Introduction

Fiscal policy is defined as “government’s program with respect to the purchase of goods and services and spending on transfer payments and also with respect to the amount and types of taxes” (Samuelson and Nordhaus 3). The difference between monetary and fiscal policy is that monetary policy is implemented by the government whereas fiscal policies are designed by the national government.

The government of the United State of America is tasked with the responsibility of managing the economic pace, stabilizing of prices and provision of employment. This is achieved mainly through fiscal and monetary policy. Fiscal policy involves the determination of taxes and monetary policy involves regulation of money supply.

Monetary and fiscal policies in the USA during great recession

The government of the USA since the great depression of 1930 has been constantly involved in efforts to find suitable monetary and fiscal policy that will stimulate growth and contribute towards the stabilization of prices.

Monetary policy in the USA is the jurisdiction of the Federal Reserve Bank. It is achieved through the varying of interest rates to either reduce or increases demand. During periods of recession, the interest rate is reduced by the relevant authority to trigger an increased money supply.

Monetary policy is a significant tool widely used during times of recession. Unlike the fiscal policy that is directly under the armpits of serving government, the monetary policy is an independent action of the Federal Reserve which is an independent entity (Policies 1).

The impact of fiscal and monetary policies during the period of recession can be analyzed using the duration analysis. This (duration analysis) models the probability that an event is likely to occur like recession (IMF 116).

Among the monetary measures undertaken during recessions are the interest rate cuts. This however might have limited impact in the times of financial crisis like the one experience during the 2008 unlike fiscal policy which is likely to reduce durations of recession that emanate from financial crisis.

This fiscal policy is achieved through government acting as the last spender. The 2008 recession led to large decrease in consumption rate in households. The fact that the recession was synchronized left limited chance of recovery. The decrease in the consumption rate in the USA resulted to decline in external demand for other countries.

Fiscal policies have been considered the best measure that can cure recession. According to Keynes, fiscal policy solves the real problem. Among the fiscal policies implemented during the great recession are;

Boosting aggregate demand; despite this being identified as one of the policies to be implemented, during the great recession, there has been lack of unanimity on how the aggregate demand can be pushed. During this period the government enlarges its spending with increase in unemployment, cushioning of the jobless and the poor.

This period is characterized by the decrease in tax revenue due to the limited economic activity. Increasing the aggregate demand among the households and the businesses is also another measure that the government undertakes to curb recession. To increase investment the government of the USA provided direct aid to states and firms in form of grants and loans (Tcherneva 4).

In 2008, the government of the USA increased its expenditure, in the era of G. Bush; the injection of government spending was in the purchasing of non performing assets from the balance sheet of ailing banks, despite being carried by the Federal Reserve it was a fiscal policy since Federal Reserve can not purchase private sector liabilities unless ordered by the congress.

The government also injected a lot of cash to the general Motors and the Citigroup besides nationalizing the insurance company AIG. This was aimed at stabilizing the balance sheets of these banks.

President Obama also implemented another fiscal policy referred as American recovery and Reinvestment Act of 2009 (ARRA). This program appropriated $787 billion and $288billion in tax cuts and benefits to both individuals and families. It also supplemented temporary assistance to poor families with emergency funds.

The above policies could not effectively deal with the recession. This is because the measures by the government where not in tandem with what other players did. It happened that when the government increased spending, firms, household and states reduced their spending. Also this had the short term effect of solving the recession since it did not boost the net output.

This government measure was short term since it did not fulfill the desire of the policy makers which was to create employment. The short term effects of these policies were that they helped solve the economic recession by achieving the short term intentions (Tcherneva 5).

The long term effect of ARRA was the creation of employment. It was argued in the Romer-Bernstein report that without the ARRA, the unemployment rate could be as high has 9% and with a strong fiscal policy it could have made it 8%. The reality on the ground was that unemployment was hovering around 10% which was a record high and exceeded the (natural) rate.

The ARRA helped the economy get out of the crisis since it enhanced spending on health care, unemployment and infrastructure. The stimulus package as it is known was aimed at promoting investment and consumer spending

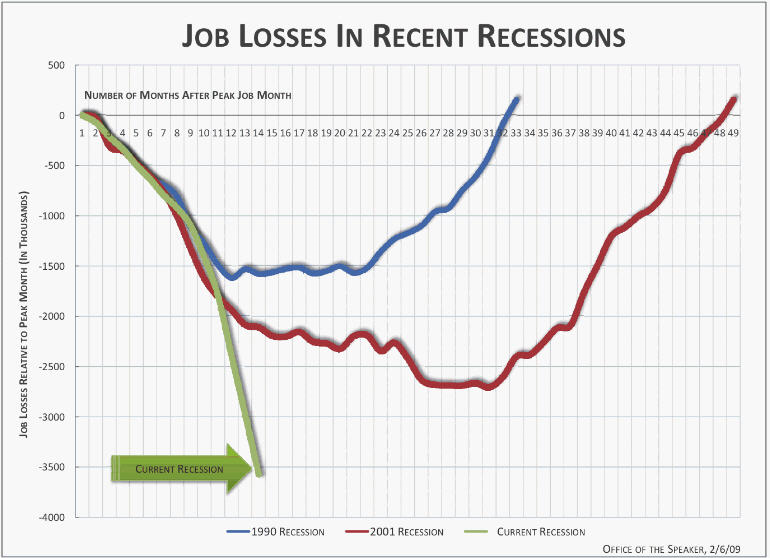

These fiscal policies have not targeted creation of employment but instead interested with the economic growth which is argued could have been the other way round. This was contrary to what Keynes advocated for; this was a direct job creation and not government spending which was short term (Baumol and Blinder 31). The following graph indicates how the global recessions led to massive unemployment in the USA.

Among the monetary rates implemented by the USA during the recession included the following:

- Cutting the interest rate; the federal reserves’ response to the inflation was to cut the interest rate by up to 500 percentage point. This was implemented by the federal open market committee (FOMC). Although this was unconventional way but it was considered a viable option for cutting the inflation.

- Increasing liquidity in banks; this was done after the collapse of the Lehman brothers. This however was not substantial to curb the crisis since despite the presence of ample liquidity in banks, there were still concerns about bank capital and its assets and hence credit risk could limit the ability of banks to extend credit, this left companies without any specific sources of funding.

This was implemented through the introduction of exceptional long term operations and also through modified discount window. This was aimed at breaking the shortfall of money supply and also to lengthen refinancing operations (Katkov 27).

The Federal Reserve also introduced the policy of term action (TAF) and the term securities lending facility (TSLF). This was aimed at providing liquidity to wider parties. Lastly, the Federal Reserve introduced the policy communication which was aimed at improving its communication with the markets.

The effects of these policies were that banks improved their lending capacity; this had the effect of creating a higher risk of defaulting and two banks could charge a high interest rate to enable them offset this risk (Janus 17).

The increased supply of credit would prove dangerous to the economy. The practice of commercial banks lowering interest rates led to an increase in money supply in the market and also increase demand for investment goods. The fall in interest rate is only a temporary measure, Ricardo also argued that increased domestic money will act as an austerity measure that will excite the common citizens but will not provide a solution to the problem of recession (Ricardo 266).

Conclusion

The policies that were used by the Federal Reserve were considered unconventional and were only aimed at achieving short term objectives and quickly arresting the recession. The long term measures were not considered and hence still places the United States at a higher risk of experiencing a recession due to its inability to overcome another recession. There is a need for long term solutions.

Regarding to the fiscal policy, several scholar and economic commentators have described them as just austerity measures which were formulated to solve the short term issues. The provision of employment which is considered a long term issue was not adequately addressed.

The increased government spending can not in any way contribute to economic growth. The creation of employment is considered the long term plan which can provide permanent solution. Yes both policies helped mitigate the recession but they did not factor in the long term solutions.

Works Cited

Baumol, William and Blinder, Alan. Macroeconomics: Principles and Policy. New York: Cengage Learning, 2010. Print.

IMF. Crisis and recovery: World economic and financial surveys, World economic outlook. New York: Prentice Hall, 2009. Print.

Janus, Jakub. The monetary policy response to the late 2000s recession in the United States. Macroeconomy, 2010. Web.

Katkov, Alexander. The great recession of 2008-2009 and Government’s role. Johnson & Wales University, 2011. Web.

Policies. Fiscal policy versus monetary policy. Faculty, 2011. Web.

Ricardo, David. Critical assessments of leading economists. New York: Routledge, 1992. Print.

Tcherneva, Pavlina. Fiscal Policy Effectiveness: Lessons from the Great Recession Levy Economics Institute of Bard College. Levy Institute, 2011. Web.