Introduction

Roberts & Family Company Ltd (R&F) is a Detroit-based business founded in 2005 by Roberts and his wife, Emily. The organization operates in the traditional dishes provision market, targeting the general public, particularly fitness-conscious citizens. The family developed the idea after one of their teenage children turned Type 2 diabetic after struggling with obesity for years. Roberts is a certified and highly skilled food specialist, while the wife is a nurse specializing in preventive care. Since its incorporation in 2005, R&F realized a sharp market upswing, making it a real force in Michigan. With ten physical eateries in different parts of the state, R&F serves over two million customers who enjoy specially-prepared dishes, humane and physically satisfying services, and excellent online ordering and delivery systems. Consequently, the organization’s revenue reports from its beginning to around mid-2019 present a constantly growing trend. However, things do not look promising these days, as revealed by declining revenues and sales reduction for over two years. Accordingly, something concerning R&F’s operations is to blame for the experienced problem regarding the entity’s inability to respond to competition.

Competition from other new players in the market has posed an unfavorable risk to R&F for at least three years now. The chain adopts the premium products operations strategy to attract and maintain its customers. The option sees R&F charge significantly higher prices than the other sector players. The strategy has worked favorably over the years due to customers’ striking trust towards the products, the brand, and the professional owners who manage the firm’s operations. Operation from several areas, having multiple delivery vehicles and bikes, and serving over two hundred delicious health-sensitive recipes are other strengths that give R&F unmatched market control. R&F’s operation’s plights started after the COVID-19 pandemic breakout in the U.S. The pandemic’s disruption of people’s daily lives and economic capabilities challenged many customers’ ability to afford the company’s premium products. Nonetheless, the desire to consume healthy dishes remained among the clients, resulting in looking for them from other low-cost providers. Accordingly, the emergence of several such (low-cost) food sellers across Michigan’s main cities, who take advantage of the healthy meals awareness created by R&F, provides a ready alternative to R&F’s costly items.

Critical Business Analysis

R&F’s success in the past depends on the organization’s mastery of the prominence and ability facets of business operations. A company’s ability to deliver exceptional quality products to consumers gives it prominence, while ‘ability’ crops from its potential to sustain excellent undertakings for a longer time (Bartolacci et al., 2020). These two operations’ aspects fall precisely under the 4Vs framework, which business analysts and operators use to determine competitiveness and sustainability aptitudes. Consequently, applying the 4Vs approach to Roberts & Family Company Ltd can help identify the specific operation-related challenge troubling the organization’s performance. According to Skouloudis et al. (2020), business operations play a significant role in determining profitability. The operations aspect handles the conversion of raw materials and other business inputs into profits. Effective operations managers thus ensure consistent success by ascertaining the realization of the appropriate volume, variety, variation, and visibility elements in the business.

Roberts is R&F’s principal operations manager, a role he combines with being the firm’s CEO. The scholar comes investor exhibits significant business management experience from his vast engagements with market leaders in the food industry, such as McDonald’s and Domino’s Pizza. Accordingly, the manager fairs significantly well, proving his ability to steer R&F to success within a short time, even silencing some renowned brands initially operating within Michigan. As noted earlier, R&F’s operations embrace premium services and products. The firm employs innovations and creativity to produce consistent quality in large volumes, millions of recipes a day, to meet its large customer sizes’ demands. The large volume allows the firm to serve millions of consumers from its ten sites across the state. Over the years, customers’ large volume purchases significantly substantiate buyers’ confidence in R&F’s products. Variety connotes the diversity of goods or services offered to customers by a firm (Szende et al., 2021). R&F’s appreciation of this V feature comes from the organization’s provision of multiple fitness products, over fifty brands, which increase sales and profitability potential.

Variation measures an entity’s ability to alter its operations due to changes from external factors. Pandemics, such as COVID-19, cause immeasurable effects on people’s income and consumption, thus affecting demand levels for various products. R&F’s choice to offer mass-produced and customized products to consumers helps the firm to manage the variation issue effectively. The business varies its production with the prevailing market condition to cushion shocks resulting from uncertainties. However, the absence of low-cost, trustworthy healthy meals alternatives within many Michigan urban centres between 2005 and 2019 cushioned R&F from the current shock it experiences. Lastly, the visibility factor concerns customers’ requirements to experience a company’s products (Szende et al., 2021). R&F excels significantly on this matter by ensuring that clients keep track of the ordered items even when in transit. The organization prepares its formulations in an open floor arrangement where customers intending to consume them inside the stores can view and appreciate the process. Accordingly, R&F excels in almost all the 4V elements of operations due to their fine-tuned procedures, further explaining its market leadership facet.

Company Data

Table 1 below provides R&F’s operations data from its incorporation in 2005 to 2019. Over the years, sales and revenue figures depict a growing trend that matches the firm’s excellent management. On the other hand, Table 2 matches R&F’s performance relative to those of its two competitors. The focus in Table 2 goes to revenues and market control changes among the three competitors since COVID-19’s onset. The provided data proves R&F’s current operations’ challenge about the inability to respond to competition.

Table 1: R&F’s operations data 2006-2021

Table 2: R&F’s Performance Relative to Competitors

Supply Chain Analysis

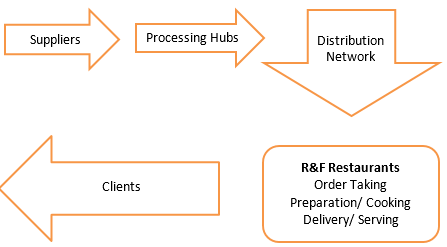

Beyond StarchesTM is one of R&F’s flagship products specially formulated to help consumers manage obesity and the two forms of diabetes. Pioneered by R&F, the product combines fibers, starch-less vegetables, natural sweeteners, and plant-based hormones that help the body utilize its stored energy, thus fighting obesity and overweight issues. Accordingly, R&F uses several supply chain approaches to produce and deliver this product to consumers, as shown in Figure 1 below. One such chain is the sale of the product by the company directly to consumers taking it at the restaurant’s physical outlets. The organization also packages a prepared product for the takeaway option, especially for persons intending to carry the meal to work.

Equally, R&F delivers Beyond StarchesTM to consumers ordering online, with the business’s delivery vehicles and bikes reaching every corner of Michigan within minutes. Since 2016, R&F operates a make-or-buy supply option, where customers intending to mix the ingredients themselves when eating at home or workplace receive separately packed components and a mixing procedure for the do-it-yourself treatment. The various options work excellently, making R&F dear to many Michigan dwellers. Using an effective order tracking system for consumers helps clients ordering the product while away from the stores have a direct experience of what is happening and the precise location of the delivery car or bike. Such openness promotes consumers’ trust, giving R&F above-average competitiveness.

Risk Assessment

Roberts & Family Company Ltd exhibits several risks worth monitoring and mitigation. Such issues include business strategy duplication by new market entrants, high prices, especially during difficult economic periods, system downtimes, and capital shortages. Other risks include changes in customer preferences due to the availability of low-priced products from competitors, accidents, and lawsuits concerning patents and formulation licenses. Table 3 below provides a detailed summary of these threats, their weights, and possible mitigation strategies.

Table 3: Risk Assessment Register

Key: Very High=5, High=4, Medium =3, Low=2, Very low = 0

Improvement Recommendations

The ‘Performance Measurement’ process improvement framework, a component of the Root Cause Analysis strategy, is significantly appropriate in R&F’s case. The model uses data to comprehend performance and introduce modifications to progress performance. Based on the organization’s situation, R&F’s plights result from the inability to manage competition during adverse economic times. According to Tables 1 and 2’s data, the two entities challenging R&F are young and smaller in size. Moreover, Abby Eateries and Affordable Fitness’s cost-leadership tactics are the primary causes of the present problems at R&F, which charges high prices to support its premium product and services.

COVID-19’s subsequent economic hardship forces many health-conscious (now unemployed) citizens to favor the two cost-leadership competitors due to the inability to afford R&F’s products, despite their uniqueness. That explains Table 2’s trend, where R&F’s revenues remained high, even after the two competitors’ entrance into the market, only for the resilience to die after the pandemic’s breakout. Therefore, adopting new low-cost strategies to reduce to support price reduction can help R&F manage the current pressure. Better still, R&F can adopt the cause marketing strategy to convert its products into a cause and have customers view purchasing its items as touching needy souls (Ferszt, 2019). The two plans promise to rejuvenate R&F’s sales and market dominance both in the short and long run.

Conclusion

Admittedly, R&F suffers a significant market loss due to the inability to manage competition resulting from young, fresh entrants into the industry. The organization’s choice of maintaining costly premium-related operations is the primary cause of the current problems. Otherwise, almost everything else, including the entity’s marketing, product protection, and workforce management, appears outstanding. Introducing ways to reduce prices during economic crises and making the organization’s products a cause, not a mere product, will make R&F an independent market leader.

References

Bartolacci, F., Caputo, A., & Soverchia, M. (2020). Sustainability and financial performance of small and medium sized enterprises: A bibliometric and systematic literature review. Business Strategy and the Environment, 29(3), 1297-1309. Web.

Ferszt E. (2019). The Toms effect. Cambridge Scholars Publishing.

Skouloudis, A., Tsalis, T., Nikolaou, I., Evangelinos, K., & Leal Filho, W. (2020). Small & medium-sized enterprises, organizational resilience capacity and flash floods: Insights from a literature review. Sustainability, 12(18), 7437. Web.

Szende, P., Dalton, A. N. & Yoo, M. (2021). Operations management in the hospitality industry. Emerald Publishing Limited.