Introduction

Wal-Mart is the world’s largest retail business. It has more than 11,000 departmental stores and warehouses worldwide. The conglomerate has ventured into numerous markets where each has its unique characteristics, which have resulted in varied outcomes for the companies.

In this case, the company has faced both success and failure in its expansion plans throughout its network across the world (Brunn 2006). The Chinese retail market is one of the main markets outside the United States into which Wal-Mart has ventured. The market has given the company a major boost to its growing network, especially due to the large population that offers a ready market for the company in China (Siebers 2011).

The company has established important strategic measures to help it in succeeding in the Chinese market, which is very competitive due to its attractiveness to other competitors. This section reviews the strategic management approaches that Wal-Mart has adopted in the Chinese retail market. The existing literature will be used to make important assertions relating to Wal-Mart’s strategic management approaches in China.

The literature review will discuss important aspects that relate to Wal-Mart’s premeditated management activities, which will include the company’s entry strategy, brand strategy, development strategy, retail life strategy, and competition strategy. The above strategies will be supported by relevant information that relates to Wal-Mart’s actual performance in the Chinese market.

Entry Strategy for Wal-Mart

Whether it is a start-up or an established firm, entering a new market requires a careful planning, consideration of all factors of success and failure, and a deliberate decision on whether the factors are good for the success of the company. Some of the key factors that a company must consider include timing, extent, and mode of admission (Chaney & Gamble 2008; Soloman 2003).

Regardless of the approaches and factors that a company chooses, it must have more advantages than disadvantages to ensure that the investment is viable for the company. Firstly, timing relates to the period that determines whether the company is the first to enter a foreign market, or joins later after other businesses have already joined a given market.

An early entry connotes a company, which enters an international market before other international players in the industry join the same market. A late entry connotes a delayed admission after other international players have entered a given market. An early entry comes with first mover advantage where ‘the initial occupant of a strategic position or a niche gains access to resources and capabilities that a follower cannot match’ (Enderwick 2009, p. 7).

The first mover advantage is that the company, which enters a new market earlier, is in a good position to establish a strong brand and reputation with customers and suppliers (Cravens & Piercy 2008; Klein 2009). Such a reputation easily pre-empts rivals while at the same time capturing demand early in advance.

Another first mover advantage is that a company can create switching costs, which make it difficult for customers to move or switch to competitors. The third first mover benefit is that a business can gain cost advantages over later entrants since it moves down the learning curve faster where it builds a large producing volume compared to its competitors.

However, according to Freeman (2010), several disadvantages are associated with being the first mover in a foreign market. For instance, the first movers can incur the pioneering expenses, which other future entrants might avoid. These overheads relate to the learning process and adjustments to a new market, which the company faces in a new region (Pearce & Robinson 2000).

Other pioneering costs include marketing and educating consumers about the new products that a company offers. Foreign governments can also establish special conditions through regulations that are aimed at protecting domestic companies in the market segment of the new entrant where such regulations may water down the company’s investment and put it in a disadvantageous position in relation to the local companies (Chernev 2009; Wu 2007).

Therefore, future entrants may learn from the challenges of the first entrants and hence avoid the costs and challenges that the first-mover companies face in the sector. Indeed, according to Best (2009), companies that enter a market after several other competitors have already joined have a higher chance of survival and success.

Wal-Mart was among the first foreign retail firms to enter the Chinese market. Hence, it took the first mover advantage, which ensured its rapid success and expansion in the country. The company, which first entered Hong Kong through a joint venture with a smaller retail company in 1994 soon expanded to the Chinese market to become a formidable player in the retail industry in China (Basker & Pham 2008).

Indeed, for a long time, China is still the most successful market for Wal-Mart after the US (Wal-Mart 2013). The company has established an elaborate customer base and distributor loyalty. The two achievements have also made it difficult for other competitors to gain admission in the country.

The second important factor for consideration in entering a new foreign market is the scale of entry. The magnitude of entry refers to the initial investment that a company commits to a new foreign market. According to Chernev (2009), the magnitude of entry may be extensive or small-scale.

However, each magnitude has its advantages and disadvantages to a company. A large-scale entry, which indicates a rapid admission, requires significant resource commitments. Therefore, the entry approach is of higher risk since it costs a company many resources (Chen, Jia, & Lau 2008).

However, despite the disadvantages that the company may face in the event of failure, on the positive side, it can work for a company by promoting trust and loyalty among suppliers and customers who feel that it (the company) is more committed and able to meet the service providers’ respective needs. Saxena and Sharma (2011) assert that a large-scale entry is a signal to suppliers, distributors, and customers of a long-standing interaction and collaboration that the company seeks.

Such interaction will most likely make it difficult for other competitors to succeed in the market. However, the disadvantage of this sweeping entry is that any failure will have a significant impact on the company’s bottom line. Further, the many resources that are committed to a large-scale admission restrict the company’s expansion or entry into other markets. Therefore, the risk is very high for the company.

Based on the above reasons, a company must be ready to balance the risks and benefits of significant strategic commitment (Plambeck & Denend 2008). On the other hand, a small-scale entry has it benefits and risks, which a firm must consider. For instance, a small-scale strategic commitment allows a firm to learn the dynamics of a foreign market with less risk to allow its expansion or withdrawal from the market depending on the outcomes of the initial investment (Porter 2008a).

However, the disadvantages of this approach are that it is difficult to achieve the economies of scale, create a switching cost, or capture a market share. In this case, it is important for a firm to weigh all options that relate to whether to choose a large-scale or small-scale commitment when entering a foreign market.

In this case, Wal-Mart has chosen a small-scale entry through a joint venture with the C.P Pokphand Company where it has opened three value club membership discount stores in the city of Hong Kong (Parboteeah & Cullen 2003). After the success of its ventures in Hong Kong, the company expanded to China’s homeland with the view of serving the over 1 billion people in more than 600 cities in the country.

The third consideration when entering a foreign market is the entry mode where six options are available for a company to choose. These modes of entry include overseas sales, multiparty ventures, franchising, wholly owned branches, certification, and turnkey developments (Meyer et al. 2009). Each of the entry modes has its pros and cons. Wal-Mart has utilised several of these modes of entry in its international expansion plan.

The company has a majorly known acquisition and joint venture, which it has utilised well in the Chinese market (Brouthers, Brouthers, & Werner 2008). The company made important past acquisitions that made it become China’s largest retailer.

Firstly, after the joint venture with the Hong Kong-based retailer, namely the C.P Pokphand Company, the company moved to China’s soil where it established its first Sam’s Club and Wal-Mart supermarket in Shenzhen through a joint venture with the Shenzhen International Credit Investment Company (Wei, Liu, & Liu 2005). Further, it has made important strides through various acquisitions.

The most notable stride was the acquisition of the Trust Mart in 2007 where it acquired a 35% share and later 100% share by 2012 (Elsner 2014). The acquisition of Yihaodian, a fast-growing eCommerce business in China in 2012, also strengthened its foothold in the Chinese market.

As of 2013, the company has 412 retail units. This achievement made the retailer the leading retail chain in the Chinese market and hence the second most lucrative Wal-Mart’s market in the world after the US market (Wal-Mart 2013).

Brand Strategy of Wal-Mart in China Retail Market

A brand strategy indicates the deliberate efforts that a company or a firm seeks to establish to the level that its stakeholders are proud when associating with the business. A brand strategy allows a company to stand out from its competitors due to its unique value promotion that it has established.

Such strategy can relate to customer care services, product pricing, and quality services among other strategies and factors that ensure that a firm gains a loyal customer base for its services and products (Detomasi 2006). Being a retailer and hence a seller of a wide range of consumer products, Wal-Mart’s brand strategy is majorly focused on pricing, reliability, and quality services.

In terms of the pricing strategy, the focus is on pricing products cheaper than the industry rates. The strategy ensures that consumers can bargain for the purchases they make. This strategy can often act to the disadvantage of a company, especially when it has a small market share and establishments.

Hence, it is majorly advantageous to big firms, which have large-scale operations and presence where profits are made through economies of scale, rather than sales margins of individual products (Brouthers, Brouthers, & Werner 2008). In other words, by setting the price to bring the minimal profits per product, the company makes profits by selling large volumes of products where the cumulative profits of each product lead to high overall yield.

The pricing strategy has worked well for Wal-Mart, which has majorly focused its brand strategy on pricing where it is known for offering cheaper products and services as compared to other competitors (Elsner 2014). Its large presence in the Chinese marker where it has more than 400 individual retail stores ensures that economies of scale translate to high profits.

In terms of reliability, the company has focused on ensuring that it is near to customers, regardless of the location of the customers. In this case, a customer is assured of a Wal-Mart store where he or she can access his or her favourite products and services, regardless of where he or she moves to in the country.

The company has focused on establishing its presence in almost all major cities and localities in China. Such brand strategy resonates well with the Chinese population, which is increasingly becoming urban and hence the need for such retailers to provide consumer products wherever the customers need them (Mullins & Walker, & Boyd 2009).

To support its reliability, the company has established an elaborate and reliable supply and distribution chain, as well as effective inventory management systems, which guarantee the availability and supply of products to ensure that the products never run out of stock. The last brand strategy that a company may adopt in the retail industry is the quality of services and products.

In this case, by ensuring that customers are assured of quality services and products, a firm can easily lead to increased loyalty and consequently a good brand identity. Wal-Mart has undertaken important milestones to warrant quality services and products.

Firstly, the company’s well-established centralised supply chain management ensures that it operates closely with suppliers to produce and make quality products that customers can be satisfied with and/or relate to Wal-Mart’s quality-focused brand (Lambin 2007; Mcgregor 2008; Palmer, Cockton, & Cooper 2007).

Further, the company has a well-trained staff team that can offer guidance and any assistance that customers need in relation to in-store issues when buying or locating products (Etgar & Rachman-Moore 2010). In addition, any complaints that relate to products and services are well supported by an elaborate customer care service, which is available throughout the day and night (Buckley, Devinney & Louviere 2007).

Such an approach ensures that customer complaints, demands, enquiries, and any other issues may be addressed promptly and satisfactorily to protect the company’s brand while at the same time ensuring a satisfied and a loyal customer base in the Chinese market.

Retail Life Cycle for Wal-Mart in Chinese Market

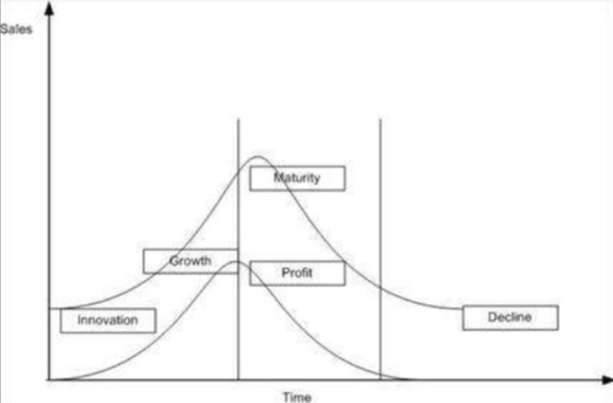

The retail life cycle is a theory that describes the change process of a retail firm. The cycle derives its tenets from the product life sequence in the marketing discipline. The retail life cycle holds that a product has four phases of development, which include modernism, the accelerated growth phase, the adulthood phase, and decline period. All firms must go through these four phases.

According to this theory, these stages of evolution are inevitable. Although other theories of institutional change have been put in place to explain the change processes in firms in the retail industry (Elsner 2014), the retail life cycle hypothesis is the most popular, most powerful, and most widely used theory of explaining the growth and decline of retail firms. The graph below shows the retail life cycle.

Figure 1: A Graph of Retail Life Cycle

Source: (Etgar & Rachman-Moore 2010)

Looking at Wal-Mart operations in the Chinese Market, the company has already passed throw the innovation stage since 1996 when it first set its operations on the Chinese motherland (Etgar & Rachman-Moore 2010). This stage is the first in the lifecycle of a retail firm that seeks to establish its business in a given market.

For instance, the company’s initial development involved a joint venture with the Shenzhen International Credit Investment Company (Smeltzer & Sifered 1998; Hitt, Ireland, & Hoskisson 2012). Further, after its initial entry into the Chinese market, the company moved to the second stage of rapid expansion through various acquisitions and expansion throughout the country.

This move allowed the Chinese market to rise from a small share of the company’s business to the second most profitable country of Wal-Mart’s operations in the world after the US (Chaney & Gamble 2008; Soloman 2003). Now, Wal-Mart has more than 400 stores in the Chinese market. This achievement makes it the largest retailer and the most profitable in this market.

The company is slowly entering the maturity stage as an indication of the move towards less expansion and stabilising of profits and revenues, as opposed to the prior stage of rapid growth and profit increment (Mottner & Smith 2009). The last stage of the lifecycle of a retail firm is the decline stage, which is characterised by a reduction in profits and revenue.

If this phase is not well addressed through rejuvenation efforts, it can lead to a firm being pushed out of the market or completely rendered non-competitive and hence its ultimate closure. Looking at the current operations of Wal-Mart supermarket, the company has experienced exponential growth in the Chinese market. For a long period, the company’s operations in this country have been the fastest growing in its operations across the world (Mottner & Smith 2009).

However, in the last few years, the company has slowed down its expansion after facing various challenges with government regulations that relate to competition practices (Camillus 2008; Porter 2008b). Such situation, which is associated with stagnation, has slowly pushed the company into the maturity stage. However, the potential of growth in China is still very high, especially due to the rising middle class due to economic success that the country has enjoyed over the last one decade since the beginning of the 21st century (Hastings & Saperstein 2009).

Therefore, the company is far from reaching the decline phase since the increasing population of well-off people will lead to growth in customers who will maintain the company’s profitability in the Chinese market for the near and far future.

Development Strategy-Environmental Theories

Wal-Mart’s operations have a significant impact and influence on the Chinese environment based on its footprint in the Chinese consumer market. The company has more than 400 stores. Each store sells numerous products and services to people (Wal-Mart 2013). Issues such as the products and their consumption have far-reaching consequences on the environment.

Wal-Mart is well aware of the political, business situation, monetary, lawful, public, and technological environments that affect the business in one way or another (Lambin 2007; Mcgregor 2008). For a company to grow, it must consider these environmental issues since they affect its operations in one way or another.

For instance, the Chinese economy is based on communism. Hence, the government has enormous control over the market. In this case, government’s regulations are very strict. They often affect how Wal-Mart conducts its business in China and other countries (Wal-Mart 2013).

Due to the strict nature of the government’s regulations in the retail market, Wal-Mart has severally found itself on the wrong hand of the law where it has been fined millions of dollars in several occasions, mostly for wrong competition practices (Kapferer 2012). However, with time, the company has learned slowly from its mistakes. Currently, the company is less involved in practices that can lead to violations that may render it uncompetitive.

These regulations also indicate major legal challenges that the company has faced in the past. The second developmental issue relates to the economy. This issue has a significant bearing on the success of Wal-Mart in China. Over the last decade, the Chinese economy has grown tremendously, thanks to the increased globalisation and gradual opening up of the economy to the international market (Gereffi & Christian 2009; Tilly 2007).

The growth has fuelled an influx of foreign companies into the highly lucrative economy of China. Wal-Mart has been keen to take advantage of this growth as evidenced by its rapid expansion and profits, which have enabled it to become the leading Chinese retailer in terms of revenues and outlet presence in the country.

In terms of social and environment issues, Wal-Mart has been at the forefront in undertaking corporate social responsibility activities, which have acted positively to create a good name for the company. For instance, for a long time, the company received criticism for poor supply chain, which was previously leading to harmful emissions to the environment (Basker & Pham 2008). However, this trend has changed.

Currently, the company’s supply chain is one of the most environmentally friendly in China. Further, the company has dedicated more efforts and resources to the elimination 20 million tonnes of carbon emissions from its supply chain. These efforts are meant to depict the company as more environmentally friendly and a better responsible citizen.

Competition Strategy

The competition strategy indicates the efforts that a company undertakes to have a competitive advantage over its rivals in the market (Cooke 2008). A firm that lacks a competition strategy is likely to be driven out of the market. Three major competition strategies have been established. They include the cost strategy, differentiation/innovation strategy, and focus strategy.

Cost Strategy

In terms of the cost strategy, a firm seeks to reduce product costs through efficiency approaches such as the use of technology, valuable supply chain management, and reduced workforce among other methods. The goal is to ensure that the company has less expenditure as compared to its competitors.

The strategy gives the company a competitive advantage where it realises more profits even when it prices its products in the same range as its competitors (Barney & Hesterly 2008; Jia 2008). Wal-Mart has used this competition strategy by establishing a highly effective and efficient supply chain, which is less costly. The supply network allows the company to set competitive processes as compared to its rivals.

Differentiation/Retail Innovation

Differentiation or innovation is a major competition strategy for any company. In this case, a company can produce unique products or services, which separate it from other companies, hence giving it a competitive advantage (Mullins & Walker, & Boyd 2009).

In the retail industry, it is difficult to achieve differentiation and innovation in the products that a company has in store since it offers a wide array of commodities from vendors who also supply the same merchandise to other retailers (Luo & Tung 2007; Basker & Pham 2008).

However, a company can achieve differentiation in terms of the services it offers. For instance, through its customer loyalty programme, Wal-Mart can offer enormous benefits to customers. The move is a major advantage to the company when it comes to competition.

Pricing Strategy

The pricing strategy is very important and a major competition strategy for an organisation in the retail industry. For instance, a company, which offers high-quality discounted services, can attract more customers and hence record more profitability through the economies of scale as compared to a company that offers the same quality of services but at a premium (Lasserre 2012).

Wal-Mart has utilised this strategy by positioning itself as a low-cost retailer where customers can access high-quality services and products at a discount (Trunick 2006). In this case, the company has set an elaborate network of retail outlets, which serve millions of customers daily. Hence, through economies of scale, the company has registered a high productivity.

The Effects of Retail Strategic Management

Retail strategic management is an important part of a retail firm’s strategies for ensuring success in its operations. Therefore, it has both advantages and disadvantages. In terms of the advantages, retail strategic management allows a firm to understand its market and hence put in place the necessary measures to ensure success (Sheremet 2013; Slack & Lewis 2002).

For instance, Wal-Mart’s strategic approaches in China through its differentiated methods and pricing strategies have allowed it to gain a strong presence and brand loyalty in the country. Further, its modes of entry such as partnerships, joint ventures, and acquisitions have allowed it to adapt to the retail market environment of the Chinese retail market.

However, just like any other strategy, retail strategic management has its disadvantages, which come in the form of overlooking other factors that may arise in a given market (Canabal & White 2008). For instance, due to the tight control of the market by the government, Wal-Mart has faced several lawsuits, which have cost it millions of dollars. These experiences can be linked to its failure on the side of its strategic management approaches of entering the Chinese market.

Retail Strategy Management in the Study of China

The Chinese retail market presents unique features, which make it very different from other retail markets in countries such as the USA, Europe, and Japan. For instance, the market is still young as compared to that of the US, Japan, and Europe.

The notion that that only a few local Chinese retailer enterprises are available is a clear indication of the fact the Chinese market is still young and growing (Zentes, Morschett, & Schramm-Klein 2007; Laudon & Traver 2007). Another major problem is that the country’s regulations on the economy present unique problems for foreign retailers as evidenced in the number of lawsuits that Wal-Mart has faced.

References

Barney, J & Hesterly, W 2008, Strategic management and competitive advantage: concepts and cases, Pearson/Prentice Hall, Upper Saddle River, NJ.

Basker, E & Pham, V 2008, Wal-Mart as catalyst to US-China trade, Prentice Hall, New York, NY.

Best, R 2009, Market Based Management: Strategies for Growing Customer Value and Profitability, Prentice Hall, New York, NY.

Brouthers, K, Brouthers, L & Werner, S 2008, ‘Real options, international entry mode choice and performance’, Journal of Management Studies, vol. 45, no. 5, pp. 936-960.

Brunn, S 2006, Wal-Mart world: The world’s biggest corporation in the global economy, Taylor & Francis, Philadelphia.

Buckley, P, Devinney, T & Louviere, J 2007, ‘Do managers behave the way theory suggests? A choice-theoretic examination of foreign direct investment location decision-making’, Journal of international business studies, vol. 38, no. 7, pp. 1069-1094.

Camillus, J 2008, Strategy as a wicked problem. Web.

Canabal, A & White, G 2008, ‘Entry mode research: Past and future’, International Business Review, vol. 17, no. 3, pp. 267-284.

Chaney, I & Gamble, J 2008, ‘Retail store ownership influences on Chinese consumers’, International Business Review, vol. 17, no. 2, pp. 170-183.

Chen, H, Jia, B & Lau, 2008, ‘Sustainable urban form for Chinese compact cities: Challenges of a rapid urbanised economy’, Habitat international, vol. 32, no. 1, pp. 28-40.

Chernev, V 2009, Strategic Marketing Management, Brightstar Media, New York, NY.

Cooke, F 2008, Competition, strategy and management in China, Palgrave-Macmillan, London.

Cravens, D & Piercy, N 2008, Strategic marketing, McGraw-Hill, New York, NY.

Detomasi, D 2006, ‘Book Review: The INSEAD-Wharton Alliance on Globalising: Strategies for Building Successful Global Businesses’, Journal of the Academy of Marketing Science, vol. 34, no. 2, pp. 265-267.

Elsner, S 2014, Retail internationalisation analysis of market entry modes, format transfer and coordination of retail acitivities, Springer Gabler, Germany.

Enderwick, P 2009, ‘Large emerging markets (LEMs) and international strategy’, International Marketing Review, vol. 26, no. 1, pp. 7-16.

Etgar, M & Rachman-Moore, D 2010, ‘Geographical Expansion by International Retailers: A Study of Proximate Markets and Global Expansion Strategies’, Journal of Global Marketing, vol. 23, no. 1, pp. 5-15.

Freeman, R 2010, Strategic management: A stakeholder approach, Cambridge University Press, The United Kingdom.

Gereffi, G & Christian, M 2009, ‘The impacts of Wal-Mart: The rise and consequences of the world’s dominant retailer’, Annual Review of Sociology, vol. 35, no. 1, pp. 573-591.

Hastings, H & Saperstein, J 2009, Improve Your Marketing to Grow Your Business. Wharton School Publishing, New York, NY.

Hitt, M, Ireland, R & Hoskisson, R 2012, Strategic management cases: competitiveness and globalisation, Cengage Learning, Boston, MA.

Jia, P 2008, ‘What happens when Wal-Mart comes to town: An empirical analysis of the discount retailing industry’, Econometrica, vol. 1, no. 1, pp. 1263-1316.

Kapferer, J 2012, The new strategic brand management: Advanced insights and strategic thinking, Kogan Page Publishers, London.

Klein, D 2009, The strategic management of intellectual capital, Routledge, London.

Lambin, J 2007, Market Driven Management: Strategic and Operational Marketing, Palgrave Macmillan, New York, NY.

Lasserre, P 2012, Global strategic management. Palgrave Macmillan, London.

Laudon, K & Traver, C 2007, E-commerce, Pearson/Addison Wesley, New York, NY.

Luo, Y & Tung, R 2007, ‘International expansion of emerging market enterprises: A springboard perspective’, Journal of international business studies, vol. 38, no. 4, pp. 481-498.

Mcgregor, H 2008, Globalisation, Wayland, London.

Meyer, K, Estrin, S, Bhaumik, S & Peng, M 2009, ‘Institutions, resources, and entry strategies in emerging economies’, Strategic management journal, vol. 30, no. 1, pp. 61-80.

Mottner, S & Smith, S 2009, ‘Wal-Mart: Supplier performance and market power’, Journal of Business Research, vol. 62, no. 5, pp. 535-541.

Mullins, J, Walker, O & Boyd, H 2009, Marketing Management: A Strategic Decision-Making Approach, McGraw-Hill Higher Education, New York, NY.

Palmer, R, Cockton, J & Cooper, G 2007, Managing Marketing: Marketing Success Through Good Management Practice, Butterworth-Heinemann, London.

Parboteeah, K & Cullen, J 2003, ‘Social Institutions and Work Centrality: Explorations beyond National Culture’, Organisation Science, vol. 14, no. 1, pp. 137-148.

Pearce, J & Robinson, R 2000, Strategic management: Formulation, implementation, and control, McGraw-Hill, New York, NY.

Plambeck, E & Denend, L 2008, ‘Wal-Mart’, Stanford Social Innovation Review, vol. 6, no. 2, pp. 53-59.

Porter, M 2008a, Competitive strategy: Techniques for analysing industries and competitors, Simon and Schuster, New York, NY.

Porter, M 2008b, On competition, Harvard Business Press, Watertown, MA.

Saxena, R & Sharma, A 2011, ‘Everyday low price â a blessing in disguise for Wal-Mart during recession’, International Journal of Business and Globalisation, vol. 7, no. 4, pp. 409-420.

Sheremet, A 2013, ‘Comprehensive Economic Analysis Of A Company’, Advances in management & marketing, vol. 3, no. 1, pp. 1-5.

Siebers, L 2011, Retail internationalisation in china: expansion of foreign retailers, Palgrave Macmillan, New York, NY.

Slack, N & Lewis, M 2002, Operations Strategy, Financial Times Prentice Hall, Harlow.

Smeltzer, L & Sifered, S 1998, ‘Proactive Supply Management: The Management of Risk’, International Journal of Purchasing and Materials Management, vol. 34, no. 1, pp. 38-45.

Soloman, M 2003, Conquering consumerspace marketing strategies for a branded world, The American Management Association, New York, NY.

Tilly, C 2007, ‘Wal-Mart and its workers: NOT the same all over the world’, Connecticut Law Review, vol. 39, no. 4, pp. 1-19.

Trunick, P 2006, ‘Wal-Mart Reinvests Itself in China’, Logistics Today, vol. 47, no. 1, pp. 17-18.

Wal-Mart 2013, Annual Report, Wal-Mart Corporation, Texas.

Wei, Y, Liu, B & Liu, X 2005, ‘Entry Modes of Foreign Direct Investment in China: A Multinomial Logic Approach’, Journal of Business Research, vol. 58, no. 1, pp. 1495-1505.

Wu, F 2007, China’s Emerging Cities: The Making of New Urbanism, Routledge, London.

Zentes, J, Morschett, D & Schramm-Klein, H 2007, Strategic retail management. Web.