Standards and systems effects

Standards are imperative in determination of network value if they entirely rely on size. Given that PSGT is a large corporation with capability to expand to global markets; it is likely that its network will be extremely wide. Owing to the fact that large corporations choose independence or prefer diversity in service provision, adoption of standards is sometimes considered to be less important.

For instance, the decisions by technology giants such as Microsoft and America online to neglect standardization in their networking practices have positively impacted their growths on a global scale. This does not however leave an absolute implication that standardization is redundant in corporation success since its adoption can greatly influence company result s in a positive way. The latter explains why consideration and adoption of standards will be important for strategic growth of PSGT Intel Co. According to Varian, PSGT adoption of standards would greatly determine its value according to the equation PSGT Value = PSGT Share x Total industry value (Varian 240).

From this equation, it is evident that market share becomes a determinant force in PSGT value. Thus, with an understanding that the value of PSGT will entirely depend on the size of VIS market industry, strategies to implement standards have been laid down. But before standard formation, it is imperative that specific aspect factors be taken into consideration. These will have to be far in mind emerging factors such as negotiation, wars and leadership in regards to standards and standard adoption (Birchler & Butler 45).

Standards wars

Strategic market acquisition is very important for a company’s wellbeing. In this perspective, PSGT understands that market rivalry is absolutely inevitable. Additionally, earlier preparation for future control of marketing is one of the strategies that PSGT Intel Co. Ltd has committed itself in order to manage future markets through employment of various tactics. For instance, price management through determination and change either in the present and or the future will be solely a PSGT exercise. This will be aimed at overcoming industry rivals and thus acquiring a bigger market share.

Secondly, This Company has put in place management strategies that seek to employ marketing domination tactics such as market share bragging. It has also committed itself towards lowering its future prices of products with an intention of overtaking its competitors. Lastly, there have been negotiations with companies such as nuance and McIntosh to make an alliance that would ensure market stability in regards to voice recognition technologies.

Standard negotiations

Normally, negotiations come at times when there is conflict of interest. With an understanding that during negotiations preference to own standards during the negotiation process is inevitable, PSGT has created a room for deliberating other players’ preferences during a negotiation process. Birchler and Butler (204) contend that if such strategy fails to augment concrete negotiations, then secession to independent bodies, such as neutral third party bodies, would be of great value. In this case, PSGT is relying on either ANSI or ITU just in case the former fails as a mediator in the process of negotiations.

Since there is a point of mistrust within organizations during negotiations, it has been considered important that PSGT Company be disclosing all its patents in order to create transparency, aimed at aiding successful negotiations. With deliberation of possible breakdowns in the process of negotiations, it has been understood from previous negotiations, keen interest has been employed to avert serious threats that would emerge after failed dialogue. It is hoped that this could further prevent the image and brand of the company in the technology industry (Varian 180).

Choice of standards leader

For standardization process to be more efficient and highly effective, there is need of choosing an extremely qualified leader that if it gets affected as standardization process is concerned, then the proprietary companies do not get adversely affected by the same standards. With a suitable leader, it is likely that regular technological changes are bound to be implemented and thus ensure that followers are also regularly upgraded.

Lastly, the leader should be able to provide for easy adaptation of standards in case they exhibit diverse characteristics (Varian 60). As far as this is concerned, PSGT has considered the use of standard adaptors in the process of linkages to avoid parallelism with followers and other players in the voice recognition technology industry. These standards include software, hardware adaptations and upgrading criterion modes.

When these factors are put into consideration, PSGT is bound to reap economically from the industry given the kind of savings that are expected to be made due to application of economies of scale. According to Birchler and Butler (45), there is also associated reduction of risks involved in the process of upgrading or complete change of hardware and software systems. Standardizations shall thus be specified and broken down to the different components of the whole to minimize risks since there is specialization of manufacturing as the parts are concerned.

The use of complements in the adoption of the VIS technology would form a significant part of integration. The decision to delegate responsibility to a final party for integration has been arrived at. With special consideration of the manufacturer’s part in the implementation of the whole process, it has been decided that the end user be responsible for final integration as system performance is concerned.

This decision is thought at shedding light and introductory instructions to the use on how to configure and make use of the system. Through such collaborative approach, there is likelihood that PSGT would gain a lot of recognition faster than its competitors. Once this information has been passed on to the end user, regular information dialogue quizzes may be employed to nurture the use of this technology for fast and addictive adoption. These supplements are intended to make this company a stronghold in the voice detection and recognition industry.

PTSG accounting information

Accounting is a critical aspect of any organization since it is responsible for computational results that draw organizational image (Birchler & Butler 130). Transaction occurrences at PSGT would be unavoidable and as such, the responsibility of mediation has been arrived at. Information provided by the accounting unit of any organization is importance in reflection and determination of company’s future. With presence of record keeping technologies such as those present in Blockbuster and the spread of Electronic vehicle management system have greatly influenced accounting systems of companies in the technology industry.

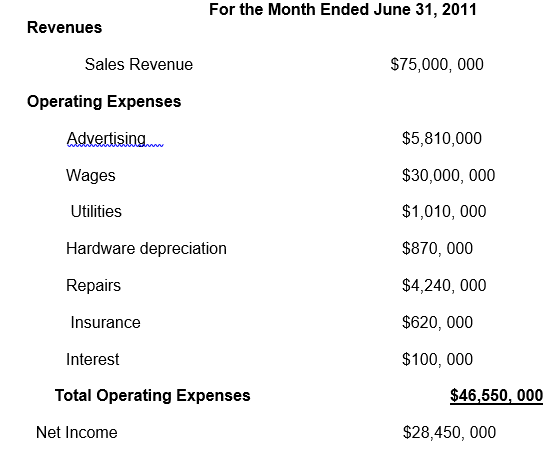

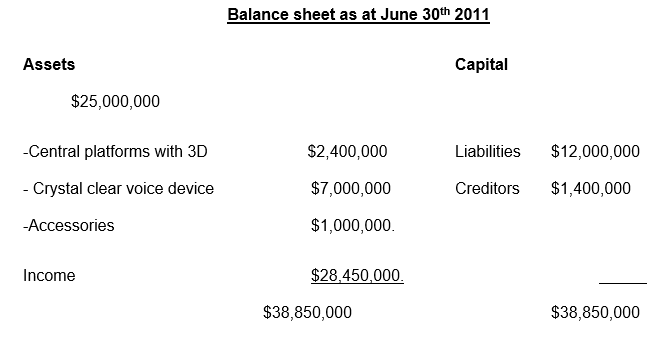

Their adoption would lead to lowering of accounting monitoring costs such as finance and time thus leading to higher levels of efficiency in production. With this perspective in the vision of PSGT Intel Co. Ltd, it is estimated that the company will be experienced a consistent annual growth of more than 40% for the following decade. Our current income statement and balance sheet would provide figures as shown below:

Income Statement

Works Cited

Birchler, Urs & Butler, Monika. Information Economic, Parkton: Routledge, 2007. Print.

Varian, Hal. Economics of Information Technology. Berkeley: University of California, 2003. Print.