Gains from International Trade

Comparative advantage states that countries should specialize in areas where they have their greatest advantage (if they have absolute profit in both products) or their smallest absolute disadvantage (if they do not have any absolute advantage in both products). Fundamental trade patterns are determined by comparative advantage. It is helpful in the comprehension of the foundation of a mutually benefiting trade relationship which can exist between a developing and a developed country. It also highlights how wages can be high in one country and yet the country’s products are still in a position to compete in the world market (Bhagwati et al. 1996).

Lastly, it demonstrates the profits derived from international specialization in production. A country is said to have comparative advantage in production of a product if the opportunity cost of producing that product is less for that country than for other countries. Opportunity cost is the potential production of other products a country must abandon to produce only one product (Choi 2003).

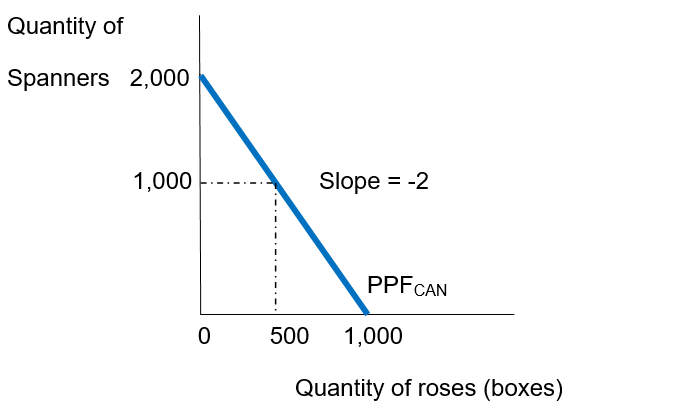

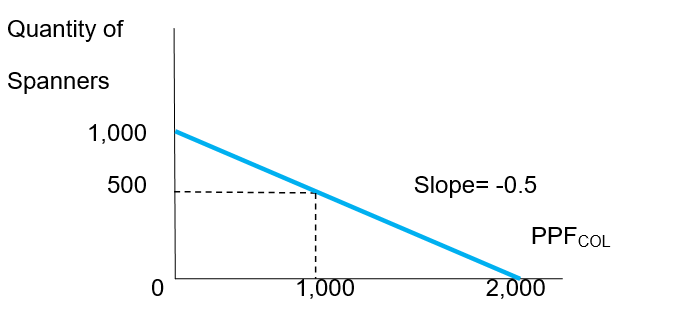

Production possibility frontier means that the opportunity costs in producing a product rises as more of the product is produced. It usually prohibits total specialization by a country in the production of a product at the cost of producing other products. As the production possibility frontier increases, the opportunity cost also increases.

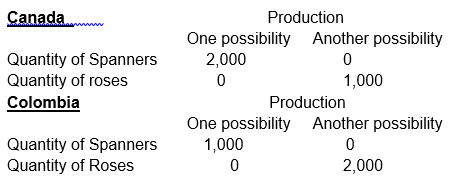

Production possibilities

Canada has an opportunity cost for a box of roses in terms of a spanner of 2: This means 2 spanners must be forgone for every one box of roses produced. For Colombia, the opportunity cost of a box of roses in terms of a spanner is 0.5: This means that 0.5 spanners must be forgone for every one box of roses produced. Canada, therefore, has a comparative advantage in spanners while Colombia has a comparative advantage in roses.

Effects of trade on welfare

The effects of international trade on welfare depend on two propositions or states. In the first proposition, there is free trading; this means no obstacles are set in place to international trade. The effect on welfare is that there is large compensation and a competitive world equilibrium where no individual in the country is worse off than in autarky. The second proposition is where the country involved in international trade sets up a custom union which is expected to be gainful.

In this situation, the world trading equilibrium is disturbed (Feenstra 2004). A custom union is comprised of two or more countries, and deals with aspects of international trading. By setting up trade tariffs, the net effect is that the state of those within the union is worse off than before they were set up. Another effect on welfare is that there is a net compensation accrued by those belonging to the union due to revenues from tariffs.

By engaging in international trade, a country’s population can now have a variety to choose from in the market since what they cannot produce they import (Feenstra & Taylor 2008). The production of its people also increases since they will produce more so as to be able to export to other countries where there is demand. A danger that international trade poses to the people’s welfare is the risk of flooding the market with substandard goods from other countries or the failure of local commodities in preference to international ones (Trebilcock & Howse1999,).

Effects of trade on prices

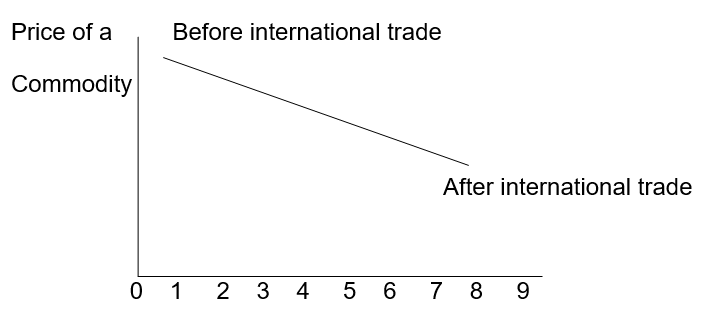

International trade creates an environment where the prices for a commodity become low since a country will be importing the same products at a lower price compared to locally produced commodities. The import of less priced commodities leads to lowering of prices for the locally produced commodities due to the competition situation introduced. Competition leads to favorable prices for the people of a country (Mankiw et al. 2009). The increase in the number of suppliers for a similar commodity is beneficial for its citizens. In a situation of international trade where tariffs are set in place, the prices of commodities that are imported are raised. This makes it hard for many consumers to make purchases of the imported product (Lach 2007).

Gains from International Immigration

Effects of Immigration on Welfare

International immigration leads to gains and losses that are felt by the natives. The gain on the accumulated level is known as the ‘immigration surplus’. Among the gains of international immigration on the welfare of the natives is the increased production and supply of products. This is because of the increase in workforce that is contributed by the immigrants (Markusen 1995). The owners of companies and industries, therefore, gain since production is increased which translates to more sales made than before.

A loss can be suffered by native workers since their wages are decreased. The owners of industries will employ more workers and still use the same total amount to pay wages, therefore, it means the same amount is divided among many more people.

There is therefore an increase in the returns accrued from capital and a decrease in the wages. The shift depends on the number of immigrants. For the immigrants, there are benefits of newer opportunities for employment in other countries and newer markets for them to invest in (Grossman 2008). The losses felt are due to closure of companies when the owners emigrate; the country where the company was located loses the products that are being produced by the company. This also leads to loss of income for families or individuals who were previously employed by the company.

Effects of Immigration on Prices

Aggregate immigration has a larger effect on prices. It has an impact on the prices of basic food items that the immigrants are likely to consume and the prices of basic services they are more likely to produce. The impact on the basic commodities can be compared to and usually are more than that on the average goods in terms of specification in consumption. The relative inflation that is, therefore, created is due to an increased demand brought about by immigration in the face of constant supply. An increase in product supply is triggered which leads to increased employment due to the now needed labor. The situation of low unemployment that is created leads to low inflation and, therefore, low prices (Frattini 2008).

References

Bhagwati, JN, Feenstra, RC, Grossman, GM, & Irwin, DA 1996, The political economy of trade policy: papers in honor of Jagdish Bhagwati, MIT Press, Cambridge.

Choi, EK 2003, Handbook of international trade. Blackwell Pub, Maiden.

Feenstra, RC & Taylor, AM 2008, International trade, Worth Publishers, Newyork.

Feenstra, RC 2004, Advanced international trade: theory and evidence, Princeton University Press, Princeton.

Frattini, T 2008, “Immigration and Prices in the UK,” unpublished manuscript, University College London.

Grossman, GM 2008, Handbook of international economics (2. print. ed.), Elsevier, Amsterdam.

Lach, S 2007, “Immigration and Prices,” Journal of Political Economy, vol. 115, no. 4, pp. 548-587.

Mankiw, NG, Croushore, DD & Stull, CA 2009, Principles of economics (5. ed.), Dryden Pr., Fortworth.

Markusen, JR 1995, International trade: theory and evidence (International ed.), McGraw-Hill, Newyork.

Trebilcock, M & Howse, R 1999, The regulation of international trade (2. ed.), Routledge, London.