In business and economics, a macro environment reflects the overall conditions in an economy. The macro-environment of a company thus encompasses the factors that are outside of the organization’s control, although they still impact organizational functioning and success. Understanding macroeconomics is significant for business leaders to be able to adjust to challenging economic conditions and ensure that their organizations succeed in the long term. The present paper will focus on two essential concepts in macroeconomics. Question 1 will consider the application of business cycles to the global economy before the 2008 financial crisis. Question 2 will explore the notion of stagflation and assess the government’s option for responding to this economic condition.

Business Cycles and the Global Economy before 2008

The authors of the provided passage focus on the global economic environment of 2007, right before the global financial crisis of 2008. Despite the upcoming recession, the passage conveys the ideas of stability and reduced volatility. In particular, the authors note that the global economic environment at the time was associated with an increased rate of growth and decreased variation in outputs. According to the passage, these factors could become a foundation for future economic stability. Despite these positive claims, the authors avoid making predictions regarding the future. In particular, they note that, despite the evident change in business cycles, there may still be emergent risks that affect the economy of individual countries, and that governments should take action to manage these risks promptly.

The application of business cycles to the passage provides an excellent opportunity for analysis. Based on the theory of business cycles, the overall positive trend in economic growth is interrupted by periods of growth and recession. During a recession, the level of economic activity decreases significantly until the point of a trough, after which it starts to rise again, reaching the peak before another recession occurs (Lipschitz and Schadler 7). It is critical to note that business cycles represent short-term changes in outputs, whereas the general growth trend remains intact (Lipschitz and Schadler 8). This is primarily because long-term economic growth depends on a set of fundamental factors, whereas short-term output fluctuations occur irrespective of them due to exogenous variables.

Several conclusions can be made from the application of the business cycle theory to the model. The first observation is that the authors are correct in stating that there are still certain risks that could affect outputs and economic growth in the short term. Based on the business cycle theory, 2007 was the time when economic activity in many global regions peaked, and thus the recession was inevitably close. Because short-term economic fluctuations depend on somewhat unpredictable, exogenous factors, the authors are correct in warning governments about the importance of monitoring and addressing emergent risks. Failure to do so was the primary reason as to why the recession of 2008 turned into a global economic crisis.

The second conclusion that can be made from the analysis is that improvements in institutional quality and monetary and fiscal policy contribute to long-term growth rather than short-term stability. The authors claim that these factors had a significant contribution to the reduction in output volatility and increased economic growth. However, as evident from the application of business cycle theory, these factors cannot prevent a recession, only delay or limit the reduction in output. This means that institutional quality and policy improvements contributed to the long-term growth trend rather than to the change in business cycles, as the authors claim.

Lastly, the overall description provided by the authors fits into the business cycle theory. The concepts and relationships discussed in the passage, including the increased growth and reduced volatility, point to the fact that the 2007 economy was at its peak point. As explained by Lipschitz and Schadler, the peak of economic activity is characterized by high outputs and fast economic growth (7-8). Additionally, the relationship between government policy and economic growth described by the authors also provides evidence in favor of the business cycle theory. Monetary and fiscal policies affect government purchases and inflation, thus contributing to GDP growth and stimulating outputs.

The analysis of short-term economic fluctuations discussed in the passage also prompts an evaluation of the desirable level of fluctuations and the reasons as to why output fluctuations occur. The answer to the first question lies in the business cycle theory. The theory posits that short-term changes do not usually impact the long-term growth trend, as the output still increases from one peak point to another (Lipschitz and Schadler 9). However, if adverse economic fluctuations are too significant, they might affect long-term economic growth, as more time will be required for an economy to recover. This means that limited, short-term fluctuations are more desirable for an economy to experience a higher long-term growth rate.

The second question is also crucial as it concerns the prevention of significant fluctuations that could influence the long-term growth rate. According to Gans et al., it is challenging to explain the factors causing short-term volatility as there are too many variables to be taken into account (742). Nevertheless, most economists agree that applying the aggregate demand and supply model helps to analyze economic fluctuations and map out their possible causes (Gans et al. 744).

Hence, the reason for short-term fluctuations is the changes in aggregate demand and supply. The factors influencing these changes are varied, but usually include variables such as productivity and price changes. In 2019, many factors can affect short-term economic fluctuations and cause a recession. In Saudi Arabia and the GCC in general, the primary factors are oil production outputs and oil prices. Changes in these variables would affect exports, leading to shifts in GDP and the AD-AS model. On the global level, monetary policy prompting currency changes could impact the economic growth of various countries by influencing exports and imports.

Stagflation

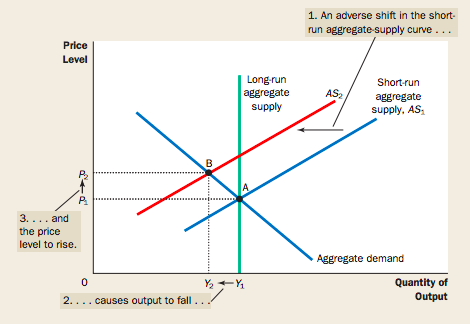

Stagflation is a complicated economic situation because it involves two competing economic conditions. On the one hand, stagflation means the rise in prices associated with inflation (Gans et al. 767). On the other hand, stagflation also includes a decrease in outputs or stagnation (Gans et al. 767). Because stagflation involves both of these aspects, it can be graphically represented using the aggregate demand and aggregate supply framework.

The AD-AS framework provides valuable insight into stagflation by allowing users to understand the causes and effects involved in stagflation. According to the explanation by Gans et al., “when some event increases firms’ costs, the short-run aggregate supply curve shifts to the left from AS1 to AS2. The economy moves from point A to point B. The result is stagflation: Output falls from Y1 to Y2, and the price level rises from P1 to P2” (768). This process is apparent in Figure 1, which explains all of the steps leading to stagflation.

Based on the AD-AS framework, the primary reason for stagflation is a sudden increase in production cost. This can occur due to a significant rise in material costs, as well as due to other factors impacting production, such as unemployment. If firms rely on a particular material to produce outputs, and the price of this material rises suddenly, this will result in higher production costs. Similarly, when firms experience staff shortages, productivity will drop, leading to an increase in firms’ costs. To control the costs, firms will typically try to decrease their output to a manageable level, leading to reduced outputs. This, in turn, causes an increase in prices and the change in demand, shifting economic growth across the AD-AS curve.

Hence, the analysis shows that the loss of output is of primary importance to economic growth during stagflation, whereas inflation can be considered a secondary issue. The cause and effect relationships explained above shape the governments’ responses to stagflation, prompting governments to focus on compensating for the loss of output. There are several options as to how this goal can be achieved, although all of them require supporting businesses. First of all, governments could establish control over the price of materials used in production. This would be particularly useful in cases when the decrease in aggregate supply was caused by increased raw material prices. For instance, governments could support domestic producers of raw materials, thus reducing the costs by limiting imports. This would help firms to make up for the loss in output by lowering production costs.

Secondly, government policy can be used to address other sources of increased production costs. In many settings, personnel costs constitute a substantial share of a firm’s production expenses. If this is the case, governments could apply deregulation, thus enabling businesses to set appropriate wages below the minimum limits. This would also contribute to output growth since companies would be able to pay less for the same quantity of goods produced.

Another vital question to consider is whether governments can address both aspects of stagflation at the same time. Based on the theory of macroeconomics, it would not be feasible for governments to control inflation while increasing outputs. To address inflation, the government would need to increase its regulation of businesses, and the resulting reduction in prices will increase firms’ losses further, thus limiting output. Nevertheless, the theoretical material suggests that controlling inflation during stagflation is not necessary. Once the businesses make up for the decline in output, and the aggregate supply curve shifts back to its previous position, the demand will also shift until it reaches an equilibrium. The shift of both curves to the right will result in a decrease in prices, thus reducing the effects of inflation.

Conclusion

Overall, the analysis of business cycles and the discussion of stagflation provides some critical insights into the contemporary macro-environment of businesses. In particular, it shows that companies face several economic challenges, which cannot always be predicted and anticipated. While the management of short-term fluctuations often involves government policy, managers should be able to tailor the business activity to changes in the external environment. This will help to limit profit losses and ensure the future stability of their business.

Works Cited

Gans, Joshua, et al. Principles of Economics. 7th edn., Cengage Learning, 2018.

Lipschitz, Leslie, and Susan Schadler. Macroeconomics for Professionals: A Guide for Analysts and Those Who Need to Understand Them. Cambridge University Press, 2019.