The Best Approach for Setting Prices Worldwide

Setting commodity prices is a complex exercise that calls for multiple considerations; the exercise becomes even more complex when commodity prices are set for foreign markets.

There is no single best method to set price globally, however, there are some factors to be considered; international prices are affected by currencies differences, trade barriers like taxes and logistic channels adopted by the exporting company.

To set international prices a company has to consider total costs incurred to deliver the commodity to the market; after accounting for all the process, then a margin of profit is added on the cost to reach at the commodity price; it is important to consider prices of similar and compliment commodities when setting the final price.

The main determinant of price will be the price charged by competitors and the target market that a company targets. The best pricing model to use is price discrimination and price skimming strategies of price determination (Carlon, 2009)

Variables to Be Considered for Foreign Customers

The following are the variable to consider when setting prices globally:

- Taxes and duties charged on the products

- Cost of production incurred either in the country of manufacture or the country that the goods will be sold

- the target market and the expectation they have regarding something will also be factor to consider – though it cannot be given a monetary figure, marketers should be aware that they will consider it.

- Fixed costs in the country of production; these cost include but not limited licenses fees, rent and administrative costs, cost of transport, insuring costs and labor costs.

Where Pricing Decisions Should Be Made in the Global Company

Prices for commodities in the global markets should be set in two different stages/places

The first’s stage is from the country of exportation; at the factory, the factory determines the price of the goods; the cost includes freights and insurance when transporting the good to the port of destination. (The cost is called CIF (Cost, Insurance and Freight).

The second point of price determination is at the country of sale, the office adds all costs incurred in the country to determine the total cost of the commodity. The final selling price of the commodity is determined as the sum total of all costs incurred to reach the commodity at the store plus a profit margin that the company wants to get (Maskell, 2003).

Should Prices Vary Across Markets?

The price of commodity cannot be the same in different countries; this is because there are different expenses that are incurred in different countries and unique to that particular country; for example import duties are dependent with a country at hand. When selling to different classes of people, prices should be different; the use of price discrimination as a tool of pricing helps in selling the same product at different people at different costs.

Prices for commodities should not be static since they are determined by other factors that keep changing; a company cannot afford to have constant prices.

The Role of Price in International Competitive Strategy

In the international market, the role that prices play is an active role, which depends on the target market that the commodity addresses; if the international company has good reputation, it can sell its products expensively and ride on the advantages offered by its strong brand.

Alternatively, if the country is able to produce at a low cost that the cost of the market country, then prices can play an active role in international competition. If prices change in international markets, then a company should be willing to adjust the prices downwards. Prices can be used as a market entry system thus; it has an active role in international market (Nagle and Holden, 2002).

How Pricing in Global Markets Is Related to a Firm’s Objective(s)

The main objective of an organization is to make profits and grow its capital base; to do this the need for products to be sold at a profit margin should be realized. The price sold in international market determines the profit margin of a company; thus it affects the objective of a firm directly.

Another main objective of a firm is to diversify in international markets and remain a leader in the market; price that commodities are sold determines the success in the international market as well as the market share.

The Essence of Organizational Objectives

The following are the main firms’ objectives

- maximize profits

- grow it shareholders wealth and ensure that all stakeholders interests have been taken care of

- Product development and ensuring that the company maintains a leadership role in the industry it is engaged in.

The reason why organizations have objectives is to ensure that they are able to be accountable to their stakeholders using a set mechanism of evaluation; objectives also define why an organization is in existence (Noreen, Brewer and Garrison, 2011).

Economic Theories Supporting Pricing in Global Markets

International marketing theory, cultural intelligence theory and the free trade theory support pricing in global markets, according to international marketing theory, a marketer should analyze target market and determine the forces that are likely to affect the prices set. The company should ensure that its prices are competitive.

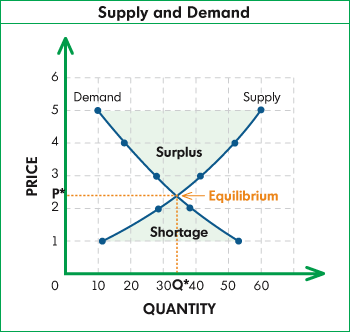

Free trade theory advocates for minimal government intervention in national and international trade and giving forces of demand and supply a chance to determine commodity prices.

Environment Effect on Pricing in Global Markets

Economic, social, and market forces changes in the international market influences commodity either prices upwards or downwards, for example if the rate of import duty reduces the cost of production of a commodity will reduce thus the company can sell cheaper (Ison and Stuart, 2007)

Consumer Decision-Making

The graph below shows how consumer decides with differences in prices charged to commodities in international market.

(Ison and Stuart, 2007)

References

Carlon, S. et al., 2009. Accounting: Building business skills. New York: John Wiley & Sons.

Ison, S. and Stuart, W.2007. Economics .New York: FT Prentice Hall.

Maskell B.2003. Practical Lean Accounting. New York: Productivity Press.

Nagle, T. and Holden, R. 2002.The Strategy and Tactics of Pricing. New York: Prentice Hal

Noreen, E., Brewer, B. and Garrison, H.,2011. Managerial accounting for managers. New York: McGraw Hill.