Executive Summary

Starting and maintaining any business venture is a process that requires determination motivation and general know-how in regards to how to operate a business and ensure that it remains profitable despite the various challenges and risks that may be available in the business environment one wants to venture in. As such, there are several considerations that should be carried out to ensure that all details regarding the business are addressed and well planned for.

The considerations include but are not limited to: the identification of the business opportunity, development of the product or service, evaluations of the suppliers, clients and business environment and market analysis among others. A recurrent and most important concept that must be considered is the quality of the output produced by all processes within the business. Total quality ensures that the business survives the harshness of business environments, all the while guaranteeing profits from the venture.

This report shall set out to explore Total Quality Management (TQM) as being among the core concepts used by business entities to safeguard their reputation, ensure effective and efficient delivery of quality products and services and manage businesses towards success. To this end, the principles of TQM shall be discussed and its relevance to human resource, client satisfaction and supplier management analyzed.

By using relevant and credible sources, this report shall present a comprehensive and informative discussion on how TQM plays an integral role in facilitating business growth, promoting efficient human resource management, guaranteeing customer satisfaction and enhance strategic management in various aspects of the business. In short, this paper shall elaborate the importance of TQM in today’s organizational management.

Introduction

Throughout their existence, organizations and businesses are considerably under a lot of pressured to raise their levels of performance and productivity. This is especially so in the modern-day business environment which is characterized by aggression and excessive competition. This constantly forces businesses to exhibit innovativeness and enhanced performance so as to remain relevant and profitable in the ever increasingly competitive arena.

To achieve the organizational goal of increased productivity, the input of both the individual and groups in the organization remains invaluable. However, for these inputs to make a significant impact there must be a strong leadership and management to steer the individual and group effort in the right direction. This being the case, the development of leadership and management strategies is of great importance to any business entity.

Exemplary leadership and management alone cannot guarantee that a business will be successful in the long-run. Due consideration has to be given to quality management as well. It is from realization that Total Quality Management (TQM) was invented. TQM is an all-inclusive improvement concept that has in the last few decades, been adopted by many organizations in their journey towards increased market share, profitability and sustainable growth.

Considering the importance of this concept, business analysts and scholars have over the years developed various TQM principles and models to assist business leaders make the most out of their ventures. However, many businesses have failed to sustain TQM in their processes long enough to realize its full benefits. This paper shall therefore provide an informative discussion on TQM, its history, principles and applicability in understanding business processes, interactions and growth.

TQM: A Brief History

Bagad defines TQM as a broad and continuous approach that businesses implement to ensure quality and performance improvement that guarantees customer satisfaction (4). According to the author, this guarantee is achieved by “integrating all quality-related functions and processes throughout the company (Bagad 12).”

As regarding to its prominence, Bagad asserts that after the Second World War, the need to inspect the quality of goods and services availed to consumers became a common practice which led to the development of the Statistical Quality Control (SQC) theory which was formulated by Dr. Edwards Deming (Bagad 18).

According to the theorist, the quality of products could only be ascertained by sampling random products produced from each batch. As such, this theory was based on the assumption that any manmade or technical error experienced in the production process would ultimately lead to defects or other quality related issues to the end products. As such, the theorist believed that by eliminating the errors in the production process, the end product would certainly be of high quality.

Testing the quality of manufactured goods was further necessitated by the fact that the Japanese manufacturing industry produced a lot of poor quality goods after the Second World War. As such, in the fifties, quality control became a major concern for most nations. Subsequently, in the 1970’s, the concept of total quality evolved.

This was attributed to the fact that business organizations had acknowledged the value of quality control. As such, it was not only logical, but a strategic move to implement measures that included all employees in quality control processes. This notion was more efficient and covered a wide range of business activities towards the delivery of quality goods.

TQM: Understanding the Concept

As has been elaborated above, TQM is a management tool that facilitates leaders and managers to direct their organization into a successful future. It is a wide concept that requires commitment from both the management and organizational employees if it is to be successful.

As such, it not only aims at managing and assuring that quality is maintained in all goods or services produced, but extends to the management of the people and processes used. This approach ensures that each internal and external production stage promotes full consumer satisfaction (Mukherjee 23). Notably, whenever leaders integrate TQM concepts in their businesses, their organizations do the right things correctly with little to no complications.

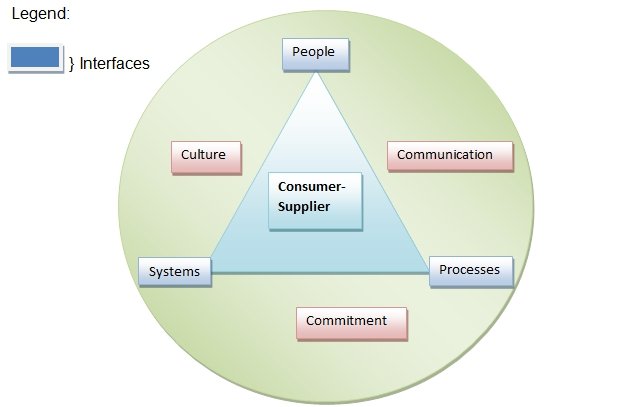

Maguad asserts that TQM, like any other management strategy utilizes the people-process- system cycle (181). This is because TQM focuses on consumer-supplier quality relations. However, the efficiency of this relationship is influenced by the level of commitment to quality, communication (as regarding to how the quality message is transmitted) and culture. Culture in this context influences the relationship in the sense that organizations have deep rooted cultures.

As such, if an organization is willing to change its culture such that it promotes improvement in quality, then the organization will have a good consumer-supplier interface. However, if the organization is reluctant to cultural change, the interface will not work as it is expected to in terms of providing total customer satisfaction. This paragraph can best be elaborated by this diagram below.

A diagram elaborating the TQM interface in an organizational setting

This diagram shows how different internal and external factors are interlinked to ensure that the quality of the product meets or exceeds the expectations of the consumer.

It should be noted that in each interface is made up of various processes. As such, they all affect each other and failure in one interface leads to the organizations inability to deliver quality goods and services. According to the Department of Trade and industry (DTI) website, quality in TQM refers to the ability of a product or service to fully satisfy a consumers needs or fully meet them as expected (2).

As such, the author(s) reiterates that quality is measured in term of a product’s or service’s performance, appearance, availability, delivery, reliability, maintainability, cost effectiveness and price (DTI 2).” The author further suggests that an organization should always ensure that its products and services meet these requirements. The only way this can be ascertained is by conducting a market research (DTI 3).

Empirical Research

The rationale for the study and its methodology

Prior to discussing the core tenets of TQM, we need to discuss the empirical survey that was aimed at examining customer’s perceptions of quality. This question is of great importance for modern companies since they need to understand which dimensions of quality are of the greatest value to clients. This information can help them to better develop products as well as services. The main objective of this survey was to determine what aspects affect the customer satisfaction and what factors affect their purchasing decisions.

It should be noted that scholars distinguish different aspects of product quality, in particular, performance, functionality, reliability, serviceable life (Sower, 7). As far as service quality is concerned, researchers speak about such dimensions as reliability, responsiveness, and assurance (Kandampully, Mok & Sparks, 54). In many cases, it is rather difficult to determine which of these dimensions of the greatest importance for customers.

The survey that has been conducted relies on quantitative relied on quantitative research methods, namely on the structured interview. The respondents were asked a series of multiple-choice questions that prompted them to assess different aspects of product and service quality in terms of their importance[1]. The participants for the study were randomly selected and the sample was divided into two equal groups; male subjects and female subjects.

The total sample size was 30; the participants were recruited in near shops and supermarkets. Each of them was informed about the purposes of this survey. The participants were not required to name themselves or identify their income level and age. This information could made the findings more accurate, in this case, the respondents would have been more reluctant to take part in this survey. In total, this survey lasted for three days.

Analysis of findings

The responses of the participants indicate that customer perceptions and interpretations of quality are not universal. The most important quality dimensions of a product are performance and reliability, 17 respondents out of 30 identified make their purchasing decisions on the basis of these characteristics. Such attributes as serviceable life and design were of lesser priority to the priority. Yet, it should be mentioned that for female respondents design was of higher priority than for male subjects.

Seven out 15 female subjects judged a product by its design. The second issue to be discussed is the quality dimensions of service companies. Judging from the responses of the participants, a large number of customers pay attention to reliability (10 respondents) and time-efficacy (12 respondents). However, one should not assume that politeness and responsiveness do not affect the clients’ decisions.

Approximately 27 percent of customers (8 respondents) evaluate a service company according to the politeness of its workers. Additionally, the results of this survey suggest the manufacturing as well as service companies should involve customers into product development or assessment of performance. 83 percent of respondents (25 participants) agreed with this statement. It has to be admitted that this study has several important limitations.

Perceptions of quality can be dependent on the income level of a respondent. For instance, customers, who are very sensitive about the price, may pay more attention to serviceable life of product. In contrast, customers, who are not price-sensitive, can attach more value to performance and design. During the survey, we could not ask the subjects about their income level since many of them might have refused to participate in the study. Hence, we do not know to what extent this variable affect people’s expectations and perceptions of quality.

Those customers, whom we interviewed, attached more value to the quality of a product rather than its price (20 respondents out of thirty). The second limitation of the research is that the questions of this survey are not applicable to all kinds of products; they are more suitable for manufactured items. They may not be suitable for grocery goods or clothing. Thus, the researchers would have to ask different questions, if they want to focus on these particular goods.

Implications and conclusions

This survey can have several implications for business administrators and practitioners of total quality management. First of all, it shows that customers wish to be more involved in the development of products and services. By acting in such a way, they will be able to strengthen their position in competitive environments.

Most importantly, they will manage to enhance customer loyalty. This argument is quite consistent wit the core principles of TQM, since this approach focuses on customer satisfaction as the major objective of any company. Secondly, this research has shown which quality dimensions of products and services are of the highest priority for modern customers. By using customer surveys, the management can understand the expectations of their target audience and their needs.

Principles of TQM

A principle can be defined as the main belief of the founding concept that makes an action or reasoning valid. Like any other management strategy, Maguad reiterates that the most integral components of TQM are leadership and commitment (185). Leadership in this context refers to a process through which one person uses the help and support of others towards achieving a particular goal or task.

As Maguad suggests, leaders are the people who are taxed with the role of marshalling the human resource in the organization for its growth and expansion (193). They do this by planning, organizing, leading and controlling the organizations activities and resources. Commitment is the level of loyalty, determination and motivation exhibited by members of an organization as they carryout their tasks.

As mentioned earlier, various interfaces often work together to ensure that an organization produces quality products and services. Leadership is very important because a leader’s ability to delegate, make decisions, resolve conflicts and motivate employees determines whether an organization will be successful in its endeavors. On the other hand, commitment affects the performance and motivation levels exhibited by employees.

If employees are committed, an organization is more likely to experience growth and increased profits because at the end of the day, an organization cannot function without the people factor. Considering these two core elements, it would be a worthwhile endeavor to shed some light on the basic principles of TQM. As may have been deduced throughout this research, TQM aims at promoting three main objectives: customer satisfaction, supplier satisfaction and continuous improvement of an organization’s processes.

Customer satisfaction

Customer satisfaction often refers to the ability of a product or service to fully satisfy the needs of the intended consumer. This should be the primary concern of any organization willing to survive the aggressive nature of today’s business environment. This is mainly because satisfied clients mean more sales, increased market share and unwavering consumer loyalty.

These elements ensure that an organization makes profits which can be used to research for cheaper and better ways of production, expanding an organization’s market base and expand the business. With these undertones, the question that is left wanting is; how does TQM ensure consumer satisfaction?

Gilmore addresses this question by reiterating that TQM is an effective strategy that can be used to minimize variations in the production process thereby increasing the organization’s chance of producing quality products and services that meet (if not exceed) the needs and expectations of the consumers (207).

The author further states that, in every organization there are various departments and offices that cater for different needs of the consumers. These factions make up quality chains which depend on each other to produce the final product or service.

These quality chains stand at a risk of being broken due to human or technical errors. Such failures often sip through and multiply down the production process and may lead to failure of the organization to meet the requirements of the clients.

As such, Kanji et al state that, TQM presents organizations with an opportunity to train their employees on different factors they should consider when handling tasks in the consumer-supplier interface (52). This in turn ensures that each employee has the necessary skills needed to achieve quality.

Similarly, Gilmore argues that TQM focuses on identifying the potential areas that may cause problems and solve them before a product or service is made available to the market (208). Considering the definition of quality provided herein, we could argue that quality is consumer driven.

This means that an organization must identify the needs of the clients and formulate the best means of meeting them satisfactorily. Gilmore states that a perfectly produced product or service is of no benefit to the organization if it fails to meet the needs of the client (207). As such, the author contends that TQM tools enable organizations to identify such needs by outlining market research methodologies and production processes that enhance accuracy and efficiency in various consumer-supplier interfaces.

In addition, Gilmore asserts that consumer preference and needs vary from one consumer to the other and from season to another (209). As such, the author contends that it is often difficult to determine what consumers need and expect from a product or service.

However, the author states that TQM presents organizations with various tools and strategies which can be implemented to ensure that the products or services produced are always tuned to the needs and expectations of the target market.

Some of the measures of TQM that can be used to address these changes include but are not limited to focus groups that concentrate on the needs of specified consumers, market surveys which gather information on current trends, competition and prices, and customer interviews which provide firsthand information on what consumers need and expect from a product or service.

Such information enables organizations to implement processes that address these needs and expectations thereby guaranteeing consumer satisfaction (Gilmore 209).

Supplier satisfaction

A supplier is the person or organization that has consented to sell you various resources needed to produce your product. This principle of TQM requires organizations to form good relationships with their suppliers. Yong and Wilkinson states that TQM places great emphasis on an organization’s ability to satisfy its suppliers (250).

The authors further contend that it is imperative that organizations provide their suppliers with clear and concise details on what they are supposed to supply and when they are supposed to supply. In addition, the authors suggest that the organization should make an effort to pay the suppliers in a fair and timely manner. In so doing, the supplier delivers quality goods and services which are then used by the organization to produce quality goods or services to its external consumers (Yong and Wilkinson 256).

Failure to do so invariably leads to delays in supply delivery, delivery of poor quality resources or even inconsistencies in deliveries. Such issues affect the quality of the products produced in terms of performance, availability, durability and reliability. These factors may cause consumers great dissatisfaction (Yong and Wilkinson 257).

In addition, Maguad states that TQM also encourages organizational leaders and managers to motivate and boost the performance of their employees (internal suppliers) if quality is to be maintained (184).

The author recommends that this can only be achieved if the people in charge provide the workers with clear and concise instructions, adequate working tools and equipments and favorable working conditions (Maguad 187). According to the TQM principle on supplier satisfaction, these factors combined with a fair reward and remuneration packages promotes commitment and motivation among the workforce, which leads to the efficient and timely execution of tasks within the organization (179).

Additionally, such measures increase the productivity levels exhibited by employees, all the while enabling management to identify good employees as well as the issues that affect the performance of various employees. In summary, this principle of TQM indicates that, when an organization satisfies its suppliers (internal and external), the quality of the end product is more likely to satisfy the needs of the consumers as well as those of the organization.

Continuous Improvement of the Organization’s Processes

This is the third and equally important principle of TQM. According to Rahman, this principle is founded on the assumption that organizations must always improve their processes, strategies and methodologies if they are to keep up with the dynamic nature of the business environment (203).

Rahman supports this assertion by contending that competition, technology and consumer preferences are improving and growing faster each day (201). As such, it is always wise for an organization to improve its methods if it aims at staying ahead of the game. Similarly, this principle encourages managers and employees to work smart rather than doing hard work.

According to Rahman some organizational leaders are under constant pressure to increase the organization’s productivity (206). As a result, such leaders try to improve the organization’s performance levels by coercing and forcing employees to work harder.

According to the author, this only results to mishaps and poor performance because the workers are in most cases de-motivated and stressed (Rahman 208). These factors may cause them to loose focus and do shoddy jobs so as to finish the tasks on time. This in turn lowers the overall quality of the goods or services produced.

Kanji et al state that this principle of TQM enables leaders to effectively find the source of the problem and device viable means of solving or avoiding them without necessarily pressuring the employees (50). In addition, this principle also recommends leaders to encourage and allow constructive criticism and suggestions from employees. Considering that the employees are often at the forefront in production processes, they are best suited to provide information on how an organization can improve an organizational process.

For example, Barad and Dror state that employees can offer valuable suggestions on whether a process is efficient or not. In addition, workers can suggest on whether a process should be improved or eliminated, and how such changes can best be implemented to avoid further complications (6630).

Some of the process improvement strategies proposed by this principle include but are not limited to just-in time-production which reduces overproduction and production costs and variable reduction tools. These are examples of TQM strategies and tools that can be implemented to improve processes all the while reducing the amount of resources that is wasted.

Similarly, Lynch and Keating II assert that the continuous improvement principle requires organizations to always find improve their productivity and growth by finding better means of carrying out business activities through learning, effective decision making processes and problem solving (353). TQM recommends the Plan-Do-Study-Act cycle (PDSA) as being among the most effective models to implement if continuous improvement of organizational processes is to be achieved. Below is a diagram elaborating the cycle.

A diagram illustrating the PDSA cycle

This cycle promotes quality in the sense that the management plans for what needs to be improved and makes decisions on how best such improvements can be implemented. The second step requires the implementation of the improvements that have been recommended. This simply means that the organization does what it has planed to do. Thirdly, after implementing/doing what was planned, the management and other concerned parties monitor how the improvements impact business processes.

In this stage, information can be collected regarding the problems, effectiveness and further improvements (recommendations and suggestions) that need to be addressed. The information collected from the third stage is used to improve the strategy or process such that it remains without any flaws. Jjjhjhjh states that this model has proven to be of great importance in effective decision-making processes, problem solving and risk management in many organizations.

TQM as a Strategy for Human Resource management

Human resource management refers to the strategies and policies that an organization implements so as to plan, control, organize and lead its workforce towards attaining the set organizational goals and objectives (Lammermeyr 175). In most cases, organizational failure is attributed to poor human resource management.

As such, having efficient HRM strategies is not only logical, but a prerequisite for successful and efficient execution of tasks by employees. TQM consists of a range of tools that can be implemented by an organization’s human resource department to ensure that it plays a greater strategic role in an organization. Some of the tools include but are not limited to the following.

Cause-and-effect diagrams

According to Wallace and Stahl, if management is to effectively identify and rectify various problems that affect the quality of the products or services produced, all employees must have the necessary skills needed to handle such problems (37). The authors acknowledge that production of quality goods or services is an organizational concept.

This means that each individual within the organization has a role to play in enhancing quality productions. As such, the authors state that the cause-and-effect diagram enables human resource managers to identify the problem, its causes and effects (Wallace and Stahl 37).

After collecting this information, the managers can develop training programs which equip employees with the skills needed to tackle or avoid these potential problems in a timely and efficient manner. As such, these charts enable the human resource department to design policies that ensures that the workforce performs as expected and meets the client’s needs effectively.

Flowcharts

Flowcharts are schematic diagrams which indicate all the steps that should be followed in order to execute a process or operation efficiently (Wallace and Stahl 37). Wallace and Stahl state that flowcharts are a form of a visual tool that can be easily used and understood (38).

By making these charts available at all operation sites, the human resource ensures that workers know what to do and how to address a problem if it arises. This is mainly due to the fact that flowcharts enable workers to develop clear mental images of how various tasks are supposed to be carried out. The provision of these charts enables human resource managers to promote quality productions because the flowcharts act as a point of reference to employees who do not know what to do in various situations.

Checklists

Checklists are documents which contain a list of all known issues and the frequency of their occurrence. Wallace and Stahl state that these lists look simple at first glance but are quite effective when it comes to gathering information about the quality or defect of certain processes (38).

Checklists may be used by human resource managers to identify and prioritize various potential issues that may affect the quality levels exhibited by an organization. Through this list, the human resource manager can make necessary changes, and decisions relating to which issue is most threatening and delegate qualified people to find a solution before things get out of hand.

Customer Satisfaction Aspect of TQM

As has been revealed within this research, TQM focuses on the strategies that can be implemented by organizations to ensure that they meet or exceed the consumer’s expectations and needs. TQM equips organizations with various tools and strategies that can be implemented to ensure that it meets the needs of its clients. To begin with, Kanji and Wallace reiterate that TQM requires organizations to do extensive research on its client’s needs and expectations.

This can be done by establishing focus groups that gather information about the needs and expectations of a specific group of consumers (Kanji and Wallace 980). In addition, Kanji and Wallace assert that, TQM also enables organizations to collect more relevant information through consumer interviews, research on market trends and behaviors; and acts as a guide to which products or services an organization should produce (983).

Similarly, TQM principles provide organizational employees with guidelines on the questions they should ask themselves and the clients in regards to the quality level they expect from a given product. Some of the questions incorporated within the TQM philosophy as regarding to customer satisfaction aim at finding out: who the customers are, their specific needs and specifications and methods of collecting this data (Lammermeyr 177).

In addition, employees are able to evaluate whether they can meet such requirements and how they can measure their ability to satisfy those needs. On the same note, organizations are able to figure out whether or not, as well as their ability to monitor and continually meet the changing needs of their clients. In summary, TQM enables organizations to research, plan, implement, monitor and improve their processes such that they constantly and continually guarantee consumer satisfaction.

TQM and sustained Organizational Growth

Notably, TQM does not only focus on the quality of the products or services produced by an organization, but also, on the factors that affect the processes and people factor that work in a given organization.

By using TQM tools and strategies such as the PDSA cycle, research methodologies, checklists and flowcharts among others, organizations are able to identify and meet the needs of their clients, pinpoint potential operational problems and defects that may affect the quality of the products or services produced and develop strategies to counter, mitigate or avoid them.

In so doing, organizations implementing such strategies and tools enjoy a large market share, reduced cost of production, increased profits and a reliable consumer base. These are some of the core factors that ensure that an organization enjoys a sustainable growth regardless of the harsh situations presented by today’s business environments.

In addition, TQM educates leaders and managers on the importance of various elements (consumers, suppliers, employee empowerment and organizational visions and cultures) that should be considered during the production of goods and services. By considering these elements, organizations are better placed to handle or avoid potential problems that may hinder the organizations from experiencing sustainable growth.

Similarly, TQM emphasizes on leadership, commitment, culture and communication as the key concepts that should be considered by organizations willing to succeed in their endeavors. If these concepts are efficiently implemented, they provide a recipe for organizational growth, competitive advantage, development and survival amidst changing business environment.

Conclusion

Managing the quality levels exhibited by an organization in terms of products, services and processes is seldom an easy undertaking and in many situations, businesses have failed in this regard due to lack of know-how by the business owners.

As such, it is always important to ensure that the philosophy of TQM is implemented before an organization initiates a project, process or operation before pouring all its investments into it. On this note, this study has provided a detailed and informative guideline as to how business entities can apply TQM concepts in all their activities.

Notably, most businesses aim at increasing their profitability by either sales or profit maximization. These strategies may be effective in the short run but may fail to guarantee the organization its survival in trivial times. However, focusing all efforts towards meeting or exceeding the needs and expectations of the consumers ensures that the organization is on the first row in terms of sustainable growth, marketing and management strategies and supply of quality products and services.

This research paper set out to explore the renowned philosophy of TQM. To this end, the evolutionary history and an overview of the same has been offered.

In addition, the basic principles of TQM have been highlighted and discussed. Similarly, ways in which TQM addresses customer satisfaction, sustainable organizational growth and enhances human resource management as a tool for strategic management have also been addressed.

As has been revealed herein, TQM has proven to be a cornerstone on which businesses can improve their performance and quality levels exhibited by their products and services. As such, business and organizational leaders should strive to ensure that their businesses utilize this viable concept.

Works Cited

Bagad, Victor. Total Quality Management. USA: Technical Publications, 2008. Print.

Barad, M., and Simon Dror. “Strategy maps as improvement paths of enterprises.” International Journal of Production Research 46.23 (2008): 6627 – 6647.

Gilmore, Harold. “Product and Service Quality-The South Pacific Way, Fiji Islands: A Case Study.” Quality Engineering 11.2 (1998): 207 – 212. Print.

DTI. Total Quality Management (TQM): From Quality to Excellence, 2009. Web.

Kandampully Jay, Mok Konnie and Sparks Beverley. Service quality management in hospitality, tourism, and leisure. London: Routledge, 2001. Print

Kanji, Gopal, et al. “Performance Measurement and Business Excellence: The Reinforcing Link for the Public Sector.” Total Quality Management & Business Excellence 18.1 (2007): 49 – 56. Print.

Kanji, Gopal, and William Wallace. “Business excellence through customer satisfaction.” Total Quality Management & Business Excellence 11.7 (2000): 979 – 998. Print.

Lammermeyr, Horst. “Human relationships: the key to total quality management.” Total Quality Management & Business Excellence 2.2 (1991): 175 – 180. Print.

Lynch, Richard, and Lawrence R. Keating II. “Problem Solving Workshop Based on Total Quality Management (TQM) Principles.” The Serials Librarian 25.4 (1995): 353 – 356. Print.

Maguad, Ben. “The modern quality movement: Origins, development and trends.” Total Quality Management & Business Excellence 17.2 (2006): 179 – 203. Print.

Mukherjee, Peter. Total Quality Management. New Delhi: PHI Learning Pvt. Ltd., 2006. Print.

Rahman, Shams-Ur. “Total quality management practices and business outcome: Evidence from small and medium enterprises in Western Australia.” Total Quality Management & Business Excellence 12.2 (2001): 201 – 210.

Sower V. E. Essentials of Quality with Cases and Experiential Exercises. NY: John Wiley and Sons. 2010. Print

Wallace, Thomas, and Robert A. Stahl. Sales forecasting: a new approach : why and how to emphasize teamwork, not formulas, forecast less, not more, focus on process improvement, not forecast accuracy. USA: T. F. Wallace & CO, 2002. Print.

Yong, Josephine, and Adrian Wilkinson. “Rethinking total quality management.” Total Quality Management & Business Excellence 12.2 (2001): 247 – 258. Print.