Abstract

The concept of sustainable development has captured the world. It is changing society, generating new social patterns, ceasing business and management models, testifies to the ultimate connectedness of the world and, as a result, encourages rethinking the legal superstructure, adapting normative supernova arrays to the current legal taxonomy, which is not always possible taking into account the positivist approach to law. Environmental, Social, and Governance (ESG) principles have become a model of sustainable business development today, due to which the goals of companies’ involvement in solving environmental, social, and managerial tasks are achieved.

Summary

To begin with, ESG principles are segmented, fragmented, and, as a rule, objectified externally in the form of norms of non-state, often sectoral regulation. Although not legally binding, the ESG principles are comparable to the law regarding the degree of impact on public relations and the legal and economic consequences generated. Cross-border contractual practices are also changing, which leads to the incorporation of “sustainability” clauses into contracts and the formation of the concept of a sustainable contract. Moreover, it is worth noting that the pre-contractual stage is becoming more complicated. Human due diligence procedures are required, the formation and evaluation of supply chains, the elaboration of strategies for disclosure of non-financial information, the study of legal risks taking into account global law enforcement practice, as well as the definition of methods and a jurisdictional forum for dispute resolution. Therefore, the main issue of the study is to identify the current significance of ECG principles and their impact on business standards.

Method

Database and document extraction

To achieve results, it is necessary to study the indicators of various companies that adhere to the principles of socio-sustainable development. To do this, it is necessary to turn to open data sources that demonstrate the number of companies and their relationship with existing ESG principles. The evaluation of these indicators is important for understanding the essence of the development of these principles among various companies.

Thematic and Conceptual Structure

The network paradigm of the modern world order, coupled with the concept of sustainable development, generates new challenges for the law. In this regard, the views of individual scientists who distinguish dialogic networks built on the foundation of persuasion and coordination and control networks based on the balance of coercion and encouragement as models for regulating modern relations are interesting. The thematic and conceptual structure will be based on identifying common patterns in various cases devoted exclusively to implementing ESG principles.

Results

Descriptive Stats

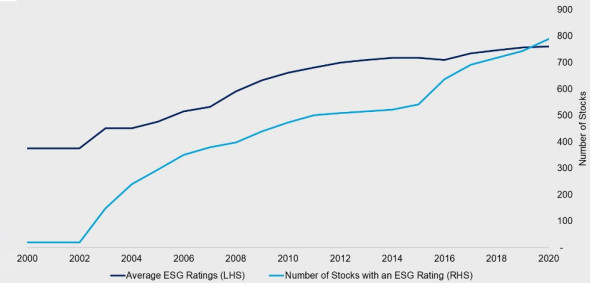

As it can be seen on picture 1, in the early 2000s, there were only 20 ESG-rated companies in the United States. As can be seen from the graph, by 2020, their number has grown to almost 800 (Polychronopoulos, 2020). It is worth noting that the average ESG rating has doubled in 20 years, which is associated with an increase in the volume, quality, and availability of data.

Analysis

Corporate reporting on greenhouse gas emissions and climate change commitments is central to the assessment of the company’s commitment to sustainable development principles, which the hydrocarbon agenda and carbon footprint assessment significantly update today (Filbeck et al., 2019). An increasing number of companies are forced to make specific, verifiable public commitments to switch to renewable energy sources and reduce greenhouse gas emissions.

Trending Standards

A significant amount of information, collectively referred to as “non-financial reporting”, serves as a tool that testifies to the ESG policy being implemented and the company’s commitment to the concept of sustainable development. However, there are no unified approaches to establishing uniform rules for disclosing ESG indicators today. Consequently, this can lead to the fact that there are various problems associated with insufficient compliance with conditional standards.

Discussion

Initially, companies viewed sustainability indicators and statements as a voluntary commitment devoid of legal or market risk. However, the regulatory space began to fragment rapidly, and industry ESG standards, systems of principles developed by both international organizations and professional associations or ad hoc associations, began to form in different segments of international business while, as a rule, devoid of legal force and qualified as non-legal sources accumulating norms of non-state regulation (Filbeck et al., 2019). There is a scaling of new types of evaluation, rating, and reputation tools (credit ratings, ESG ratings, ESG standards), which form an extra-legal system of social management, are built based on decentralized information control, and create specific legal consequences or risks of their occurrence for assessment subjects.

Digital technologies, such as distributed ledger technology or blockchain, offer new opportunities for ensuring transparency within supply chains as a new contractual paradigm of “sustainable contracts”. The combined use of innovative technologies allows new opportunities to track product origin and current status, identify suppliers and their reputations, and reduce fraud risks and costs throughout the supply chain.

Limitations

There is a significant limitation of this study since in order to understand the prospects and risks for companies adhering to these principles, it is necessary to study the data of lawsuits. Further research should be aimed at understanding how the positive factors outweigh the costs.

References

Filbeck, A., Filbeck, G., & Zhao, X. (2019). Performance assessment of firms following sustainalytics ESG principles. The Journal of Investing, 28(2), 7–20. Web.

Polychronopoulos, A. (2020). Is ESG a factor?Research Affiliates. Web.