Introduction

Firms are established with the goal of maximizing the level of their profitability. However, the attainment of this goal might be subject to diverse macro environmental changes. For example, the intensity of competition may shrink a firm’s profitability potential. Additionally, changes in the economic environment may affect the consumers’ purchasing power.

Despite these market dynamics, managers should have an obligation to ensure that their businesses attain an optimal market position, which highlights the significance of adopting effective strategic management practice.

One of the aspects that managers should consider in an effort to promote their firms’ competitive advantage relates to pricing. Caplin and Leahy (80) argue that a significant proportion of firms have not incorporated pricing in their strategic framework. Therefore, the prices of their products are based on naive pricing rules.

Price is a critical component that organizational managers should consider in their effort to influence the consumers’ decision-making process. Choi, Kiljae, and Yong-Yeon (603) emphasize that consumers are very sensitive to price. Despite their level of sensitivity, the consumers’ purchasing decision is motivated by the need to maximize their level of utility.

This aspect underscores why firms should adopt an optimal pricing format in order to attract and retain customers, hence increasing the profit maximization potential. This paper evaluates the concept of pricing format by focusing on the odd and even pricing formats.

Moreover, the relevant theories that support the two pricing formats are also assessed. In this study, it is assumed that the price ending strategy does not communicate the quality of the product.

Literature review

Analysis

Previous studies have led to the development of different theories in an effort to explain consumer behaviors. Some of these theories include the prospect, expected utility, and the cumulative prospect theories.

The expected utility theory

This theory postulates that consumers face risky prospects and uncertainties in their purchasing decision-making process. The risky outcomes emanate from the view that they are faced by a wide range bundles of goods and services from which they are required to select. Thus, their decision-making process is undertaken by assessing the expected utility values, which refers to the degree of consumer preference.

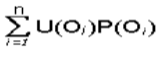

Consequently, if the utility of product A is greater than that of product B [U (A)>U (B)], then the consumer will prefer product A to B. Under conditions of uncertainty, the consumers’ choice is based on the expected utility, which is a summation of all possible (n) utilities with regard to the various outcomes (Oi).The model below illustrates the formula of the expected utilities.

Source: (Caplin and Leahy 65).

The prospect theory

This theory emphasizes the psychological component of consumer choice. The theory is based on the element of uncertainity in the consumers’ purchasing process. The theory contends that consumers follow two main stages in making decisions involving risky options. The first phase is characterized by editing or simplification of the situation faced by assesing the associated gains and losses.

For example, the decision to purchase a car worth $ 20,000 may be simplified into gaining the automobile and losing the $ 20,000. However, the process of simplifying the purchase decision varies from one situation to another. This aspect means that the prospect is influenced by the situational circumstances.

Caplin and Leahy (63) assert that the consumers’ purchasing decision is based the edited prospects. Subsquently, the process followed in editing the prospects is fundamental in determining the consumers’ purchasing decision.

The second phase entails making a choice on the most effective options available. The choice of the edited options is influenced by the weight and the apparent value of the options.

Consumers select the option that has the highest combined value. Therefore, the prospect theory emphasizes the importance of establishing a reference point. According to the prospect theory, the value of a particular product is determined by comparing with that of another.

The cumulative prospect theory

This theory is an improvement of the expected utility theory. Nielson and Stowe (31) assert that this theory is comprized of three critical components. The first component entails the value function, which takes into account the gains associated with selecting a particular product. The second component entails the loss aversion function.

Nielson and Stowe assert that the loss aversion function “tranforms utilities over gains into utilities over corresponding losses” (32). Under this function, consumers are risk seeking over losses and risk averse over gains. The third component entails the weighing function. According to the cumulative prospect theory, consumers are more concerned about losses than gains associated with purchasing a particular product.

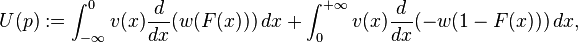

Furthermore, the cumulative prospective theory asserts that consumers have diverse risk attitude. The following model describes the cumulative prospect theory of a risky outcome, where p= probability, v= the value function, w= weighing function, and F (x) is the cumulative probabilities all values up to x.

Source: (Caplin and Leahy 65)

Pricing formats

Marketers are cognizant of the view that effective product pricing plays a fundamental role in maximizing revenue, and hence the level of profitability. Furthermore, marketers have the capacity to influence the consumers’ purchasing decision by adopting effective pricing strategies. One of the marketing strategies that have extensively been utilized by marketers is psychological pricing strategy.

The decision to adopt this pricing strategy arises from the need to “appeal the consumers’ emotions and perceptions in their purchase decision-making process” (Chovancova 29). In addition, Chovancova asserts that the consumers’ decision to buy a “particular product is based on the perception of the price point set by marketers rather than the actual money price” (29).

Chovancova further emphasizes that customers “react diffently if the price is broken into parts or the product or service is bundled with other items” (29). Therefore, it is imperative for marketers to take into account the consumers’ perceptions in setting the price point.

Odd and even pricing formats

Choi, Li, Priyamvadha, Promothesh, and Surendra (1) define odd-end pricing as a price setting strategy whereby the price of a product is set a few cents below the rounding end counterpart. Examples of odd-end pricing include $3.99 and $3.95, which is just below $4.00. On the other hand, even pricing strategy, refers to a pricing strategy whereby the price point of a product is set at a whole number, for example $4.

Even-end pricing strategy is not as attractive amongst retailers as compared to odd-end pricing. This assertion arises from the view that even-end pricing is not effective in enhancing market communication, hence its ineffectiveness in influencing the consumers’ purchasing decision (Choi, Li, Priyamvadha, Promothesh, and Surendra 2).

Odd-end pricing is one of the most common psychological pricing strategies amongst marketers. Findings of previous studies show that the probability of consumers purchasing products whose prices end with a 9 is higher as compared to products whose prices end with 0, for example $ 99.99 versus $ 100.00 (Choi, Li, Priyamvadha, Promothesh, and Surendra 1).

However, the effectiveness of odd-end pricing varies between utilitarian and hedonic produts. Hedonic products mainly incude luxuries while utilitarian products refer to the necesities.

Choi, Li, Priyamvadha, Promothesh, and Surendra (1) are of the opinion that odd-ending pricing is more effective in influencing the consumers’ decision to purchase hedonic products as compared to utilitarian products. Consumers consider odd-end pricing as a way of communicating the price discount being offered.

Consumers develop the perception that purchasing a product whose price is set using odd-end pricing is equivalent to recieving a price discount of the amount subtracted from the nearest whole number. Thus, odd-end pricing is effective in communicating the unexpected gains associated with purchasing the product.

Choi, Li, Priyamvadha, Promothesh, and Surendra assert that odd-end pricing “is characterized by a high degree of pursuasiveness of gain-framed versus loss-framed messages” (3). Additionally, Choi, Li, Priyamvadha, Promothesh, and Surendra (2) assert that odd-end pricing plays a fundamental role in stimulating the demand for a product.

According to Schindler (Relative price level 245), odd-end pricing communicates low price to consumers. Retailers are increasingly exploiting rightmost digits in an effort to indicate the competitiveness of their products to consumers.

Schindler (The 99 price ending 74) is of the opinion that odd-end pricing has a positive effect on a firm’s revenue. The effectiveness of odd-end pricing arises from the view that this pricing strategy is effective in communicating a positive image regarding the price of the product to consumers.

Schindler and Kibarian (95) are of the view that using odd-end pricing is likeliy to minimize price sensitivity amongst consumers.

Furthermore, odd-end pricing communicates that consumers are not likely to find the product being sold at another outlet at a price lower than the price being offered. Therefore, the 99 ending pricing strategy is the most effective in communicatig the strongest expectations of recieving a product at a low price.

Relationship between price ending and consumer choice theory

According to the prospect theory, the consumers’ choice of a product is based on a reference point. This assertion means that consumers are faced by a bundle of goods from which they are required to select the product that will result in utility maximization. Despite the view that consumers aim at maximizing utility, they are constrained by their budget.

Consequently, they tend to select a bundle of goods that results in maximum utility. The use of odd-end pricing such as the 9-ending communicates that the retailer is issuing a discount to the consumer. Therefore, the consumer develops the perception that purchasing a product with odd-end pricing will enhance the likelihood of achieving the expected level of utility.

One of the core components of the prospect theory is the value function. Using odd-end pricing as opposed to 0-ending plays a fundamental role in communicating the gains associated with purchasing a given product.

The expectation of recieving a gain from purchasing a product ending with 9 improves the consumers’ perception of the product, which is referred to as the percieved-gain effect. However, the gain recieved is disproportionate to the percieved discount (Schindler and Kirby 193).

Conclusion

Consumers are price-sensitive in the thier purchasing process. Therefore, price is one of factors that they evaluate before making a purchasing decision. Despite this aspect, retailers have an opportunity to influence the consumers’ purchasing decision-making process. This goal can be achieved by adopting effecitve pricing strategies. Retailers should consider pricing as a critical aspect in thier strategic framework.

Psychological pricing is one of the most effective strategies that retailers can adopt in thier quest to influence the consumers’ purchasing decision. The effectiveness of psychological pricing strategy arises from its ability to influence the consumers’ perception on the price point. Odd-end pricing strategy has extensively been used by marketers in an effort to influence the consumers’ purchase decizion.

The above analysis shows that odd end pricing is effective in communicating value and expected gains to customers, which underscores the principles of the expected utility theory. Through odd-end pricing, consumers develop the perception that the set price has taken into account the discount.

Thus, consumers assume that the difference between the price point and the nearest roundoff figure is equal to the price discount offered. Furthermore, odd-end pricing is aligned with the prospect theory, which argues that consumers are required to select the products that will result in utility maximization. However, the consumers’ choice of the bundle of goods is influenced by the price of the product.

Therefore, consumers select a particular product based on the price, which acts as the reference point. The analysis above shows that pricing is an important element that retailers should consider in their strategic management practices. The pricing strategy adopted determines the extent to which the firm influences the consumers’ purchasing decision, and hence the likelihood of achieving the profit maximization objective.

Works Cited

Caplin, Andrew, and John Leahy. “Psychological expected utility theory and anticipatory feelings.” The Quarterly Journal of Economics 2.2(2001): 59-80. Print.

Choi, Jungsil, Lee Kiljae, and Ji Yong-Yeon. “What type of framing message is more appropriate with nine-ending pricing.” Mark Lett 23.1 (2013): 603-614. Print.

Choi, Jungsil, Yexin Li, Rangan Priyamvadha, Rangan Promothesh, and Singh Surendra. “The odd-ending price justification effect: the influence of price ending on hedonic and utilitarian consumption.” Journal of the Academic Marketing Science 2.2(2014): 1-13. Print.

Chovancova, Asamoah. “The influence of price endings on consumer behaviour; an application of the psychology of perception.” Acta Universitatis Agriculturae Et Silviculturae Mendelianae Brunensis 59.7(2011): 29-39. Print.

Nielson, William, and Jill Stowe. “A further examination of cummulative prospect theory parameterizations.” The Journal of Risk and Uncertainity 24.1(2002): 31-46. Print.

Schindler, Robert. “Relative price level of 99-ending prices: image versus reality.” Marketing Letters 12.3 (2001): 239-247. Print.

—. “The 99 price ending as a signnal of a low price appeal.” Journal of Retailing 82.1 (2006): 71-77. Print.

Schindler, Robert, and Patrick Kirby. “Patterns of rightmost digits used in advertized prices: implications for nine-ending effects.” Journal of Consumer Research 24.2 (2003): 192-202. Print.

Schindler, Robert, and Thomas Kibarian. “Image communicated by the use of 99 ending in advertized.” Journal of Advertizing 30.4(2001): 96-112. Print.