Prices of Raw Materials

Increase in the cost of raw materials boosts the cost of production since raw materials are the main input in the production process which forms a part of the direct outcomes to a firm. At the initial stage, the growth of the costs in raw materials will compel us to increase the unit price our commodities because supply is inelastic in the short run.

Due to increase in prices of the commodity, the demand for the product will reduce if it is a normal good, it will lead to reduction in the goods produced to meet the new demand.

It is important to note that if the elasticity of demand for the product is higher, the increase in revenue, due to growth in price of the commodity, can be far much lower than the loss in revenue due to decrease in demand, and in this case, we might choose to dig deep into our profits (Mankiw 2011).

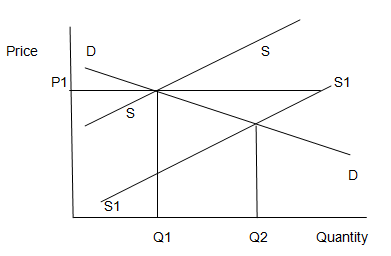

The graph below shows a demand curve that is high price elastic, and any change in price causes a more than equal decline in demand. In a case like this firms are better if they explore options than changing price.

Appreciation of the Local Currency

Appreciation of the local currency means that foreigners will require more of their money for one pound, which means that exports become expensive in the foreign market. These will decrease the amount of goods demanded in the foreign markets, and therefore, the exports will reduce (Ferrington 2006).

However, the decrease in demand depends on the price elasticity of demand for the commodities in the foreign market. If the products’ price elasticity is high, then the fall in demand will be significant, and this will reduce the earnings while increasing costs of holding high inventories, hence our firm might be forced to lower its supply.

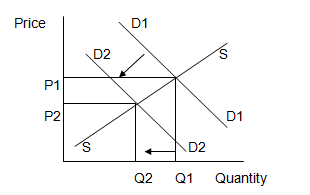

From the figure above, appreciation of the pound causes a shift in the demand curve from D1 to D2, thus, reducing quantity demanded from Q1 to Q2. This may make the firm to focus more on the internal market as opposed to the external market in order to maintain its profit margin.

Increase in Product Popularity

When popularity of a commodity increases, demand for the product boosts as well which shifts the demand curve upwards. The firm producing the commodity may be forced to raise the price of the good since supply is inelastic in the short run (Tucker 2008).

But we are aiming at increasing profits in the future, we will acquire the required inputs to increase production, and this will lead to increase in quantity supplied with time.

However, before deciding to enlarge the output, the reasons for increase in demand should be looked into to ascertain if the demand will still be high in the future.

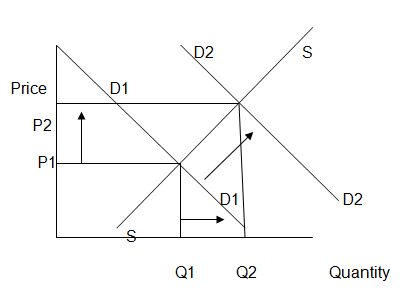

The graph below shows a shift in demand curve rightwards from D1 to D2 due to increase in popularity which augments the quantity demanded at any given price. The firm will be forced to raise the price of the commodity to cater for the excess demand.

Effects of Economic Downturn in Export Markets

If our major export market experiences an economic recession, then the purchasing power of the people in that market reduces, therefore, decreasing the demand for the firm’s commodities.

This will force us to reduce prices in order to boost demand, but the decrease in revenue due to decline in price should be offset by increase in demand for this policy to be feasible. In some instances, the demand might low drastically to the extent that even the reduction in price will not boost enough the demand to cover for the loss in revenue (Rima 2009).

In this case, our firm may choose to cut down the production process and reduce costs by decreasing some inputs like raw materials and direct labor to maintain profitability, or find ways of boosting domestic demand, for example, by cutting down domestic price.

Our firm might also choose to venture to enter into other foreign markets to ensure that demand for its commodity remains steady even when one market is not in good shape (Tucker 2008).

Effects of Increase in Wages

Increase in average wages across the economy has two effects on a firm that produces goods and offers services. To begin with, increase in wage rate means that the firm’s cost of production increases since labor costs raise, and this may mean that the company has to enhance the price of its commodity or accept to fully absorb the costs hike as well as a reduction in profits (Madura 2011).

On the other hand, workers will have higher incomes, and they will, therefore, have a higher purchasing power, which will in turn enlarge the quantity of goods demanded at any given price, causing the firm to push up its commodity prices and supply in the long run.

The overall effect of enhancing the average wages depends on the factor, which of the two effects is stronger albeit price will be surely sent up given that both options lead to hike in costs (Madura 2011).

It should be noted that due to the increase in purchasing power of the people, demand is bound to be higher than the raise in labor cost; hence, strategies of expanding production should be apparent.

Price of Substitutes Decreases

When the price of substitutes decreases, demand for our product lowers as people choose to use the substitutes, while supply remains the same. Our firm may react by cutting down the price of its commodity to counter the decrease in substitute prices or force up the value of its product and make advertisement boost the demand.

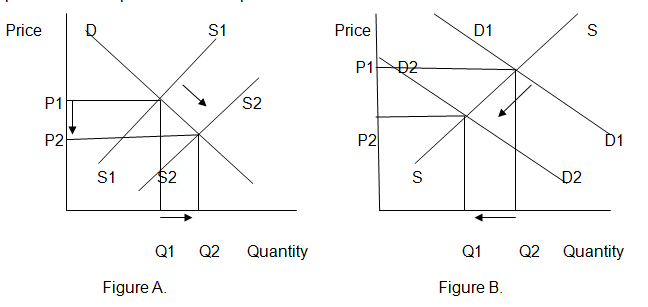

The two figures above shows demand curves for substitute commodities. The decrease in price of one product as shown in figure A from P1 to P2 cause the quantity demanded of the same product to increase from Q1 to Q2 in figure A.

However, this causes the quantity demanded of the substitute product to decrease from Q1 to Q2 as shown in figure B. In the long run the price of the substitutes can also be reduced from P1 to P2 in figure B if the price of the first commodity remains low.

Increase in Production

When production increases, we have to find ways of promoting the demand for the excess production. In this situation, our firm can reduce prices a little bit to encourage people to buy more of the product, though this should be done taking into consideration the price elasticity of demand since it determines the quantity change.

On the same note, increased advertisement will help in creating awareness among people, thus increasing demand.

Feasible Price Cannot Cover All Costs

In this case, our firm has two ways to react in order to enhance its revenue. Firstly, we may choose to reduce costs by improving efficiency in production and cutting down unnecessary costs, therefore improving the profit margin.

On the other hand, our firm can opt to extend the production and diminish commodity prices, therefore increasing demand and consequently turnover if the price elasticity of demand for the commodity is high.

Alternative answers

References

Ferrington, L.M. 2006, Currency and Globalization, Nova Publishers, New York.

Madura, J. 2011, International Financial Management, Cengage Learning, Stanford.

Mankiw, N. 2011, Principles of Economics, Cengage Learning, Stanford.

Rima, I. H. 2009, Development of Economic Analysis, 7edn, Taylor & Francis, New York.

Tucker, I. 2008, Economics for Today. Cengage Learning, Stanford.