Introduction

Monetary policies are key in the management of a country’s economy. Indeed, these policies rarely change except when there is a financial crisis. It should be noted that both developed and Third World countries get reasons to change an aspect on their monetary policies. Critically, the issue of dollarization generally touches on the changing of a country’s local currency to the US dollar. Often, countries that decide to dollarize are in such dire need for financial help due to their weakened local currencies. This can be attributed to poor governance, warfare or conflict and a weakened economy. It is debatable that dollarization is often done to help the country in question. However, if not properly managed, the process can be detrimental to the economy of the affected country. There are three main factors that have to be considered in relation to monetary policy and dollarization. All the countries that consider the approach have to think about whether they will fully integrate the new currency, use it as an alternative, or use it as the main currency with the local currency acting as an alternative.

This essay analyzes the process of dollarization. Further, the essay looks at some of the countries that have dollarized and their experiences of the same. For example, some of the countries that will be analyzed include Zimbabwe, Panama, Liberia and the British Virgin Islands. It is important to note that these countries had different reasons for dollarization, and this might contribute to the fact that they also had different experiences of the process. Overall, it will be argued that despite the advantages of dollarization, countries should have an exit strategy in place that reintroduces their local currency for sustainability purposes.

Define and Discuss the Policies that Fall Under “Dollarization”

There are three main factors that have to be considered when discussing policies that fall under dollarization. The three are unofficial dollarization; semiofficial dollarization; and official dollarization. Bocola and Lorenzoni define unofficial dollarization as the holding of wealth in foreign currency even though the country of foreign does not officially use that foreign currency (2524). An example can be given to explain the premise better. An investor in China can invest in the US stock market, where he uses the American dollar. However, even after being paid dividends, the investor does not change his money to the Chinese Yen. It can be argued that individuals who prefer to invest in foreign markets might prefer this type of dollarization. It makes trading easy due to the fact that a significant number of economies are dollar friendly. It is also common to find that unofficial dollarization is common even when the home country does not trade in dollars.

It should also be noted that having foreign bank accounts with foreign currencies is also a type of unofficial dollarization. Bocola and Lorenzoni confirm that people who save money at home as opposed to banks can also participate in this dollarization approach (2526). Critically, there are some countries that allow for unofficial dollarization while there are some that term it illegal. It is important for investors to do their research and find out if their country of interest allows for the same. Further, some countries allow some form of unofficial dollarization and not others. For example, a country might allow investors to have foreign bank accounts with foreign currencies but deny the same investors an opportunity to have local bank accounts with foreign currencies. All these elements affect the monetary policy for both the foreign and home countries.

A second element of monetary policy that has to be considered is semi-official dollarization. Here, foreign currency is recognized and used by the government as a legal tender (Balimaa 146). This means that the currency in question can be used to trade with and also pay debts. One of the reasons why this is a more common factor in dollarization compared to the others is the fact that it can be used for contractionary monetary policy. As Balimaa notes, there are numerous reasons why this type of policy might be needed by a government (147). The most common is usually to deal with the challenges brought on by a great and abrupt growth of the economy. Some of the countries that allow this type of dollarization include Bahamas, Haiti and Liberia, all which also use the American dollar.

It is arguable that despite the reason for semiofficial dollarization, some of the countries that have used this approach are relatively poor. Bocola and Lorenzoni confirm that the approach not only allows for the use of the foreign currency in paying debt but also in trading on a daily basis alongside the home country’s local currency (2527). This can negatively affect the home country’s monetary policy by weakening the local currency based on which coins the locals prefer to use. Due to the fact that the foreign currency also means a difference in status, it is expected that the local coin will be neglected and in doing so, negatively affect the economy. In order to properly monitor the country’s monetary policy, governments that allow this approach also have to ensure they have a domestic central bank that or any other significantly powerful monetary authority.

The last factor that has to be considered is the official dollarization policy. According to Imam, this refers to when country fully accepts the use of a foreign currency as their own (12). In this case, the government also pays its debts using the foreign currency. In fact, locals openly use the currency in their day-to-day activities as well. It should be noted that in such a system, the country often still has its own local currency. However, this currency is assigned a secondary role and might only be used in small transactions. Also, it is possible to find a country have more than one foreign currency if its fully dollarized. Individual country monetary policies dictate this. It can be argued that one of the reasons this factor is important is the fact that it also affects expansionary monetary policy.

Expansionary monetary policy refers to the use of different strategies to help expand the economy and cater for inflation. A significant number of these strategies often strive to ensure that there is easy access to funds by the public. An example of a country that has used this approach is Panama. Critically, any of the approaches taken by a government depends on that country’s monetary policy. It should be noted that one of the reasons why expansionary monetary policies help boost the economy is that they also lower the interest rates for loans. Therefore, more people are able to start businesses and also attract foreigners who can invest in the same due to the low interest rates. On the same note, these foreigners are able to comfortable trade with foreign currencies and not get affected by exchange rate policies.

Discuss Some Examples of Countries That Have Dollarized. Has It Been Beneficial?

There are several companies that have dollarized, with some being successful while others were not. One of the full dollarized nations, as mentioned is Liberia. It should be noted that Liberia has had dual currency since the 1800s. In fact, as Imam notes, the country initially only traded in American dollar and the introduction of their own currency was an attempt to push a Pan-Africanist agenda (13). There are several reasons why Liberia is still a fully dollarized nation. Imam explains that one such reason is political instability (13). A country’s monetary policy is heavily affected by the political environment. The policy does not only affect local politics and governance but also international relations that the country in question will engage in. Imam also confirms that donor flows can also lead to full dollarization as is observed in Liberia (14). Due to high levels of poverty, there are numerous donors that have given both funds and services to the country.

Despite the years of being fully dollarized, Liberia is still one of the poorest countries in the world. Therefore, it can be boldly stated that the dollarization has not been beneficial to the country. Imam argues that one of the reasons for this is the fact that the country still has a largely underdeveloped financial system/sector (14). Therefore, a flow of any type of foreign currency will not help. The systems have to be improved by the leaders. Secondly, the fact that the country has a large amount of the American dollar in circulation makes implementing the monetary policy, which largely focuses on the local currency, that much harder. It is due to these and other similar reasons that the country is considering de-dollarizing.

A second country that has also fully dollarized, as mentioned earlier, is Panama. Balimaa notes that the country has been using the American dollar for approximately 100 years now (147). In order to understand why this is so, it is critical to analyze Panama’s institutional framework. The country’s government has in the past maintained that dollarization helped monitor and manage the economy. However, it should be noted that the country does not have a central bank. As mentioned previously, due to the challenges that dollarization poses, it is often encouraged that countries first establish a central back or a monetary authority to ensure that the economy of the country is not affected by the dollarization process.

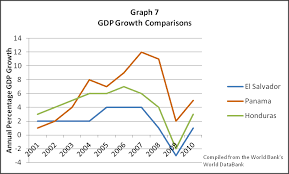

One of the advantages of Panama’s institutional framework compared to that of Liberia is that the market is controlled by private agents and banks. Therefore, there is a lower foreign exchange risk and attacks. Compared to Liberia, one can argue that the dollarization process in Panama was successful. This might be due to the fact that the country does not have a competing local currency. It can also be argued that the approach was successful for this specific country due to lower levels of information needed by foreign investors. Balimaa notes that countries with more than one currency being used as legal tenders have to inform their investors of everything that affects the economy (148). The absence of these in the Panama institution framework makes it easier to attract investors, thereby, boosting the economy. It should be mentioned that the country has focused fully on service exports. The full integration with the American dollar in the economy, therefore, gives the country an upper hand in global trade. The table below shows how this affected the GDP of Panama.

Zimbabwe also was fully dollarized albeit the fact that the decision was reversed in 2019. Imam explains that the country initially dropped their local currency for the American dollar (15). This US dollar was recognized as the legal tender for a decade before the decision was reversed in 2019 paving way for the relaunch of the Zimbabwean dollar. One of the reasons why Zimbabwe first dollarized was in an attempt to reduce inflation. Imam explains that the government was also keen on increasing the public’s bargaining power at the time (17). The inflation and slow growth of the economy was due to significant political changes that the government had pushed for in an attempt to push out white settlers from the country. This goes to prove just how influential the political environment is determining the success of dollarization.

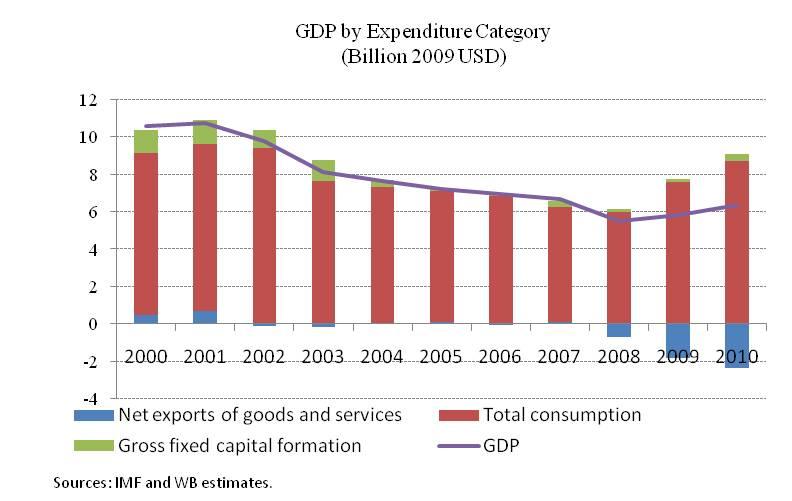

It should be noted that although the dollarization helped the country in the beginning, it was generally not beneficial to the country. Zimbabwe still has a relatively unstable economy, and it is due to this that they are de-dollarizing. It can be argued that the dollarization of the currency actually created hyperinflation that made the economy highly dependent on aid. One of the mistakes that the government made was print more money and pumped it into the economy. This was a limitation due to the fact that it lowered the public’s bargaining power, putting the country back where it was before dollarization. The government recently increased loan interests to 50% from 15% to help lower the American dollars in circulation in the country (Balimaa 148). Indeed, it can be argued that the country seeks to not only relaunch its local currency but also remove the American dollar from their system completely. Below is a table on Zimbabwe’s GDP per expenditure for ten years.

Last but not least is the British Virgin Island, which have also been fully dollarized. Balimaa notes that one of the key reasons why the country was dollarized was for ease of trade (149). It should be noted that the relationship between the Islands and the US is cordial especially when it comes to trading. The economy of the British Virgin Island is supported mainly by exports, meaning they have significant interest in the global economy. It can be added that one of the challenges of global trade is exchange rate policies. When countries use the same currency, this is avoided. In turn, the traders are able to save money that would have otherwise been lost in the exchange system.

Critically, the American dollar is the most accepted form of currency for global trade. It should be noted that countries that dollarized mainly for trading purposes have experienced the benefits of the dollarization process. This is especially the case if the trade business is being conducted with the US. Towards this end, therefore, one can argue that dollarization in British Virgin Island has been beneficial to the country. Not only has the government further enhanced its relationship with the US, but it has also stabilized the country’s economy. It is interesting that the issue of trade does not only affect the country’s relation with the US but other countries as well. Due to the popularity of the American dollar, it has become easier for the government to trade with others in the global platform.

What are the Mechanics of Dollarization?

When discussing the mechanisms of dollarization, one has to first understand how it starts. Therefore, the political and economic environment is the first element of mechanism of dollarization that has to be discussed. It can be argued that one of the factors that support dollarization is an unstable economy. This is one of the key reasons why a country can decide to dollarize. For example, Liberia and Zimbabwe, as mentioned previously, had to dollarize due to economic constraints. A second factor to consider before of dollarization is political insecurity. Often, a poor economic system goes hand in hand with poor governance. Political goodwill and security is essential for the economic growth of a country. Once a country experiences these two elements, often at the same time, the possibility of dollarization becomes more.

A second mechanism is pegging, which is often done by the currency board. Bocola and Lorenzoni define this as the anchoring of a local currency to a foreign one so that when the foreign one rises, so does the local one (2532). It can be argued that pegging gives the local currency the same status as that of the foreign currency, which in this case is the US dollar. There are two reasons why pegging is important in the dollarization process. The first is that it stabilizes the exchange rate policies, therefore, making the local currency more powerful. Secondly, it gives the government an idea on how their local currency measures against international currencies such as the US dollar. It is against this backdrop that the country can then decide to either do a semi-official or full dollarization.

Advantages of Dollarization

There is primarily one advantage of dollarization. This is that it can lead to a more stable monetary and economic system. There are several ways that the process of dollarization uses to ensure this. The first is that it lowers the administrative costs that are tied to printing money. Bocola and Lorenzoni notes that there are significant administrative costs that are tied to not only printing but also managing a currency (2534). Critically, full integration of a foreign currency also ensures that the affected government does not have to support a part of their economic structure that is already failing. The responsibility to ensure that the currency used by the country performs against other currencies is also removed from the government and placed squarely at the government of the currency’s place of origin. These savings can be critical in stabilizing an economy.

Second, dollarization helps stabilize the economy by lowering interest rates. This mainly affects locals who are looking for loans to enhance their own businesses. Due to the fact that the American dollar is already a strong and secure currency, interests for loans taken in dollars can be lowered. This ensures that more people are able to take loans for their various activities. Additionally, it also encourages the lenders to create better packages that can attract borrowers. It should be noted that for this to work clearly, a strong monetary authority should be identified. Lastly, it also boosts the economy by creating a firmer basis for financial recovery. This applies to countries that have already suffered from economic pitfalls. Often, the dollarization process is incorporated into the country’s monetary policy. This makes it easier for the nation to come up with strategies for improving their economy.

Apart from stabilizing the economy, another advantage of dollarization is that it enhances trading. It should be noted that this applies to any currency that is mainly used in trade. As mentioned, some of the countries that have experienced the benefits of dollarization are those that changed their currency for trading purposes. For example, Panama and British Virgin Island have been successful in their dollarization experience due to their close trading ties with the US. It is essential to note that due to this, both countries are not affected by exchange rate policies. This lowers the amount of money needed or lost during trading as they do not have to undergo currency changes. The fact that borrowing from other institutions and governments is also determined by the type of currency a country had makes dollarization a key element in the development of some nations as stated earlier.

Further, it can be argued that dollarization increases the credibility of a market or a government. The American dollar is one of the strongest currencies in the world. Therefore, dollarization would put a country in a similar bargaining position, especially for international loans for purposes of development. The lender, such as IMF can be assured that the government’s legal tender is not only stable but also one of the strongest in the market. This relates in similar fashion to locals borrowing from local banks. The interest rates will also be relatively low due to the stated removal of exchange rate policies.

Disadvantages of Dollarization

Despite the numerous advantages mentioned, there are several disadvantages to dollarization. One such limitation is that it also increases a risk in financial crisis. Bocola and Lorenzoni note that a sudden influx in American dollars in the affected country can lead to the rapid expansion of capital inflows compared to international reserves (2548). This in turn forces banks to increase their own reserves, especially if they have monetary authorities or the central bank. All this can lead to the deterioration of the affected country’s position especially in regards to their currency dominated position globally. On the same note, the fact that loans will have lower interests will lead to a rapid increase in borrowing. Whereas this ensures there is an ease of accessing funds for businesses, it also taps into the bank reserves that are already unstable. It can, therefore, be argued that the loan portfolio will also become unstable.

Secondly, the affected nation will have to forfeit its monetary autonomy. As mentioned earlier, countries that dollarize do not have the pressure of managing their own currencies vis-à-vis other global ones. Although this can be perceived as an advantage, it is also a disadvantage. One limitation of this is that the country no longer has unilateral control over the currency it uses. Therefore, anything that affects the US will also affect the countries that are using its currencies. Further, the US can make monetary policies that affect its currency and does not have to consider how this affects the countries that have dollarized. It can be argued, however, that the affected country was already in poor condition for it to consider dollarization. Additionally, this country’s currency was not performing well in the global markets, therefore, leaving no choice for the country other than dollarization.

Another disadvantage of dollarization is that it negatively affects public expenditure. Due to the lowered monetary autonomy, the country in question will also have challenges creating money, which is also known as seigniorage (Bocola and Lorenzoni 2541). It is important to note that all governments have three main ways of creating or raising funds. The first, and most common is taxation. Each country has its own rules and regulations that guide the process of taxation. Secondly, all governments borrow from one another and from international financial institutions. Thirdly, governments rely on seigniorage as their third alternative to create money. This process uses the printing press, but cannot happen if the currency is foreign. It should be noted that for this third alternative to work, the country has to agree to a formula with the US, which is the originator of the currency.

Additionally, an affected country also gives up its central bank when it dollarizes. This means that the nation is not able to play the lender of last resort role that the central bank plays whenever there is a crisis. It can be argued that it is this particular reason that led to the economic downfall of Zimbabwe. Bocola and Lorenzoni confirm that when an economic crisis begins, governments, through the central bank, puts out several types of discounts to help boost the economy (2539). Due to the mentioned monetary autonomy that the affected nation lacks, it is not able to do the same.

Discuss the “De-Dollarization” That is Occurring in Peru

Peru is one of the countries that had to dollarize in order to stabilize their economy. However, as from 2013, the country has been applying different strategies to help de-dollarize and make their local currency more popular (Bocola and Lorenzoni 2543). One approach that has worked for the country is the dollarization coefficient of private credit. Bocola and Lorenzoni explain that in 2013, the coefficient was at 56% while in 2018 it had gone down to 39% (2541). It should be noted that despite the numerous achievements that Peru has in regards to de-dollarization, the country has had its fair shares of challenges in the process. For example, in 2012, the world experienced low levels of international interests that increased dollar credits. This had a negative impact on the country’s effort to de-dollarize.

It should be noted that the decision to de-dollarize is supported by the country’s economic recovery. The country has so far made stringent requirements to their reserves that have lowered the amount of dollars that is in their systems. It can be argued that one of the reasons why Peru’s de-dollarization activities have been successful is the fact that they are market driven as opposed to politically tied. The government was able to first put in measures that would boost the economy before starting the de-dollarization process. Although the process began with the credits, it has also ensured the lowering of deposits in the foreign currency. The holistic approach is critical in understanding why Peru is one of the most successful countries in regards to de-dollarization.

Conclusion

In conclusion, there are numerous reasons why a country would decide to dollarize. First, an unstable economy can force governments to take up a new currency in an attempt to boost their markets. This happens primarily due to the fact that it reduces administrative costs that are often also associated with the exchange rates. It is important to note that there are also governments that are forced to dollarize due to the warfare or conflict. Significantly, there are nations that suffer from both conflict and economic instability that have also been forced to dollarize. There are numerous advantages for dollarization. This is especially the case when the country’s own currency is significantly weak. Apart from the fact that the process helps stabilize the economy it also boosts trade between countries that use the same currency.

There are various countries that have dollarized. Each country has had different experiences with the process. For example, Liberia’s efforts to dollarize were not successful. It is still one of the poorest countries in the world. Further, it still has one of the weakest economies on the globe. On the other hand, Panama’s dollarization has worked for the benefit of the country and its people. It should be noted, however, that Panama has a close relationship with the US. The dollarization, therefore, has helped with trading between the two countries and others that use the American dollar as their legal tender. Arguably, despite the advantages of dollarization, there are several limitations of the process. The first is that it forfeits the country’s monetary autonomy. This means that the nation cannot control how it makes money or even manages the currency.

Works Cited

Balimaa, Wenéyam Hippolyte. Do domestic bond markets participation help reduce financial dollarization in developing countries? Economic Modelling, vol. 66, 2017, pp. 146-155.

Bocola, Luigi, and Guido Lorenzoni. “Financial Crises, Dollarization, and Lending of Last Resort in Open Economies.” American Economic Review, vol. 110, no. 8, 2020, pp. 2524-2557.

Imam, Amir Patrick. “De‐dollarization in Zimbabwe: What lessons can be learned from other sub‐Saharan countries?” International Journal of Finance & Economics, 2020, pp. 12-32.