Primarily, an exchange rate is a monetary system of exchanging the currency of one country to that of another. Exchange rates play a significant role in international trade aimed at bringing a balance of capital. The most imperative issue for any country’s trade and domestic pricing is the level at which the exchange rate affects the price of imported and exported goods.

In the past, various countries all over the world have experienced imbalance of trade due to the ever-changing exchange rates. For instance, research shows that skewed change rates make a country’s exports cheaper as compared to other countries. Thus, in order to correct this artificially, a nation must exchange its own currency with another through borrowing contrary to the nation’s wealth (Cathy, p.1).

For instance, in a scenario where exports goods from a meticulous country are of elevated demand, the value of the country’s currency appreciates. This is because many businesspersons are interested to acquire the currency of that country, which will enable them to buy commodities and services.

Thus, countries that engage in business of exporting goods, capital and services enjoy competition and high prices for their goods in international markets due to the fluctuation of the exchange rates. The same case applies to countries that rely on imports.

The fluctuation of the exchange rates causes a fall or rise in the price of commodities and services. A very good example lies in the oil industry. Many oil-producing countries want to keep the value of their currency as low as possible and wait when the US dollar is in demand for them to sell their product.

These countries are aware that exchange rates affect realized income on an investment assortment emanating from overseas fortunes. For instance, if a businessperson owns stock in an overseas company, and the value of the local currency rises by 20 percent, then the value of the investment in the foreign company also rises by 20 percent notwithstanding the change in the stock price (Cathy, p.1).

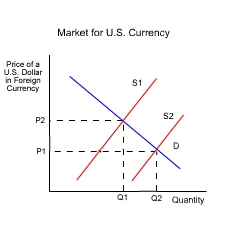

In economics, the rate of exchange rates has a great impact on the demand for exports and imports. For example, if a US Dollar becomes stronger, that is, appreciates its value, the price of exports will definitely rise and imports becomes cheaper. Thus, exporters will be at pain to do business due to the affected circular flow of returns.

Largely, the elasticity of demand for goods, services and agreed conventions determines the level at which exchange rate influences exports and imports. Suppose a dollar depreciates. Then, we expect the demand for exports to rise so long as the demand for United States goods overseas remains elastic.

For instance, assume that economy starts at position X characterized with current account deficit and low value of exchange rate. At first, the volume of imported goods will remain fixed mainly because of the signed contracts. Nevertheless, further depreciation will hoist the dollar price of imports hence, making the price of imports expensive.

This will also affect the export demand by making it inelastic. Clearly, the investment returns from exports will be inadequate to recompense for the elevated expenditure on imports hence, degenerating the current account deficit. Thus, in order to keep the balance of trade fixed, it is better countries keep the elasticties of demand fro all imports and exports more than one, Marshall-Lerner condition. This will influence how an exchange rate depreciates or appreciates (Council for Economic Education, p.1).

Works Cited

Cathy, Jabara. Exchange Rates and U.S. Import Prices: Bilateral and Aggregate. 2009. Web.

Council for Economic Education. Exchange Rates and Exchange: How Money Affects Trade. 2010. Web.