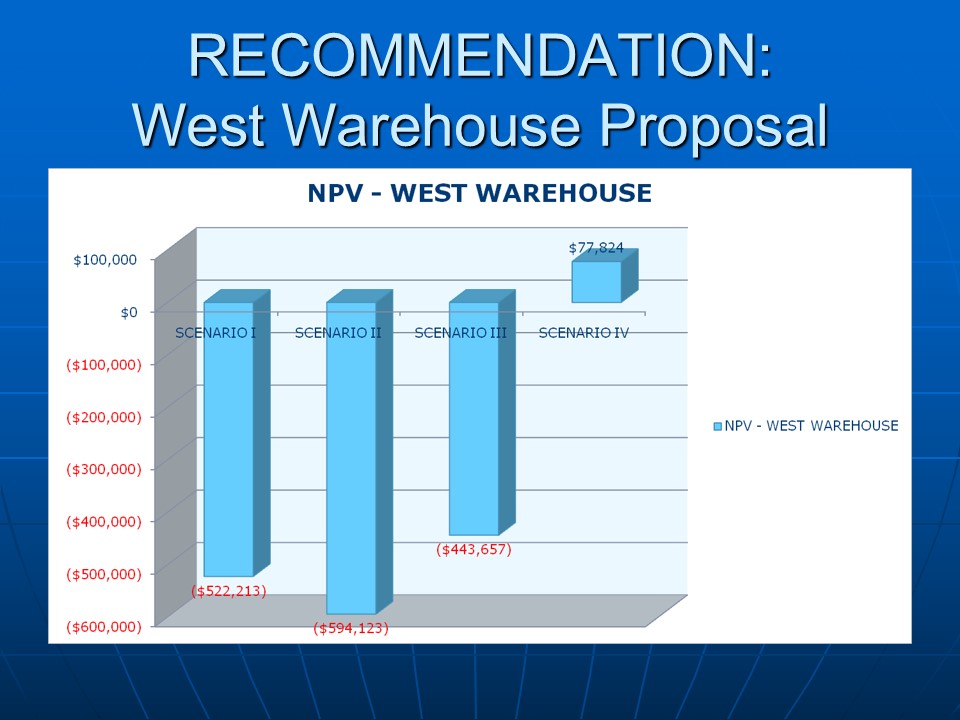

In the case of west warehouse one of the scenarios (Scenario IV) result in positive NPV.

Here also the scenarios are considered with different cost of capital and contribution margin percentages.

Therefore the west warehouse under Scenario IV with a cost of capital of 8% and contribution margin of 65% is accepted.