Adjusting entries refer to those adjustments made to certain accounts at the end of any fiscal period. Fundamentally, these entries pertain to accounts that relate to income and expenditure. Additionally, items adjusted during the closing of the fiscal duration have numerous entries in related accounts. The accounts could be prepaid or owing. Furthermore, there is the actual fund that the entity pays which appears in the cash account. Therefore, it is imperative to adjust the above accounts to give an apt picture of the revenues or expenditure relating to those accounts. Adjusting entries normally occur when one assumes an accrual basis.

According to this basis, accountants recognize proceeds and expenses once they are due or earned. Therefore, monetary transfer is not vital for the recording of transactions assuming this basis. Adjusting entries are critical since they assist in preparation of final accounts. At the end of an accounting period nears, relevant departments adjust records. The balances in the adjusted accounts are transferred to the income records. Therefore, adjusting of accounts ensure that the figure posted to the income statement is accurate. Overall, adjusting entries ensures accuracy and adherence to accounting principles. Additionally, they ensure that the balance makes a fair representation of the state of affairs (Internet centre for management and business administration, 2010).

Different adjusting entries

There are diverse forms of adjusting entries. The classification depends on different factors. The classification primarily depends on the item and transfer of money. A matrix can represent this classification appropriately, as it outlines all the combinations. Classification based on the item generates two forms, either income or expenditure. Additionally, classification may also rely on monetary transfer. If the entity pays for expenditures prior to receiving any service, it is a prepaid item. Conversely, if an entity has not made any monetary transfer for expenses incurred, it is an accrual item. If an entity records income before the actual monetary transfer, then it is unearned revenue. Conversely, income already earned but not recorded is accrued income (Albrecht et.al 2010). The list below outlines the forms of adjusting entries;

- Prepaid expenses- This refers to expenditure that the organization pays for prior to incurring it.

- Accrued expenses- This an adjusting entry that relates to incurred expenses not yet settled.

- Unearned revenues- This refers to proceeds that has not accrued but appears in the statement.

- Accrued revenue- This is an adjusting entry that refers to income that has accrued however, it is absent in the statements.

Recording of Adjusting entries in a computerized system

A computerized system eliminates physical accounting. Therefore, it reduces human efforts required to make adjustments. A computerized accounting system operates based on software that contains instructions on the actions to execute once provided with certain information. Initially, the accountant should enter certain data. Subsequently, the computer will create the appropriate ledger accounts. Accounting software contains instructions on when to adjust accounts. During the end of the accounting duration, the accounting system institutes actions that result in the adjusting of accounts. Visibly, no distinct actions are necessary for a computerized system to adjust its accounts. The software institute relevant action to adjust accounts independently (Albrecht et.al 2010).

Ethical issues emanating from manufacturing entities

Manufacturing firms face many challenges in preparation of accounts since they have to estimate many items. First, the entity makes multiple estimates of items such unfinished goods. Estimation of such items may affect the balance sheet. Thus, it is critical for the entity to make reasonable estimations. This is an ethical issue since many firms may overestimate the cost to inflate the balance sheet thus making the entity attractive to investors

Steps in the accounting cycle

Identification of transaction

At this stage, the transaction is identified and the document generated.

Analyze transaction

Establish the entry figure and the accounts, which relate to the transaction. Additionally, establish the impact it will have on the accounts.

Journal entries

Transfer the transaction to journal and show the debit plus credit entries.

Posting

This stage posts the transaction into respective ledger accounts. The transaction may affect numerous ledger accounts.

Trial balance

This account assists to establish if debits are equivalent to credits.

Adjusting entries

These entries relate to accounts with prepaid and accrued balances.

Adjusted trial balance

It contains adjusted balances of accounts.

Financial statements

At this stage, accountants prepare financial records.

Closing entries

At this phase, accountants transfer balances to provisional accounts that relate to revenues, shareholding and expenses. This allows for preparation of final records relating to the fiscal period.

After closing trial balance

There is preparation of the ultimate trial balance (Albrecht et.al 2010).

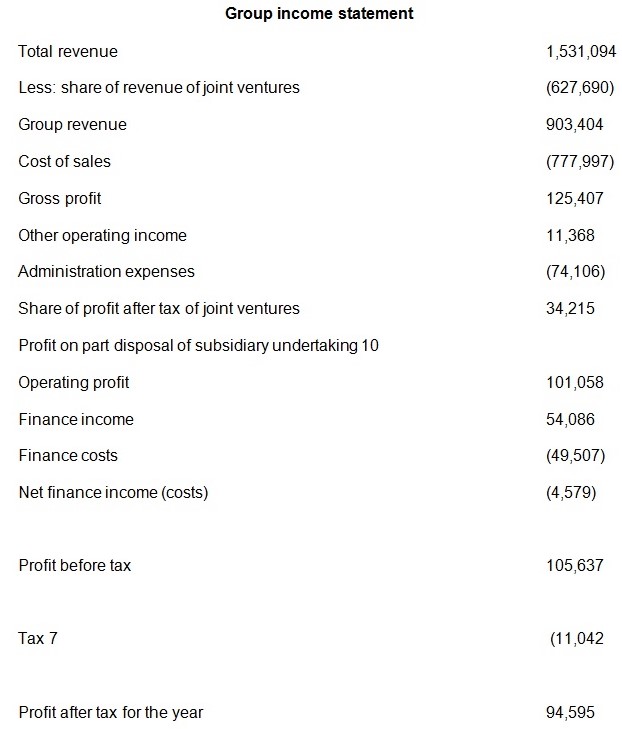

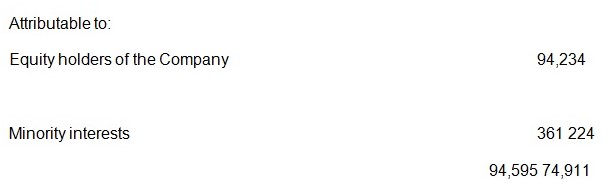

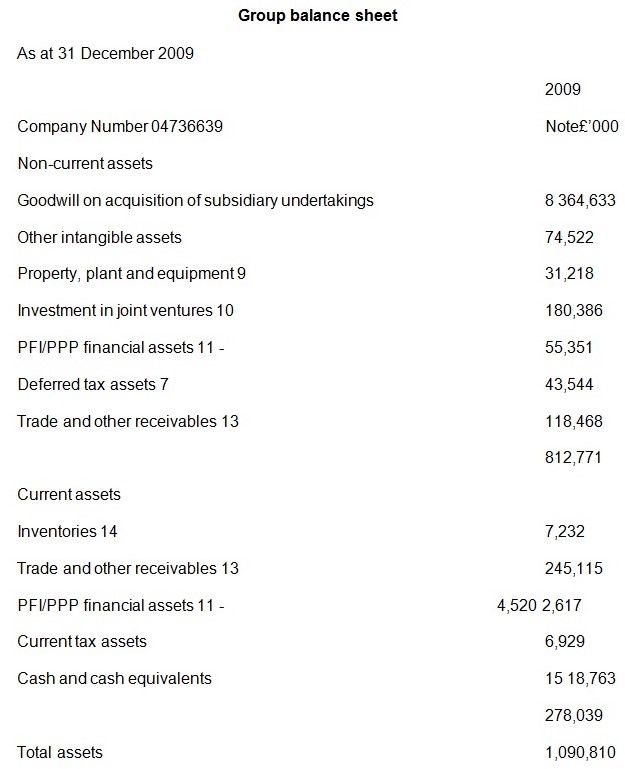

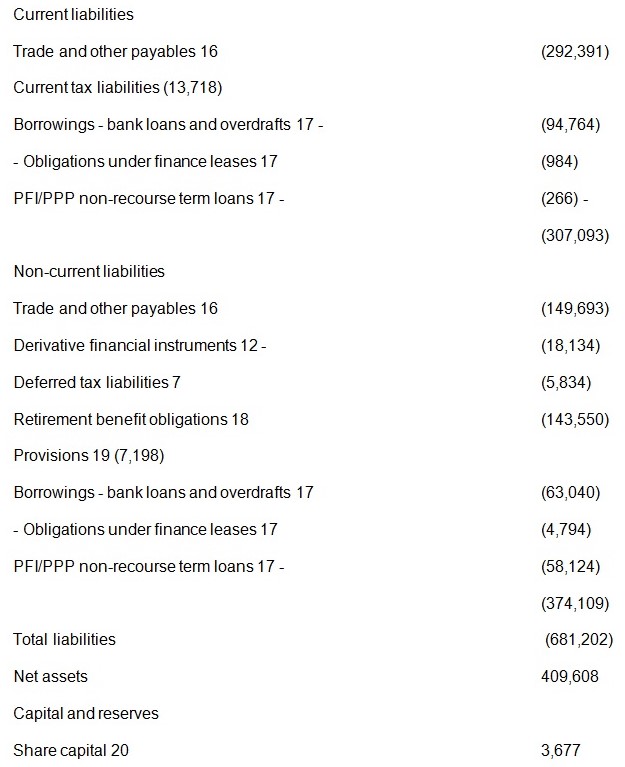

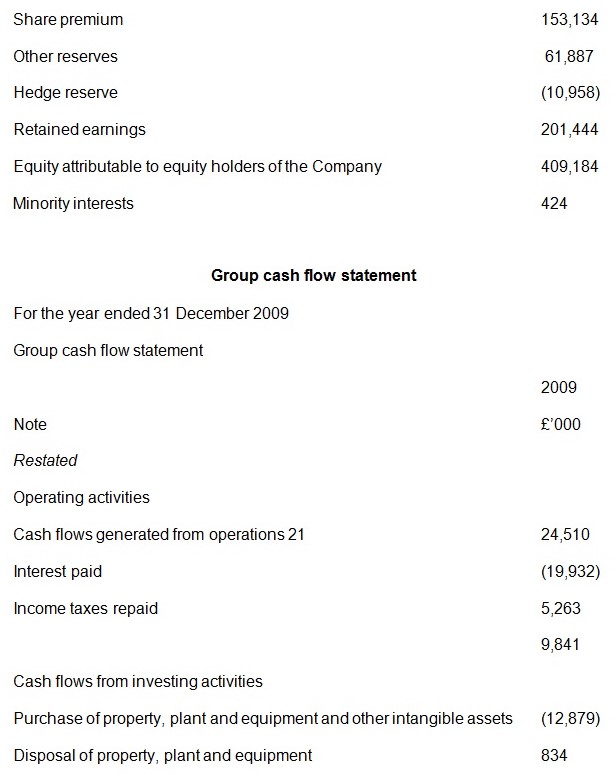

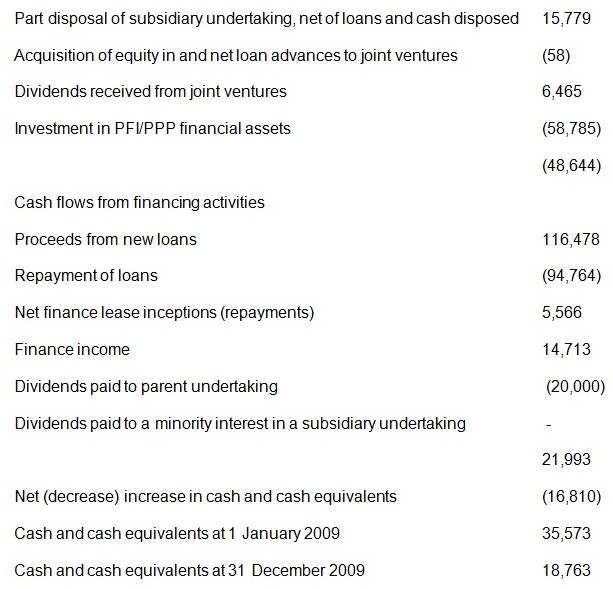

Four main financial records

The records below relate to Amey UK plc. The records include a cash flow, a consolidate income statements, a balance sheet and a statement of retained earnings. The trial balance contains balances of all items that relate to the entity. The second statement is a consolidated income statement. The statement outlines the entity’s monetary inflow and outflows. The third statement shows the entity’s retained earnings. The retained earnings are the proportion of profits that the entity wishes to plough back. The final statement is a balance sheet. This statement reveals the state of affair in any entity by revealing an entity’s capital, assets and responsibilities.

Group statement of changes in equity

For the year ended 31 December 2009

Share

Share premium Other Hedge Retained Minority Total capital account reserves reserve earnings interests equity:

Analysis of statements

First, the cash flow statement contains numerous receipts and payments from the entity. Essentially, the account details monetary inflows and out flows from the entity. Therefore, the account reflects the liquidity status of an entity. The income statement detail all the proceeds and expenditure from Amey UK plc. This statement covers all items that require adjustment in totality. The statement of retained earning details the entire dividend paid. Notably, at time the account relating to payment of dividend may require adjustment where some of the dividends were unpaid. The final statement is the balance sheet that receivable, prepaid, accrual and payable accounts, which require adjustment prior to the preparation of final records.

References

Albrecht, W., Stice, E., Stice, D., & Swain, R. (2010). Accounting: Concepts and Applications. New, York, NY: Cengage learning.

Internet centre for management and business administration. (2010). The Accounting Process. Web.