Introduction

Cost-Volume-Profit (CVP) analysis is an important tool in profit determination through the application of cost and pricing strategies. It helps management to explore the profit returns for management actions. CVP plays an important role in several other decision-making areas; for instance, it helps in the determination of efficiency in resource allocation for non-profit organizations. Without CVP, companies would be running into losses without the realization of the management; therefore, CVP is a crucial tool in management for it gives a clear picture of how a company is performing.

CVP Assumptions

In CVP analysis and calculations, there are key assumptions that are employed. Horngren, Foster, and Srikant (1997) present these key assumptions as follows:

- The price per unit is constant

- The variable cost is constant

- The total fixed costs remain constant

- Only activity changes can affect the costs

- Where a company sells more that one product, the product means remain the same (p.62).

In CVP analysis, there are key calculations that are required for proper CVP determination. The calculations include Contribution Margin (CM), Contribution Margin Ratio (CMR), and The Break-Even Point (BEP). The contribution margin is the amount of income after the fixed costs have been met. Caldwell and Welch (1989) describe CM as the amount of income that the company realizes less the fixed costs (p.7). BEP, on the other hand, refers to the level of sales that equals the total variable and fixed costs incurred; the net income equals Zero.

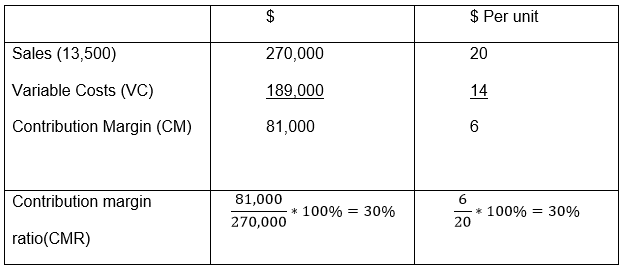

ABC Company’s contribution margin ratio and break-even point

Income statement for the recent month

Contribution margin ratio

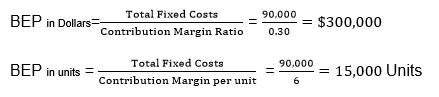

Break-Even Point

Increase in advertisement budget and net operating income

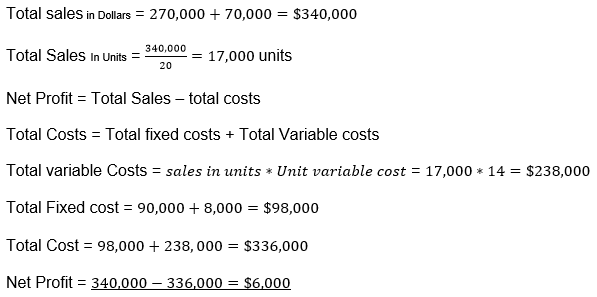

If management increases the advertisement budget by $8,000, followed by intensive marketing by the sales staff, this is expected to increase the total sales by $70,000. Ensuing is CVP analysis of the effects of these management actions.

If the management increases the advertisement and sales efforts to achieve an increase in sales of $70,000 monthly, the effects shall be net monthly profits of $6,000.

Conclusion

It is important to note that CVP is an integral tool in management regardless of the nature of business the firm is engaging in. Hanna, Newman, and Sridharan (1993), say that, even though CVP is majorly employed in manufacturing firms, it is also an important tool for other firms (p.200). Weygandt, Kieso, and Kimmel (2005) further emphasize the opinion that CVP can be effective in the banking industry, real estates, and non-profit organizations (69). In the banks, CVP can help in the pricing of bank products and services, while in real estate it would readily provide crucial information while carrying out feasibility tests. On the other hand, CVP would be a key too to non-profit organizations, as it will aid in the identification of ways to allocate resources efficiently.

References

Caldwell, C. & Welch, K. (1989). Applications of Cost-Profit-Volume Analysis in the Governmental Environment. Government Accountants Journal, 6, 3-8.

Hanna, M., Newman, R., & Sridharan, V. (1993). Adapting Traditional Breakeven Analysis of Modern Production Economics: Simultaneously Modeling Economies Of Scale and Scope. International Journal of Production Economics, 29, 187–201.

Horngren, C., Foster, G., & Srikant, M. (1997). Cost Accounting: A Managerial Emphasis. Upper Saddle River, NJ: Prentice-Hall.

Weygandt, J., Kieso, E., & Kimmel, P. (2005). Managerial Accounting: Tools for Business Decision Making. Hoboken, NJ: John Wiley & Sons Inc. Print.