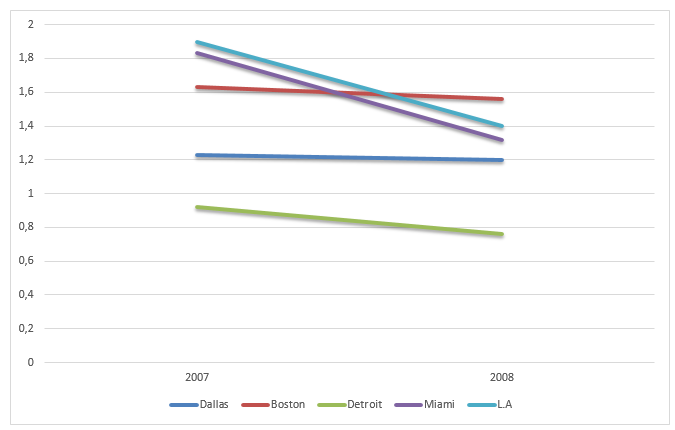

Houses in Miami lost more value as compare to other five towns in under study, they lost 0.51 while Los Angeles house value fell from 1.9 to 1.4 which is 0.5. Houses in Dallas shed off a small margin which was by 0.03 and Boston houses lost by 0.07 and lastly houses in Detroit lost by 0.16. In the year 2007 the data values mainly fall to the left of the mean, the distribution is said to be negatively or left-skewed.

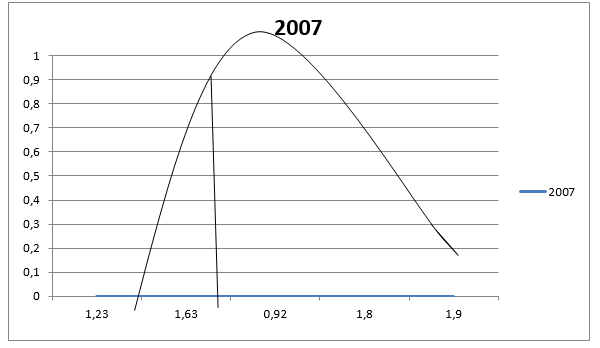

This mean falls to the right of he median, and both mean and the median fall to the right of the mode. This is the same case with the year 2008 although the negative skewness reduced in value. In the year 2007 the skewness was -0.67 and 2008 -1.23. The geometric mean for the data in 2007 was 1.45 while in the year 2007 was 1.2 while the mean was 1.5 and 1.2 respectfully. The standard deviations was 0.42 and 0.3 for the year 2007 and 2008 respectfully this shown in the excel extract below (Sprague, John 2008).

The chart below shows the trend taken by these houses

The rate which the value of houses fell was higher in Detroit, Los Angeles and Miami as compared to Dallas and Boston as shown by the chart above.

After conducting a literature review and looking at relevant surveys, the three propositions emerged to steer this discussion. The results were complied and interpreted using analytical framework all propositions were seen to be proved accurate and supportive of the existing theory, evident in the literature review. From the propositions it was clear that the financial crisis has had impact on the value of home homes. Those towns where job losses were affected more because people were unable to pay for the mortgages and thus value went down at a bigger rate(Sprague,2008).

The value of houses has gone down to a great extend for the last 2 years. And there are certain factors which have been associated with the decline that is performance of the economy.

The lose of jobs influenced to great extend the demand of the homes and people were unable to secure credit facilities thus unable to pay for their mortgages. Reliability was another factor which was said to contribute much to the people ability to secure money to pay for mortgages this is because employment was being lost at higher rate(Sprague,2008).

Since the slow down of the housing market severely affects the financial market, and the economy, slowing down the number of foreclosures may be the first step in the recovery of the housing market Sprague (2008). As a first step, Banks should tighten their lending requirements and increase the interest rates to discourage people from borrowing to purchase new homes. However, lending to eligible applicants has to commence again. A combination of these two actions will help reduce the inventory of homes on the market and stabilization of house prices. Drop in inventory of homes will spur increase in the construction of new homes, improving cash flows and employment, and increased spending on housing and private construction. However, realization of the benefits of such actions will take some time (Sprague,2008).

Removing flaws in legislations and state rules can be of great help. Existing legislations such as Low Income Housing Tax Credit (LIHT), created under the Tax Reform Act of 1986, and which address needs for rental housing especially for the poor citizens is one such where reform promises good results (Sprague, 2008). Legislations, which would best address this crisis, would be those that take care of the homeowners while simultaneously addressing revival of the housing market (Sprague,2008).

Foreclosure is a reality and needs immediate attention. Homeowners deserve to retain their homes especially that they have paid for them. Government legislations such as the new legislation H.R. 3221, which assist the homeowners while easing the housing crisis, would be effective since it protects both, the people and the industry (Sprague, John 2008).

Bibliography

Altman, Roger C. (2009): The Great Crash: A Geopolitical Setback for the West, Foreign Affairs, Vol. 88, Issue 1.

Andrews, Edmund, L. and Calmes, Jackie (2008): United States Fed enters zero interest to fight crisis, New York Times.

Mankiw, N. Gregory, and others. (1993): A Symposium on Keynesian Economics Today” Journal of Economic Perspectives, 7: 3–82.

Sprague, John (2008): Is This a Housing Crisis Or a Financial Crisis?. Web.