A monopoly market player is a firm, which is the only one existent in a market. Monopolization is when a firm has a significant control to set the prices in a multiplayer market.

In 2005, even with more than one player in its market segment, Apple was able to sell a more expensive product and achieve 63% control of digital music players and 83% control of legal digital music download market. Such an achievement was made through leveraging on its ITunes store and stylish status of iPods.

In charging high products, Apple built a premium and exclusives status for its products. Over the long term, this will create a cult like following for its products as long as the firm can keep on developing digital music players with the better technology than that of its competitors.

This will require massive investment in idea and technology generation and development. Low sales numbers can easily lead to the company being bankrupt. In conclusion, charging high prices is a risky but highly rewarding option (Manikw, 2008).

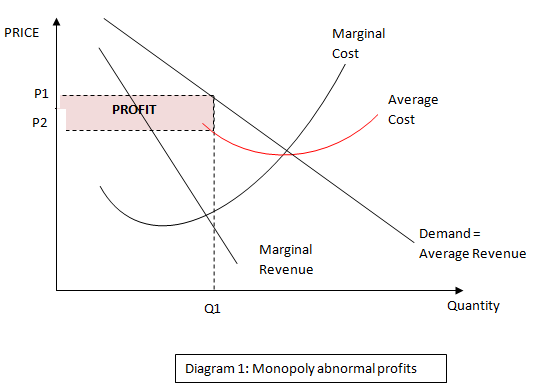

Diagram 1 represents a monopoly market. A monopolist is a price maker because the company does not face any competitors in such a case. Thus, there is a price inelastic demand where marginal cost meets marginal revenues, which represents the quantity for profit maximisation.

The extrapolating the output up to its maximum to meet the average revenue and cost curves, we arrive at the prices P1 and P2. The total cost of production is P1Q1, while the total revenues are P2Q2; the difference is the supernormal profit.

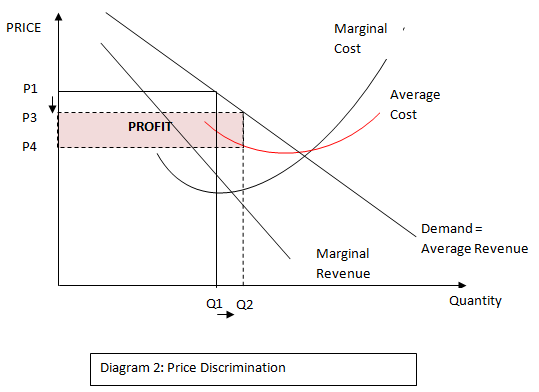

Considering diagram 2, prices decrease from P1 to P3, while quantity sold has an increase from Q1 to Q2. This is due to a different demand pattern brought about by different demographic and physiographic population factors, while a different cost pattern brought about by a change of the tax regime affects the cost pattern resulting in a different price maximizing output and different prices.

First, for price discrimination to take place, it must be performed in different geographical markets. Secondly, market segmentation is based on different demographic and physiographic population factors. Thirdly, inelastic price elasticity of demand ensures the advantage of price discriminators (Manikw, 2008).

Monopolies and oligopolies are vital firms in a country especially if they can work competitively to bring new products to the market, while providing job places.

Secondly, they accumulate large amounts of capital to the benefit of economy. However, consumer and labor groups have no trust in monopolies and oligopolies achieving this economic function without government oversight.

Arguments for intellectual property rights include giving the right of intellectual property to its owner, who can use it for financial gain. The right to own an intellectual property is a result of hard labor and investment in creating it.

Thus, development to humanity would not occur from private entities but only from the government. The socialist and economic growth would follow the government’s agenda. Margins for firms would be thin since it is a price market (Dwivedi, 2002).

Every industry deserves to obtain its intellectual rights, especially considering the economic significance of motivating capital and expertise investment.

In such areas as healthcare, its importance to ensuring human rights observance and proper solutions to human health problems is significant. For such markets, additional control by government authorities is necessary to balance morality and intellectual rights (Perloff, 2009).

References

Dwivedi, D. (2002). Microeconomics: Theory and Application. India: Pearson education.

Manikw, G. (2008). Principles of microeconomics: a guided tour. Connecticut: Cengage Learning.

Perloff, J. (2009). Microeconomics. London: Pearson/Addison Wesley.