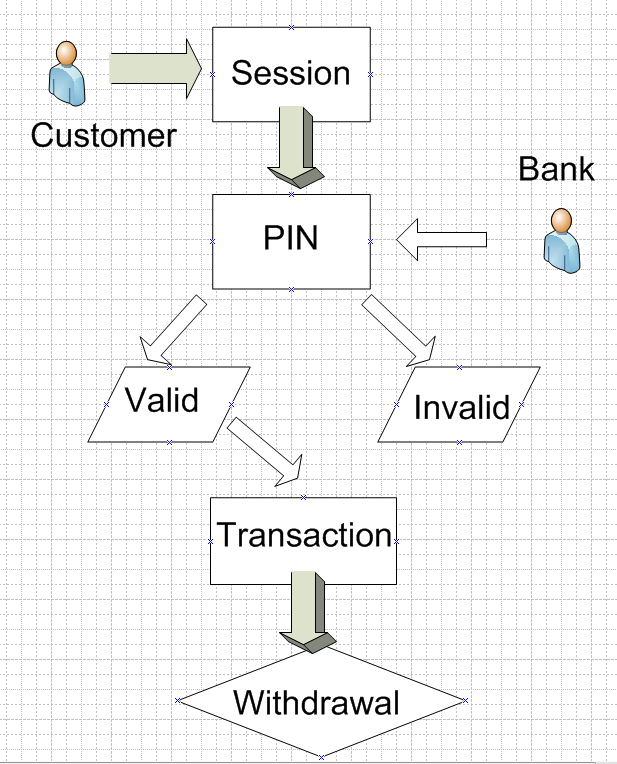

Making an ATM Money Withdrawal

The process of money withdrawal from an ATM can be viewed as a rather basic procedure. As Figure 1 shows, the bank customer needs to insert the card and provide the pin code. However, the above-mentioned scenario may have certain variations. Mainly, the code provided may turn out incorrect. In case of the specified error, the bank customer will have their card returned by the ATM and possibly blocked by the bank.

Afterwards, the type of the account, from which funds are to be withdrawn, needs to be specified. Traditionally, a bank client needs to choose between the current account and the savings. In both cases, the next step will require detailing the amount of money to be withdrawn from the ATM. Afterwards, the question regarding the receipt will be asked. Answering “yes,” the bank client will receive one prior to retrieving the money, whereas answering “No” means that no receipt will be provided.

If the sum of money stated in the corresponding field exceeds the one that the card was loaded with, the notification concerning the insufficient funds will appear on the screen of the ATM. If the amount of money to be withdrawn from the ATM is legitimate, the ATM will dispense the cash, possibly the receipt and the credit card (Seven easy steps to withdraw with your debit (ATM) card, n. d.).

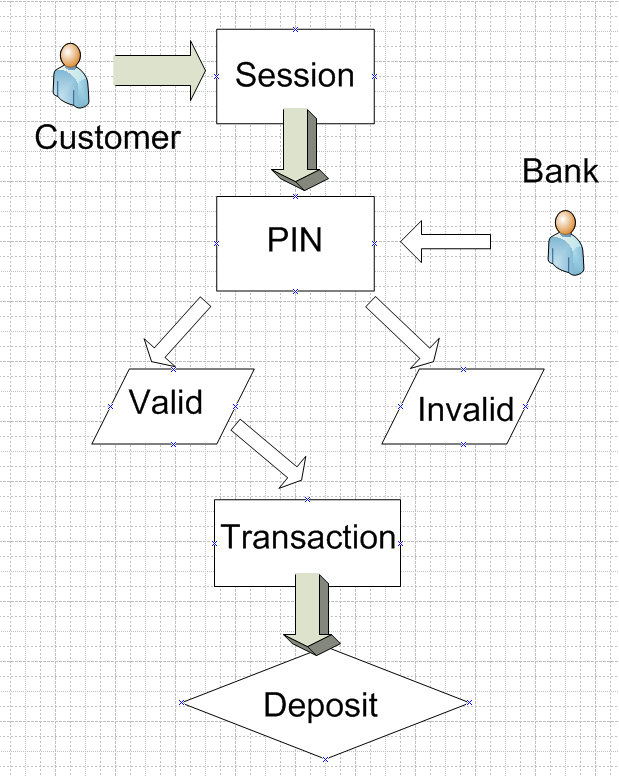

Making an Account Deposit

As the picture provided above shows, the process of making an account deposit is rather basic. Also involving the use of an ATM, it repeats the first two steps. As soon as the card is inserted, and the pin is provided, one must select the “Deposits” option and then choose “Savings.”

As soon as the specified steps are carried out, a window for entering the amount of money to be deposited will emerge. Using the keys of the ATM, one must state the sum to be deposited from the account.

The above-mentioned step may lead to two key outcomes. In case the sum has been entered correctly, the customer proceeds to the next step of the transaction. However, in case the sum was entered incorrectly (particularly, in case the amount of money requested is larger than the sum of money that the customer is going to deposit) a notification regarding insufficient funds will arrive.

The latter scenario presupposes that the ATM suggests performing a different transaction. In this case, one should press “yes” and retrieve the card. In the former case, the bank client should choose the option of carrying out a different transaction and repeat the steps mentioned above.

After confirming the operation by pressing the “OK” button, the bank client will need to slide either the check or the deposit envelope with the required information on it into the corresponding slot. Both the “cash back” and the “another transaction” options emerging on the screen afterwards will need to be declined. Finally, the card must be retrieved along with the receipt (Savings deposit using an ATM card, n. d.).

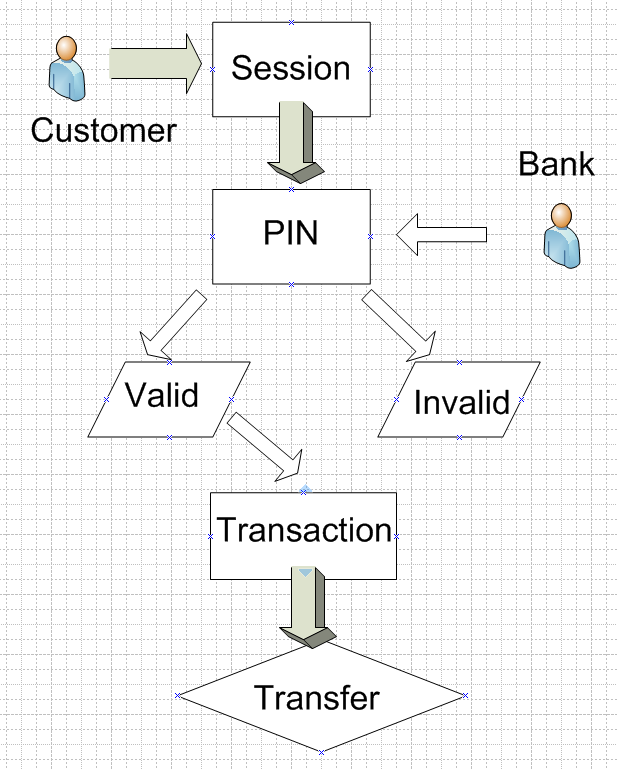

Making an Account Transfer

As the diagram above shows, the process of making an account transfer is a rather simple procedure that has a relatively small amount of possible outcomes. In fact, the two basic results of the specified transactions include a successful and an unsuccessful transfer. The first two steps are the same as the ones required for the money withdrawal and the card deposit described above: the owner enters the card into the ATM slot and types the PIN in.

In case the PIN code was entered incorrectly, the ATM suggests that the customer should perform a different transaction. The option mentioned above should be chosen. As soon as the specified step is taken, the ATM suggests a list of transactions that may be carried out. By selecting an account transfer, the user returns to the first step of the procedure and will have to repeat the actions taken previously. The following confirmation made by pressing the “OK” button presupposes that the user may proceed to the next step of the operation.

As soon as the pin is entered, the bank client must select the “account transfer” option. The next step involves typing in the sum of money that the client wants to transfer. Finally, the “OK” button must be pressed.

ATM, Risks and Ethics

It should be noted that the process of using ATM services implies certain risks (Yuen, 2014). Particularly, the fact that the ATM users need to display utmost honesty when carrying out financial transactions with the help of ATMs deserves to be mentioned (Siddiqui & Muntjir, 2013). In case an ATM starts malfunctioning, it may release the amount of money that exceeds the demanded one several times, yet mark it as the one that the customer asked for. Consequently, using ATM poses several major ethical risks such as whether one may use a broken ATM to their advantage (Liquing, 2008).

Needless to say, the outcomes of fraudulent actions are most likely to be drastic. Seeing that there is always a possibility to track down the person, who has been provided with more money that they have actually attempted to withdraw, the penalty for taking what does not belong to one will have drastic results. Posing a very serious ethical dilemma to the owners of credit and debit cards, faults in ATM’s functioning need to be viewed as problems and not an opportunity to gain money in a fast yet dishonest way.

Reference List

Liquing, F. (2008). Analysis on the legal nature of malicious withdrawal from a defected ATM. Frontiers of Law in China, 3(4), 494–506.

Savings deposit using an ATM card. (n. d.). Web.

Seven easy steps to withdraw with your debit (ATM) card. (n. d.). Web.

Siddiqui, A. T. & Muntjir, M. (2013). A study of possible biometric solution to curb frauds in ATM transaction. IJASCSE, 2(3), 1–6.

Yuen, J. (2014). ACC 626 computer assisted auditing techniques money laundering detection. Web.