Introduction

Organisations can incorporate different categories of marketing metrics in an effort to appraise their performance. Examples of such metrics include customer-based and traditional marketing metrics. Some of the traditional marketing metrics include market share, customer satisfaction, sales growth, customer loyalty, and ad awareness.

However, “market share and sales growth are the most popular traditional marketing metrics” (Davis 2007, p.96). Kumar and Reinartz (2012) assert that traditional marketing metrics were formulated after it turned out difficult to obtain individual customer data. Consequently, such metrics are deficient for they do not give customer-level insight.

However, the availability of customer information over the past few decades has led to the formulation of new metrics that assist managers to develop a comprehensive understanding of individual customer and the value of a given customer to the firm (Hauser & Katz 1998). Customer-based metrics fall into two categories, viz. customer activity metrics, and customer acquisition metrics.

Customer activity metrics include survival rate, the probability of a particular customer being active [p (Active)], lifetime duration, survival rate, retention and defection rate, and average inter-purchase time (Ambler 2003). The customer acquisition metrics include acquisition cost and acquisition rate. On the other hand, the most popular customer-based value metrics include share of wallet, size of wallet, and share of category requirement.

Market share entails the share of a firm’s sale relative to other firms and it is expressed as a percentage. Farris, Bendle, Pfeifer, and Reibstein (2006) assert that market share gauges a firm’s performance against its competitors. The market share metrics enable a firm to determine the prevailing selective and primary demands effectively.

The market share metrics does not only enable marketing managers to determine the total market decline or growth, but also to assess the customers’ trend in selecting where to purchase their products or services. Therefore, the market share metrics enables organisations to assess the external market (Best 2010). According to Doyle (2000), market share can be determined on volumetric or on a monetary basis.

In the course of its operation, Alliance Boots has managed to attain a relatively high market share of 35 per cent in all its global markets. The sales growth metric of a particular firm or brand is determined by comparing the changes in the firms’ sales during a given period (Kumar & Reinartz 2012).

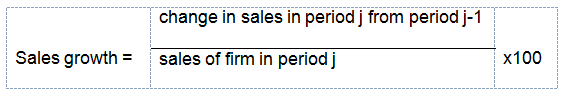

Sales growth is determined using the following formula:

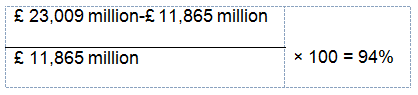

In 2008, Alliance Boots sales amounted to £ 11,865 million (Alliance Boots 2008). Due to its marketing commitment, the firm’s sales in 2012 amounted to £ 23,009 million. Using the above formula, the firm’s sales growth is illustrated below:

The high sales growth [94 per cent] experienced by Alliance Boots during the period ranging from 2008 to 2012 shows that the firm has been very effective in marketing its products.

Over the past few years, managers have increasingly focused on customer acquisition metrics in an effort to make optimal decisions. According to Ismail and Murphy (2009), acquiring new customers is critical in a firm’s effort to improve its long-term profitability. Marketing managers can determine acquisition metrics by evaluating the acquisition cost and acquisition rate.

Acquisition cost assesses the responsiveness of the marketing campaign undertaken by a particular firm and it is determined by determining the cost of marketing campaign and the target number of potential customers. In the course of its operation, Alliance Boots has managed to attract and sustain a relatively large customer base successfully, as illustrated by the fact that the firm has a high customer retention rate of 65.2 per cent (Alliance Boots 2013).

The customer retention rate refers to the firms’ ability to sustain continuous trading relationships with their customers. The rate of customer retention is an indicator of the customer’s probability of defecting to competing products. The firm’s sales growth has also emanated from its ability to deliver products and services that meet the customers’ needs. Consequently, Alliance Boots has been in a position to create a high level of customer satisfaction. By 2012, the firm’s rate of customer satisfaction averaged 64.

Business environment

Alliance Boots focuses at maximising its profitability. Consequently, the firm has ventured into the international marketing by incorporating the concept of global marketing. Farris, Bendle, Pfeifer, and Reibstein (2006) are of the opinion that global marketing has increasingly become very complex, expansive, and extensive. The complexity of the global marketing emanates from the dynamic nature of the environment.

Smit (2007) asserts that it is vital for firms’ management teams to possess broad knowledge and understanding of the business environment in which their firms operate. The three main categories of the business environment that firms’ managers should understand include the market environment, microenvironment, and the macro environment (Samli 1996).

Bygrave and Zacharakis (2009) are of the opinion that understanding these environments is vital in firms’ effort to exploit market opportunities. In a bid to achieve this goal, it is fundamental for firms’ managers to invest in market research in order to acquire important market information. In the course of its operation, Alliance Boots is subject to changes in the external business environment.

These changes emanate from different sources such as changes in customer demographics, economic changes, sociological changes, technological changes, and political changes (Hill & Gareth 2009). Lamb, Hair, and McDaniel (2012) assert that things in the external environment are continuously undergoing through change. The pharmaceutical market in which Alliance Boots operates is “very attractive due to the positive market and macro-economic trends” (Alliance Boots 2013, Para.9).

Firstly, the industry is experiencing an increment in demand for pharmaceutical products especially medicines (Alliance Boots 2012b). The rise in demand has arisen from two main factors, which include continued global population growth emanating from improvement in life expectancy and increment in the average age of the population especially in the developed economies.

Findings of a market research conducted by the marketing department revealed that the size of the firm’s customer group aged over 65 years would grow with over 40 per cent between 2011 and 2030. Thus, this customer group will increase with approximately 35 million by 2030 (Age UK 2013). This scenario presents a unique marketing opportunity for the firm to increase its customer base.

The pharmaceutical industry is also experiencing the emergence of more innovative and new prescription medicines (Phelps2004). For example, some prescriptions may involve specialised handling and administration, which presents a unique opportunity for the firm to be innovative in its marketing strategies (Needle 2004).

Governments from both developed and developing economies are employing measures aimed at encouraging usage of lower cost-generic prescriptions (Alliance Boots 2012b). This transformation will enable the firm to increase its market share by driving down costs and increasing operational efficiency and ultimately, the firm will attain its wholesaling and distribution objectives (Alliance Boots 2012b).

Over the past few years, manufacturers of branded pharmaceutical products have increasingly focused at attaining higher control of their distribution channel. Direct distribution and reducing the number of distributors are some of the avenues that the pharmaceutical firms are shifting to in the contemporary market. This move will significantly enable the firm to lower the cost of its operations.

The industry is also undergoing an increment in the rate of consolidation with regard to distribution and wholesaling, which has arisen from growth in demand for a lean distribution channels. There is also a high probability of the firm experiencing an increment in sales revenue due to increased demand for healthcare services (Tucker 2011). Additionally, Alliance Boots should also expect an increment in demand for home healthcare.

Financial report

The management team of Alliance Boots is very committed at ensuring that the firm attains a high level of profitability. This aspect explains why the firm has integrated various growth and marketing strategies such as organic and acquisitive strategies.

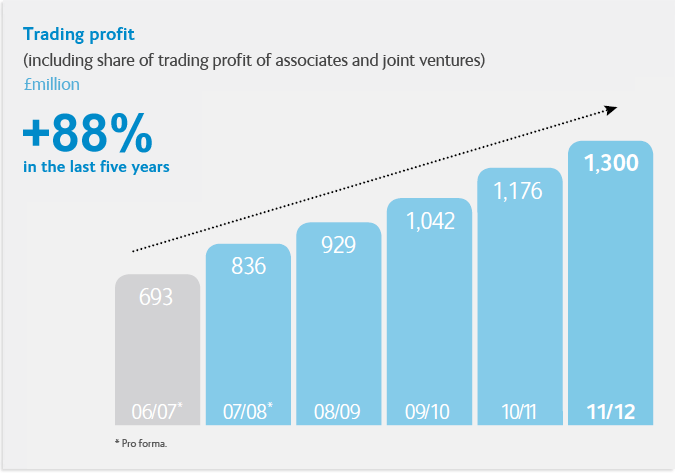

Over the past few years, the firm has experienced a considerable growth in its sales trading profit. During the past 5 years, Alliance Boots has continued to experience double-digit growth in its trading profit. From 2007 to 2012, the firms trading profit has increased with a margin of 88 per cent as illustrated by chart 1 below. Additionally, chart 2 illustrates changes in respective revenue over the past five years.

Chart 1: Changes in Alliance Boots trading profit: Source: (Alliance Boots 2012a)

Chart 2: Alliance Boots financial report

Source: (Alliance Boots 2012a)

Business review

In the course of its operation, Alliance Boots has established a number of business divisions. The decision to establish these divisions hinges on the need to attain high profit growth. In developing these divisions, the firm has incorporated two main strategies, which include organic growth and formation of mergers and acquisitions. Lockett et al. (2009) affirm that the incorporation of acquisitive and organic growth strategies enables firms to improve the probability of their future growth.

The two main divisions include health, beauty, and the pharmaceutical wholesale division (Alliance Boots 2012b). The health and beauty division constitutes brands that are well established in the market such as No7, Botanics, and Soltan. In an effort to stimulate sales, Alliance Boots undertakes “continuous product development and innovation, product marketing, and product packaging” (Alliance Boots 2012b, Para.6).

In the recent past, Alliance Boots launched other operational lines, which include Boots Laboratories and Boots Pharmaceuticals. The firm ensures that all its health and beauty products are customer-focused (Alliance 2012). In 2012, Alliance Boots health and beauty division experienced an increment in its sales revenue with a margin of 0.6 per cent while its trading profit grew with 6 per cent.

The pharmaceutical wholesaling and distribution division has continued to experience significant growth over the past few years despite the challenging business environment (Russell & Russell 2006). One of the factors associated with the firm’s growth relates to its effectiveness in implementing the integration process of the undertaken mergers (Lockett & McDonald 2009).

Additionally, the firm has continued to improve its customer focus strategy. The pharmaceutical and wholesaling division experienced a revenue growth with a margin of 27.9 per cent, while the trading profits experienced a growth of 24.7 per cent. In 2012, Alliance Boots sales revenue grew with a margin of 18.4 per cent due to contribution from the two market divisions, while the trading profits increased by 12.4 per cent (Alliance Boots 2012b).

The chart below illustrates the performance of the two market divisions for the year ending 31st March 2012.

Assessing sales growth

Considering the prevailing changes in the market, the macro environment, and the microenvironments, there is a high probability of Alliance Boots experiencing a significant growth in its sales. Some of the factors that might stimulate sales growth include growth in the size of population and increment in demand for home healthcare. Growth in the size of the population will culminate in significant growth in the firm’s sales revenue.

Additionally, incorporation of low cost generic prescriptions by most governments will also stimulate the firm to experience sales growth. Additionally, sales growth will also be subject to the high rate at which governments are focusing at increasing their spending on health care (ECORYS 2009).

In an effort to attain market leadership, Alliance Boots has integrated effective market expansion strategies, which include organic growth and formation of joint ventures, mergers, and acquisitions. Incorporation of these strategies is an indicator that the firm will experience significant sales growth in the future. Consequently, the pharmaceutical industry is characterised by a high market potential and demand hence making it very attractive.

Conclusion

The analysis conducted in this paper indicates that Alliance Boots has been very effective in its operation as illustrated by the various marketing metrics considered. For example, the firm has a relatively high market share, which has positioned it at the top of the market hence a market leader. Its success in venturing into the international market has enabled the firm to attain a relatively high rate of sales growth.

Due to its effectiveness and efficiency in meeting customers’ health, beauty, and well being needs, Alliance Boots has been in a position to nurture a relatively high rate of customer satisfaction. The prevailing business environment also presents a high probability of the firm experiencing high sales growth hence its future success.

Recommendation

In a bid to improve its chances of succeeding in its operation, it is paramount for Alliance Boots to take into account the following recommendations:

- The management team should incorporate comprehensive and continuous improvement plan and new product development programs aimed at ensuring that its products and services align with changes in customers’ needs. Incorporation of these strategies will enhance the firm’s competitiveness, and thus its future success.

- A comprehensive market research should be undertaken to improve the effectiveness of marketing and operational decisions made.

- The firm should take advantage of the technological changes affecting the pharmaceutical industry in order to improve its competitiveness.

Reference List

Age UK: Later life in the United Kingdom. Web.

Alliance Boots: Annual Report 2011/2012 2012a. Web.

Alliance Boots: Consolidated financial statement 2008. Web.

Alliance Boots: Markets and business environment 2013. Web.

Alliance Boots: Our five year financial record 2012b. Web.

Ambler, T. 2003, Marketing and bottom line, Pearson Education Limited, London. Best, R 2010, Marketing metrics handbook, Palgrave, London.

Bygrave, W. & Zacharakis, A. 2009, The portable MBA in entrepreneurship, Wiley, New Jersey.

Davis, J. 2007, Measuring marketing: 103 metrics every marketer needs, Wiley, Singapore.

Doyle, P., 2000, Value-based marketing, Wiley, Chichester.

ECORYS: Competitiveness of the EU market and industry for pharmaceuticals 2009. Web.

Farris, P., Bendle, N., Pfeifer, P. & Reibstein, D. 2006, Marketing metrics: 50+ Metrics every executive should master, Pearson Publishing, New Jersey.

Hauser, J. & Katz, G. 1998, ‘Metrics: You are what you measure’, European Management Journal, vol. 16 no. 5, pp. 517–528.

Hill, C. & Jones, G. 2009, Strategic management theory: An integrated approach, Houghton Mifflin, Boston.

Ismail, A. & Murphy, J. 2009, Acquisition methods and customer lifetime value. Web.

Kumar, V. & Reinartz, W. 2012, Customer relationship management: Concept, strategy and tools, Springer, Belbin.

Lamb, C., Hair, J. & McDaniel, C. 2012, Essentials of marketing, Cengage, Ohio.

Lockett, A. & McDonald, M. 2009, Marketing accountability: A new metrics model to measure marketing effectiveness, Kogan Page Limited, London.

Lockett, A., Wiklund, J., Davidsson, P. & Sourafel, G. 2009, Organic and acquisitive employment for growth: Re-examining, testing and extending Penrose’s growth theory. Web.

Needle, D. 2004, Business in context: An introduction to business and its environment, Thompson, London.

Phelps, B. 2004, Smart business metrics: Measure what really counts and manage what makes different, Pearson Education Limited, London.

Russell, J. & Russell, L. 2006, Strategic planning 101, ASTD Press, Alexandria.

Samli, A. 1996, Information-driven marketing decisions: Development of strategic information system, Greenwood Publishing Group, New York.

Smit, P. 2007, Management principles: A contemporary edition for Africa, Juta, Cape Town.

Tucker, I. 2011, Macroeconomics for today, Cengage, Mason.