Introduction

Chinese exports and imports have been changing in the last two decades. This report will explain trade patterns as observed in China and will account for the process at which exports and imports are traded in the country. Positive and normative features of china as a global market will be examined including the use of economic theories involved in international trade.

As one of the major economic hub in the world, there has been a steady decline in the imports and exports as depicted in the article. This decline has made the ruling class in the country to take a more explicit pro-growth policy. The problems that are facing the country are that the manufacturing industry in the country is slowing down.

According to Aaron Smith “Chinese factories have been driving the nation’s economy, so the slowdown could have global ramifications. China’s gross domestic product grew at an annual pace of 9.1% during the third quarter, down from 9.5% growth in the second quarter and 9.7% growth in the first three months of the year.” This report will look at the economic implication of steps taken in the country.

Discussion

Case as depicted in the article

Growth in Chinese exports and imports slowed in November, further evidence of the faltering demand abroad and at home that is pushing Beijing towards a more explicit pro-growth policy.

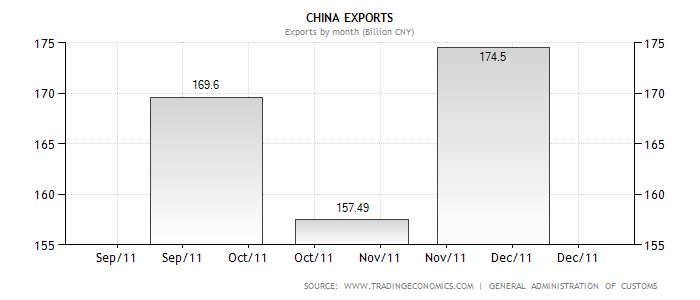

Customs data on Saturday showed exports expanded 13.8 percent year on year in November, the lowest in nine months, but it was the most sluggish performance since November 2009 when the traditionally volatile month of February is stripped out.

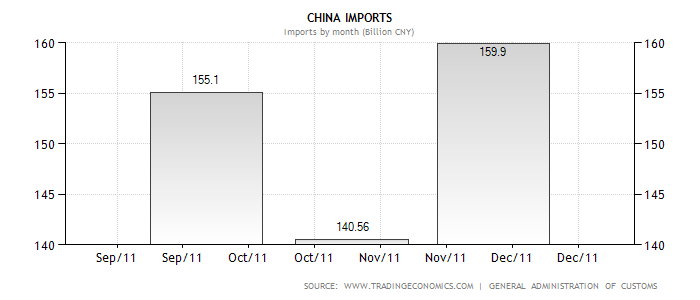

Imports increased 22.1 percent in the year to November, weaker than a rise of 28.7 percent in October, but stronger than September’s 20.9 percent.

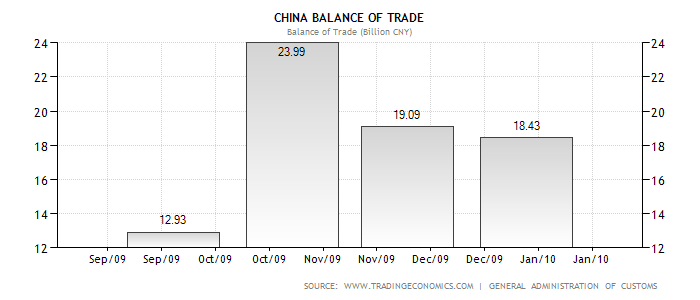

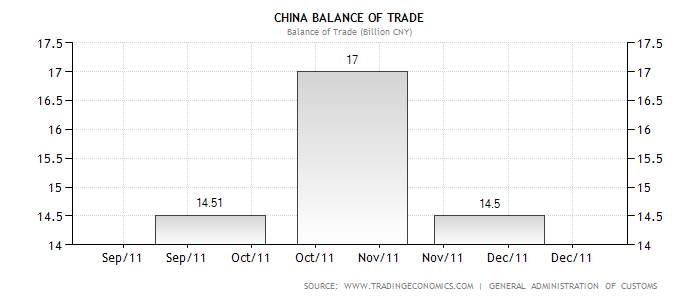

Economists in the benchmark Reuter’s poll forecast annual export growth of 11 percent in November and a 19 percent rise in import, with a trade surplus of $14.3 billion. The surplus turned out to be $14.5 billion, narrowing from October’s $17.0 billion and the same level as in September.

The trade data reinforced a slowing trend in the world’s No. 2 economy, after key indicators on Friday showed a serious risk of a sharp industrial slowdown — accompanied by an easing of inflationary pressure — that is prompting Beijing to provide more support for growth and jobs.

The Communist Party’s top leaders said in a statement hours after the data deluge on Friday that they would ensure stable and reasonably fast economic growth in 2012, fine-tuning policy in tandum with changes in the global economy.

The central bank surprised the market on November 30 with an earlier-than-expected cut in banks’ required reserves, the first such move in three years, signaling a policy shift, although in words, China has so far kept its official line of sticking with a “prudent” monetary policy.

Economic concepts/theories and analysis

From the above graphs, it is clear that the imports have been increasing more than the export levels. The levels of imports increased by in the month of November compared to the previous months while the level of exports increased in the same month. Although there was an increase in the level of exports made by the country it is clear that the economy is shrinking.

This is because the levels of imports are increasing more than the levels of exports. From the graph showing China’s balance of trade, it is evident that there is a slowing trend in the economy of the country. This slow trend in the economy of the country poses a great risk, because if it continues the country will find itself having a deficit, which will negatively affect the economy. When a country starts to record negative economic growth, it signals an industrial slow down.

This slow down in turn reflects negatively on the population of a country, because many will find themselves without employment and this becomes the early indicator of recession. During recessions, many people can barely afford to cover their living costs, let alone their financial obligations such as mortgages and loans. The first hard hit sector is the housing and financial institutions. Countries are thus forced to spend a lot of their reserves and this poses a risk to the overall economic situation in a country.

In response to the situation, the country’s central bank surprised many by cutting bank’s required reserves on November 30. This move was the first in more than thre years and shows the gravity of the economic situation where the levels of imports are increasing than the levels of exports.

The move by the central bank is aimed at increasing the liquidity and therefore ramp up the flow of money in the country’s economy. This is also aimed at making up for the slackening demand for the country’s products in both the local and international markets. The country has been experiencing a rapid growth in the past few years and this has caused many to worry the economy might suffer high levels of inflation.

To tackle this and at the same time prevent stifling the economic growth, the central banks opted to reduce the bank’s reserves requirements. In the previous months, the country had increased the bank interest rates five times and the reserves requirements eight times. The move by the bank is seen as a change in policy making in the country and this shows that the country’s economy may be at a tipping point.

When the banks lower the banks required reserves they inject money into the country’s economy and this acts as a catalyst to development and economic growth. According to Williams, an economist, “The move will ease constraints on bank lending, lowering the reserve requirement by half percent point will be equivalent to injecting 400 billion Yuan.” He continues to state that the move will impact lending, but this will be slow and gradual. He predicts that the effect of this will be seen during the first quarter of 2012.

Conclusion

When the levels of imports in a country increase at a higher rate than those of exports, it places the economy of the country at the risk of shrinking and in worse situations risk of recession. Countries must strive to keep the levels of exports to be higher than those of imports and at the same time try to keep the rate of growth of exports higher than those of imports. In the case of China, the ruling class opted to lower the required reserve levels for banks and this is important if the country is to avert a financial crisis.

Bibliography

Smith Aaron, “China manufacturing slows to 32-month low,” CNNMoney, 2011. Web.

Smith Aaron, “China steps on the economic accelerator,” CNNMoney, 2011. Web.

Chiang Langi and Edwards Nick, “Growth in Chinese exports and imports slowed in November, further evidence of the faltering demand abroad and at home that is pushing Beijing towards a more explicit pro-growth policy,” Reuters. Web.

Thomas Lloyd Brewster, Money, banking, and financial markets. (Mason (OH) : South-Western, cop. 2006).

hang Zhongguo yin, Economic review, Issues 292-300. (Taipei: The International Commercial Bank of China., 1996).