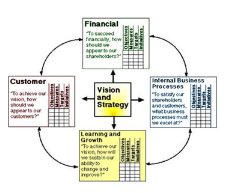

Financial Perspective

The example of Toyota company best suits here which puts the financial perspective on priority in comparison to the other three perspectives of the scorecard. The company suffered from the basic three worse scenarios of the downfall of the Detroit auto industry, the failure of the financial market, and the gap in Toyota’s quality control. As a result, the company had to suffer from damage to property, peculiar injury, and the recall of the products.

The dilemmas of Toyota quality control loss are more prominent due to the internal changeover that arose. This indicated that the company shifted from its roots of working in cultural involvement and interests to the self-interest and self-protection. The deviation from the root is evidenced by deviation from employees and society development, excellence in operations, and quality improvement. The hurry in greater financial profits collapsed the historical reputation of the company and made the company vulnerable and questionable in the eyes of its internal and external stakeholders.

Customers

Almost all organizations have relevant and non-relevant customers. The only thing is that the objective of the business decides the nature of the customers. These businesses have to do a careful distinguishing in which customers are relevant and which ones are not. Relevant customers are usually direct buyers of the products and services whereas the investors and internal customers are non-relevant customers for the business (Duff, 2017).

The example of Wal-Mart and Kmart are appropriate as the Kmart was leading the market until Wal-Mart approached. Kmart was unable to identify till a long time due to the constant profitability of business unless the market was taken over. Later strategically changes were made in Kmart but it was too late and the strategical segmentation of relevant and non-relevant customers in the business made Wal-Mart the giant retail chain with approximately $378 billion (Reuters, 2017).

Business Process Perspective

The stakeholders are the most vital parts of any business, but at the same time, they are highly inappropriate for each other in respect of their interests that conflict with one another. Such incidents are quite common in all organizations whether small or big.

The simple example is that the corrosion repair company should use waterborne equipment to save the atmosphere whereas they are unable to do so because of the high cost and expenses required shifting to new technology raising the conflict between CSR and Finance dept. stakeholders (Pérez, Montequín, Fernández, & Balsera, 2017). In MNC the Production manager stake is optimum production without flaw whereas the Quality manager stake is to find flaws in the production creates conflict. The conflicts of stakeholders can be minimized with the help of Stakeholder Analysis to understand the potential stakeholders and what they are interested in to put their maximum efforts, ultimately giving the company the maximum profit (Keyes, 2016).

Ability to create more value for customers

This is a future-based question for the companies that are having the involvement of the shareholders, stakeholders, customers, and the internal strategic process of the business. The more a company invests in learning, innovations, and development, the higher are the chances of value-added to the business (Duff, 2017). This question unfolds the intangible ability of a business to enhance business and integrate it into new markets.

Some companies are focusing to improve the future like a semiconductor manufacturing company relies on points for improvements like time cycle, delivery, yields, and the rate of the defect. A well-known company named Milliken & Co. implemented a one-four plan for improvement in which the employees are asked to reduce the count of deliveries missed, defects in the process, and the number of scraps to be reduced by ten factors in the coming four years. The major impact on value to the customer relies basically on the people, systems, and procedures of an organization (Stella, 2015).

References

Duff, V. (2017). How Can Stakeholders Negatively Influence a Project? Web.

Hong, S. G., Siau, K., & Kim, J. W. (2016). The impact of ISP, BPR, and customization on ERP performance in manufacturing SMEs of Korea. Asia Pacific Journal of Innovation and Entrepreneurship, 10(1), 39-54.

Keyes, J. (2016). Implementing the IT Balanced Scorecard: Aligning IT with Corporate Strategy. CRC Press.

Pérez, C. Á., Montequín, V. R., Fernández, F. O., & Balsera, J. V. (2017). Integration of Balanced Scorecard (BSC), Strategy Map, and Fuzzy Analytic Hierarchy Process (FAHP) for a Sustainability Business Framework: A Case Study of a Spanish Software Factory in the Financial Sector. sustainability, 9, 1-23.

Reuters. (2017). Wal-Mart Stores Inc (WMT.N).

Stella. (2015). Implementing A Balanced Scorecard In A Not-For-Profit Organization. Web.