Introduction

The existence of markets is essential in promoting consumption behavior amongst individuals and institutions. Different models define the selling environment or market structures. The four main models include “monopoly, perfect competition, oligopoly, and monopolistic competition” (Hussein 46). These market structures vary from each other based on the degree of product differentiation, ease of entry, and the number of firms in the market. The nature of the market structures has a significant influence on the consumers’ purchasing behavior.

A perfect competitive market is the ideal type of market structure. In this type of market structure, “the market is comprised of a large number of small market players offering identical products” (Hussein 73). Other firms can easily enter and exit the market. Moreover, the market is characterized by the existence of perfect knowledge of the products’ prices and the prevailing technology. Subsequenntly, it is impossible for particular sellers to set higher prices for their products as compared to other sellers. However, such a market does not exist in real life situation.

One of the most common types of market structures in real life situation is the oligopoly market structure. This market structure is characterized by few industry players that provide identical or differentiated products, high barriers to market entry, and a high rate of interdependence amongst the industry players.

Firms in such a market frequently charge high prices for their products, which is highly inefficient as opposed to competitive markets. Subsequently, such firms enjoy abnormal profit levels and they are likely to collude with other industry players. This paper evaluates the existence of oligopoly in individuals’ consumption behaviors coupled with how it affects their daily life.

Analysis

Factors that motivate the existence of oligopolies

The core objective of every business entity is to maximize its profits. Subsequently, firms must ensure that they are effective in setting the price for their products. Most consumers are price sensitive in their purchasing patterns. Subsequently, price constitutes one of the most important elements in the consumers’ decision-making process.

Oligopolists are motivated to set high prices for their products by the profit maximization objective. Subsequently, the price level in an oligopoly market is usually higher as compared to the market-clearing price. Additionally, the level of output in an oligopoly is usually lower. Oligopolists have the capacity to produce at an output level higher than that of a monopoly and charge a relatively low price. However, this aspect limits their ability to maximize the level of profitability.

These market practices are motivated by the need to gain higher market control. In order to control the market, oligopolies may collude with each other, thus acting like a monopoly. Consider an industry that is comprised of two bakers, viz. X and Y, producing identical breads. Firm X incurs a constant marginal cost of $1 for every loaf of bread produced, while Firm Y incurs a marginal cost of $2 for every loaf of bread. The fixed cost of production in Firm A and Firm B is zero. The difference in marginal cost between the two firms is relatively low. Subsequently, the firms can collude in setting the price of the loaf, hence controlling the market.

In a bid to achieve this goal, the various oligopolies in the market collaborate in deciding the level of output to supply in the market. One of the strategies used in gaining market control is by reducing their output level, hence ensuring their collective output in the market is similar to that of a monopolist. This aspect means that the output level of firm X is influenced by that of firm Y. Consequently, they are in a position to gain high profits. This sort of behavior restricts production, which is similar to that of a monopoly.

In addition to controlling the level of output, monopolies tend to integrate predatory and limiting pricing strategy. One of the ways through which this goal is achieved is by setting the price of their products and services at a point that is relatively low in order to limit the entry of other industry players. However, oligopolies ensure that the price set will enhance their ability to maximize profit. Moreover, oligopolies practice predatory pricing by setting the price level of their goods at a point that is below the cost price.

The core objective is to make it difficult for competitors to cope. However, prices are later raised. The Times Newspaper is a classic example of a firm an oligopolist. At one time, the firm cut the price of its newspaper to a level lower than the cost of production in an effort to drive out ‘The Independent’ newspaper, but it failed. In an effort to drive out competition out of the market, oligopolies reduce the price of their products, which leads to price wars.

Continuous reduction in product prices leads to the formation of collusive agreements. Burger King and McDonald, which are renowned fast food companies, engaged in price wars in an effort to gain high market shares. Therefore, oligopolies have the tendency of acting like cartels, which are motivated by the need to form a monopoly in order to control the market.

Collusion is mainly common in unstable markets. Subsequently, the few firms in the industry collude in an effort to eliminate the inherent market risks, hence increasing the likelihood of survival. For example, during the 1970s, the Organization of Petroleum Exporting Countries [OPEC] was very powerful in controlling oil prices, hence acting like a cartel. The OPEC instituted a restriction on the level of output amongst the oil producing countries. This move benefited some of the oil producing countries, while the economy of the poor oil-producing countries was affected adversely.

The organization’s power has reduced significantly over the years. Another example of industry characterized by oligopolistic tendencies is the mobile telephony industry. Firms in these industries are increasingly adjusting the price of data and voice services downwards in an effort to control the market. However, most governments have imposed legal restrictions on cartels in an effort to enhance market efficiency. Collusion is necessitated via the existence of price leadership courtesy of one of the industry players.

Illustration

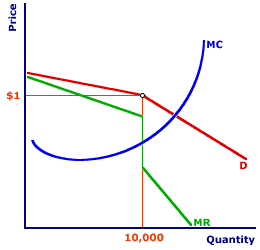

An oligopoly market is characterized by an imperfect competition. Subsequently, the demand for such a market is kinked, which illustrates the extent of elasticity above the set market price and inelasticity below the set market price as illustrated by the graph below.

The figure above illustrates the marginal revenue [MR] curve of an oligopoly firm, viz. a soft drink producer and the corresponding demand curve. At the price of $ 1, the firm is in a position to sell 10,000 cans. Below this price and quantity, the demand curve develops a kink. The graph shows that the demand curve is relatively elastic if the price of one can of soft drink is above $1 and the quantity to be produced is less than10, 000 cans.

On the other hand, the firm’s demand curve becomes inelastic if the price is set below $1 per can and the quantity demanded is more than 10,000. The firm’s marginal revenue curve below 10,000 cans is relatively elastic, which illustrates the firm’s response to high prices and low quantity demanded. On the other hand, the MR curve becomes inelastic at 10,000 cans.

In order to maximize profit, the firm’s marginal revenue must be equal to the marginal cost. In a bid to achieve this goal, the firm sets the price of a can of soft drink at $0.60 and produces the same quantity. The intersection between marginal revenue and marginal cost enables the oligopoly to achieve a profit-maximizing equilibrium. Producing at this price would limit the firm’s ability to maximize its profit. Subsequently, the firm has to produce at the price of $ 1 per can.

The kinked nature of the demand curve in an oligopoly market makes the industry players adopt non-price competitive strategies in order to increase their market share and revenue. Some of the strategies used today by oligopolies such as car manufacturing companies include product branding, producing high quality products, and sales promotion.

Illustration of oligopolies behavior; game theory

The behavior of oligopolies can be illustrated best using game theory, which aids in capturing behavior of subjects in strategic situations whereby the choice or behavior of one subject depends on that of another. Economists have developed a number of theories based on the game theory in an effort to explain oligopoly behaviors. One of the models is the Bertrand’s oligopoly. The model asserts that firms choose the price of their products and services simultaneously.

The model is used to evaluate the behavior of two oligopolies. One of the assumptions made under this model is that the firms do not cooperate and rival based on prices, which are determined simultaneously. Subsequently, the firms can adjust their output level after determining the market price. Examples of firms that engage in this behavior include shopping malls and bars. In such a market, firm

A will set the price of its product at a point that it believes that firm B will set. Setting the price of the product at a lower point as compared to the other firm will increase the likelihood of maximizing profit. However, if firm A expects firm B to set the price of its product below the marginal cost, it would be profitable if it sets its price at a high point at the marginal cost. In such a situation, firm A’s best response function can be illustrated by p1” (p2), which represent the respective price of the two firms.

Setting the price at this level will enable firm A to achieve the best possible price point for each of the prices set by the competitor. The graph shows that when firm B sets the price of its product at a point below the MC, firm A responds by setting the price at a point where P1=MC. On the other hand, if firm B sets the price at a point higher than the marginal cost, but below the prevailing monopoly prices, firm A responds by setting its price at a point lower than firm B. Furthermore, if the firm sets the price at a point above that of the monopoly, firm A responds by setting the price at a point equivalent to that of the monopoly. The figure below illustrates the firm A’s Bertrand oligopoly reaction function

Policies strategies

Consumers cannot rule out the likelihood of collusion amongst firms leading to the formation oligopolies. Different markets are experiencing an increase in such behaviors. Examples of such markets include the telecommunication industry and the farming industry. In the US, the few fertilizer-producing companies are colluding in an effort to maximize their level of profit.

The existence of such behavior amongst producers can affect consumers adversely. First, the firms may exploit consumers by limiting the level of output in the market, which gives them an opportunity to set high prices in order to achieve their profit maximization objectives. Subsequently, oligopolies limit the determination of market prices by the forces of demand and supply, which highlights the importance of policy makers such as governments to eliminate such collusive behavior.

One of the remedies that can be used in fighting collusive behavior entails the formulation of comprehensive antitrust policies. The antitrust policies should prevent industry players from gaining excessive market power that can increase their ability to control the market. It is imperative for governments to review the antitrust policies continuously in order to ensure that industry players do not take advantage of their ability to control the market. Such review of antitrust policies will aid in making the necessary adjustments, hence increasing the effectiveness with which the consumers are protected (Wu par.9).

Furthermore, it is imperative for industry regulators to implement effective policies to curb anti-competitive practices. Firms engaging in such practices; for example, instituting market entry barriers should face the law. Considering the degree of industry concentration in some sectors, market regulators should review the market power of the few firms in order to identify possible anti-competitive practices. Moreover, it is essential for market regulators such as the US Federal Communications Commission to ensure that firms that have oligopoly tendencies, for example, mobile telephony firms do not exploit consumers.

In addition to implementation of antitrust policies, it is imperative for market regulators to consider instituting price regulators in some of the markets. Some of the industries that the government should regulate the market prices include energy companies. These companies have the ability to exploit consumers by charging high prices.

Conclusion

The above analysis cites market as one of the most important components in enhancing consumption behavior amongst individuals. The consumers’ purchasing ability is influenced by behaviors of players in different market structures. One of the most common market structures is the oligopoly market structure, which is characterized by a few firms offering homogeneous or highly differentiated prices.

Oligopolies have the ability to set the price of products at a higher point than the market price by influencing the level of market price and output. Subsequently, the consumers’ purchasing power is affected adversely. Moreover, oligopolies can collude with each other, hence increasing their market power and the ability to influence the market output. The existence of oligopoly tendencies can affect the consumers’ choice and ability to achieve their desired level of utility. Therefore, it is imperative for market regulators to curb such practices by ensuring adherence to antitrust laws and the regulation of the price of some products.

Works Cited

Amosweb: Kinked demand curve analysis. 2007. Web.

Husein, Mohammed. Oligopoly: Competition among the few, New York: King Fahd University of Petroleum and Minerals, 2013. Print.

Wu, Tim. The oligopoly problem. 2013. Web.