Situation Analysis

Company Overview

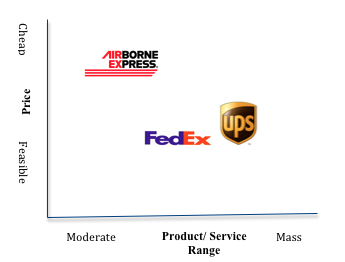

Airborne’s vision statement is not clear from the case. However, the firm pursues a differentiation strategy focused on providing quality low-priced services and unique customer experience. Airborne Express projects itself as a flexible, customer-oriented carrier that provides tailored express mail services to high-volume shippers. Airborne’s core values that could be deduced from the case include customer focus and innovation/creativity. The firm values its clients through quality express mail services. It fosters innovative solutions such as the tracking software called FOCUS.

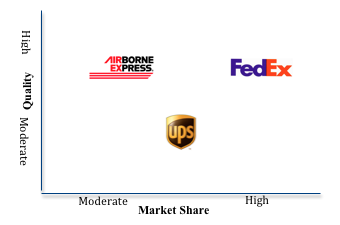

Airborne Express lies third in the express mail industry with a market share of 16%. The firm faces moderate competition from industry leaders, Federal Express, and United Parcel Service, which control 45% and 25% of the market, respectively. A comprehensive analysis of Airborne’s internal and external environments using different tools will give insights into the firm’s current competitive position.

Four-box Business Model Analysis

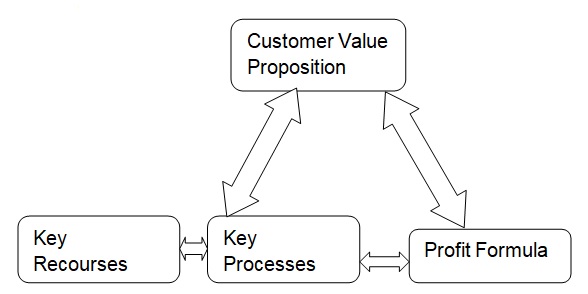

From the textbook, the core elements of the Four-box business model include a customer value proposition, profit formula, key processes, and key recourses, as shown in figure 1 below.

The four-box business model applied to Airborne Express (Appendix 1) shows that the carrier can move to the ‘white space’ through the provision of package tracking to small businesses, optimized delivery time (service quality), and improved website to support scheduling and shipping paperwork. These issues would increase the Airborne’s customer value proposition. In addition, Airborne can create value for itself (profit formula) through adopting distance-based pricing, extensive use of contractor fleets to reduce operational costs, improved plane utilization rate to more than 95%, and greater overseas operations/investments. These strategies would lower its overheads, increase the inventory cycles, and bolster its asset utilization, resulting in better margins.

Airborne’s key resources that could enable it to realize its value proposition include human resource (500-sales team), the FOCUS system, 12 cargo planes, strategic partnerships with RPS, and airport hub. However, the firm should invest in marketing campaigns and promotions to sell the brand, as it receives less media attention compared to its rivals. The key processes for delivering the value proposition include purchasing low-cost passenger planes for cargo transportation, outsourcing to contractors, high afternoon and second-day deliveries, and use of the unmanned drop off boxes. The firm should increase its morning deliveries, online ordering, and partnerships with retail stores to realize its customer value proposition.

External Analysis – Porter’s Five Forces analysis

The external analysis of Airborne Expresses indicates that buyer power and the threat of new substitutes have a higher impact on the firm’s competitiveness (Appendix 2). Buyer power is significant because of low switching costs between express mail firms. The market also has several players that offer differentiated products/options for customers. On the other hand, the threat of substitutes is high because of the existence of product alternatives. Facsimile and electronic mail are cheaper and faster alternatives than express mail.

In contrast, the threat of new entrants is low because Airborne and the two ‘gorillas’ (FedEx and UPS) control 86% of the market. Further, the industry requires heavy capital investment; hence, small entrants cannot compete effectively. Competitive rivalry in this industry can be considered moderate because of the low switching costs. In addition, the three top firms enjoy oligopoly and face no threat from smaller competitors because of cost-differentiated products/services. Supplier power is also moderate because the three express mail firms own cargo planes and delivery vans. Airborne owns the Wilmington airport; hence, supplier power is not significant.

External Analysis – Competitor Analysis

Competition within the local express mail industry is evident through the market share and service quality. As shown below, FedEx is the market leader (45% market share) followed by UPS (25%). Airborne comes third with a 16% share of the local market. Therefore, an oligopoly can be seen because the top firms control 86% of the market. Another dimension of the competitive environment relates to timely delivery. It is estimated that 96-97% of Airborne’s shipments arrive on time, while its competitors score more than 99% in this respect. This shows that FedEx and UPS lay more emphasis on superior service quality than Airborne. However, in 1997, UPS experienced a 16-day industrial action that affected its volumes by 6% and led to a $700m in revenue losses. A strategic group map of how the top tier firms compete in terms of price and quality is shown in Graph 1 and 2 below.

The competition also comes from small players, including DHL, BAX Global, and TNT, among others. These firms primarily focus on the overseas market. The competitive environment is also characterized by cheaper and faster offerings, i.e., facsimile and electronic mail.

The primary business objective of a firm is to give quality services at competitive prices. An in-depth analysis of Exhibit 8 gives a picture of each firm’s price differentiation structure and segments. The aggregated average cost of the services differs between the three firms. FedEx had the most costly product/service, costing on average $27.90 for the morning, afternoon, and second-day deliveries. Compared to FedEx, UPS had a relatively cheaper product. Its aggregated product/service costs an average of $26.36. Its aggregate price was still higher than that of Airborne’s product ($24.52). However, UPS operates in the domestic and overseas segments; hence, the firm can gain competitive advantages from geographical differentiation. Its foreign investments account for 19% of its assets. FedEx has also invested in a global distribution system to a tune of $2bn (12% of assets). In contrast, Airborne’s international presence is the lowest with only 6% of its assets in foreign locations.

Internal Analysis – Resource and Capabilities Analysis

The internal analysis of Airborne Express focuses on its internal environment, including value chain and resources/capabilities.

Value Chain Analysis

Airborne’s competitive resources and capabilities can be determined through a value chain analysis. From the textbook, a firm’s value chain includes its inbound/outbound logistics, operations, service, and marketing/sales based on Porter’s value chain model. From Appendix 3, Airborne gains efficiency and cost savings from its outbound logistics through an owned central Wilmington hub, and use of independent contractors to ship 60-65% of its volume. Further efficiency is achieved in its operations through less automation in the warehouses, tracking using the FOCUS system, and large volumes (900,000 packages daily). Its outbound logistics involve the RPS/contractors and sending of packages to customers from the Wilmington hub. Further, Airborne does not use mass media to drive its marketing/sales goals. Instead, it relies on the logistics managers of major freight firms and an autonomous sales team. The firm offers integrated services that include express mail delivery, automated call centers, and package tracking.

Resources/Capabilities

From a resource-based view, Airborne’s capabilities lie in its tangible and intangible resources. The tangible resources include an owned Wilmington hub/warehouse, assets in foreign destinations, cargo planes (refurbished passenger carriers), third party contractors, customization codes, human resources (sales team), and tracking software deployment. Its intangible resources include relationships with logistics managers of major shippers, RPS, and large firms, e.g., Xerox and Nike. Others include brand reputation and flexible cost structure.

SWOT Analysis

Airborne’s SWOT analysis based on the case reveals its internal strengths and weaknesses as well as the opportunities and threats to its operations (Appendix 4). The SWOT analysis results show that Airborne’s strengths lie in its phenomenal revenue growth, B2B relationships with RPS, Wilmington hub, and market share. The firm should leverage these strengths to improve its ground operations, shipment tracking, and global presence. Further, in light of rising costs (fuel) of air deliveries, ground operations through an expanded delivery fleet and partnerships with transport firms in non-metropolitan areas could increase revenue. Airborne can gain competitive advantages from improved shipment tracking capabilities. Smaller and medium customers should be able to track their packages in real-time through the FOCUS system and website. In addition, strategic alliances/partnerships with players in foreign markets can support their international growth efforts.

PEST Analysis

A PEST analysis of Airborne (Appendix 5) shows that government regulations and increased labor union activity affect the political environment where the firm has its operations. On the other hand, the economic factors that affect the firm include higher fuel costs for long-haul carriers and the availability of fax and e-mail that are faster and less costly than express mail. The express mail carrier is also affected by multiple social factors. Globalization has increased the need for international expansion by local firms. Consumer loyalty is also low in this industry due to lower switching costs. In addition, the fast-paced lifestyles demand a timely delivery. Airborne could increase its just-in-time delivery to 99% through extensive utilization of contractor vans. The technological factors affecting Airborne include shipment-tracking software and increased demand for better online services.

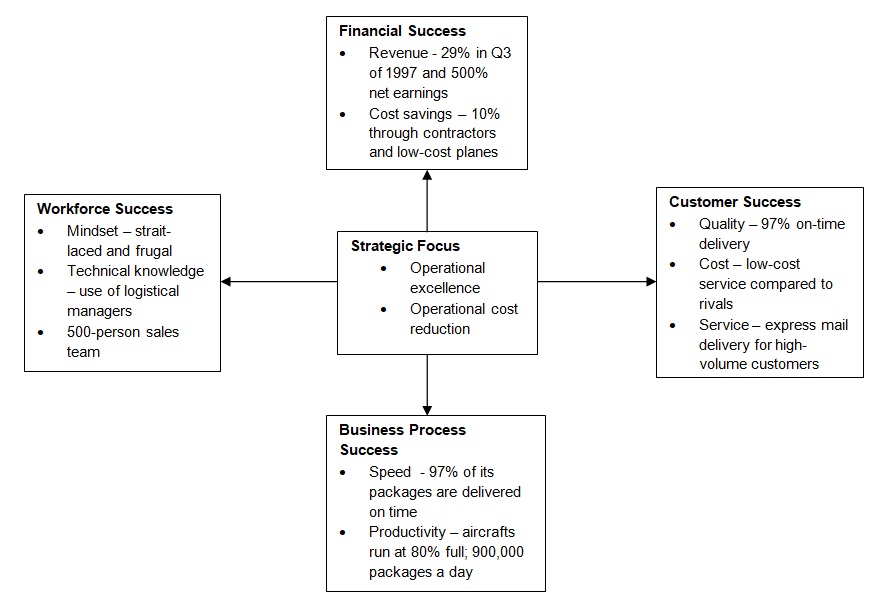

Balanced Scorecard

The balanced scorecard of Airborne shows that the key performance indicators (KPIs) relate to its financial, business process, and customer perspectives. From a financial perspective, Airborne aims at growing its revenue, which increased by 29% in the last quarter of 1997. It also improves its financial condition through cost reduction. Cost savings are obtained through the purchase of low-cost cargo planes, the use of contractor fleets (gives 10% savings), and reduced advertising/promotional costs. Its customer success is hampered by delays (97% timely deliveries). However, low-cost offerings, i.e., $24.52 on average compared to $27.90 and $26.36 for FedEx and UPS, respectively. Business process efficiency is achieved through high throughput (900,000 deliveries per day) and speed. In contrast, workforce success is affected by mindset and technical knowledge of Airborne’s managers and sales team.

Key Issues Development

The key issues that emerge from the situational analysis include improvement in ground operations, shipment tracking, and marketing campaigns, and international expansion.

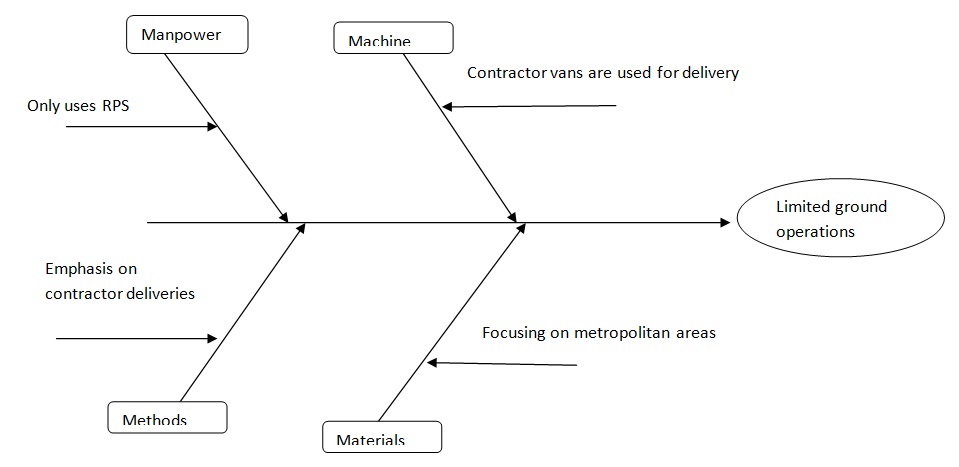

Ground Operations

Airborne has limited ground operations. The shipments are flown to the customers. It uses limited contractor vans from RPS for its ground operations. The root causes of this problem as identified through a root-cause analysis using the Ishikawa diagram (Appendix 6) include the overreliance on a single contractor for all its ground service (RPS), fewer delivery vans compared to its rivals, and focus on metropolitan areas.

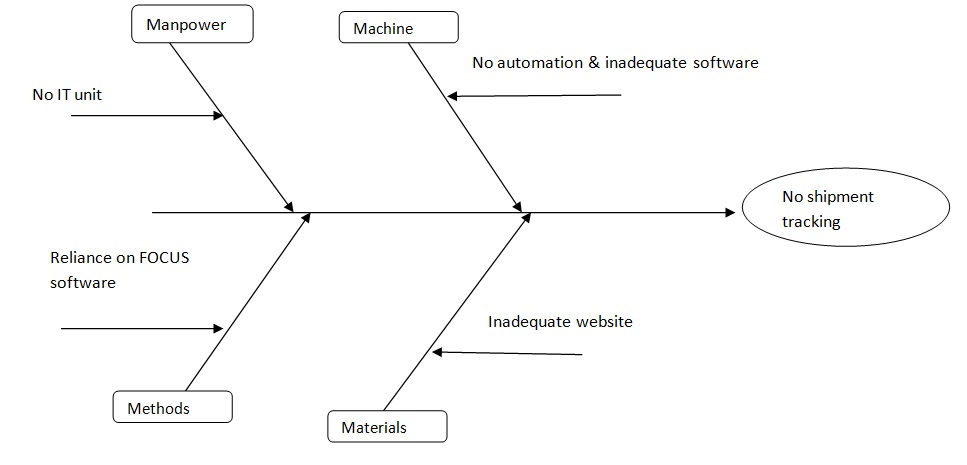

Shipment Tracking

The second issue that emerges from the situational analysis relates to the lack of effective shipment tracking for small and medium-volume clients (Appendix 7). While the high-volume clients use FOCUS, smaller customers do not. One of the causes of this problem relates to Airborne’s lack of a dedicated IT unit to develop software with new capabilities. In addition, its website cannot support tracking by customers. Further, the FOCUS software functionalities, including shipment tracking, are only available to high-volume clients. The firm also relies on limited automation and invests selectively in technology development.

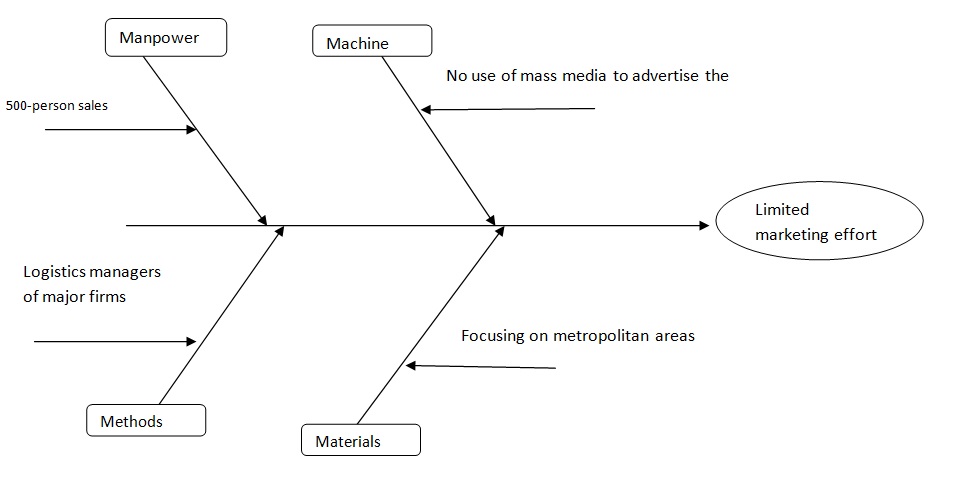

Market/Brand Presence

From the situational analysis, Airborne has a limited market presence. The root cause analysis reveals that the main cause of this problem is the firm’s failure to use mass media to market the brand and its products (Appendix 8). Another cause relates to the reliance on a limited sales team of 500 people that are compensated based on sales to drive its marketing efforts. The firm also uses a few logistics managers of major firms to market their services. Its operations are also concentrated in metropolitan areas. To increase its market presence, the firm needs to diversify into non-metropolitan markets currently occupied by smaller players.

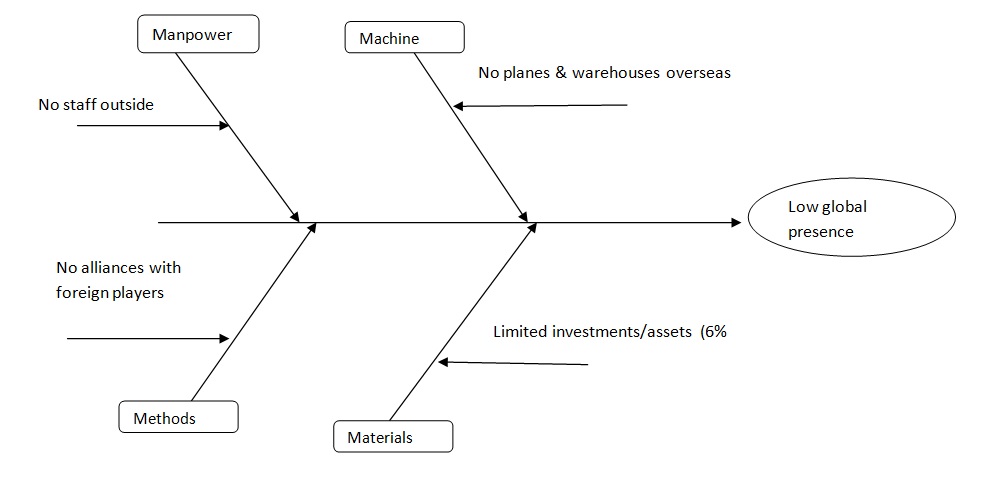

International Expansion

Airborne has a limited presence in foreign markets. The root-cause analysis identified four causes (Appendix 9). The first one is the absence of planes and warehouses outside the US. The firm has its operations concentrated in the domestic market, especially in metropolitan areas. Secondly, Airborne’s assets outside the US are lower compared to those of its competitors (6% vs. 19% for FedEx). The firm also lacks strategic alliances and partnerships with local players or carriers to complete foreign deliveries.

Strategic Recommendation and Rationale

Four strategic alternatives are proposed for Airborne to allow it to acquire competitive advantages in the future. They include the provision of shipment information to small- and medium-volume customers, improved internationalization efforts, marketing campaigns, and improvement in ground operations. The specific details of each alternative are given in appendix 10.

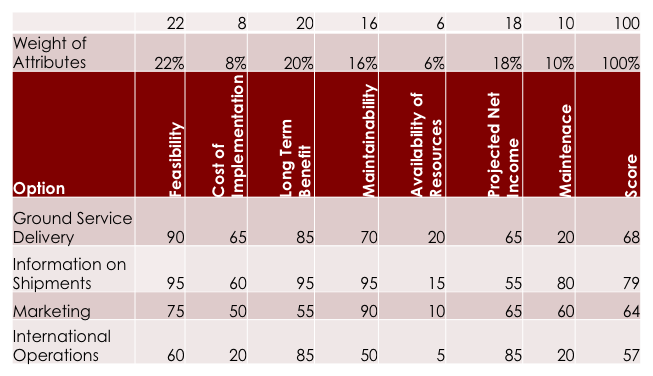

Based on the decision matrix (Appendix 11), it is clear that each strategic option has advantages and disadvantages. In this analysis, the provision of shipment information has the highest average score (79) among the four options. The factors that contributed to the high rating relates to its feasibility, long-term benefit, and maintainability. In the digital age, an online presence is a strategic advantage. Firms invest in software that allows them to track their shipments for effective inventory management. Airborne should invest in additional software (besides FOCUS) and website to allow small- and large-volume customers to know the status of their packages throughout the supply chain. Therefore, investment in tracking software is feasible. The long-term benefit of the software relates to its scalability to support more customers. The tracking system can be maintained for a long time; thus, this option scored highly in the maintainability criterion.

The second strategic alternative evaluated using the decision matrix was the marketing campaigns. Companies advertise their products/services through mass media and social media. For B2B relationships in the express mail industry, the low switching costs affect the return on investment for the marketing department. Thus, the option is associated with low long-term benefits; hence, the overall score is low. I would recommend that Airborne invests in its website and tracking system as opposed to media marketing, as shipment information would increase customer satisfaction and loyalty.

Improvement in ground operations emerged as the second-best strategic alternative. The factors that contributed to the high overall score its feasibility, long-term benefit, and maintainability with time. The option with the least score is international expansion. It is affected by its high cost of implementation and availability of resources.

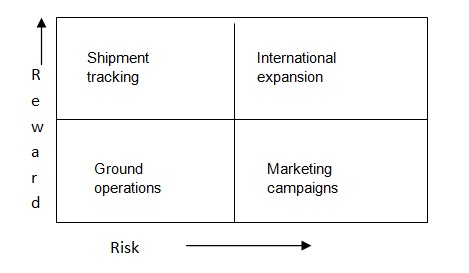

The risk-reward analysis favors the shipment tracking option (Appendix 12). Investment in shipment tracking software has a high long-term reward because of its scalability to accommodate more customers. Airborne can expand its FOCUS software to allow smaller customers to track their packages or invest in a new scalable system. Shipment tracking is a low-risk venture because software providers can help manage the system. International expansion is also a high-reward option. However, this option can be considered as a high-risk strategy because of unfavorable foreign regulations, fluctuating oil prices, and terror threats that affect air transport. Increasing ground operations can be considered a low-risk option because strategic alliances with established small players can spread the business risks. On the other hand, marketing campaigns are a low return, high-risk strategic option. As stated, B2B business has low switching costs, and thus, customers can change carriers without incurring significant losses. For this reason, the return on investment of marketing campaigns, i.e., television advertising, billboards, and newspaper ads, may not be high. My recommendation is that Airborne should advertise its services through its website to reduce marketing costs and complement its traditional promotional approach, i.e., using logistics managers of major firms. The recommended strategic alternative (shipment tracking) will help Airborne increase its market presence. It will also be useful in B2B customer relationship management.

Conclusions

Airborne is ranked the third-largest firm in the express mail industry by market share (16%). Airborne together with the other two firms (FedEx and UPS) have an oligopoly on the local market, where they control 85% of the market. The key issues identified from the situational analysis of Airborne include limited ground operations, inadequate shipment tracking/information for smaller customers, insufficient market presence, and slow expansion to foreign markets. To address these issues, four strategic alternatives are proposed, namely, shipment tracking, improvement of ground operations, marketing campaigns, and international expansion. An in-depth decision matrix revealed that shipment tracking is the most viable option that Airborne should pursue. It has higher long-term returns, feasibility, and maintainability scores. Further, a reward-risk analysis of the four alternatives shows that shipment tracking is a high-reward, low-risk option. Further, Airborne can leverage on shipment tracking software to increase its market presence and expand to foreign destinations through an online ordering functionality. This shows that the recommended strategic option could give Airborne Express competitive advantages in the express mail industry.

Appendices

Appendix 1: Four-box Business Model

Appendix 2: Porter’s Five Forces analysis

Appendix 3

Appendix 4: SWOT Analysis

Appendix 5: PEST Analysis

Appendix 6: Root-cause Analysis -Ground Operations

Appendix 7: Root-cause Analysis – Shipment Tracking

Appendix 8: Root-cause Analysis – Marketing Efforts

Appendix 9: Root-cause Analysis – International Expansion

Appendix 10: List of Strategic Options

Appendix 11: Decision Matrix

Appendix 12: Reward-Risk Analysis