Introduction

The 21st century has undoubtedly presented business organizations with immense opportunities for growth as well as high-level challenges in both function and performance.

Technological advances, infrastructural development, globalization, and increased diversification have created opportunities for growth and expansion that could not be fathomed in preceding centuries. Business organizations, however, have had to surmount new and challenging issues within their internal and external environments to safeguard their own survival (Baron, 2000).

In the middle of all these, there exists another stratum of variables that may be influenced either way – positive or negative – by the stiff competition and underhand strategies employed by organizations in the hope of retaining their competitive advantage (Buchanan, 2001). It is, therefore, the purpose of this paper to look at some of these factors by undertaking a critical analysis on externalities and government involvement in a business setting.

Externalities

Externalities are widespread in practically every area and aspect of economic activity. Seminal studies on the concept have become more extensive in recent years, especially after the realization that externalities have the capacity to cause market failure if proper strategies are not initiated (Buchanan, 2001).

By definition, externalities are third-party effects of an economic transaction arising from the production or utilization of goods or services for which no suitable reparation is done to the party that is not straightforwardly involved in the transaction (Baron, 2000).

When stated in another way, “…an externality arises when a person engages in an activity that influences the wellbeing of a bystander and yet neither pays nor receives any compensation for that effect” (Mankiw, 2008, p. 204). In such a scenario, the price mechanism does not reflect the full social costs or full social gains of a product or service. This, according to economists, is a sure recipe for market failure due to the nature of trade imbalances involved.

The mechanisms behind externalities are easily comprehensible to the market players who benefits, but this may not be so for players who undergoes immeasurable losses.

The single foremost presupposition of externalities is that producers and consumers in a competitive market may either not stomach all of the social costs or benefit from all of the social gains of a certain economic transaction (Mankiw, 2008). Another presupposition of externalities is that it is largely grounded on selfish connotations, though not seen as largely controversial in the field of economics.

The notion of selfishness and the desire to get rich causes competitive markets and producers to keep on producing whatever consumers are anxious to buy without making any considerations to the implications that such products and services may cause (Caplan, 2008). Externalities, indeed, go further to challenge the social gains of individual selfishness. According to Kaplan, “…if selfish consumers do not have to pay producers for benefits, they will not pay; and if selfish producers are not paid, they will not produce” (para. 1).

Types of Externalities

There exist two broad categories of externalities – positive and negative externalities. Any type of transaction that bears an external benefit or advantageous impact on third parties is known as positive externality (Baron, 2000).

For example, an investor may have to foot costs of fire-proofing his rental houses even if such costs may not have been included in the initial cost estimations of the project. In such a scenario, the neighbors, who are not in any way part of the investor’s decision, will stand to benefit from improvements in fire safety.

Specifically, a positive externality is achieved when third parties receives external benefits arising from the production and consumption of particular goods and services in the marketplace. Some of the external benefits in production that can be achieved include human capital development, corporate social responsibility ventures, education, public safety, and industry-specific research and development (Mankiw, 2008).

Standard economic theory presupposes that, if there are external benefits in such areas as described above, too little of the goods will indeed find their way into private markets since producers and buyers are not interested in extending external benefits to third parties.

In equal measure, producers in a competitive marketplace will engage in overproducing goods if the market experiences external costs to third parties such as air or noise pollution since the producers do not take into consideration the external costs involved in availing the goods to the buyers (Mankiw, 2008).

A negative externality is deemed to occur when a transaction initiates a disadvantageous impact on third parties (Baron, 2000). For instance, car manufacturers benefit a great deal from the proceeds they get from car sales, while oil companies smile all the way to the bank after raking millions of dollars in fueling the vehicles.

However, the air pollution caused by the economic transactions involving the car manufacturers, oil companies, and the car owners has obvious implications in that they facilitate air pollution, thereby imposing social costs on society members who are not party to the transactions.

Other negative externalities include congestion, forest cover destruction, engaging in antisocial behavior, passive smoking, littering the streets, noise pollution, and crime (Mankiw, 2008). Admittedly, passive smoking as a negative externality continues to affect the health status of millions of people across the globe.

Implications of Externalities

In a competitive market, externalities are known more for their drawbacks rather than their benefits. First and foremost, externalities are known to sire a market environment where both the producers and consumers disregard the external effects that their actions may cause when make a decision on how much they will produce or consume (Mankiw, 2008).

This, according to the author, leads to an unstable and inefficient market since “…the equilibrium fails to maximize the total benefit to society as a whole” (p. 204). As such, it is safe to argue that externalities are likely candidates for market failure.

It is imperative to note that discrepancies brought into the market by externalities can always be quantified using such measures as Net Present Values, Cost-Benefit Analysis, Risk values, consumer and producer surpluses, and willingness to pay, among others (Baron, 2000).

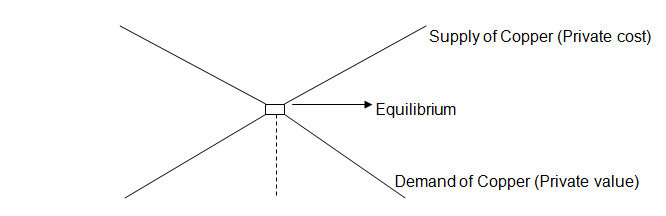

According to Mankiw (2008), externalities influence the economic wellbeing of an industry by causing markets to apportion fundamental resources inefficiently. To give an example, it is a well known fact that supply and demand curves hold significant information in terms of costs and benefits to both consumers and producers. In the natural resources sector, for example, the demand curve for copper demonstrates the value of this precious mineral, as evaluated by the prices that buyers are willing to pay for the copper.

In the same vein, the supply curve demonstrates the costs that producers and sellers have footed in producing the metal. Mankiw (2008) suggests that, in the absence of any external influences such as government conventions, the price for the commodity will normally regulate itself to balance the supply and demand for copper.

This means that “…the quantity produced and consumed in the market equilibrium is efficient in the sense that it maximizes the sum of producer and consumer surplus” (p. 205). As such, the figure below best captures how demand and supply curve will look like in the absence of external influences.

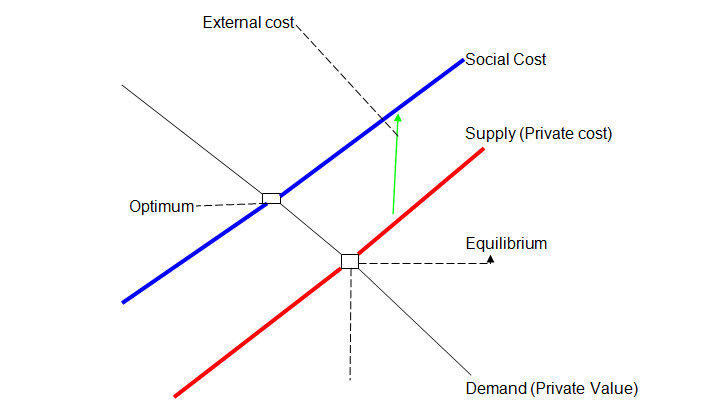

The nature of the market takes new dimensions when externalities are introduced. In this example, it is a well known fact that factories dealing with copper production emit a lot of smoke, thereby polluting the environment. This is a negative externality in terms of the fact that a certain quantity of smoke gains entry into the environment for each component of copper produced. This smoke inarguably creates a lot of health risks to third parties such as people who live within the vicinity of the factory.

Because of the negative externality, the cost to third parties of producing the coveted metal becomes far much bigger than the cost footed by the copper producers since the social costs to the third parties unfavorably affected by the emissions must be accounted for. This, according to economists, is what leads to market inefficiency and failure (Baron, 2000). Figure 2 illustrates how the market changes when social costs are factored in.

According to the figure above, the social costs curve has been placed above the market-driven supply curve since it takes into consideration the external costs obligated on third parties by copper producers. The divergence between the social cost curve and the supply curve reveals the quantifiable costs of pollution discharged to the environment, also known as the external cost (Mankiw, 2008).

In many occasions, these differences contribute to market failure, especially when the price apparatus fails to include all social costs and social gains related to the production and use of goods and services (Tutor2U, n.d.).

Market failure also occurs in cases where the producer of the good is engrossed in maximizing his or her own profits, thereby only taking into consideration the personal or private costs and benefits at the expense of social costs and social benefits.

Government Role & Involvement

Externalities are mostly used in the economic field to rationalize the government’s ownership of sectors and industries that demonstrates positive externalities, and exclusion of products and services that demonstrates negative externalities (Caplan, 2008).

It is, indeed, the function of government to promote efficiency in the market so as to guarantee its stability. Traditional economists such as Adam Smith argued that the role of government in a free market economy was strictly limited to instituting the rules of the game in an attempt to defend property rights.

The 20th century economists, however, “…learned that it is worthwhile for the government to subsidize or tax private activities whenever the market produces too little of a good thing such as education or too much of a bad thing such as pollution” (Ruffin, 1996, para. 2).

The above checks and balances, initiated by government, not only guards against market inefficiency and failure, but also discourage situations where players take advantage of other players to selfishly maximize their profits. For example, selfish paper manufacturers, in their quest to maximize their profits, may not take into account the full costs of environmental pollution arising from their production processes.

In equal measure, the consumers of the factory-manufactured paper may not take into account the full costs of the environmental pollution that arises from their buying decisions. As such, the government must step in with some measures to control such a firm from vicariously polluting the environment.

These measures may be in the form of taxes on both parties – paper producers and paper consumers – to make the whole process expensive. Governments are also known to control such a scenario by setting emission standards and other regulations that must be followed by all parties to reduce social costs while enhancing social benefits (Mankiw, 2008).

Conclusion

This paper has adequately addressed the issues of externalities, including their causes, types, and their impact on the proper functioning and efficiency of the market. Certainly, externalities have the capacity to initiate a complete market failure due to their tendencies of shifting the equilibrium between supply and demand of commodities to reflect social costs that are inexorably passed on to third parties (Mankiw, 2008).

The third parties, however, are not in anyway associated with the transactions between the producer and the consumer, and therefore, they end up shouldering costs or benefits of transactions they are not party to.

Graphical representations have been offered to demonstrate how externalities affect the business environment based on perceived social costs and social benefits. The paper has also aptly demonstrated the government’s role in ensuring that externalities do not destabilize the business environment, including facts of how it could get involved in balancing these influences in the business arena.

Consequently, it is safe to argue that business managers need to acquaint themselves with comprehensive knowledge on externalities to safely negotiate the many challenges presented by these arrangements in the business environment.

Reference List

Baron, D.P. (2000). Business and its environment, 3rd Ed. Upper Saddle River: New Jersey: Prentice Hall. Web.

Caplan, B. (2008). Externalities. In The Concise Encyclopedia of Economics. Web.

Mankiw, N.G. (2008). Essentials of Economics. Cengage Learning. Web.

Ruffin, J., & Anderson, M.D. (1996). Externalities, markets, and government policy. Web.

Tutor2U. (n.d.). What are externalities? Web.