Introduction

Oligopoly refers to a market that is largely dominated by a small number of suppliers of a given commodity (Vives, 2001). In essence this type of market is a type of a monopoly. By the mere fact that the suppliers are very few, actions of one of the suppliers in the market are largely expected to affect the actions of other suppliers.

This also goes hand in hand with the decisions that are taken by the firms in the industry. A concept that is largely embraced by the four major mobile phone providers in the US is strategic planning. The possible responses that T-Mobile and Nextel will take most likely affect the strategic plans that Verizon and AT&T take.

It was in the fourth quarter in 2008 that Verizon, AT&T, Sprint Nextel, and T-Mobile combined took a control of about 89% of the American mobile phone market. AT&T buys the cellular phone companies Stackelberg Model is seen where AT&T chooses output before rivals only to be followed. T-Mobile chose to increase prices, other competitors did not react however when it did decrease prices, other firms in the industry followed suit.

This is because the other firms have been in much fear of losing the market by maintaining their prices when T-Mobile has lowered the prices. In this then the Stackelberg model of oligopoly is seen. In this model, one company chooses to take a price leadership strategy upon which the other firms follow suit.

Collusion in oligopoly

In oligopoly, collusion by the firms is common feature (Bergin, 2005). This is especially in terms of the price and the quality to offer to the customers. Just to maintain the profits, a look at the prices of the firms shows that there is not much discrepancy and so the firms need to maintain their profit levels.

Verizon and AT&T have particularly engaged in collusion in ensuring that after a price decrease, they instituted more expensive data bundle packages that were unfortunately had to be compulsorily taken up by the customers of the two firms. This involved the customers getting into a deal of purchasing smart phones.

This collusion has also been noted in the raising of prices by the cellular firms as well as sharing their market. Just to make sure that the market shares are maintained the oligopolistic firms have a collusion on when and what percentages to increase the prices of their services. This collusion has resulted in more profits for the firms with a retained market share level.

Competitiveness of oligopoly

Oligopoly is usually characterized by very fierce competition and the American cellular companies have best depicted this. Cut throat competition has been witnessed by T-mobile lowering their prices in the desire to get more customers. Towards this end, the companies have introduced more quality service among them faster access to the internet via the phone, clearer calls by Sprint and a variety of plans that would fit a varied number of clientele.

T-mobile has ended up carrying out mass differentiation with over 7 call plans that can be utilized. This though follows Sprint who has over 9 plans that their customers can call other people or other networks. Verizon has become a market leader in the area of internet provision. Its customers can now pay different rates for their internet access while they are at different places at different times. The other firms have since then followed suit. Sprint has taken mobile telecommunications to the next level.

Very soon the firm is intending to introduce 4G which will mean that internet will be so fast. Other firms will have to follow suit since there will be that fear of losing the market especially for the data users that have been formidably loyal to AT&T and Verizon.

AT&T and Verizon have been able to include more diverse features followed by the rest of the companies among them funky calling tones and voicemail features that easily record the time and the person who called. On a general scale, the oligopolistic nature of the cellular industry has operated to largely improve the quality of the products that they bring for offer in the market. This has equally been achieved through diversity.

War of prices

A war of prices is a common feature in oligopoly (Levine, 1981). In the American cellular market, Verizon Wireless and AT&T have been noted to be most fiercely involved in the price wars. They also have been in a position to extend the wars into that area of creativity and innovations just so as to woe the market to themselves.

Both companies at the beginning of the year announced that they were in for a 30 dollar reduction of the unlimited voice calling packages. However collusion is also noted in these moves since the firms are interested in wooing subscribers to opt for data services that are charged higher.

Even as the cellular firms are involved in the tug of war in terms of pricing and quality, the firms are very aware that profitability is vital. To this end then, the production and supply of their services is inclined in such a way that the marginal revenue is equal to the marginal cost. This in essence implies that the additional cost that Sprint incurs when introducing a new service is ideally equal to the additional revenue that would be realized per customer that it has.

An oligopolistic market is mostly characterized by price setters much more than price takers. This is true because as noted in the previous example, T-Mobile on several occasions has been able to lower its price for various plans only to be followed suit by the other firms. AT&T and Verizon have equally individually worked to set their prices and hence the tug of war that they have been engaged in. This is a sharp contrast of perfect competition market where firms are usually price takers.

Barriers to entry

According to Bergin (2005) the oligopolistic market has witnessed immeasurable barriers to entry. Other mobile telephone companies that have tried to cut it in the American market have gone through very much struggle and difficulty yet most have not even been able to cut through.

Alltel for example has to no avail tried to enter into the “Big four” race. This barriers to entry are largely facilitated by the economies of scale already presently enjoyed by the firms, patents to the innovations and general the cut throat completion presented by the incumbents.

A high level of product differentiation has always been a feature that is witnessed by oligopolies. This has also been true for the American cellular market major players. The call service for example has each of the companies with at least three varieties for the subscribers to select from. AT&T has differentiated to Nation 450, Nation 900 and unlimited. The rest of the companies have options like simple everything, everything messaging, Nationwide unlimited just to mention but a few.

Oligopolies usually have a perfect knowledge of the quantity demanded and their respective cost functions (Mas-Colell, Whinston & Green, 1995). On the other hand, the customers will always have imperfect knowledge as relates to the quality offered in the market and the price. This is true for the Cellular market in America since in as much as there are various differentiated products some which may be cheaper, the customers at times are unaware and keep using the costly less effective options in the market.

Interdependence of firms

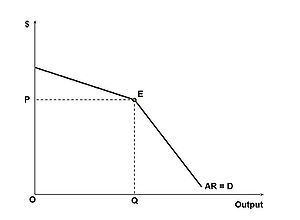

The interdependence that is seen in oligopolies is best noticed in the way prices are increased and decreased by the firms in the cellular market. The Kinked demand curve model plays a major role in explaining this phenomenon.

Each firm in the oligopoly faces a demand curve that is kinked at the existing market price. According to Abbring and Campbell (2006) in this, if one of the firms raised its price above the existing, the other firms will not follow through. However if firms were to lower the prices, the other will follow so as to preserve their market share.

The acting firm will only increase but slightly to take home more profits. In this case then, the following shall be witnessed; the marginal revenue of the firm shall have a discontinuity with a gap witnessed at the kink. Prices that are placed higher than the prevailing one, there is elasticity in the shape of the curve.

Mas-Colell, Whinston and Green (1995) denotes that on the other hand prices below the kink indicate relative inelasticity in the shape of the curve. The diagram below is used to best illustrate the kink experienced in the oligopolistic markets.

The prevalent gap in the marginal revenue curve acts as an indication that marginal costs can take a fluctuating shape while the equilibrium price and quantity remains constant. A price war is a commonality under this theory.

A close look at the pricing of the phones for various plans that are instituted by the mobile companies shows that for those with similar features say all night and all weekend discounts, the prices are the same.

Sprint has a plan called Talk 450 in which one talks for 450 minutes per month is similar to AT&T’s Nation 450 where still the customers may talk for 450 minutes in a month and paying 39.99 dollars per month for both firms. Verizon has a similar one called nationwide basic in which 450 minutes in a month are charged at 39.99dollrs. There is therefore a similarity in the charges that the firms put on their customers just so that they do not lose their customers.

Conclusion and predictions

As the situation stands at present, the oligopoly market in the cellular industry in America will continue to be. However, government deregulation and intervention may result in more competitive players coming into the market. This is not the only case. Other countries too like Kenya France and Qatar have their mobile industry run by one or two providers. In some other countries it was a monopoly of Safaricom Ltd until lately.

An unlikely occurrence however is that the cellular market in America should take the monopolistic nature. Competitiveness is expected to soar more. We expect that in the next one and a half years, the mobile firms will come up with more diverse innovations that will help to consolidate the market shares.

Further, the firms are expected to come up with strategies that will keep customers hooked up to the services into the long term. This is in the quest to reduce the rampant switching that is witnessed. I envision a time when the collaboration of the mobile firms will have two or even three service providers all in one sim-card. This may take long though to be realized. Finally customers need to carry out an evaluation of the actual costs and benefits that each provider has to offer before jumping into any bandwagon.

References

Vives, X. (2001). Oligopoly pricing: old ideas and new tools. Massachusetts: MIT Press.

Mas-Colell, A., Whinston, M. & Green, J. (1995). Microeconomic theory. New York: Oxford University Press.

Bergin, J. (2005). Microeconomic theory: a concise course. New York: Oxford university press.

Levine, D. (1981). The enforcement of collusion in oligopoly. Massachusetts: Massachusetts Institute of Technology.

Abbring, J. & Campbell, J. (2006). Oligopoly dynamics with barriers to entry. Chicago: Federal Reserve Bank.