- Economy of Greece

- History and the decline Greece economy

- Emergence of economical crisis in Greece

- The main economical crisis in Greece

- Effects of Greece economical crisis

- Measures to curb the current economical crisis

- How European Countries are helping Greece to resolve its economical crisis

- Conclusion

- Works Cited

Greece economical power has been deteriorating every year. Currently, the country is facing a major economical crisis and it has been reported that the current poor economical situation in Greece has affected day-to-day lives of the citizens. Most people are struggling in order to meet their basic needs.

Because of this severe economical crisis, many economical analyst and other economists have predicted that Greece will face major economical hurdles in the future since the current level of debts are devastating. In this paper, we shall provide a general overview of the Greece economical crisis.

Throughout the discussion, the paper will highlight the main economical problems faced by Greece, the major causes of economical crisis, how the current economical crisis is affecting other European countries, and the measures that Greek’s administration has put in place to address the devastating economical crisis.

Economy of Greece

Before discussing the current economical crisis in Greece, it is imperative to provide a general understating of Greece economical status for the past few years. By providing such an overview, we will be able understand how the current crisis emerged and how deep the problem is.

According to the world trade organization and World Bank, Greece has been an economical powerhouse for a long time (Petrakis 12). According to another report released in 2010, the economy of Greece was ranked number 32 in the world in terms of nominal gross domestic product (GDP) (Charter 23).

According to the same report, Greece was also ranked as the 37th largest purchasing power in the world (Charter 23). Because Greece is an economical powerhouse as well as a well-developed country, it has earned a membership in the European Union, Eurozone, World Trade Organization, the OECD, and the Black Sea Economic Cooperation Organization (BSECO) (Telegraph Media Group Limited).

On the other hand, Greece is one of the most developed countries in Europe and for many years, it has always been categorized as a high-income country (Telegraph Media Group Limited).

In addition to this, it has been reported that Greece’s service sector brings about 78 percent of the gross domestic product (GDP), industry brings 17.9 percent, and agriculture brings 3.3 percent (Telegraph Media Group Limited). Other public sectors including tourism contribute about 40 percent of the total economical output (Telegraph Media Group Limited).

History and the decline Greece economy

A study of the Greece economical history shows that Greece became economically stable during the 19th century due to the great industrial revolution (Lynn 4). Recent research on economical development reveals that Greece has had a gradual economical growth over the years, which can be attributed to development in shipping industry and agriculture (Lynn 10).

It has also been reported that Greece experienced economical hardships towards the end of the 19th century (Lynn 11). Other similar studies have also revealed that Greece became an economical powerhouse after the World War II. The Post World War II economical growth in Greece is popularly referred as “the Greek economical miracle” (Charter 31).

Looking at Greek’s history, it becomes apparent that Greece entered the Eurozone as early as 2001 (Charter 14). It is clear that economical development of Greece has been positive since the year 1961. For a very long time, “Greece has enjoyed a high standard of living and good Human Development Index (HDI) ranking top fifty in the world” (Lynn 15).

Over the years, Greece has enjoyed economical benefits from tourism, shipping, agriculture, textiles, chemical, metal products, mining, and petroleum products (Charter 32).

On the other hand, Greece economy has also faced many challenges slowing development in this particular country. Among the major challenges, include a number of significant problems such as rising unemployment, tax evasion, rapid corruption, and poor global competitiveness (Belkin 5). These among other factors have contributed to the current economical crisis in Greece today.

According to the EU data, Greece has been reported to have the worst corruption index (Belkin 5). In terms of corruption, Greece has been ranked second in Europe after Bulgaria and it ranks 80th in the world (Belkin 8).

According to another report released by World Bank, corruption and tax evasion are the two major factors that have contributed to current economical crisis in Greece (Belkin 8). In fact, because of these two issues, Greece has not been able to overcome its ever-growing debts.

Emergence of economical crisis in Greece

As already mentioned, Greece has been an economical powerhouse for many years and its economical position has been a positive one since World War II (Petrakis 43). After a long period of economical development and growth, Greece went into recession in the year 2009 (Petrakis 43).

A study of the past economical trends reveals that for some time Greece has had a behavior of over-lending, which has contributed to loans exceeding hundred percent mark (Petrakis 44). This trend became more pronounced in the year 2009. It has been reported that by the end of 2009, Greek’s economy began deteriorating rapidly.

In the same year, Greece experienced the highest budget deficit and the government recorded the highest level of debts in the EU (European Union). In fact, in the year 2009 alone Greece’s budget deficit rose high above 15 percent mark. Because of this and other problems inclding the rising debts, borrowing cost emerged causing a severe economical crisis (Petrakis 42).

Towards the mid of year 2009, Greece was accused of attempting to cover up its huge budget deficit during the time when the world was facing an economical crisis too (Telegraph Media Group Limited). Because of this particular issue, the new socialist government that was appointed in 2009 revised the budget and this saw a reduction in the budget deficit by significant figures (Telegraph Media Group Limited).

Because of the continued economical crisis in Greece, there was a decline in shipping and industrial production, which was recorded to have dropped down by 8 percent (Charter 14).

Between the years 2010 and 2011, the industrial sector of Greece was the hardest hit. To be more specific, the garment industry and the housing sector were most affected and it is said that building activities recorded a massive reduction by 73 percent between 2010 and 2011 (Charter 41).

In addition to that, unemployment rates increased in a big way. It is estimated that unemployment rates skyrocketed by over 10 percent from as low as 7 percent to 20 percent (Belkin 9). This increase in unemployment rates saw over 900,000 people being laid off (Belkin 9). Because of this massive unemployment rates, the number of unemployed youths also rose up to 36 percent causing another major crisis in Greece.

The main economical crisis in Greece

Greece was accepted into the Economic and Monetary Union of European Union (EU) in the year 2000 after the European Council assessed the Greece economical crisis (Belkin 11). During this time, Greece had recorded high rates of inflation, budget deficit, increased public debts, and long-term interest rates (Belkin 12).

After an audit done in 2004 by the new socialist government, European statistics commission (Eurostat) revealed that the budget deficit was extremely high (Belkin 11). Today, Greek’s economical crisis is one of the biggest problems Eurozone is facing (Lynn 32). In fact, because of the economical crisis in Greece, the European Union has signed an agreement to use funds from both Europeans countries and International Monetary Fund (IMF) to help ‘financial-crippled Greece” (Lynn 42).

The main economical crisis in Europe has emerged as a result of years of unrestricted spending, cheap lending and lack of timely financial reforms (Lynn 22). These and other numerous factors left Greece stuck in a position of poor economical growth during the time when global economy went down too. Since the extent of the problems was beyond control, the level of debts in Greece exceeded the actual limits set by Eurozone.

It’s no doubt that the current debts are very high. In 2009 Greece debts was recorded to be standing at $ 413.6 billion (roughly about three hundred billion Euros) (Lynn, 47). Because of the decreasing economical trends in 2009, many financial analysts predicted that the debts would increase to 120 percent in 2010 (Charter 51). As per now, the current deficit is estimated to be standing at 12.7 percent (Charter 54).

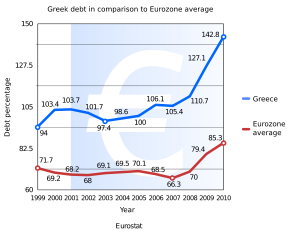

Greece’s debt crisis

Graph: shows Greek debts compared to Eurozone Average (Petrakis 124).

The year 2009 is recorded as the worst financial year for Greece. It is said that in the year 2009, Greece faced major economical challenges resulting to the highest deficit ever (Charter 36).

Year 2009 marked the beginning of major economical crisis in Greece. At the end of 2009, Greek economical situation worsened and it experienced the most severe economical crisis (Telegraph Media Group Limited). This was caused by a number of factors such as the world financial crisis, uncontrolled spending and poor budgeting by the government (Telegraph Media Group Limited).

On the other hand, it is also said that Greek’s government was deliberately reporting false economical statistics in order to remain within the Monetary Union Guidelines (Eurozone) (Telegraph Media Group Limited). During this time, Greek continued to spend beyond its means.

Eurostat carried out another audit in May 2010 and the result revealed that the government deficit was around 13.5 percent, which is one of the highest deficit recorded in the world in terms of GDP (Petrakis 61). Because of the high deficit in Greece, there was a crisis in international community as it lost confidence in Greece’s ability to repay its debts (Petrakis 61).

However, after some consideration the international community including IMF and other Eurozone countries agreed to help Greece in resolving its financial crisis (Lynn 64). In order to receive a loan, Greece was supposed to meet some conditions. In May 2010, the IMF and Eurozone gave Greece a loan of about €45 billion (Telegraph Media Group Limited).

After being granted the loan, the Eurozone required Greece to develop strict monetary measures (Lynn 34). In addition to this, the European commission, European Central Bank, and the International Monetary Fund insisted that they must continue to evaluate the adoption and implementation of all the proposed measures (Telegraph Media Group Limited).

Today, the financial crisis and the strict measures put forward by EU and the IMF has contributed to mass actions, chaos, and public riots by the citizens across Greece (Lynn 27). However, despite of the loan granted to Greece and the strict measures, the government deficit has not decreased as expected. According to different economists and financial analysts, the budget deficit has not been reduced due to the subsequent recession (Lynn 56). As a result, Greek’s debt has recorded a continued rise.

Effects of Greece economical crisis

As already mentioned, Greece’s ability to repay its debts is one of the biggest problems the government is facing at the moment (Petrakis 112). After an extensive assessment of its ability, the Eurozone has reported that Greece’s potential to pay its current debts has been declared almost impossible.

Because of this issue, it has been viewed that Greece will soon become “a financial black hole” and people will shy away from making investment in this country (Petrakis 116). This means that the current financial crisis is likely to deepen since the country will continue struggling to repay debts as the interests rates also continue to increase (Petrakis 121).

The only solution that can really work is for the current government (The Greek government of Prime Minister George Papandreou) to implement harsh measures, which will reduce the national spending (Telegraph Media Group Limited).

On the other hand, it is very important for the government of Greece to make proper consideration that would not negatively affect other European countries. In its current economical state, Greece is already in a very bad financial position and it has already breached some of the Eurozone policies regarding deficit management (Telegraph Media Group Limited).

Because of this, fears are emerging that the current economical state of Greece will have severe effects on other European countries. The main worry is that, the behavior of breaching Eurozone policies by Greece will be infected to other European countries that are also facing economical hardship (Telegraph Media Group Limited).

Measures to curb the current economical crisis

What is Greece doing to control the current economical situation? This is a question of whether Greece government is committed to restore its country back to a state of financial stability. Indeed, Greek’s government is committed towards restoring economical stability.

Foremost, the government has begun reducing spending and it is already implementing economical policies, which are aimed at reducing the current deficit by not less than €10 billion (Telegraph Media Group Limited). As such, the government has increased tax on basic commodities and products including fuel, alcohol, tobacco, developed tough tax evasion penalties, raised the retirement age, and forced public sector pay cuts (Belkin 13).

However, because of these measures by government, chaos has been reported across the country. In some of the big cities, people have staged strikes abandoning work and closing airports, offices and schools (Petrakis 113). The bad news is that this kind of mass action has been on the increase and is expected to become more rampant in the near future (Petrakis 110).

How European Countries are helping Greece to resolve its economical crisis

Most of the European countries are committed to help Greece overcome the current economical crisis. Led by Germany’s Chancellor Angela Merkel, all the European countries (16 countries that make up the Eurozone) have signed an agreement to help Greece restore its economical status (Charter 67). This move by the European countries is being seen as the “last resort that will involve co-ordinate bilateral loans” from all countries in Eurozone which use the common currency (Charter 71).

In a move to help “the sailing neighbor”, most of the economically stable countries in Eurozone will contribute loan based on the GDP and population size (Lynn 71). However, all the 16 countries will contribute the loan once Greek’s government fails to access funds from international financial markets like IMF (Lynn 71).

According to EU and European Commission, based on the GDP and population size Germany will contribute the highest amount followed by France (Lynn 73). However, it is not clear how much each country will contribute but according to other sources (particularly, European Commission officials), it is estimated that each countries will contribute about € 20 billion (Telegraph Media Group Limited).

Conclusion

According to the World Trade Organization and World Bank, Greece has been an economical powerhouse for many years. However, for the last few years Greece’s economical status has been deteriorating every year and today the country is facing a major economical crisis.

Recent research on economical development reveals that Greece has had a gradual economical growth over the years, which can be attributed to development in shipping industry and agriculture. In the past few decades, it has also been reported that Greece experienced economical hardships especially towards the end of the 19th century. Today, Greek’s economical crisis is one of the biggest problems Eurozone is facing.

According to Eurostat, 2009 is recorded as the worst financial year for Greece. It is said that in the year 2009 alone, Greece faced major economical hurdles resulting to highest deficit ever. Year 2009 marked the beginning of major economical crisis in Greece. On the other hand, Greek’s government and other European Countries are committed towards restoring economical stability in Greece.

To shows its commitment, Greek’s administration has started reducing spending and it has also began implementing tough economical measures which are aimed at reducing the current budget deficit. With the help of all Eurozone countries, there is hope that the current economical crisis in Greece will eventually be eradicated.

Works Cited

Belkin, Paul. Greece’s Debt Crisis: Overview, Policy Responses, and Implications. 2011. Web. <https://fas.org/sgp/crs/row/R41167.pdf>

Charter, David. Storm Over Bailout of Greece, EU’s Most Ailing Economy. Time Online: Brussels, 2010.

Lynn, Matthew. Bust: Greece, the Euro and the Sovereign Debt Crisis. New Jersey: Bloomberg press. 2011.

Petrakis, Panagiotis. The Greek Economy and The Crisis: Challenges and Responses. Indianapolis: Springer Inc, 2011.

Telegraph Media Group Limited. Eurozone Bail-out ‘Not Big Enough’ as Greek Debt Worries Grow. 2012. Web.