Thesis summary of Animal Spirits

There has always been arguments over the last few decades between different economists on the appropriate policies that should be taken to help resolve serious economic crisis that affect different countries of the world. Since Adam Smith era up to the times of Keynesian and Classical theories, so many opinions have come up to help curb the crisis. Animal spirits as referred to by Akerlof and Shiller support the Keynesian approach that emphasize the importance of government intervention in economic activities (Akerlof and Shiller 15).

According to Animal Spirits, many problems facing various countries could only be avoided if the state could be allowed to play some role in controlling and regulating the economic activities in the market. Animal spirits identifies five aspects that affect economic decision making and are confidence, fairness, corruption and bad faith, money illusion and stories. The free market mechanism has been unable to yield fruits and the past recessions and depressions have been due to the government’s reluctance to intervene in the markets and give the necessary support.

The economies have been collapsing before the public eyes since no action has ever been taken. What shocks the two economists is the fact that even after the free market mechanism failed in several instances, the policymakers did not think of trying alternative policies. Those who went through the great depression are in a position to appreciate the importance of regulatory principle. Financial markets should not be left freely to operate and this is what has been causing much public outcry (Akerlof and Shiller 21). The government plays an important role in capitalist societies and if they are not watched over closely serious economic damage can occur. Animal spirits hold that since credit markets collapsed, two goals should be aimed to avoid the repetition of the same mistake.

Aggregate Demand (AD) that should be enhanced by fiscal and monetary policy to achieve full employment demand levels is the first target. Secondly, since investors have lost trust, government should come in and help credit markets. Some countries like US have succeeded in meeting these targets. The first target has been addressed through stimulus package since president Obama came to power. The second has been achieved through expansion of balance sheet assets by three times since 2007 to aid in replacing credit markets that almost collapsed in 2008 (Akerlof and Shiller 21).

In a move to get economy moving, all the possible plans must be tried until a workable decision is reached. Microeconomics reforms that can be approached through three different perspectives are recommended. One, since past experience has proved that previous system failed to provide sufficient safeguards to protect financial institutions from going bankrupt, it is essential that financial regulation be put in place. Secondly, there is need to impose bankruptcy law by governments that take into consideration the employees and public interest and these will make financial institutions more careful while dealing with public.

Thirdly, appropriate policies like taxation techniques must be put in place to address the gap between the rich and the poor. Animal Spirits warn of a possible repeat of 1930s Great Depression that left many people jobless. This is because economists, states and the public have become complacent in the recent past and forgotten what happened in 1930s. During the Great Depression, Maynard Keynes produced ‘The General Theory of Employment, Interest and Money’. He emphasized how successful governments could borrow and spend thus restoring employment (Akerlof and Shiller 29).

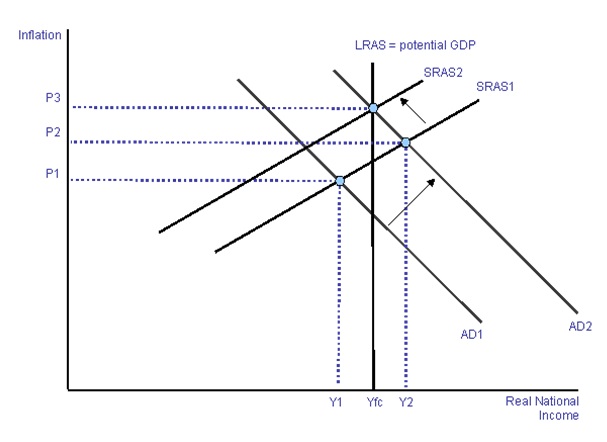

Aggregate Supply-Aggregate Demand (AS-AD) and Phillips curve Model

Assume in the below diagram Long Run Average Supply (LRAS) is vertical implying productive capacity of an economy depends on price level in the long run (Delong 6). A shift of AD to the right shifts national output from Yfc to Y2. The resultant outcome is inflationary pressure. Excess demand in the markets and other factor markets lead to increase in costs of production and subsequent inward movement in the short run AS from Short Run Average Supply (SRAS1) to Short Run Average Supply (SRAS2). The decline in supply will move the economy back to the potential output though at increased price level. This phenomenon is what the Animal Spirits are against, where the forces of supply and demand dictate output and price levels.

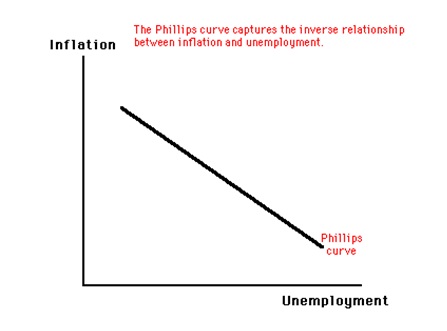

Phillips Curve

Phillips curve tries to analyze the relationship between the unemployment and inflation. It holds that there is an inverse relationship between unemployment and inflation. When unemployment is high, inflation is low and vice-versa. Unemployment is to be high or low with regard to the natural rate of unemployment (Delong 3). Natural rate of unemployment is the lowest level of unemployment that an economy can be sustained without the risk of unacceptable rate of inflation.

Monetary Policy and Aggregate Demand

The below graph tries to analyze the relationship between Aggregate Demand and Aggregate Supply. Keynesian economists in a move to relate Aggregate demand and money, criticize the workings of the labor markets arguing they were imperfect and they could not allocate resources optimally. They hold that unemployment may not necessarily lead to falling of wages. To eliminate unemployment, the government needs to intervene to boost demand and create employment to those unemployed people (Delong 2). Long run and short run supply curves are the same and the only way to reduce unemployment is for the government to apply its reflationary policies.

IS Curve and monetary Policy

The IS curve describes the relationship between interest rates and output that wipes away goods and services from the market in the short run. The market is said to be clear when spending incurred by all the buyers in the markets equals to the output. The equation for the IS curve is Y=C+I+G, where Y=income, C= consumption, I= investment and G=government spending.

Works Cited

Akerlof, George and Shiller, Robert. Animal spirits: How human psychology drives the economy and why it matters. United Kingdom, UK: Princeton University Press, 2010.

Delong, Bradford. The Philips curve. Multimedia. 1998. Web.