Introduction

Marketing has increasingly become a competitive undertaking in the face of globalization. Organizations increasingly find it challenging to weather the competition presented by internationally acclaimed competitors, which direct their aggressive international marketing strategies to virtually all parts of the globe. In the food and beverage industry, companies such as Coca-Cola and PepsiCo have left nothing to chance.

In light of this trend, emerging firms in this arena find it quite a challenge to assert their presence in the market and present themselves as worthy competitors. However, although such a scenario is typical of most industries, it has not deterred new entrants from making notable achievements.

Al-Marai, a Saudi Arabian food and beverage company, has achieved notable progress within its mother country as well as in the Gulf Cooperation Council region (GCC). Its achievement notwithstanding, the company still has a long way to go in order to establish a worldwide presence in the food and beverage industry.

The focus of this report is thus to draw from the company’s existing facts and figures and develop an international market entry plan (for its dairy products) that can guide the company to enter the South African dairy industry successfully.

Tenets of an International Market Entry Plan

International marketing presents companies with numerous challenges especially as global giants in various industries are aggressive players that grab every available opportunity.

This assertion implies that any new entrant or a smaller firm that intends to expand its operations must brace itself for serious competition. In this respect, Al-Marai should be fully conscious of the inevitable challenges it will encounter in its quest to penetrate strategic markets in key regions for starters. The company thus needs an elaborate market entry strategy that will inform all its moves in a new territory since wrong moves could be detrimental to the company.

An Internal analysis of Al-Marai Company

Al-Marai Company, as already noted, is a Saudi Arabian Company, which majorly specializes in the production and processing of a variety of dairy products coupled with juice, bakery, and poultry production.

The company was founded in 1977 by HH Prince Sultan bin Mohammed bin Saudi Al Kabeer with a focus to overhaul the dairy industry of Saudi Arabia to make it commensurate with the needs of the rapidly expanding domestic market (Al-Marai Para. 6). Over the years, the company has realized illustrious growth that pitches it as the world’s largest vertically integrated dairy company today.

The company’s dairy sector is leading in Saudi Arabia and the GCC region. Its products are “synonymous with quality and freshness so that the name Al-Marai, which means ‘fresh pastures,’ has become a highly esteemed household name in the region” (Al-Marai Para.4).

Al-Marai’s dairy products include an assortment of dairy liquids, which include a wide range of fresh and long-life products such as Fresh Laban, Fresh Milk, delicious Flavored Milk, lactose-free milk, Vetal Milk, and Vetal Laban. In addition, the company also produces “yoghurts and desserts ranging from traditional favorites ranging from Zabadi, Gishta, and Labneh to Fruit Yoghurts and Crème Caramel” (Al-Marai Para.8).

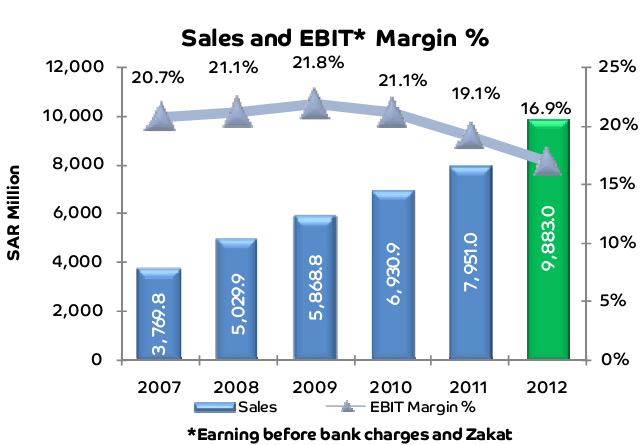

These products are highly reputed within Saudi Arabia as well as the Gulf region and beyond as attested by the high sales volumes that the company has managed to realize in the recent past. Appendix 1 shows the company’s sales statistics ranging from the year 2007 to 2012. It has been in a position to realize phenomenal growth.

According to the annual Board report of the year 2012, the company made sales of “SAR 9,883 million, which was a growth of 23.4% from the previous year’s sales…the company also achieved a record figure of net operating costs of SAR 1,672.9 million and sales growth was strong across all product categories” (Al-Marai Para.12). These figures pitch the company as the most successful Food and Beverage Company in the entire GCC region.

Al-Marai has drawn from its array of advantages to position itself at the top in Saudi Arabia and the rest of the GCC region. In only five years, beginning from 2007, the company has grown its sales from less than SAR 4,000 to almost SAR 1 billion. The explosive growth in sales is as exhibited in Appendix 2.

The company currently serves half of Saudi Arabia’s milk demands and it is touted as one of the country’s largest exporters of food produce. The company boasts of an annual milk production of about 240 million liters and a packaging capacity of about 500 million liters.

In addition to such statistics, the company has pursued ambitious expansion programs through which it intends to establish its presence outside the GCC region.

It invested jointly with the PepsiCo in IDJ, a move that is touted by the annual Board Report of 2012 as having immensely boosted the sales for 2012. Apart from the joint venture with PepsiCO, Al-Marai also joined hands with Mead Johnson, an American baby food company, in its bid produce infant formula and is currently constructing a plant in Saudi Arabia for local production (Al-Marai Para.11).

Additionally, the company recently acquired 12,000 acres of land in Argentina to help strengthen its supply chain. This move clearly outlines this company as the most ambitious in the Gulf region as it not only seeks to expand its geographic footprint, but it is also diversifying into other areas of the market.

However, Al-Marai’s growth has also stimulated a notable expansion in its competition. Its most illustrious competitors include Al-Safi Danone and Nadec at a national or regional level and Kraft and Nestlé at an international level. This competition means that although the company is committed to staying at the top of the market standings in the Gulf region and beyond, there are possibilities of market contrition if it makes a wrong move.

In a bid to keep its ambition of expanding its export business globally in the vicinity, Al-Marai needs to keep improving its strengths coupled with address its weaknesses. This move will help it retain a firm hold of already captured markets while seeking out new opportunities to keep up its upward trend in the market as it would be illogical to lose the existent market segments in search of new ones.

Selection of Target Market

Country selection, as mentioned earlier, involves a careful consideration of possible target markets in order to select the most suitable that can be used as a starting point. This report shall settle on South Africa. This country was chosen because it is an internationally acclaimed emerging market, which provides ample ground for potential growth for any company that successfully penetrates its market.

South Africa is a strategic market for the entire Southern and Central Africa region such that basing operations there can provide the company with immense growth opportunities with minimal difficulties and in addition to this advantage, the country is relatively politically stable and with among the best infrastructure on the entire African continent.

In addition, South Africa is the latest addition to the BRICS countries where Brazil, Russia, India, and China (and lately South Africa) are coming together to form a trading block, which will be probably a formidable trade block in the region and across the world. These aspects make it a suitable target market for Al-Marai.

However, the conventional way of arriving at choices follows an analysis of the target country’s market potential, legal requirements, political environment, infrastructure, economy, and culture. The order in which these elements have been mentioned outlines their level of importance and as such, the most important should be given due weight in determining which country is suitable for venturing into for Al-Marai.

External Analysis (Analysis of Target Market)

South Africa, as a country, is located on the Southern frontier of the African continent extending longitudinally from latitudinally from 22° to 35° south and longitudinally from 17° to 33° east. This implies that the country largely falls outside the tropical climate, which is characteristic of most African countries. It borders the Indian and Atlantic oceans to the south and Namibia, Zimbabwe, and Botswana to the north.

The country also entirely encloses Swaziland, Mozambique, and Lesotho. Its territory spans 1,219,090 km2 and it is divided into nine provinces. It has great influence on the affairs of the Southern Africa region both politically and economically. In a larger perspective, South Africa is among the largest economies on the African continent and as such, the country has influence on the economic matters of the continent.

The country’s greatest asset is its people who according to a 2011 census, total to 58.1 million. The country boasts of a diverse ethnic heritage with a plethora of cultures and languages of which eleven are recognized by the constitution as official languages. Its constitution espouses freedom of worship, but its populace is largely Christian, which makes about 80 per cent of the total population.

The South African government strives to ensure that the country’s economy remains at the top of the fast-growing emerging economies and be an endearing investment destination. The South African government, in its bid to provide employment to all its citizens, has strived to create an ambient environment for investment from both locals and aliens.

Its constitution was touted as being among the most progressive ones during its promulgation after the country’s independence in the 1990s. This aspect allows the country to present minimal hurdles for an individual who looks to venture into the country’s business arena. The most challenging aspect of the South African business environment is the poor state of roads that extend into the countryside, which negatively affects transportation of products and raw materials.

South Africa’s Dairy Market

The South African dairy sector is the fifth largest in the agricultural industry and employs about 100,000 South Africans, thus making it a notable employer among the South African sectors. However, it only contributes only about 0.5 per cent to the world milk production. It is divided into two categories, which include the primary milk production sector and secondary milk production sector.

Primary milk producers are farmers who produce raw milk from the farm and sell it while secondary milk producers are the processing plants, which buy raw milk and process it into a variety of milk products before releasing them to the consumer.

The dairy market is divided into 60 per cent liquid milk and 40 per cent concentrated milk products. Pasteurized milk and UHT milk form the bulk of liquid products. The local production capacity often falls short of the country’s dairy needs thus forcing the country to be a net importer of milk products.

New Entrants

The competition in the South African dairy market is largely from external milk products. Although the country has its local producers, countries such as New Zealand and the Euro Zone export cheaper milk products to the South African market thus causing instability in the dairy industry.

The instability may discourage new entrants from the dairy industry. The South African dairy industry may not appeal so much to emerging players with little capital since the big players may easily choke them out of the market. However, there is room for new entrants to establish because the country imports milk products to augment its local production. Al-Marai, at its level of operation, can withstand the pressure from incumbents and establish itself in the market.

Substitute Products

Substitute products already exist in the South African dairy market. However, if Al-Marai enters the market with its signature quality goods, the existing players may have no option but to yield some ground for the company.

The fact that the company’s goods are the best in the Middle East and that its joint venture with PepsiCo raked in unprecedented volumes of sales means that its commitment to quality can propel it to overcome the threat of substitute products successfully. The superior quality of Al-Marai products can help it sail through into the new market without much difficulty.

Competitors

Competition in the South African dairy industry is largely imbalanced as already hinted. Low cost milk producers such as the Euro Zone countries, New Zealand, and Australia clog the market with milk at cheap prices, which prove unfavorable to local producers. The local producers also do the same among themselves such that established producers sell products to retailers at cheaper prices during times of surplus thereby hurting the upcoming producers with unfavorable prices.

Apart from this scenario, competition in the South African dairy markets takes many familiar forms that are witnessed in other industries such as advertising campaigns, improving service to customers, and normal price discounting. Al-Marai has proved in the Middle East that it can weather competition from ardent competitors such that such competitive strategies may not deter it from making notable progress in the new market.

Buyers

South Africa’s giant supermarkets, which dominate the dairy market, have the potential to influence milk prices considerably. However, this influence may only have the effect of reducing profit margins slightly.

The fact that there are milk-processing industries, which have made notable progress in the milk sector, implies that the buyers only wield acceptable levels of influence in the determination of retail prices. They also need the industries to supply them with milk products so that their activities cannot get to the extent of killing milk-processing industries.

Suppliers

The South African milk supplier has had to go through a tough time in delivering milk to processors. The industry has over three hundred processors, but the top five players buy up to 65 per cent of the available raw milk. This move leaves only 35 per cent for the remaining lot, which gives the top players room to dictate the prices to the suppliers so that farmers are offered very low prices for their milk. They have no option but to take the low prices, which implies that the suppliers are not in a position to influence production costs much.

This analysis presents the South African dairy industry as one that needs a player who can help in stabilizing it by balancing out the inequalities that currently exist to help farmers benefit from their toil as well. Al-Marai is fully capable of achieving such a task quite easily.

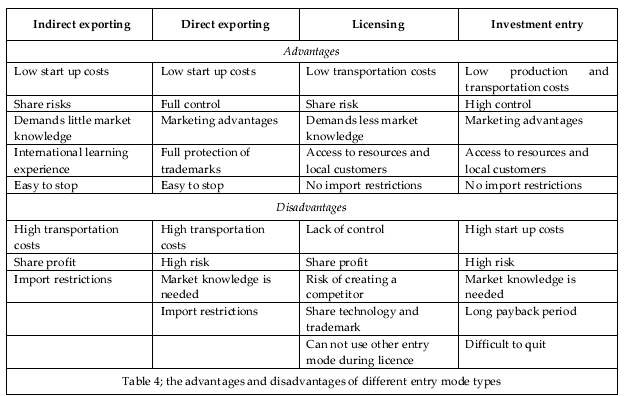

Entry mode decision

The most suitable entry plan depends on the company’s intended level of involvement and accountability. Cheaper options such as exports may not make the company’s intentions of entering a new market to be taken seriously. This entry mode may only be seen as a move to test the waters even if the company seriously wants to establish its presence in the new market. The best option is thus the investment entry mode in which the company makes an acquisition, sets up a joint venture, or sets up a production plant in the target market.

This entry mode is expensive and very involving, but in the end, it gives the company the necessary control over its processes and products. The commitment that Al-Marai has shown to high quality standards may only be achieved when it has a direct and exclusive control over production and quality assurance processes. Conventionally, the best way to go about entry mode decision involves analyzing the home country, the target country, and the company characteristics and coming up with a viable option.

Marketing Plan

A marketing plan is inevitable when entering new markets. A good marketing plan incorporates market segmentation, preparation, targeting, positioning, and execution. These activities need to occur in the sequence in which they have been listed since each of them sets precedence for the next one. The entry-mode selection section settled for investment entry as the most suitable in this report. This assertion then implies that the marketing plan should be laid out in a manner that matches the selected entry mode.

Market segmentation, which is the first step, involves analyzing the market and setting apart various segments appropriately. Al-Marai’s array of milk products that it produces back at home can be matched effectively to the various market segments outlined to find out exactly which products are needed for a start. The company’s rich variety of liquid milk and concentrated products can perfectly match with the available market segments and even create the need for differentiated products as the market forces may dictate.

Market preparation then follows through advertisement campaigns and other awareness creation mechanisms such as building networks and even undertaking some social corporate responsibility projects that will place the company in the lime light. This step serves an important function of making the prospective customers aware of the presence of the new company, its intended activities, and its line of products, thus serving to build anticipation in the customers so that they become eager to use the products.

The company, at this stage, then needs to further analyze the market and find out the effect that the awareness creation program has had on the target market. This step assists the company to develop a clear concept of the customers who are interested in buying its products. This step is the final targeting from which the company then positions itself for takeoff. It is important to know exactly what the customers wants before positioning the company and its products.

Positioning then follows where the company should then use its advertising prowess to position its products strategically. Al-Marai successfully did this undertaking back at home and in the GCC region as aforementioned. That prowess can be put to good use at this stage so that before the goods actually hit the market, the target market should know that the company does not compromise on quality whatsoever.

Everyone always wants value for his or her money and successfully positioning a company or product as a mark of quality and freshness will always yield results. This stage also requires the company to get in place a distribution network that will facilitate its sales. The company will initially target local retail outlets to deliver its products to the customers.

The final part of the plan involves the actual selling of the products to the customer. At this point, the company will organize a colorful launch that will give the prospective customers a chance to access the products and test them before the actual sales. Such launches often create excitement that drives sales for some time.

After the excitement wanes out, the company will invest in customer awareness to ensure that its products are known for what they are, not the marketing hype used by most manufacturers. This aspect will help in building confidence in the company’s product and eventually customer loyalty.

Exit Plan

This portion of the larger picture is often ignored or simply assumed as if it does not exist yet that is not the case. Although all firms enter markets with the determination to stay in those markets to posterity, there is a need for a firm to take precaution against any eventualities. For this report, the most suitable exit mechanism will be a sellout.

This choice hinges on the fact that this option leaves the company with attachments to the project. However, buyers may not be easy to come by thus a company may be forced to gradually yield its shares of the company until all are taken up other buyers. These two options will be appropriate if it ever becomes necessary for the company to exit.

Conclusion

Entry into new markets often presents numerous challenges to many organizations. However, with a well laid down approach, a company can enter a new market without much difficulty. Al-Marai is a company that has worked hard to place itself among achievers in the Middle East.

This trend can be replicated anywhere else it chooses to base its business activities. The market entry plan outlined in this report is a framework that could guide the company’s entry into the South African dairy industry. If carefully and systematically followed, the company will definitely achieve its cherished dream of achieving international presence in unexplored regions.

Works Cited

Al-Marai. Welcome to Almarai: Quality you can trust, 2013. Web.

Appendices

Appendix 1: Market Entry Mode Types

Appendix 2: Al-Marai’s Sales Statistics from 2007 – 2012